Financial And Managerial Accounting

15th Edition

ISBN: 9781337902663

Author: WARREN, Carl S.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 7, Problem 1MAD

Analyze and compare Amazon.com to Netflix

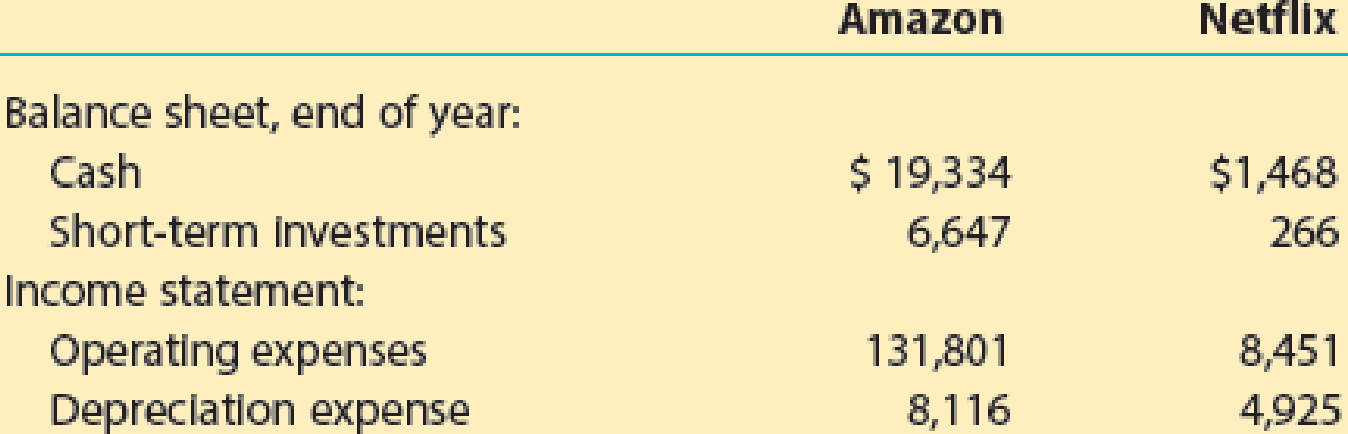

Amazon.com, Inc. (AMZN) is one of the largest Internet retailers in the world. Netflix, Inc. (NFLX) provides digital streaming and DVD rentals in the United States. Amazon and Netflix compete in streaming and digital services; however, Amazon also sells many other products online. The cash, temporary investments, operating expenses, and depreciation expense from recent financial statements were reported as follows for both companies (in millions):

- a. Determine the days’ cash on hand for Amazon and Netflix. Round all calculations to one decimal place.

- b. Interpret the results.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Compute returns on assets for AT&T and Verizon and answer the question below. Be sure to show your work.

Key figures($ millions). AT&T Verizon

Sales 126,723 110,875

Net Income 4,184 10,198

Average Assets 269,868 225,233

AT&T

Verizon

Which company is more successful in returning net income from its assets invested?

Charles Schwab Corporation (SCHW) is one of the more innovative brokerage and financial service companies in the United States. The company recently provided information about its major business segments as follows (in millions):

InvestorServices

AdvisorServices

Revenues

$5,411

$2,067

Operating income

2,031

962

Depreciation

180

54

Investor Services(in millions)

Advisor Services(in millions)

Estimated contribution margin

2211

1016

d. If Schwab decided to sell its “Advisor Services” accounts to another company, estimate how much operating income would decline under the following assumptions.

Assume the fixed costs that serve Advisor investors would not be sold but would be used by the other sector: ____________

Assume the fixed assets were “sold”: ________________

Staples, Inc. is one of the largest suppliers of office products in the United States. Suppose it had net income of $790 million and sales of $23,900 million in 2022. Its total assets were $14,500 million at the beginning of the year and $15,650 million at the end of the year. What is Staples, Inc.’s (a) asset turnover and (b) profit margin? (Round answers to 2 decimal places, e.g. 1.25.)

(a)

Asset turnover

enter asset turnover in times rounded to 2 decimal places

times

(b)

Profit margin

Enter profit margin in percentages rounded to 1 decimal place

%

Chapter 7 Solutions

Financial And Managerial Accounting

Ch. 7 - Prob. 1DQCh. 7 - Why should the employee who handles cash receipts...Ch. 7 - Prob. 3DQCh. 7 - Why should the responsibility for maintaining the...Ch. 7 - Prob. 5DQCh. 7 - Prob. 6DQCh. 7 - Prob. 7DQCh. 7 - Prob. 8DQCh. 7 - Prob. 9DQCh. 7 - Prob. 10DQ

Ch. 7 - Prob. 1BECh. 7 - Prob. 2BECh. 7 - Prob. 3BECh. 7 - Prob. 4BECh. 7 - Prob. 5BECh. 7 - Sarbanes-Oxley internal control report Using...Ch. 7 - Prob. 2ECh. 7 - Prob. 3ECh. 7 - Prob. 4ECh. 7 - Prob. 5ECh. 7 - Prob. 6ECh. 7 - Prob. 7ECh. 7 - Prob. 8ECh. 7 - Prob. 9ECh. 7 - Prob. 10ECh. 7 - Prob. 11ECh. 7 - Entry for cash sales; cash short The actual cash...Ch. 7 - Entry for cash sales; cash over The actual cash...Ch. 7 - Prob. 14ECh. 7 - Prob. 15ECh. 7 - Prob. 16ECh. 7 - Prob. 17ECh. 7 - Prob. 18ECh. 7 - Prob. 19ECh. 7 - Prob. 20ECh. 7 - Prob. 21ECh. 7 - Prob. 22ECh. 7 - Prob. 23ECh. 7 - Prob. 24ECh. 7 - Prob. 1PACh. 7 - Prob. 2PACh. 7 - Prob. 3PACh. 7 - Prob. 4PACh. 7 - Prob. 5PACh. 7 - Prob. 1PBCh. 7 - Prob. 2PBCh. 7 - Prob. 3PBCh. 7 - Prob. 4PBCh. 7 - Prob. 5PBCh. 7 - Analyze and compare Amazon.com to Netflix...Ch. 7 - Analyze and compare J. C. Penney and Macys J. C....Ch. 7 - Prob. 3MADCh. 7 - Prob. 4MADCh. 7 - Analyze and compare Nike, lululemon, and Under...Ch. 7 - Ethics in Action Tehra Dactyl is an accountant for...Ch. 7 - Bank error During the preparation of the bank...Ch. 7 - Prob. 4TIFCh. 7 - Prob. 5TIF

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Deere Company (DE) manufactures and distributes farm and construction machinery that it sells around the world. In addition to its manufacturing operations, Deeres credit division loans money to customers to finance the purchase of their farm and construction equipment. The following information is available for three recent years (in millions except per-share amounts): 1. Calculate the following ratios for each year. Round ratios and percentages to one decimal place, except for per-share amounts, which should be rounded to the nearest cent. a. Return on total assets b. Return on stockholders' equity c. Earnings per share d. Dividend yield e. Price-earnings ratio 2. Based on these data, evaluate Deeres profitability.arrow_forwardAnalyze and compare Amazon.com and Wal-Mart Amazon.com, Inc. (AMZN) is one of the largest Internet retailers in the world. Wal-Mart Stores, Inc. (WMT) is the largest retailer in the United States. Amazon and Wal-Mart compete in similar markets; however, Wal-Mart sells through both traditional retail stores and the Internet, while Amazon sells only through the Internet. Interest expense and income before income tax expense from the financial statements of both companies for two recent years follow (in millions): a. Compute the times interest earned ratio for both companies for the two years. Round to one decimal place. b. Interpret Amazons interest coverage from Year 1 to Year 2. c. Does a times interest earned ratio less than 1.0 mean that creditors will not get paid interest? d. Interpret Wal-Marts interest coverage from Year 1 to Year 2. e. Which company appears to have the greater protection for creditors?arrow_forwardNvidia Corporation, a global technology company located in Santa Clara, California, reported the following information in its 2014 financial statements ($ in thousands): 2014 2013 Balance sheets $ 582,740 Property, plant, and equipment (net) Income statement Net sales for 2014 $576,144 $4,130,162 Required: 1. Calculate the company's 2014 fixed-asset turnover ratio. 2. How would you interpret this ratio?arrow_forward

- Assume that you are purchasing an investment and have decided to invest in a company in the digital phone business. You have narrowed the choice to Digitized Corp. and Very Network, Inc. and have assembled the following data. LOADING... (Click to view the income statement data.) Data Table Selected income statement data for the current year: Digitized Very Network Net Sales Revenue (all on credit) $418,290 $494,940 Cost of Goods Sold 210,000 256,000 Interest Expense 0 15,000 Net Income 62,000 70,000 (Click to view the balance sheet and market price data.) Data Table Selected balance sheet and market price data at the end of the current year: Digitized Very Network Current Assets: Cash $24,000 $21,000 Short-term Investments 42,000 19,000 Accounts Receivables, Net 36,000 46,000 Merchandise Inventory 67,000 98,000 Prepaid Expenses 22,000 18,000 Total…arrow_forwardFind online the annual 10-K report for Costco Wholesale Corporation (COST) for fiscal year 2015 (filed in October 2015). a. Compute Costco's net profit margin, total asset turnover, and equity multiplier. b. Verify the DuPont Identity for Costco's ROE. c. If Costco's managers wanted to increase its ROE by 1 percentage point, how much higher would their asset turnover need to be? a. Compute Costco's net profit margin, total asset turnover, and equity multiplier. The net profit margin is %. (Round to two decimal places.) The total asset turnover is (Round to two decimal places.) The equity multiplier is (Round to two decimal places.) b. Verify the DuPont Identity forCostco's ROE. The ROE is %. (Round to two decimal places.) c. If Costco's managers wanted to increase its ROE by 1 percentage point, how much higher would their asset turnover need to be? The total assets turnover should be (Round to two decimal places.) The total asset turnover should be % (Round to two decimal places and…arrow_forwardGreen Technologies is a leading global end-to-end technology provider, with a portfolio of hardware, software and service solutions. In a recent annual report, the balance sheet included the following information ($ in millions): Current assets: Receivables, less allowance of $289 in 2020 and $280 in 2019 Req 1 In addition, the income statement reported sales revenue of $105,232 million for the current year. All sales are made on a credit basis. The statement of cash flows indicates that cash collected from customers during the current year was $104,868 million. There could have been significant recoveries of accounts receivable previously written off. Required: 1. Compute the following ($ in millions): Req 2A 2020 a. The amount of bad debts written off by Green during 2020 (Hint. Treat it as a plug in the gross accounts receivable account). b. The amount of bad debt expense that Green included in its income statement for 2020 (Hint. Treat it as a plug in the allowance for…arrow_forward

- Question :) Staples, Inc. is one of the largest suppliers of office products in the United States. Suppose it had net income of $790 million and sales of $23,900 million in 2022. Its total assets were $14,500 million at the beginning of the year and $15,650 million at the end of the year. What is Staples, Inc.'s (a) asset turnover and (b) profit margin? (Round answers to 2 decimal places, e.g. 1.25.) (a) Asset turnorer enter-asset-turnever in timesTounded to 2 decimal places (b) Profit margin Enter profit margin in percentages rounded to 1 decimal place % timesarrow_forwardHow solvent the business is and how many interest payments the business can service from operations alone? The cost per share of Universal Home Products Co Ltd was $67.00 in 2015 and $64.72 in 2016;arrow_forwardNeiman Marcus Group (NMG) is one of the largest luxury fashion retailers in the world. Kohls Corporation (KSS) sells moderately priced private and national branded products through more than 1,100 department stores located throughout the United States. The current assets and current liabilities at the end of a recent year for both companies are as follows (in millions): a. Would an analysis of working capital between the two companies be meaningful? Explain. b. Compute the quick ratio for both companies. Round to one decimal place. c. Interpret your results.arrow_forward

- Household Brands Inc. (HBI) manufactures household goods in the United States. The company made two acquisitions in previous years to diversify their product lines. In 2011, HBI acquired cosmetics and consumer electronics companies. HBI is now, in 2020, comprised of three divisions: cosmetics, household, and consumer electronics. The following information (in thousands of dollars) presents operating revenues, operating income, and invested assets of the company over the last three years: Revenue Operating Income Assets Cosmetics 2018 $ 25,400 $ 2,500 $ 9,200 2019 19,800 1,300 8,100 2020 20,000 1,400 9,770 Household 2018 15,900 1,700 7,260 2019 16,100 1,000 7,210 2020 12,300 880 6,680 Electronics 2018 13,300 1,700 4,330 2019 9,560 1,000 4,130…arrow_forwardCompute Liquidity and Solvency Ratios for Competing Firms Halliburton and Schlumberger compete in the oil field services sector. Refer to the following 2018 financial data for the two companies to answer the requirements. $ millions Cash and equivalents Short-term investments Accounts receivable Current assets Current liabilities Total liabilities Total equity Earnings before interest and tax (EBIT) Interest expense, gross HAL SLB $2,008 $1,433 1,344 5,391 8,117 11,151 15,731 4,946 13.891 16,438 33,921 1. Current ratio 2. Quick ratio 3. Times interest earned 4. Liabilities-to-equity 9,830 37,684 2,541 3,142 554 537 a. Compute the following measures for both companies. Note: Round your final answers to two decimal places (for example, enter 6.78 for 6.77555). HAL SLB b. Which company appears more liquid? c. Which company appears more solvent? ◆arrow_forwardYou are given the following information for Smashville, Incorporated. Cost of goods sold: Investment income: Net sales: Operating expense: Interest expense: Dividends: Tax rate: Current liabilities: Cash: $ 184,000 $ 1,600 $ 387,000 $ 88,000 $ 7,400 $ 6,000 21% $ 12,000 $ 21,000 Long-term debt: $ 32,000 $ 40,000 Other assets: Fixed assets: Other liabilities: Investments: Operating assets: $ 125,000 $ 5,000 $ 36,000 $ 64,000 During the year, Smashville, Incorporated, had 17,000 shares of stock outstanding and depreciation expense of $19,000. At the end of the year, Smashville stock sold for $42 per share. Calculate the price-book ratio, price-earnings ratio, and price-cash flow ratio. Note: Do not round intermediate calculations. Round your answers to 2 decimal places. Answer is not complete. Price-book ratio Price-earnings ratio Price-cash flow ratio 15.19arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

How To Analyze an Income Statement; Author: Daniel Pronk;https://www.youtube.com/watch?v=uVHGgSXtQmE;License: Standard Youtube License