FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

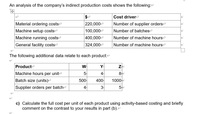

Transcribed Image Text:An analysis of the company's indirect production costs shows the following:-

$

Cost driver

Material ordering costsa

220,000

100,000

|400,000

Number of supplier orders

Machine setup costsa

Number of batchese

Machine running costs

Number of machine hours

General facility costs

324,000

Number of machine hours

The following additional data relate to each product:

Producta

Y

Z

Machine hours per unite

54

Batch size (units)

500

400

1000

Supplier orders per batche

4

3

c) Calculate the full cost per unit of each product using activity-based costing and briefly

comment on the contrast to your results in part (b).

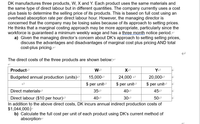

Transcribed Image Text:DK manufactures three products, W, X and Y. Each product uses the same materials and

the same type of direct labour but in different quantities. The company currently uses a cost

plus basis to determine the selling price of its products. This is based on full cost using an

overhead absorption rate per direct labour hour. However, the managing director is

concerned that the company may be losing sales because of its approach to setting prices.

He thinks that a marginal costing approach may be more appropriate, particularly since the

workforce is guaranteed a minimum weekly wage and has a three month notice period.e

a) Given the managing director's concern about DK's approach to setting selling prices,

discuss the advantages and disadvantages of marginal cost plus pricing AND total

cost-plus pricing.

The direct costs of the three products are shown below:

Product-

Budgeted annual production (units)

15,000-

24,000

20,000

$ per unita

$ per unite

$ per unita

Direct materials

354

40

45a

Direct labour ($10 per hour)

In addition to the above direct costs, DK incurs annual indirect production costs of

$1,044,000.

b) Calculate the full cost per unit of each product using DK's current method of

absorption

40

30-

50

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 6 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- RelyaTech Corporation manufactures a number of products at its highly automated factory. The products are very popular, with demand far exceeding the factory's capacity. To maximize profit, management should rank products based on their selling price gross margin contribution margin per unit of the constrained resource contribution marginarrow_forward'Brisbane Refinery Ltd' (BRL) processes canola oil for the Supermarket Chain G-Mart. It is involved in continuous processing to produce canola oil and uses FIFO process costing to account for its production costs. The FIFO is suitable for BRL as costs are quite unstable due to the volatile price of the canola seeds it uses in production. The canola seeds are processed through one department. Overhead is applied based on direct labour costs, and the application rate has not changed over the period covered by the problem. The Work-in-Process Inventory account showed the following balances at the start of the current period. Direct materials $195,500 Direct labour 390,000 Overhead applied 487,500 These costs were related to 78,000 litres that were in process at the start of the period. During the period, 90,000 litres were transferred to finished goods inventory. Of the litres finished during this period, 80 percent were sold. After litres have been transferred to finished goods…arrow_forwardDecorative Doors Ltd produces two types of doors: interior and exterior. The company’s costing system has two direct-cost categories (materials and labour) and one indirect-cost pool. The costing system allocates indirect costs on the basis of machine-hours. Recently, the owners of Decorative Doors have been concerned about a decline in the market share for their interior doors, usually their biggest seller. Information related to Decorative Doors production for the most recent year is as follows: Particulars Interior Exterior Units sold 3200 1800 Selling price $125 $200 Direct material cost per unit $30 $45 Direct production labour cost per hour5 $16 $16 Direct production labour-hours per unit 1.50 2.25 Production runs 40 85 Material moves 72 168 Machine set-ups 45 155 Machine-hours 5500 4500 Number of inspections 250 150 The owners have heard of other companies in the industry that are now…arrow_forward

- DK manufactures three products, W, X and Y. Each product uses the same materials and the same type of direct labour but in different quantities. The company currently uses a cost plus basis to determine the selling price of its products. This is based on full cost using an overhead absorption rate per direct labour hour. However, the managing director is concerned that the company may be losing sales because of its approach to setting prices. He thinks that a marginal costing approach may be more appropriate, particularly since the workforce is guaranteed a minimum weekly wage and has a three month notice period. Required: a) Given the managing director's concern about DK's approach to setting selling prices, discuss the advantages and disadvantages of marginal cost plus pricing AND total cost-plus pricing. The direct costs of the three products are shown below: Product Y Budgeted annual production (units) 15,000 24,000 20,000 $ per unit $ per unit $ per unit Direct materials 35 40 45…arrow_forwardHansabenarrow_forwardWhat is the breakeven point under (a) variable costing and (b) absorption costing?arrow_forward

- Pharoah Company has decided to introduce a new product. The new product can be manufactured by either a capital-intensive method or a labor-intensive method. The manufacturing method will not affect the quality of the product. The estimated manufacturing costs by the two methods are as follows. Direct materials Direct labor Variable overhead Fixed manufacturing costs (a) Pharoah' market research department has recommended an introductory unit sales price of $28.00. The selling expenses are estimated to be $432,000 annually plus $2.00 for each unit sold, regardless of manufacturing method. Capital-Intensive $4.00 per unit $5.00 per unit $3.00 per unit $2,284,000 Calculate the estimated break-even point in annual unit sales of the new product if Pharoah Company uses the: 1. Capital-intensive manufacturing method. Labor-intensive manufacturing method. 2. Labor-Intensive $4.50 per unit $7.00 per unit $4.00 per unit $1,437,000 Break-even point in units Capital-Intensive Labor-Intensivearrow_forwardAny manufacturing company has costs which include fixed costs such as plant overhead, product design, setup, and promotion; and variable costs that depend on the number of items produced. The revenue is the amount of money received from the sale of its product. The company breaks even if the revenue is equal to the cost. A company manufactures dog leashes that sell for $18.13, including shipping and handling. The monthly fixed costs (advertising, rent, etc.) are $22,920 and the variable costs (materials, shipping, etc.) are $9.78 per leash. How many leashes must be produced and sold each month for the company to break even? leashes. Round to the nearest leash.arrow_forwardChocolate Bars, Inc. (CBI), manufactures creamy deluxe chocolate candy bars. The firm has developed three distinct products: Almond Dream, Krispy Krackle, and Creamy Crunch. CBI is profitable, but management is quite concerned about the profitability of each product and the product costing methods currently employed. In particular, management questions whether the overhead allocation base of direct labor-hours accurately reflects the costs incurred during the production process of each product. Skipped In reviewing cost reports with the marketing manager, Steve Hoffman, who is the cost accountant, notices that Creamy Crunch appears exceptionally profitable and that Almond Dream appears to be produced at a loss. This surprises both him and the manager, and after much discussion, they are convinced that the cost accounting system is at fault and that Almond Dream is performing very well at the current market price. Steve decides to hire Jean Sharpe, a management consultant, to study the…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education