Variable costing income statement and effect on income of change in operations

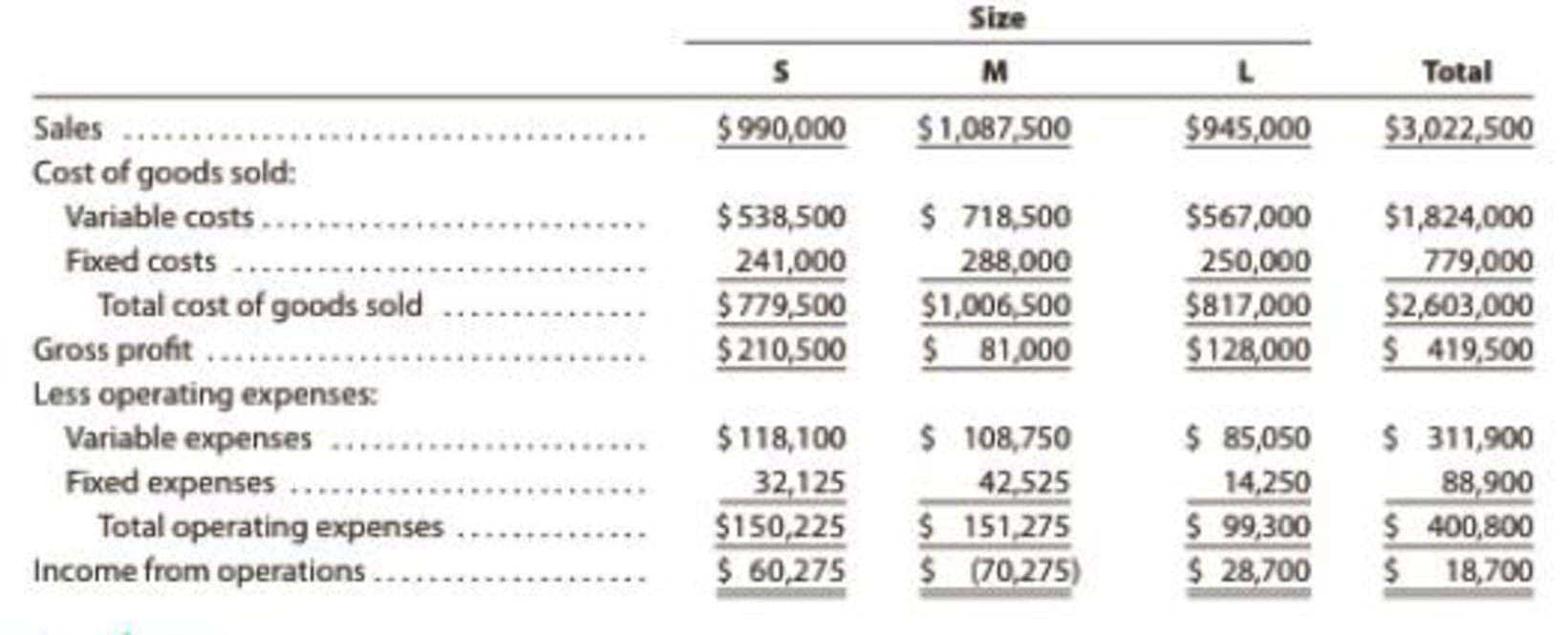

Kimbrell Inc. manufactures three sizes of utility tables—small (S), medium (M), and large (L). The income statement has consistently indicated a net loss for the M size, and management is considering three proposals: (1) continue Size M, (2) discontinue Size M and reduce total output accordingly, or (3) discontinue Size M and conduct an advertising campaign to expand the sales of Size S so that the entire plant capacity can continue to be used.

If Proposal 2 is selected and Size M is discontinued and production curtailed, the annual fixed production costs and fixed operating expenses could be reduced by $142,500 and $28,350, respectively. If Proposal 3 is selected, it is anticipated that an additional annual expenditure of $85,050 for the salary of an assistant brand manager (classified as a fixed operating expense) would yield an additional 130% in Size S sales volume. It is also assumed that the increased production of Size S would utilize the plant facilities released by the discontinuance of Size M.

The sales and costs have been relatively stable over the past few years, and they are expected to remain so for the foreseeable future. The income statement for the past year ended December 31, 20Y8, is as follows:

Instructions

- 1. Prepare an income statement for the past year in the variable costing format. Use the following headings:

Data for each size should be reported through contribution margin. The fixed costs should be deducted from the total contribution margin, as reported in the “Total” column, to determine operating income.

- 2. Based on the income statement prepared in (1) and the other data presented above, determine the amount by which total annual operating income would be reduced below its present level if Proposal 2 is accepted.

- 3. Prepare an income statement in the variable costing format, indicating the projected annual operating income if Proposal 3 is accepted. Use the following headings:

Data for each style should be reported through contribution margin. The fixed costs should be deducted from the total contribution margin as reported in the “Total” column. For purposes of this problem, the additional expenditure of $85,050 for the assistant brand manager’s salary can be added to the fixed operating expenses.

- 4. By how much would total annual operating income increase above its present level if Proposal 3 is accepted? Explain.

Want to see the full answer?

Check out a sample textbook solution

Chapter 7 Solutions

Managerial Accounting

- Segment variable costing income statement and effect on operating income of change in operations Valdespin Company manufactures three sizes of camping tentssmall (S), medium (M), and large (L). The income statement has consistently indicated a net loss for the M size, and management is considering three proposals: (1) continue Size M, (2) discontinue Size M and reduce total output accordingly, or (3) discontinue Size M and conduct an advertising campaign to expand the sales of Size S so that the entire plant capacity can continue to be used. If Proposal 2 is selected and Size M is discontinued and production curtailed, the annual fixed production costs and fixed operating expenses could be reduced by 46,080 and 32,240, respectively. If Proposal 3 is selected, it is anticipated that an additional annual expenditure of 34,560 for the rental of additional warehouse space would yield an additional 130% in Size S sales volume. It is also assumed that the increased production of Size S would utilize the plant facilities released by the discontinuance of Size M. The sales and costs have been relatively stable over the past few years, and they are expected to remain so for the foreseeable future. The income statement for the past year ended June 30, 20Y9, is as follows: Instructions 1. Prepare an income statement for the past year in the variable costing format. Use the following headings: Data for each size should be reported through contribution margin. The fixed costs should be deducted from the total contribution margin, as reported in the Total column, to determine operating income. 2. Based on the income statement prepared in (1) and the other data presented, determine the amount by which total annual operating income would be reduced below its present level if Proposal 2 is accepted. 3. Prepare an income statement in the variable costing format, indicating the projected annual operating income if Proposal 3 is accepted. Use the following headings: Data for each style should be reported through contribution margin. The fixed costs should be deducted from the total contribution margin as reported in the Total column. For purposes of this problem, the expenditure of 34,560 for the rental of additional warehouse space can be added to the fixed operating expenses. 4. By how much would total annual operating income increase above its present level if Proposal 3 is accepted? Explain.arrow_forwardThe management of Hartman Company is trying to determine the amount of each of two products to produce over the coming planning period. The following information concerns labor availability, labor utilization, and product profitability: a. Develop a linear programming model of the Hartman Company problem. Solve the model to determine the optimal production quantities of products 1 and 2. b. In computing the profit contribution per unit, management does not deduct labor costs because they are considered fixed for the upcoming planning period. However, suppose that overtime can be scheduled in some of the departments. Which departments would you recommend scheduling for overtime? How much would you be willing to pay per hour of overtime in each department? c. Suppose that 10, 6, and 8 hours of overtime may be scheduled in departments A, B, and C, respectively. The cost per hour of overtime is 18 in department A, 22.50 in department B, and 12 in department C. Formulate a linear programming model that can be used to determine the optimal production quantities if overtime is made available. What are the optimal production quantities, and what is the revised total contribution to profit? How much overtime do you recommend using in each department? What is the increase in the total contribution to profit if overtime is used?arrow_forwardEvaluating selling and administrative cost allocations Gordon Gecco Furniture Company has two major product lines with the following characteristics: Commercial office furniture: Few large orders, little advertising support, shipments in full truckloads, and low handling complexity Home office furniture: Many small orders, large advertising support, shipments in partial truckloads, and high handling complexity The company produced the following profitability report for management: The selling and administrative expenses are allocated to the products on the basis of relative sales dollars. Evaluate the accuracy of this report and recommend an alternative approach.arrow_forward

- Assume that a company uses the absorption costing approach to cost-plus pricing. It is considering the introduction of a new product. To determine a selling price, the company has gathered the following information: Number of units to be produced and sold each year Unit product cost Estimated annual selling and administrative expenses Estimated investment required by the company Desired return on investment (ROI) What is the markup percentage on absorption cost required to achieve the desired ROI? 15,000 30 $ $81,900 $780,000 12%arrow_forwardA manufacturer is considering eliminating a segment because it shows the following $6,300 loss. All $21,100 of its variable costs are avoidable, and $38,500 of its fixed costs are avoidable. Segment Income (Loss) Sales Variable costs Contribution margin Fixed costs Income (loss) (a) Compute the income increase or decrease from eliminating this segment. (b) Should the segment be eliminated? Complete this question by entering your answers in the tabs below. Required A $ 63,300 21,100 42,200 48,500 (6,300) Required B Compute the incomoarrow_forwardActivity-Based Management, Non-Value-Added Costs, Target Costs, Kaizen Costing Joseph Hansen, president of Electronica, Inc., was concerned about the end-of-the-year marketing report that he had just received. According to Asha Kumar, marketing manager, a price decrease for the coming year was again needed to maintain the company's annual sales volume of integrated circuit boards (CBs). This would make a bad situation worse. The current selling price of $27 per unit was producing a $3-per-unit profit—half the customary $6-per-unit profit. Foreign competitors keep reducing their prices. To match the latest reduction would reduce the price from $27 to $21. This would put the price below the cost to produce and sell it. How could the foreign firms sell for such a low price? Determined to find out if there were problems with the company's operations, Joseph decided to hire Ahmed Kumar, a well-known consultant and brother of Asha, who specializes in methods of continuous improvement. Ahmed…arrow_forward

- Make-or-Buy Decision Matchless Technologies Company has been purchasing carrying cases for its portable tablets at a delivered cost of $58 per unit. The company, which is currently operating below full capacity, charges factory overhead to production at the rate of 42% of direct labor cost. The fully absorbed unit costs to produce comparable carrying cases are expected to be as follows: Direct materials $24.00 Direct labor 22.00 Factory overhead (42% of direct labor) 9.24 Total cost per unit $55.24 If Matchless Technologies Company manufactures the carrying cases, fixed factory overhead costs will not increase and variable factory overhead costs associated with the cases are expected to be 13% of the direct labor costs. a. Prepare a differential analysis report for the make-or-buy decision. Enter your final answer as a positive amount if it represents a net cost savings; enter a negative amount if it represents an increase in cost. MATCHLESS TECHNOLOGIES COMPANY Manufacture Carrying…arrow_forwardScarce resource; discontinued product lines; negative contribution marginThe officers of Bardwell Company are reviewing the profitability of the company’s four products and the potential effects of several proposals for varying the product mix. The following is an excerpt from the income statement and other data. Total Product P Product Q Product R Product S Sales $187,800 $30,000 $54,000 $37,800 $66,000 Cost of goods sold (132,822) (14,250) (21,168) (41,904) (55,500) Gross profit $54,978 $15,750 $32,832 $(4,104) $10,500 Operating expenses (36,012) (5,970) (8,904) (8,478) (12,660) Income before taxes 18,966 $9,780 $23,928 $(12,582) $(2,160) Units sold 3,000 3,600 5,400 6,000 Sales price per unit $10.00 $15.00 $7.00 $11.00 Variable cost of goods sold 2.50 3.00 6.50 6.00 Variable operating expenses 1.17 1.25 1.00 1.20 Each of the following proposals is to be considered independently of the other proposals. Consider only the product changes stated in…arrow_forwardScarce resource; discontinued product lines; negative contribution marginThe officers of Bardwell Company are reviewing the profitability of the company’s four products and the potential effects of several proposals for varying the product mix. The following is an excerpt from the income statement and other data. Total Product P Product Q Product R Product S Sales $187,800 $30,000 $54,000 $37,800 $66,000 Cost of goods sold (132,822) (14,250) (21,168) (41,904) (55,500) Gross profit $54,978 $15,750 $32,832 $(4,104) $10,500 Operating expenses (36,012) (5,970) (8,904) (8,478) (12,660) Income before taxes 18,966 $9,780 $23,928 $(12,582) $(2,160) Units sold 3,000 3,600 5,400 6,000 Sales price per unit $10.00 $15.00 $7.00 $11.00 Variable cost of goods sold 2.50 3.00 6.50 6.00 Variable operating expenses 1.17 1.25 1.00 1.20 Each of the following proposals is to be considered independently of the other proposals. Consider only the product changes stated in…arrow_forward

- Value- and Nonvalue-Added Costs Waterfun Technology produces engines for recreational boats. Because of competitive pressures, the company was makong an effort to reduce costs. A part of this effort, management implemented an activity-based management system and began focusing its attention an procetses and activties. Receiving was among the processes (activities) that were carefully studied. The study revealed that the number of receiving orders was a good dnver fur receiving costs. During the last year, the company incurred fixed receiving costs of $630,000 (salaries of 10 empleyees). These fxed costa provide a capacity of processing 72,000 receiving orders (7,200 per employee at practical capacity). Management decided that the efficient level for receiving should use 36,000 receiving orders. Requiredi 1. Explain why receiving would be viewed as a value-added activity. Which of these are possible reasons that explain why the demand for receiving is more than the efficient level of…arrow_forwardIn response to a request from your immediate supervisor, you have prepared a CVP graphportraying the cost and revenue characteristics of your company’s product and operations.Explain how the lines on the graph and the break-even point would change if ( a ) the selling priceper unit decreased, ( b ) fixed cost increased throughout the entire range of activity portrayed onthe graph, and ( c ) variable cost per unit increased.arrow_forwardCost Structures for Global Shippers Inc. Management from Global Shippers Inc, an international shipping business, is in the process of assessing the choice between two different cost structures for the business. Option A has relatively higher variable costs per unit shipped but lower annual fixed costs, while Option B has the opposite—relatively lower variable costs in its cost structure but higher fixed costs. Assume that delivery selling prices per unit are constant. The table below contains critical information in making the decision: Cost Information Option A Option B Delivery price (revenue) per shipment $100 $100 Variable cost per shipment delivered $85 $60 Contribution Margin per unit $15 $40 Fixed costs (annual) $1,200,000 $4,500,000 Management wants you to write a professional report, answering the following questions: Find the breakeven point and plot a CVP graph Question 3 How many bricks need to be sold so as to earn a…arrow_forward

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning