Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

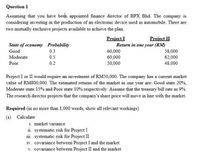

Transcribed Image Text:Question 1

Assuming that you have beeh appointed finance director of BPX Bhd. The company is

considering investing in the production of an electronic device used in automobile. There are

two mutually exclusive projects available to achieve the plan.

Project I

Return in one year (RM)

60,000

60,000

Project II

State of economy Probability

Good

0.3

58,000

62,000

Moderate

0.5

Poor

0.2

50,000

48,000

Project I or II would require an investment of RM50,000. The company has a current market

value of RM800,000. The estimated returns of the market in one year are: Good state 20%,

Moderate state 15% and Poor state 10% respectively. Assume that the treasury bill rate as 9%.

The research director projects that the company's share price will move in line with the market.

Required (in no more than 1,000 words, show all relevant workings)

(a) Calculate

i market variance

ii. systematic risk for Project I

iii. systematic risk for Project II

iv. covariance between Project I and the market

v. covariance between Project II and the market

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- A firm wants to start a project. A team of financial analysts estimated the following cash flows year cash flow 0 -$100,000 1 55,000 2 43,000 3 45,000 Based on your calcification of the pay back period and if the cut off point is 2 years, the project should Group of answer choices Undertake the project Can not decide because we do not have enough information not undertake the project in the short run but undertake the project in the long run Not undertake the projectarrow_forwardCo. has an investment opportunity (Project B) that requires a cash outlay of $18,000 today. They estimate that they will receive in exchange $6,200 in year 1, $6,500 in year 2, and $8,200 in year 3. Our Co 10. Marvelous me a) What are the IRR and the NPV of Project B? b) If the discount rate is 10%, would you invest in Project B? c) Let's imagine that we had a second project (Project B) that has an IRR of 18%. If the crossover rate between these two projects is 13%, which project would you choose when the appropriate discount rate is below that crossover rate?arrow_forwardTWITTERCO has an opportunity to invest in two business initiatives: MUSK #3 & MUSK #4 Expected cash flow data for these two projects is shown below: M #3 M #4 -250 90 90 90 90 2022 2023 2024 2025 2026 -250 105 105 105 TwitterCo has a cost of capital for these projects of 14%. Calculate the NPV of these projects. Project M#3 NPV: Project M#4 NPV: Based on NPV, preferred is: If both projects can be undertaken, should they?arrow_forward

- TWITTERCO has an opportunity to invest in two business initiatives: MUSK #1 & MUSK #2 Expected cash flow data for these two projects is shown below: M #1 M #2 -250 90 90 90 90 2022 2023 2024 2025 2026 -250 105 105 105 TwitterCo has a cost of capital for these projects of 11%. Calculate the NPV of these projects. Project M#1 NPV: Project M#2 NPV: Based on NPV, preferred is: If both projects can be undertaken, should they? If the projects are independent of each other, should they both be undertaken? If the projects are mutually exclusive of each other, should they both be undertaken?arrow_forwardThanks stepsssarrow_forwardPlease help me with part D. Thank you so mucharrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education