Financial And Managerial Accounting

15th Edition

ISBN: 9781337902663

Author: WARREN, Carl S.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 7, Problem 5MAD

Analyze and compare Nike, lululemon, and Under Armour

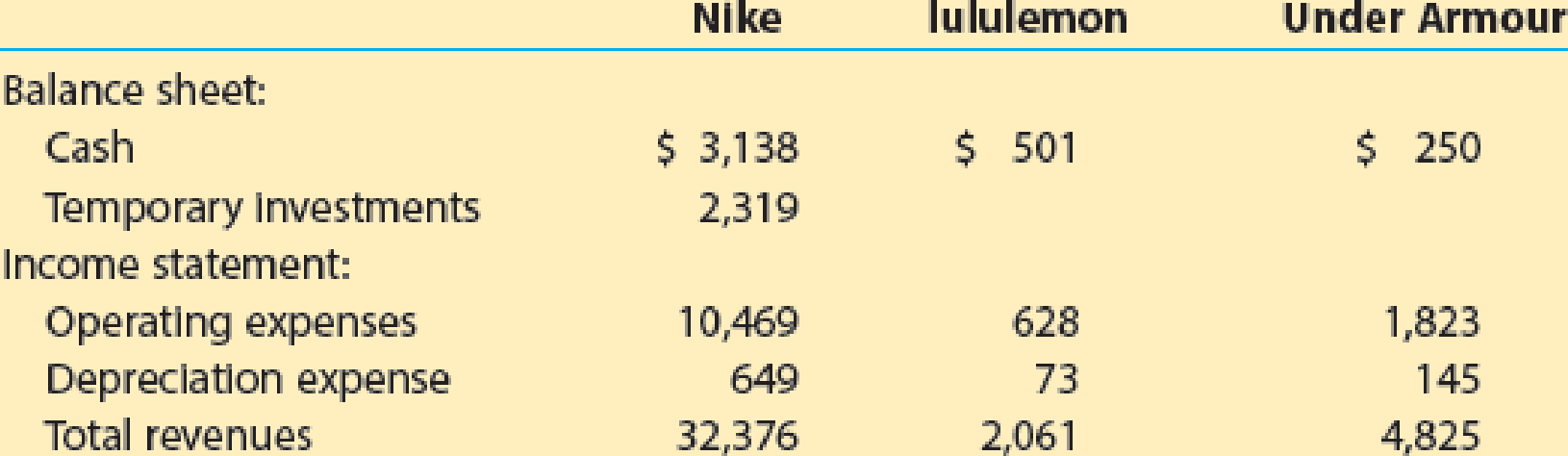

Three companies that compete in the athletic and activewear market segment are Nike, Inc. (NKE), lululemon athletica inc. (LULU), and Under Armour, Inc. (UAA). Nike is the largest designer and seller of athletic footwear and apparel in the world. Lululemon designs and sells technical athletic apparel featuring yoga, fitness, and dance-inspired wear. Under Armour designs and sells athletic apparel featuring high-performance fabrics for men and women around the world. Selected financial information for a recent year follows (in millions):

- a. How does the size of these companies, as represented by total revenues, compare to each other?

- b. Compute the days’ cash on hand for all three companies. Round all calculations to one decimal place.

- c. Comment on the cash sufficiency for these three companies.

- d. Which company appears to have the greatest cash liquidity?

- e. Why is a ratio used to compare cash sufficiency across the three companies rather than just the companies’ cash balances?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Kindly help me with accounting questions

Cariveh Co sells automotive supplies from 25 different locations in one country. Each branch has up to 30 staff working there, although most of the accounting systems are designed and implemented from the company's head office. All accounting systems, apart from petty cash, are computerised, with the internal audit department frequently advising and implementing controls within those systems.Cariveh has an internal audit department of six staff, all of whom have been employed at Cariveh for a minimum of five years and some for as long as 15 years. In the past, the chief internal auditor appoints staff within the internal audit department, although the chief executive officer (CEO) is responsible for appointing the chief internal auditor.The chief internal auditor reports directly to the finance director. The finance director also assists the chief internal auditor in deciding on the scope of work of the internal audit department.You are an audit manager in the internal audit department…

Accounting question

Chapter 7 Solutions

Financial And Managerial Accounting

Ch. 7 - Prob. 1DQCh. 7 - Why should the employee who handles cash receipts...Ch. 7 - Prob. 3DQCh. 7 - Why should the responsibility for maintaining the...Ch. 7 - Prob. 5DQCh. 7 - Prob. 6DQCh. 7 - Prob. 7DQCh. 7 - Prob. 8DQCh. 7 - Prob. 9DQCh. 7 - Prob. 10DQ

Ch. 7 - Prob. 1BECh. 7 - Prob. 2BECh. 7 - Prob. 3BECh. 7 - Prob. 4BECh. 7 - Prob. 5BECh. 7 - Sarbanes-Oxley internal control report Using...Ch. 7 - Prob. 2ECh. 7 - Prob. 3ECh. 7 - Prob. 4ECh. 7 - Prob. 5ECh. 7 - Prob. 6ECh. 7 - Prob. 7ECh. 7 - Prob. 8ECh. 7 - Prob. 9ECh. 7 - Prob. 10ECh. 7 - Prob. 11ECh. 7 - Entry for cash sales; cash short The actual cash...Ch. 7 - Entry for cash sales; cash over The actual cash...Ch. 7 - Prob. 14ECh. 7 - Prob. 15ECh. 7 - Prob. 16ECh. 7 - Prob. 17ECh. 7 - Prob. 18ECh. 7 - Prob. 19ECh. 7 - Prob. 20ECh. 7 - Prob. 21ECh. 7 - Prob. 22ECh. 7 - Prob. 23ECh. 7 - Prob. 24ECh. 7 - Prob. 1PACh. 7 - Prob. 2PACh. 7 - Prob. 3PACh. 7 - Prob. 4PACh. 7 - Prob. 5PACh. 7 - Prob. 1PBCh. 7 - Prob. 2PBCh. 7 - Prob. 3PBCh. 7 - Prob. 4PBCh. 7 - Prob. 5PBCh. 7 - Analyze and compare Amazon.com to Netflix...Ch. 7 - Analyze and compare J. C. Penney and Macys J. C....Ch. 7 - Prob. 3MADCh. 7 - Prob. 4MADCh. 7 - Analyze and compare Nike, lululemon, and Under...Ch. 7 - Ethics in Action Tehra Dactyl is an accountant for...Ch. 7 - Bank error During the preparation of the bank...Ch. 7 - Prob. 4TIFCh. 7 - Prob. 5TIF

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:CengagePrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:CengagePrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

How To Analyze an Income Statement; Author: Daniel Pronk;https://www.youtube.com/watch?v=uVHGgSXtQmE;License: Standard Youtube License