ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Options for iii are "knows" and "doesn't know"

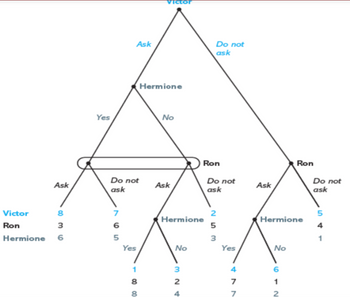

Transcribed Image Text:This image depicts a game theory decision tree involving three players: Victor, Hermione, and Ron. The decision tree outlines the possible choices and outcomes based on whether each player chooses to "Ask" or "Do not ask."

1. **Victor's Decision**:

- At the start, Victor can choose between two actions: "Ask" or "Do not ask."

- If Victor "Asks," the decision moves to Hermione.

2. **Hermione's Decision**:

- If Victor "Asks," Hermione then decides between "Yes" or "No."

- If Hermione says "Yes," the utility values are:

- Victor: 8

- Ron: 3

- Hermione: 6

- If Hermione says "No," the decision moves to Ron.

3. **Ron's First Decision**:

- Ron decides between "Ask" or "Do not ask."

- If Ron "Asks," Hermione decides again between "Yes" or "No."

- If Hermione says "Yes," the utility values are:

- Victor: 1

- Ron: 8

- Hermione: 8

- If Hermione says "No," the utility values are:

- Victor: 3

- Ron: 2

- Hermione: 2

- If Ron chooses "Do not ask," the utility values are:

- Victor: 7

- Ron: 6

- Hermione: 5

4. **Victor's Alternative Decision**:

- If Victor chooses "Do not ask," the decision moves directly to Ron.

5. **Ron's Second Decision**:

- Ron must choose again between "Ask" or "Do not ask."

- If Ron "Asks," Hermione makes the final decision between "Yes" or "No."

- If Hermione says "Yes," the utility values are:

- Victor: 4

- Ron: 7

- Hermione: 7

- If Hermione says "No," the utility values are:

- Victor: 6

- Ron: 1

- Hermione: 1

- If Ron chooses "Do not ask," the utility values are:

- Victor: 5

- Ron: 4

- Hermione: 1

This decision tree illustrates the strategic interactions and potential payoffs associated with

![**Title: Analyzing Decision-Making in Social Interactions: A Yule Ball Scenario**

**Introduction:**

In this educational exercise, we explore a decision-making scenario involving Victor and Ron as they contemplate inviting Hermione to the Yule Ball Dance. The game tree provided (not shown) outlines their interaction. Your task is to analyze and answer the following questions based on the tree.

**Questions:**

i. **Subgames Identification:**

- How many subgames are present, including the entire game?

- Remember to count the single (terminal) decision nodes as separate subgames, as discussed in class.

ii. **Information Sets Analysis:**

- Determine the number of information sets each character has:

- Victor: [Dropdown for the number]

- Hermione: [Dropdown for the number]

- Ron: [Dropdown for the number]

- Recall that an information set may consist of one or more decision nodes.

iii. **Conditional Decision-Making:**

- Consider Ron's decision-making process:

1. Before deciding to ask Hermione, Ron [Dropdown: knows/does not know] whether Victor has asked her.

2. If Victor invited Hermione, Ron [Dropdown: knows/does not know] Hermione's response to Victor before making his own decision to ask her.

**Conclusion:**

This exercise encourages a deeper understanding of strategic decision-making using game theory, focusing on information availability and subgame identification. Reflect on how each character’s knowledge and actions influence the outcome of their choices.](https://content.bartleby.com/qna-images/question/177574ce-3b5a-448a-a84d-30bf74afb543/4a88d860-8e62-41a2-9d79-caf6ebcb42e3/7dxlimc_thumbnail.png)

Transcribed Image Text:**Title: Analyzing Decision-Making in Social Interactions: A Yule Ball Scenario**

**Introduction:**

In this educational exercise, we explore a decision-making scenario involving Victor and Ron as they contemplate inviting Hermione to the Yule Ball Dance. The game tree provided (not shown) outlines their interaction. Your task is to analyze and answer the following questions based on the tree.

**Questions:**

i. **Subgames Identification:**

- How many subgames are present, including the entire game?

- Remember to count the single (terminal) decision nodes as separate subgames, as discussed in class.

ii. **Information Sets Analysis:**

- Determine the number of information sets each character has:

- Victor: [Dropdown for the number]

- Hermione: [Dropdown for the number]

- Ron: [Dropdown for the number]

- Recall that an information set may consist of one or more decision nodes.

iii. **Conditional Decision-Making:**

- Consider Ron's decision-making process:

1. Before deciding to ask Hermione, Ron [Dropdown: knows/does not know] whether Victor has asked her.

2. If Victor invited Hermione, Ron [Dropdown: knows/does not know] Hermione's response to Victor before making his own decision to ask her.

**Conclusion:**

This exercise encourages a deeper understanding of strategic decision-making using game theory, focusing on information availability and subgame identification. Reflect on how each character’s knowledge and actions influence the outcome of their choices.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- MINIMIZE the amount and what is the minimum amount of pounds?arrow_forwardCurrent Attempt in Progress All of the following are disadvantages for using simulation in risk analysis, except оооо Simulations can be quite time-consuming to formulate. Simulations can be used when analytical solutions are difficult to obtain. Simulations introduce a source of randomness not present in analytical solutions (sampling error). Simulations are so easily applied that they are often used when analytical solutions can be more easily obtained at considerably less cost.arrow_forwardPlease show work on Excel. A new engineer is evaluating whether to use a larger diameter pipe for a water line. The pipe will cost $327,089 more initially but will reduce pumping costs. The optimistic, most likely, and pessimistic projections for annual savings are $30,000, $20,000, and $5000, with respective probabilities of 20%, 50%, and 30%. The interest rate is most likely to be 7%, but is equally likely to be 6% or 8%, and the water line should have a life of 40 years. Find the expected annual savings and the expected interest rate. Determine the Expected PW based on these. Hint: Based on the different saving and their probabilities, find the expected value of savings. Then find the expected value of the interest rate (each option has equal probability). Then find the PW using these values.arrow_forward

- DECISION TREE APPLIED TO PRODUCT DESIGN Silicon, Inc., a semiconductor manufacturer, is investigating the possibility of producing and market-ing a microprocessor. Undertaking this project will require either purchasing a sophisticated CAD system or hiring and training several additional engineers. The market for the product could be eitherfavorable or unfavorable. Silicon, Inc., of course, has the option of not developing the new productat all.With favorable acceptance by the market, sales would be 25,000 processors selling for $100 each. Withunfavorable acceptance, sales would be only 8,000 processors selling for $100 each. The cost of CADequipment is $500,000, but that of hiring and training three new engineers is only $375,000. However,manufacturing costs should drop from $50 each when manufacturing without CAD to $40 eachwhen manufacturing with CAD. The probability of favorable acceptance of the new microprocessor is .40; the probability of unfa-vorable acceptance is .60.arrow_forwardA distribution company purchases two parts from the same supplier. When the company places an order there is a common procurement cost of $1750, in addition to $300 (Product I) and $100 (Product II) of individual procurement costs. Product I has a weekly demand of 500 units with a standard deviation of 50 units, Product I values $200, target CSL is 94%, and lead time is one month. Product II has a weekly demand of 60 units with a standard deviation of 15 units, each Product II values $1200, target CSL is 99%, and lead time is 3 months. The company uses 24% as the inventory holding rate per year (1 year is 52 weeks or 12 months) • Assuming each product is individually ordered using periodic review policy, compute T*, M*, and TC of Product I and II individually. . Assuming these products are jointly replenished, what will be the T*, M₁, M₁, TC? What is the amount of savings when products are jointly ordered compared to individual ordering?arrow_forwardFirst blank option is "use" or "not use" Second blank option is "0" or "between 0 and 300" or "between 300 and 400" or "between 400 and 700" Third option is "use" or "not use" Fourth option is "0" or "between 0 and 300" or "between 300 and 400" or "between 400 and 700" Fifth option is "it has property rights to clean the water" or "the chemical lab has property rights to pollute the water"arrow_forward

- Do not use chatgpt.arrow_forwardThe management of Brinkley Corporation is interested in using simulation to estimate the profit per unit for a new product. The selling price for the product will be $45 per unit. Probability distributions for the purchase cost, the labor cost, and the transportation cost are estimated as follows: Procurement Cost($) 10 $ 11 12 Probability 0.25 0.45 0.30 Labor Cost ($) 20 22 24 25 Probability 0.10 0.25 0.35 0.30 Transportation Cost ($) 3 5 (a) Compute profit per unit for the base-case, worst-case, and best-case scenarios. Base Case using most likely costs Profit = $ /unit Worst Case Profit = $ /unit Best Case Profit = $ /unit Probability 0.75 0.25 (b) Construct a simulation model to estimate the mean profit per unit. (Use at least 1,000 trials.) (c) Why is the simulation approach to risk analysis preferable to generating a variety of what-if scenarios? Simulation will provide ---Select--- of the profit per unit values which can then be used to find ---Select--- ◆ of an unacceptably low…arrow_forward= 1. (i) A utility function has the form U(w) aw³ +bw² where a, b E R. Assuming w > 0 and a 0, is U(w) ever suitable for a non-satiated and risk-averse investor? If it is, state the range of values of w this holds for as a function of a and b. You must include your working. (ii) Give an example of a utility function with DARA. Show all your working. (iii) An investor has IRRA. Would this investor prefer a fair gamble or to do nothing? Provide a short explanation of your answer.arrow_forward

- A company is evaluating 3 different distribution plans for a new product. The company has developed best case (60% probability) and worst case (40% probability) estimates for each plan. Results are summarized in the table below. What is the optimal decision based on the maximum expected value criterion? Worst Best Plan 1 -2 10 Plan 2 3 6 Plan 3 4 5 Prob 0.4 0.6arrow_forwardKarpoff Kremes (KK) planned to sell 40,000 Kings at $20 each and 20,000 Kweens at $15 each. Actual sales of the former were 45,000 and 25,000 of the latter, at $19 and $16 respectively. Which is true of KK's mix variance? so $175,000 fav $28,333 fav $8,333 unfav Unable to determinearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education