Amortization of a long-term loan

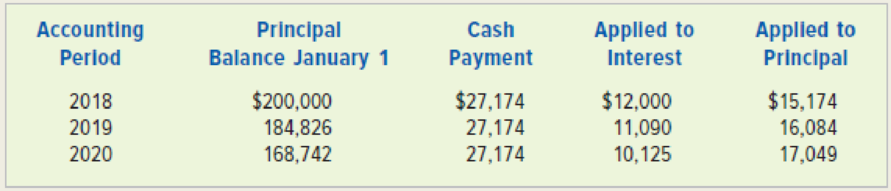

A partial amortization schedule for a 10-year note payable that Mabry Company issued on January 1, 2018, is shown as follows.

Required

a. What rate of interest is Mabry Company paying on the note?

b. Using a financial statements model like the one shown, record the appropriate amounts for the following two events:

(1) January 1, 2018, issue of the note payable.

(2) December 31, 2018, payment on the note payable.

c. If the company earned $62,000 cash revenue and paid $45,000 in cash expenses in addition to the interest in 2018, what is the amount of each of the following?

(1) Net income for 2018.

(2)

(3) Cash flow from financing activities for 2018.

d. What is the amount of interest expense on this loan for 2021?

Want to see the full answer?

Check out a sample textbook solution

Chapter 7 Solutions

Survey Of Accounting

- Discounting of Notes Payable On October 30, 2019, Sanchez Company acquired a piece of machinery and signed a 12-month note for 24,000. The lace value of the note includes the price of the machinery and interest. The note is to be paid in four 6,000 quarterly installments. The value of the machinery is the present value of the four quarterly payments discounted at an annual interest rate of 16%. Required: 1. Prepare all the journal entries required to record the preceding information including the year-end adjusting entry and any payments. Present value techniques should be used. 2. Show how the preceding items would be reported on the December 31, 2019, balance sheet.arrow_forwardOn January 1, 2018, King Inc. borrowed $150,000 and signed a 5-year, note payable with a 10% interest rate. Each annual payment is in the amount of $39,569 and payment is due each Dec. 31. What is the journal entry on Jan. 1 to record the cash received and on Dec. 31 to record the annual payment? (You will need to prepare the first row in the amortization table to determine the amounts.)arrow_forwardNon-Interest-Bearing Notes Payable On November 16, 2019, Clear Glass Company borrowed 20,000 from First American Bank by issuing a 90-day, non-interest-bearing note. The bank discounted this note at 12% and remitted the difference to Clear Glass. Required: 1. Prepare the journal entries of Clear Glass to record the preceding information, the related calendar year-end adjusting entry, and payment of the note at maturity. 2. Show how the preceding items Would be reported on the December 31, 2019, balance sheet. 3. Next Level What is Clear Glass Companys effective interest rate?arrow_forward

- Chemical Enterprises issues a note in the amount of $156,000 to a customer on January 1, 2018. Terms of the note show a maturity date of 36 months, and an annual interest rate of 8%. What is the accumulated interest entry if 9 months have passed since note establishment?arrow_forwardA partial amortization schedule for a 5-year note payable that Mabry Company issued on January 1, 2018, is shown as follows. accounting period principal balance cash payment app. to interest app to principal 2018 136000 34965 12240 22725 2019 113275 34965 10195 24770 2020 88505 34965 7965 27000 what is the rate of interest being paid in percentage?arrow_forwardRecording Accrued Interest Expense Alaska Inc. borrowed $16,000 by signing a one-year note payable on November 1, 2020. The note bears interest at 10% and interest is payable upon maturity of the note. a. Record this financing transaction on November 1, 2020. b. Record the year-end adjusting entry required on December 31, 2020. Hint: Prorate the annual interest of 10% for two months. c. Record the entry to repay the note on November 1, 2021. Note: Round your answers to the nearest dollar. For example, enter 50 for 50.49 and enter 51 for 50.5arrow_forward

- FINANCIAL ACCOUNTING (a) Compute the amount of interest during 2020, 2021, and 2022 for the following notes receivable; on april 30, 2020, BCDE lent $170,000 to Abbot on a two-years 7% note. (b) Which party has a (an) a. notes receivable b. notes payable c. interest revenue d. interest expense (c) How much total would BCDE collect if Abbot paid off early, say on November 30, 2020?arrow_forwardasap Recording Entries for Note Payable Lacey Corp. issued a three-year, $17,500 note with an 8% stated rate to Hayley Co. on January 1, 2020, and received cash of $17,500. The note requires semiannual interest payments on June 30 and December 31. Provide journal entries to be made at each of the following dates. a. January 1, 2020, for issuance of the note. b. June 30, 2020, for the interest payment. Date Account Name Dr. Cr. a. Jan. 1, 2020 Answer Answer Answer Answer Answer Answer b. June 30, 2020 Answer Answer Answer Answer Answer Answerarrow_forwardNotes payable-discount basis On May 15, 2022, Powell Inc. obtained a six-month working capital loan from its bank. The face amount of the note signed by the treasurer was $600,000. The interest rate charged by the bank was 7 %. The bank made the loan on a discount basis. Required: Calculate the loan proceeds made available to Powell, and use the horizontal model (or write the journal entry) to show the effect of signing the note and the receipt of the cash proceeds on May 15, 2022. Calculate the amount of interest expense applicable to this loan during the fiscal year ended June 30, 2022. What is the amount of the current liability related to this loan to be shown in the June 30, 2022, balance sheet?arrow_forward

- Instructions Ellsworth Enterprises borrowed $486,000 on an 12%, interest-bearing note on September 30, 2020. Ellsworth ends its fiscal year on December 31. The note was paid with interest on March 31, 2021. Required: 1. Prepare the entry for this note on September 30, 2020. 2. Prepare the adjusting entry for this note on December 31, 2020. 3. Indicate how the note and the accrued interest would appear on the balance sheet at December 31, 2020. 4. Prepare the entry to record the repayment of the note on March 31, 2021.arrow_forwardFor items 11 to 12 LYR Finance Company reports a loan receivable from Choice Company in the amount of P7,500,000. The initial loan's repayments include a 10% interest rate plus annual principal payment of P1,500,000 on January 1 of each year. The loan was made on January 1, 2021. Choice made the P750,000 interest payments for 2021 but did not make the P1,500,000 principal payment nor the P500,000 interest payment in 2022. Choice is having financial difficulty and LYR has concluded that the loan is impaired. Analysis of Choice's financial condition on December 31, 2022 indicates that the principal and interest currently due can be collected but it is probable that no further interest can be collected. The probable amounts and timing collection are determined as follows: December 31, 2023 December 31, 2024 December 31, 2025 Total P2,140,000 3,400,000 2,950,000 P8,490,000 The present value factors at 10% are as follows: 1 period - 0.909; 2 periods 0.826; 3 periods - 0.751 How much is the…arrow_forwardDakota Company received a $25,000, one year, 9 percent bank loan on October 31, 2018. Interest is payable at the end of the loan term. Dakota's adjustment at the end of their fiscal year on March 31, 2019 is to increase Interest Payable and Interest Expense for: Select one: a. $375 b. $937.50 c. $1,125 d. $2,250arrow_forward

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College