Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

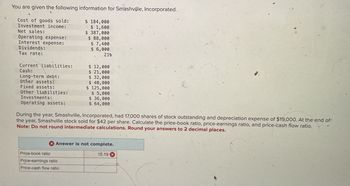

Transcribed Image Text:You are given the following information for Smashville, Incorporated.

Cost of goods sold:

Investment income:

Net sales:

Operating expense:

Interest expense:

Dividends:

Tax rate:

Current liabilities:

Cash:

$ 184,000

$ 1,600

$ 387,000

$ 88,000

$ 7,400

$ 6,000

21%

$ 12,000

$ 21,000

Long-term debt:

$ 32,000

$ 40,000

Other assets:

Fixed assets:

Other liabilities:

Investments:

Operating assets:

$ 125,000

$ 5,000

$ 36,000

$ 64,000

During the year, Smashville, Incorporated, had 17,000 shares of stock outstanding and depreciation expense of $19,000. At the end of

the year, Smashville stock sold for $42 per share. Calculate the price-book ratio, price-earnings ratio, and price-cash flow ratio.

Note: Do not round intermediate calculations. Round your answers to 2 decimal places.

Answer is not complete.

Price-book ratio

Price-earnings ratio

Price-cash flow ratio

15.19

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Examine the balance sheet of commercial banks in the following table. $ Billion % Total 201.2 28.9 230.1 Assets Real assets Equipment and premises Other real estate Total real assets Financial assets Cash Investment securities Loans and leases Other financial assets Total financial assets Other assets Intangible assets Other Total other assets Total $ Ratio of real assets to total assets $ $ 876.3 2,032.1 6,627.3 1,201.2 $10,736.9 $ 416.4 780.7 $ 1,197.1 $12,164.1 1.7% 0.2 1.9% 7.2% 16.7 54.5 9.9 88.3% 3.4% 6.4 9.8% 100.0% Liabilities Deposits Liabilities and Net Worth Debt and other borrowed funds Federal funds and repurchase agreements Other Total liabilities Net worth Balance sheet of FDIC-insured commercial banks and savings institutions Note: Column sums may differ from total because of rounding error. Source: Federal Deposit Insurance Corporation, www.fdic.gov, October 2018. a. What is the ratio of real assets to total assets? (Round your answer to 4 decimal places.) $ Billion %…arrow_forwardSome recent financial statements for Smolira Golf, Incorporated, follow. Assets Current assets Cash Accounts receivable Inventory Total Fixed assets Net plant and equipment Total assets Sales Cost of goods sold Depreciation EBIT Interest paid Taxable income Taxes SMOLIRA GOLF, INCORPORATED 2022 Income Statement Net income Dividends Retained earnings 2021 Short-term solvency ratios a. Current ratio b. Quick ratio c. Cash ratio Asset utilization ratios d. Total asset turnover e. Inventory turnover f. Receivables turnover Long-term solvency ratios g. Total debt ratio h. Debt-equity ratio i. Equity multiplier j. Times interest earned ratio k. Cash coverage ratio Profitability ratios I. Profit margin m. Return on assets n. Return on equity $3,061 4,742 12,578 $ 20,381 SMOLIRA GOLF, INCORPORATED Balance Sheets as of December 31, 2021 and 2022 2022 Liabilities and Owners' Equity Current liabilities Accounts payable Notes payable Other $ 52,746 $ 73,127 2021 $ 188,370 126, 703 5,283 $ 56,384…arrow_forwardASSETS Cash Accounts receivable Inventory Net plant and equipment Total assets LIABILITIES AND STOCKHOLDERS' EQUITY Accounts payable Accrued expenses Long-term debt Common stock Paid-in capital Retained earnings Total liabilities and stockholders' equity Sales (all on credit) Cost of goods sold Gross profit Sales and administrative expenses Depreciation Operating profit Interest expense Profit before taxes Taxes (30%) Net income Multiple Choice O Refer to the tables above. What Is Megaframe Computer's total asset turnover? O MEGAFRAME COMPUTER COMPANY Balance Sheet As of December 31 MEGAFRAME COMPUTER COMPANY Income Statement For the year ended December 31 O 7.58x 3.6x 2x 1.94x $ 875,000 600,000 $ 275,000 30,000 55,000 $ 190,000 25,000 $ 165,000 49,500 $ 115,500 $ 50,000 70,000 110,000 220,000 $ 450,000 $ 70,000 50,000 130,000 70,000 40,000 90,000 $ 450,000arrow_forward

- EMM, Inc. has the following balance sheet: EMM, Incorporated Balance Sheet as of 12/31/X0 Assets Liabilities and Equity Cash $ 1,200 Accounts payable $ 4,900 Accounts receivable 8,900 Bank note payable 7,700 Inventory 6,100 Long-term assets 4,400 Equity 8,000 $ 20,600 $ 20,600 It has estimated the following relationships between sales and the various assets and liabilities that vary with the level of sales: Accounts receivable = $3,560 + 0.35 Sales, Inventory = $2,356 + 0.28 Sales, Accounts payable = $1,449 + 0.20 Sales. If the firm expects sales of $27,000, what are the forecasted levels of the balance sheet items above? Round your answers to the nearest dollar. Accounts receivable: $ Inventory: $ Accounts payable: $ Will the expansion in accounts payable cover the expansion in inventory and accounts receivable? Round your answers to the nearest dollar. The expansion in accounts payable of $ the total…arrow_forwardHere are simplified financial statements for Watervan Corporation: INCOME STATEMENT (Figures in $ millions) Net sales $ 887.00 Cost of goods sold 747.00 Depreciation 37.00 Earnings before interest and taxes (EBIT) $ 103.00 Interest expense 18.00 Income before tax $ 85.00 Taxes 17.85 Net income $ 67.15 BALANCE SHEET (Figures in $ millions) End of Year Start of Year Assets Current assets $ 375 $ 324 Long-term assets 270 228 Total assets $ 645 $ 552 Liabilities and shareholders’ equity Current liabilities $ 200 $ 163 Long-term debt 114 127 Shareholders’ equity 331 262 Total liabilities and shareholders’ equity $ 645 $ 552 The company’s cost of capital is 8.5%. Required: What is the company’s return on capital? (Use start-of-year rather than average capital.) Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. P.S- Answer is not 26.48%arrow_forwardSales Revenue Less: Cost of Goods Sold Gross Profits Less: Operating Expenses Operating Profits Less: Interest Expense Net Profits Before Taxes Less: Taxes (40%) Net Profits After Taxes Assets Cash Income Statement Pulp, Paper and Paperboard, Inc. For the Year Ended December 31, 2019 Accounts receivable Inventories Total current assets Gross fixed assets Less: Accumulated depreciation Net fixed assets Total assets Liabilities and stockholders' equity Current liabilities Balance Sheet Pulp, Paper and Paperboard, Inc. December 31, 2019 Accounts payable Notes payable Accruals Total current liabilities Long-term debts Total liabilities Stockholders' equity Common stock Retained earnings Total stockholders' equity Total liabilities and stockholders' equity Calculate the following: NP, GP $2,080,976 1,701,000 $ 379,976 273,846 $ 106,130 19,296 S 86,834 34,810 S 52,024 Current Ratio - Quick Ratio Receivable days - Payable days $ 95,000 237,000 243.000 $ 575,000 500,000 75.000 $ 425,000…arrow_forward

- The following information is given to you relating to the operations of PrincehallCorporation: The income tax rate is 40%. Net sales $11,862 Cost of sales 8,321 Gross margin ? Selling, general, and administrative expenses $ 2,743 Depreciation, amortization, and asset write-offs 278 Total operating expenses: ? Income from operations : ? Interest expense 91 Interest and other income 11 Earnings before income taxes: ? Income taxes ? Net earnings: ? Determine the earnings before taxes:arrow_forwardWhat's the total asset turnover ratio of this company? Assets: Cash and marketable securities Accounts receivable Inventories Prepaid expenses Total current assets Fixed assets Less: accum. depr. Net fixed assets Total assets Liabilities: Accounts payable Notes payable Accrued taxes Total current liabilities Long-term debt Owner's equity (1 million shares of common stock outstanding) Total liabilities and owner's equity Net sales (all credit) Less: Cost of goods sold Selling and administrative expense Depreciation expense Interest expense Earnings before taxes Income taxes Net income 1.41 2.33 O 4.45 1.11 8,000,000 (2,075,000) $600,000 900,000 1,500,000 75,000 $3,075,000 $5,925.000 $9,000,000 $800,000 700,000 50,000 $1,550,000 2,500,000 4,950,000 $9,000,000 $10,000,000 (3,000,000) (2,000,000) (250,000) (200,000) 4,550,000 (1,820,000) $2,730,000arrow_forwardPlease helparrow_forward

- Calculationarrow_forwardSales. Costs and expenses Cost of goods sold. Operating expenses. Interest expense... Income before income taxes. Income tax expense.. Net income.. Statement of Income For the Year Ended December 31, 2020 $1,140,000 $1,700,000 364,800 37,800 1,542,600 157,400 55,090 $ 102,310 GEORGE INDUSTRIES Statement of Financial Position December 31, 2020 Total assets. Total liabilities.. Total shareholders' equity... 2020 2019 $842,110 $717,800 329,600 279,600 512,510 438,200 Calculate the Net profit margin ratio (use up to 2 decimal places and do not use a % sign)arrow_forwardThunder Corporation's balance sheet and income statement appear below: Assets: Cash and cash equivalents Accounts receivable Inventory Property, plant, and equipment Less accumulated depreciation Total assets Liabilities and stockholders' equity: Accounts payable Bonds payable Common stock Retained earnings Total liabilities and stockholders' equity Sales Cost of goods sold Gross margin Selling and administrative expense Net operating income Income taxes Net income Operating activities: Comparative Balance Sheet Income Statement @ 550 D RSA $ 891 Required: Prepare a statement of cash flows in good form using the indirect method. Note: List any deduction in cash and cash outflows as negative amounts. Thunder Corporation Statement of Cash Flows For This Year Ended December 31 334 $ 116 Santa Ending Balance 72 53 466 206 $ 425 53 $ 425 SER SIS The company did not dispose of any property, plant, and equipment, issue any bonds payable, or repurchase a stock during the year. The company…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education