FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

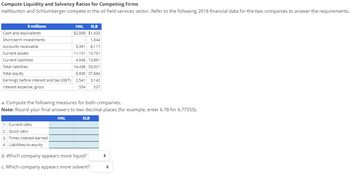

Transcribed Image Text:Compute Liquidity and Solvency Ratios for Competing Firms

Halliburton and Schlumberger compete in the oil field services sector. Refer to the following 2018 financial data for the two companies to answer the requirements.

$ millions

Cash and equivalents

Short-term investments

Accounts receivable

Current assets

Current liabilities

Total liabilities

Total equity

Earnings before interest and tax (EBIT)

Interest expense, gross

HAL SLB

$2,008 $1,433

1,344

5,391 8,117

11,151 15,731

4,946 13.891

16,438 33,921

1. Current ratio

2. Quick ratio

3. Times interest earned

4. Liabilities-to-equity

9,830 37,684

2,541 3,142

554 537

a. Compute the following measures for both companies.

Note: Round your final answers to two decimal places (for example, enter 6.78 for 6.77555).

HAL

SLB

b. Which company appears more liquid?

c. Which company appears more solvent?

◆

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 1. Calculate the cash operating cycle of Stone Limited for the year ended 30 April, 2018 and 2019.2. Calculate the comparative ratios for Stone limited for the year ended 30 April 2019. (to two decimal places where appropriate).3. Based on the result of the previous year end and the industry average. Draft a report addressed to the Board of Directors of Stone Limited analysing the performance of the company for the year 2019arrow_forwardYou are an investment analyst at FI Investments tasked to value FBC firm a Southern Agricultural Conglomerate. The following financial information was recently released for FBC. The company’s 2018 and 2017 annual financial reports are contained in tables 1 and 2 below, along with important additional information: Table 1: FBC statement of financial position (R millions) 2018 2017 Cash and equivalents R149 R83 Accounts receivable 295 265 Inventory 275 285 Total current assets R719 R633 Total fixed assets 3 909 3 856 Accounts payable 228 220 Notes payable 0 0 Total current liabilities 228 220 Long term debt 1 800 1 650 Total liabilities and shareholders equity 3 909 3 856 Number of shares outstanding (millions) 100 100 Additional information: Depreciation (2018): R483. The firm spent R250m in profitable projects during the…arrow_forwardUsing the financial statements in the image, calculate the following ratios for both the FY 2017 and FY 2018: Current Ratio Quick Ratio Total Asset Turnover Average Collection Total Debt to Total Assets Times Interest Earned Net Profit Margin Return on Assets Return on Equity Modified Du Point Equation for FY 2018 PE Ratio Market to Book Ratioarrow_forward

- Compute Liquidity and Solvency Ratios for Competing Firms Halliburton and Schlumberger compete in the oil field services sector. Refer to the following 2018 financial data for the two companies to answer the requirements. $ millions Cash and equivalents Short-term investments Accounts receivable HAL SLB $2,008 $1,433 1,344 5,182 7,802 Current assets Current liabilities Total liabilities Total equity 11,151 15,731 4,754 13,351 16,438 33,921 9,449 36,220 Earnings before interest and tax (EBIT) 2,442 3,020 Interest expense, gross 554 537 a. Compute the following measures for both companies. Note: Round your final answers to two decimal places (for example, enter 6.78 for 6.77555). HAL SLB 1. Current ratio 2.32 X 1.17 x 2. Quick ratio 1.5 x 0.68 * 3. Times interest earned 4.45 x 5.67 x 4. Liabilities-to-equity 1.7 x 0.92 x b. Which company appears more liquid? HAL c. Which company appears more solvent? SLB =>arrow_forwardCalculate the Rate of Return on Assets (ROA) for 2011. Disaggregate ROA into the profit margin for ROA and total assets turnover components. Calculate the Rate of Return on Common Stockholders’ Equity (ROCE) for 2011. Disaggregate ROCE into the profit margin for ROCE, total assets turnover and capital structure leverage components.arrow_forwardPERFORM A LIQUIDITY AND PROFITABILITY ANALYSIS ON THE FOLLOWING COMPANY UTILIZING THE FOLLOWING RATIOS: ASSET TURNOVER RETURN ON ASSESTS RETURN ON EQUITY statement of operations 12 Months Ended Jul. 31, 2020 Jul. 31, 2019 Revenues: Revenues $ 1,497,826,000 $ 1,684,392,000 Costs and expenses: Operating expense - personnel, vehicle, plant and other 493,055,000 468,868,000 Operating expense - equipment lease expense 33,017,000 Equipment lease expense, preadoption 33,073,000 Depreciation and amortization expense 80,481,000 78,846,000 General and administrative expense 45,752,000 59,994,000 Non-cash employee stock ownership plan compensation charge 2,871,000 5,693,000 Asset impairments 0 0 Loss on asset sales and disposals 7,924,000 10,968,000 Operating income 148,670,000 113,028,000 Interest expense (192,962,000) (177,619,000) Loss on extinguishment of debt (37,399,000) Other income (expense), net (460,000) 369,000 Loss before income…arrow_forward

- Calculate the ratios of Coles group of Australia for the year 2019: Ratios to calculate: Profitability (ROSF, ROCE, Gross margin, Operating profit margin, Cash flow to Sales*) Efficiency (Inventory turnover period, Average settlement period, Sales revenue to capital employed) Liquidity (Current ratio, Acid test (quick) ratio, Cash flow ratio*). Stability/Capital Structure (Gearing ratio, Interest cover ratio, Debt coverage ratio*) Investment/Market Performance (Earnings per share, Price earnings ratio, Operating cash flow per share*)arrow_forwardYou are required to calculate:1. Liquidity ratios 2. Solvency rations 3. Profitability ratios For the selected companies and shortly write your comments and findings.arrow_forwardThe image uploaded is the calculation of Cal Bank's Profitability ratios, shorter liquidity ratios, long-term liquidity ratios, and investment ratios for 2020, 2021, 2022. A base year of 2019 was also added. Evaluate the financial performance by comparing the three (3) years' financial performance that is 2020, 2021, and 2022 I have provided in the table with the base year.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education