ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

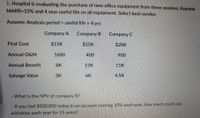

Transcribed Image Text:1. Hospital is evaluating the purchase of new office eguipment from three vendors. Assume

MARR=15% and 4 year useful life on lall equipment. Select best vendor.

Assume: Analysis period = useful life = 4 yrs

Company A

Company B

Company C

First Cost

$15K

$25K

$20K

Annual O&M

1600

400

900

Annual Benefit

8K

13К

11K

Salvage Value

3K

6K

4.5K

- What is the NPV of company B?

If you had $500,000 today in an account earning 10% each year, how much could you

withdraw each year for 25 years?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Hospital is evaluating the purchase of new office equipment from three vendors. Assume MARR=15% and 4 year useful life on all equipment. Select best vendor.

What is the best vendor?

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Hospital is evaluating the purchase of new office equipment from three vendors. Assume MARR=15% and 4 year useful life on all equipment. Select best vendor.

What is the best vendor?

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- A Startup is considering buying a $300,000 prece of equipment. If it puranases the equipment, to will take a loan for the entire amout; the interest on the loan is 3%. and the luan will be repond in 5 equal end of year payments. The Startup estimaks that the equipment would generall an additional $160,000 of revenue each year. At the end of 5 year, the equipment would have a salvague. value of $20,000. The tax rate is 25% Assuming a planning horizon of 5 years. that the equipment as depreciated using MACKS (3-year property class) and that the medical practice uses MARK of 7%. an after tax (a) Compute the Present Worth and determine whether the startup Should invest in the equipment (b) Re - compute the present worth if there exists a cl. inflation / year. would descision your change?arrow_forwardQ1).Using AW method compare between the following alternatives: Operating and maintenance Alt. F.C. Income at the Annual nd S.V. Useful life i. end of 2 yearIncome A 35000 3500 2800 7000 8 8% B. 32000 1500 4700 2500 8%arrow_forwardYou have been asked to perform a sensitivity analysis on a plant modernization plan. The initial investment is $30,000. Expected annual savings is $13,000. Salvage value is $7,000 after a 7 year planning horizon. The MARR is 12%. Determine the AW if the annual savings change by the following percentages from the initial estimate: b. -80%c. -60%d. -40%e. -20%f. +20%g. +40%h. Determine the percentage change in net annual savings that causes a reversal in the decision regarding the attractiveness of the projectarrow_forward

- A new bridge project is being evaluated at i = 20%. Recommend an alternative based on the capitalized cost for each. AnnualO&M Life(years) $250,000 $500,000 Construction Cost Concrete $50million Steel $40million Solution: 1. Here 2. CC concrete 50 3. CC steel 4. Choose capitalized cost (CC). million dollars; million dollars; 70 50arrow_forwardNonearrow_forwardFitzgerald, Ivy, Garcia, Nichols, Eudy, Williams, Thomas, Owens, and Nagy (FIGNEWTON) Inc. must replace its fig - crushing equipment. The alternatives under consideration are presented below. Alternative First Cost Net Annual Benefits Useful Life A $170, 500 $14, 675 5 years B 205,000 17,000 7 years C 242,500 16, 350 8 years D 290,000 14,825 10 years a) Which anlaysis method should be used to select the alternative? b) Why should that analysis method be used? c) if FIGNEWTON uses a MARR of 8%, what alternative should be chosen? d) if FIGNEWTON uses a MARR of 18%, what alternative should be chosen? Submit one excel file with answers a), b), c) and d) highlighted clearly.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education