Concept explainers

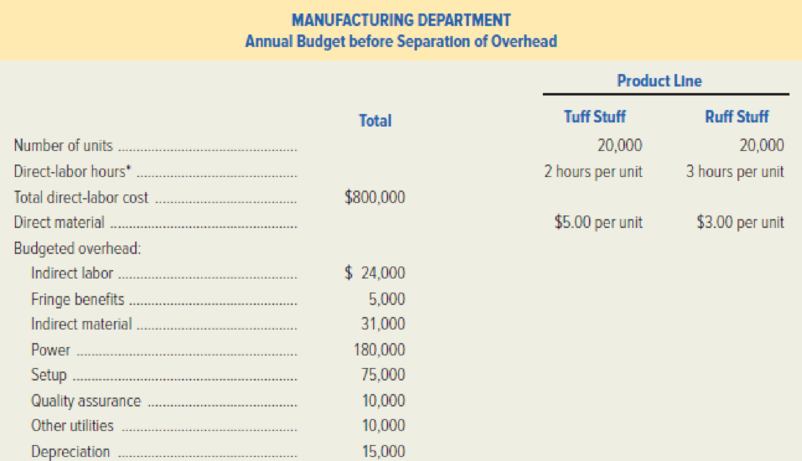

Marconi Manufacturing produces two items in its Trumbull Plant: Tuff Stuff and Ruff Stuff. Since inception, Marconi has used only one manufacturing-overhead cost pool to accumulate costs. Overhead has been allocated to products based on direct-labor hours. Until recently, Marconi was the sole producer of Ruff Stuff and was able to dictate the selling price. However, last year Marvella Products began marketing a comparable product at a price below the cost assigned by Marconi. Market share has declined rapidly, and Marconi must now decide whether to meet the competitive price or to discontinue the product line. Recognizing that discontinuing the product line would place an additional burden on its remaining product, Tuff Stuff, management is using activity-based costing to determine if it would show a different cost structure for the two products.

The two major indirect

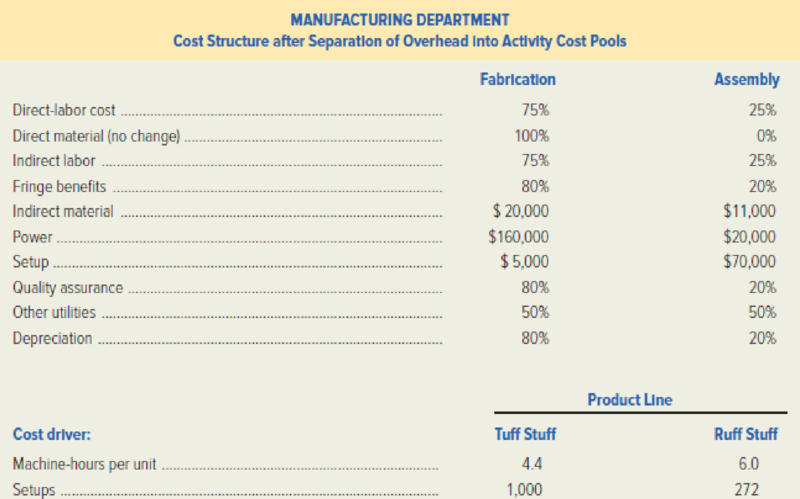

A decision was made to separate the Manufacturing Department costs into two activity cost pools as follows:

Fabrication: machine hours will be the cost driver.

Assembly: number of setups will be the cost driver.

The controller has gathered the following information.

*Direct-labor hourly rate is the same in both departments.

Required:

- 1. Assigning overhead based on direct-labor hours, calculate the following:

- a. Total budgeted cost of the Manufacturing Department.

- b. Unit cost of Tuff Stuff and Ruff Stuff.

- 2. After separation of overhead into activity cost pools, compute the total budgeted cost of each activity: Fabrication and Assembly.

- 3. Using activity-based costing, calculate the unit costs for each product. (In computing the pool rates for the Fabrication and Assembly activity cost pools, round to the nearest cent. Then, in computing unit product costs, round to the nearest cent.)

- 4. Discuss how a decision regarding the production and pricing of Ruff Stuff will be affected by the results of your calculations in the preceding requirements.

Want to see the full answer?

Check out a sample textbook solution

Chapter 5 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

- DK manufactures three products, W, X and Y. Each product uses the same materials and the same type of direct labour but in different quantities. The company currently uses a cost plus basis to determine the selling price of its products. This is based on full cost using an overhead absorption rate per direct labour hour. However, the managing director is concerned that the company may be losing sales because of its approach to setting prices. He thinks that a marginal costing approach may be more appropriate, particularly since the workforce is guaranteed a minimum weekly wage and has a three month notice period. Required: a) Given the managing director’s concern about DK’s approach to setting selling prices, discuss the advantages and disadvantages of marginal cost plus pricing AND total cost-plus pricing. The direct costs of the three products are shown below: Product W X Y Budgeted annual production (units) 15,000 24,000 20,000 $ per unit $ per unit $ per unit Direct materials…arrow_forwardDK manufactures three products, W, X and Y. Each product uses the same materials and the same type of direct labour but in different quantities. The company currently uses a cost plus basis to determine the selling price of its products. This is based on full cost using an overhead absorption rate per direct labour hour. However, the managing director is concerned that the company may be losing sales because of its approach to setting prices. He thinks that a marginal costing approach may be more appropriate, particularly since the workforce is guaranteed a minimum weekly wage and has a three month notice period.arrow_forwardDK manufactures three products, W, X and Y. Each product uses the same materials and the same type of direct labour but in different quantities. The company currently uses a cost plus basis to determine the selling price of its products. This is based on full cost using an overhead absorption rate per direct labour hour. However, the managing director is concerned that the company may be losing sales because of its approach to setting prices. He thinks that a marginal costing approach may be more appropriate, particularly since the workforce is guaranteed a minimum weekly wage and has a three month notice period. The direct costs of the three products are shown below: notice period. product w x y Budgeted annual production (units) 15,000 24,000 20,000 $ per unit $ per unit $ per unit Direct materials 35 40 45 Direct labour ($10 per hour) 40 30 50 In addition to the above direct costs, DK incurs annual indirect production costs of $1,044,000. a)Calculate the…arrow_forward

- DK manufactures three products, W, X and Y. Each product uses the same materials and the same type of direct labour but in different quantities. The company currently uses a cost plus basis to determine the selling price of its products. This is based on full cost using an overhead absorption rate per direct labour hour. However, the managing director is concerned that the company may be losing sales because of its approach to setting prices. He thinks that a marginal costing approach may be more appropriate, particularly since the workforce is guaranteed a minimum weekly wage and has a three month notice period. Required: a) Given the managing director's concern about DK's approach to setting selling prices, discuss the advantages and disadvantages of marginal cost plus pricing AND total cost-plus pricing. The direct costs of the three products are shown below: Product W Y Budgeted annual production (units) 15,000 24,000 20,000 $ per unit $ per unit $ per unit Direct materials 35 40…arrow_forwardDK manufactures three products, W, X and Y. Each product uses the same materials and the same type of direct labour but in different quantities. The company currently uses a cost plus basis to determine the selling price of its products. This is based on full cost using an overhead absorption rate per direct labour hour. However, the managing director is concerned that the company may be losing sales because of its approach to setting prices. He thinks that a marginal costing approach may be more appropriate, particularly since the workforce is guaranteed a minimum weekly wage and has a three month notice period. Required: a) Given the managing director's concern about DK's approach to setting selling prices, discuss the advantages and disadvantages of marginal cost plus pricing AND total cost-plus pricing. The direct costs of the three products are shown below: Product Y Budgeted annual production (units) 15,000 24,000 20,000 $ per unit $ per unit $ per unit Direct materials 35 40 45…arrow_forwardDK manufactures three products, W, X and Y. Each product uses the same materials and the same type of direct labour but in different quantities. The company currently uses a cost plus basis to determine the selling price of its products. This is based on full cost using an overhead absorption rate per direct labour hour. However, the managing director is concerned that the company may be losing sales because of its approach to setting prices. He thinks that a marginal costing approach may be more appropriate, particularly since the workforce is guaranteed a minimum weekly wage and has a three month notice period.e a) Given the managing director's concern about DK's approach to setting selling prices, discuss the advantages and disadvantages of marginal cost plus pricing AND total cost-plus pricing. The direct costs of the three products are shown below: Product- Budgeted annual production (units) 15,000- 24,000 20,000 $ per unita $ per unite $ per unita Direct materials 354 40 45a…arrow_forward

- DK manufactures three products, W, X and Y. Each product uses the same materials and the same type of direct labour but in different quantities. The company currently uses a cost plus basis to determine the selling price of its products. This is based on full cost using an overhead absorption rate per direct labour hour. However, the managing director is concerned that the company may be losing sales because of its approach to setting prices. He thinks that a marginal costing approach may be more appropriate, particularly since the workforce is guaranteed a minimum weekly wage and has a three month notice period. Required: Given the managing director’s concern about DK’s approach to setting selling prices, discuss the advantages and disadvantages of marginal cost plus pricing AND total cost-plus pricing. Calculate the full cost per unit of each product using DK’s current method of absorption The direct costs of the three products are shown below: Product W X Y Budgeted…arrow_forwardDK manufactures three products, W, X and Y. Each product uses the same materials and the same type of direct labour but in different quantities. The company currently uses a cost plus basis to determine the selling price of its products. This is based on full cost using an overhead absorption rate per direct labour hour. However, the managing director is concerned that the company may be losing sales because of its approach to setting prices. He thinks that a marginal costing approach may be more appropriate, particularly since the workforce is guaranteed a minimum weekly wage and has a three month notice period. Required: Given the managing director’s concern about DK’s approach to setting selling prices, discuss the advantages and disadvantages of marginal cost plus pricing AND total cost-plus pricing. * please help me to answer this question in details, thanksarrow_forwardDK manufactures three products, W, X and Y. Each product uses the same materials and the same type of direct labour but in different quantities. The company currently uses a cost plus basis to determine the selling price of its products. This is based on full cost using an overhead absorption rate per direct labour hour. However, the managing director is concerned that the company may be losing sales because of its approach to setting prices. He thinks that a marginal costing approach may be more appropriate, particularly since the workforce is guaranteed a minimum weekly wage and has a three month notice period. Required: a) Given the managing director's concern about DK's approach to setting selling prices, discuss the advantages and disadvantages of marginal cost plus pricing AND total cost-plus pricing. The direct costs of the three products are shown below: Product W Y Budgeted annual production (units) 15,000 24,000 20,000 $ per unit $ per unit $ per unit Direct materials 35 40…arrow_forward

- DK manufactures three products, W, X and Y. Each product uses the same materials and the same type of direct labour but in different quantities. The company currently uses a cost plus basis to determine the selling price of its products. This is based on full cost using an overhead absorption rate per direct labour hour. However, the managing director is concerned that the company may be losing sales because of its approach to setting prices. He thinks that a marginal costing approach may be more appropriate, particularly since the workforce is guaranteed a minimum weekly wage and has a three month notice period. Required: a) Given the managing director’s concern about DK’s approach to setting selling prices, discuss the advantages and disadvantages of marginal cost plus pricing AND total cost-plus pricing.arrow_forwardDK manufactures three products, W, X and Y. Each product uses the same materials and the same type of direct labour but in different quantities. The company currently uses a cost plus basis to determine the selling price of its products. This is based on full cost using an overhead absorption rate per direct labour hour. However, the managing director is concerned that the company may be losing sales because of its approach to setting prices.He thinks that a marginal costing approach may be more appropriate, particularly since the workforce is guaranteed a minimum weekly wage and has a three month notice period. Required:a) Given the managing director’s concern about DK’s approach to setting selling prices, discuss the advantages and disadvantages of marginal cost plus pricing AND total cost-plus pricing. The direct costs of the three products are shown below: Product W X Y Budgeted annual production (units) 15,000 24,000 20,000 $ per unit $ per unit $ per unit Direct…arrow_forwardBrees, Inc., a manufacturer of golf carts, has just received an offer from a supplier to provide 2,600 units of a component used in its main product. The component is a track assembly that is currently produced internally. The supplier has offered to sell the track assembly for $65 per unit. Brees is currently using a traditional, unit-based costing system that assigns overhead to jobs on the basis of direct labor hours. The estimated traditional full cost of producing the track assembly is as follows: Direct materials $40.00 Direct labor 16.00 Variable overhead 4.00 Fixed overhead 40.00 Prior to making a decision, the company’s CEO commissioned a special study to see whether there would be any decrease in the fixed overhead costs. The results of the study revealed the following: 3 setups—$1,180 each (The setups would be avoided, and total spending could be reduced by $1,180 per setup.) One half-time inspector is needed. The company already uses part-time inspectors hired…arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning