Engineering Economy (17th Edition)

17th Edition

ISBN: 9780134870069

Author: William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 6, Problem 85FE

Problems 6-82 through 6-85. (6.4)

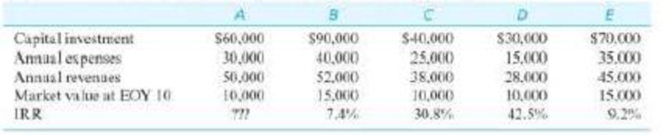

Table P6-82 Data for Problems 6-82 through 6-85

6-85. Using a MARR of 15%, the preferred Alternative is:

- a. Do Nothing

- b. Alternative A

- c. Alternative B

- d. Alternative C

- e. Alternative D

- f. Alternative E

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Carlisle Company has been cited and must invest in equipment to reduce stack emissions or face EPA fines of $18,500 per year. An emission reduction filter will cost $75,000 and have an expected life of 5 years. Carlisle’s MARR is 10%/year. Solve, a. What is the future worth of this investment? b. What is the decision rule for judging the attractiveness of investments based on future worth? c. Is the filter economically justified?

Can you compute the PW of alternative A, the AW of alternative B, the FW of Alternative C, and the PW of alternative D? Also for a MARR of 12%, rank the MEAs from most profitable to least profitable. HINT: You will need to perform additional calculations before answering this question.

A city government feels that the energy production capacity must be

expanded to meet anticipated demands for energy. There are three

alternatives to consider:

@A nuclear facility with an investment of $250 million, operating

costs of $3 million per year and life of 20 years.

@ A coal plant with an investment of $200 million operating costs

of $10 million per year and a life of 20 years.

26°C I

P Type here to search

Chapter 6 Solutions

Engineering Economy (17th Edition)

Ch. 6 - An oil refinery finds that it is necessary to...Ch. 6 - The Consolidated Oil Company must install...Ch. 6 - One of the mutually exclusive alternatives below...Ch. 6 - Three mutually exclusive design alternatives are...Ch. 6 - Prob. 5PCh. 6 - Prob. 6PCh. 6 - Fiesta Foundry is considering a new furnace that...Ch. 6 - Prob. 8PCh. 6 - DuPont claims that its synthetic composites will...Ch. 6 - Prob. 10P

Ch. 6 - Which alternative in the table below should be...Ch. 6 - Prob. 12PCh. 6 - The alternatives for an engineering project to...Ch. 6 - Prob. 14PCh. 6 - Prob. 15PCh. 6 - Prob. 16PCh. 6 - Refer to the situation in Problem 6-16. Most...Ch. 6 - An old, heavily used warehouse currently has an...Ch. 6 - Prob. 19PCh. 6 - Two electric motors (A and B) are being considered...Ch. 6 - Two mutually exclusive design alternatives are...Ch. 6 - Pamela recently moved to Celebration, Florida, an...Ch. 6 - Environmentally conscious companies are looking...Ch. 6 - Prob. 24PCh. 6 - Two 100 horsepower motors are being considered for...Ch. 6 - In the Rawhide Company (a leather products...Ch. 6 - Refer to Problem 6-2. Solve this problem using the...Ch. 6 - Prob. 28PCh. 6 - Prob. 29PCh. 6 - Two electric motors are being considered to drive...Ch. 6 - Prob. 31PCh. 6 - Prob. 32PCh. 6 - Prob. 33PCh. 6 - Potable water is in short supply in many...Ch. 6 - Three mutually exclusive investment alternatives...Ch. 6 - Prob. 36PCh. 6 - A companys MARR is 10% per year. Two mutually...Ch. 6 - Prob. 38PCh. 6 - a. Compare the probable part cost from Machine A...Ch. 6 - A one-mile section of a roadway in Florida has...Ch. 6 - Two mutually exclusive alternatives are being...Ch. 6 - Prob. 42PCh. 6 - IBM is considering an environmentally conscious...Ch. 6 - Three mutually exclusive earth-moving pieces of...Ch. 6 - A piece of production equipment is to be replaced...Ch. 6 - Prob. 46PCh. 6 - Prob. 47PCh. 6 - Prob. 48PCh. 6 - Prob. 49PCh. 6 - Prob. 50PCh. 6 - Prob. 51PCh. 6 - Prob. 52PCh. 6 - Prob. 53PCh. 6 - Use the imputed market value technique to...Ch. 6 - Prob. 55PCh. 6 - Prob. 56PCh. 6 - Prob. 57PCh. 6 - Prob. 58PCh. 6 - Prob. 59PCh. 6 - Prob. 60PCh. 6 - Prob. 61PCh. 6 - Prob. 62PCh. 6 - Prob. 63PCh. 6 - Prob. 64PCh. 6 - Prob. 65PCh. 6 - Prob. 66PCh. 6 - Three models of baseball bats will be manufactured...Ch. 6 - Refer to Example 6-3. Re-evaluate the recommended...Ch. 6 - Prob. 69SECh. 6 - Prob. 70SECh. 6 - Prob. 71SECh. 6 - Prob. 72CSCh. 6 - Prob. 73CSCh. 6 - Prob. 74CSCh. 6 - Prob. 75FECh. 6 - Prob. 76FECh. 6 - Prob. 77FECh. 6 - Complete the following analysis of cost...Ch. 6 - Prob. 79FECh. 6 - For the following table, assume a MARR of 10% per...Ch. 6 - Prob. 81FECh. 6 - Problems 6-82 through 6-85. (6.4) Table P6-82 Data...Ch. 6 - Prob. 83FECh. 6 - Problems 6-82 through 6-85. (6.4) Table P6-82 Data...Ch. 6 - Problems 6-82 through 6-85. (6.4) Table P6-82 Data...Ch. 6 - Consider the mutually exclusive alternatives given...Ch. 6 - Prob. 87FE

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- There are two mutually exclusive projects Alpha and Beta. The Alpha alternative has a life of 3 years, an initial cost of $11,000, an expected annual income of $7,000, and a salvage value after 3 years of $2,000. The Beta alternative has a life of 5 years and is expected to have an annual income of $7,000, but the initial cost will be $17,000, with a salvage value of $3,000. A MARR of 9% will be used for the analysis. Solve: USING EXCEL (show the forumla) 1) Which project would be chosen using the Truncated Method and the VAE? 2) Calculate the discounted payback period of the second. 3) Index of profitability of the first 4) The IRR of the first.arrow_forwardEvaluate the two alternatives A and B and decide the economic justified alternative using: Present worth method Annual worth method Future worth method I.R.R method E.R.R Method E.R.R.R method M.A.R.R = 15% the details of alternatives are shown in the table below Alternatives A Investments $6,000 $7,500 Useful life (years) 10 Annual disbursements $2,500 $3,500 Annual revenues $4,500 $6,000 Salvage values $500 $1,000arrow_forwardThe estimated negative cash flows for three design alternatives are shown below. The MARR is 13% per year and the study period is four years. Which alternative is best based on the IRR method? Doing nothing is not an option. Capital investment Annual expenses EOY 0 A. Alternative B B. Alternative A C. Alternative C 1-4 A $82,400 6,200 Alternative B $64,500 12,100 с $71,900 9,550 Which alternative would you choose as a base one? Choose the correct answer below.arrow_forward

- There are three alternatives X,Y,Z. With 10% MARR, which alternative should be chosen based on following conditions and why? For X, initial cost is $10k, yearly revenue is $6K, Salvage is $1k and useful life is calculated as 2yrs. For Y, initial cost is $15k, yearly revenue is $10K, Salvage is -$2k and useful life is calculated as 3yrs. For Z, initial cost is $12k, yearly revenue is $5K, Salvage is $3k and useful life is calculated as 4yrs.arrow_forwardConsider the five investment alternatives described below. Which alternatives can be eliminated from an incremental ROR analysis by applying short cuts for an investor with a MARR of 10%? Each alternative has a 5-year life and no salvage value. Initial cost Alternative ROR (%) (Sk) 60 14 45 20 50 18 D 30 25 75 12 Can eliminate do-nothing and C Can eliminate do-nothing and A Can eliminate do-nothing and E Can eliminate do-nothing onlyarrow_forwardConsider the following two investment alternatives. Determine the range of investment costs for Alternative B (i.e., min. valuearrow_forwardFive alternatives are being evaluated by the incremental rate of return method. Initial investment Overall ROR (TL) Alternative Incremental ROR (%) (%) B E -23.000 9.6 12.3 8.2 23.3 31.1 -37.000 12.2 5.2 23.5 22.4 -42.000 17.4 6.5 27.3 D -50.000 14.4 9.8 E -75.000 25.7 If the projects are mutually exclusive and the MARR is 13% per year, what is the best alternative? O a. B O b.C O c.D Od.E e. Aarrow_forwardOptions for iii are "knows" and "doesn't know"arrow_forwardCarlisle Company has been cited and must invest in equipment to reduce stack emissions or face EPA fines of $23,500 per year. An emission reduction filter will cost $85,000 and have an expected life of 5 years. Carlisle's MARR is 10%/year. Part a Your answer is incorrect. What is the future worth of this investment? $ Carry all interim calculations to 5 decimal places and then round your final answer to the nearest dollar. The tolerance is ±10.arrow_forwardSnip & Sketch Sales price Equipment cost Overhead cost Operating and maintenance cost Production time per 1,000 units Study period (planning horizon) MARR New 44 I $12.50 per unit $200,000 $50,000 per year 5 years 15% per year 0 $25 per operating hour 100 hours x An electronics firm is planning to manufacture a new handheld gaming device for the preteen market. The data have been estimated for the product. Assuming a negligible market (salvage) value for the equipment at the end of five years, determine the breakeven annual sales volume for this product. Click the icon to view the data estimated for the product. Click the icon to view the interest and annuity table for discrete compounding when i= 15% per year. The breakeven annual sales volume is nearest whole number.) units. (Round to thearrow_forwardHospital is evaluating the purchase of new office equipment from three vendors. Assume MARR=15% and 4 year useful life on all equipment. Select best vendor. What is the best vendor?arrow_forwardThe estimated negative cash flows for three design alternatives are shown below. The MARR is 10% per year and the study period is four years. Which alternative is best based on the IRR method? Doing nothing is not an option. Capital investment Annual expenses OA. Alternative B OB. Alternative C OC. Alternative A EOY 0 1-4 A $85,700 8,500 Alternative B $64,500 Which alternative would you choose as a base one? Choose the correct answer below. 15,150 C $71,900 12,450arrow_forwardarrow_back_iosSEE MORE QUESTIONSarrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education

Valuation Analysis in Project Finance Models - DCF & IRR; Author: Financial modeling;https://www.youtube.com/watch?v=xDlQPJaFtCw;License: Standard Youtube License