World Gourmet Coffee Company (WGCC) is a distributor and processor of different blends of coffee. The company buys coffee beans from around the world and roasts, blends, and packages them for resale. WGCC currently has 15 different coffees that it offers to gourmet shops in one-pound bags. The major cost is raw materials; however, there is a substantial amount of manufacturing overhead in the predominantly automated roasting and packing process. The company uses relatively little direct labor.

Some of the coffees are very popular and sell in large volumes, while a few of the newer blends have very low volumes. WGCC prices its coffee at full product cost, including allocated overhead, plus a markup of 30 percent. If prices for certain coffees are significantly higher than market, adjustments are made. The company competes primarily on the quality of its products, but customers are price-conscious as well.

Data for the 20x1 budget include manufacturing overhead of $3,000,000, which has been allocated on the basis of each product’s direct-labor cost. The budgeted direct-labor cost for 20x1 totals $600,000. Based on the sales budget and raw-material budget, purchases and use of raw materials (mostly coffee beans) will total $6,000,000.

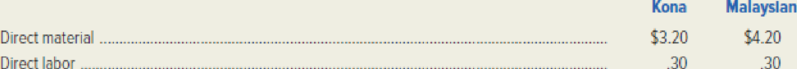

The expected prime costs for one-pound bags of two of the company’s products are as follows:

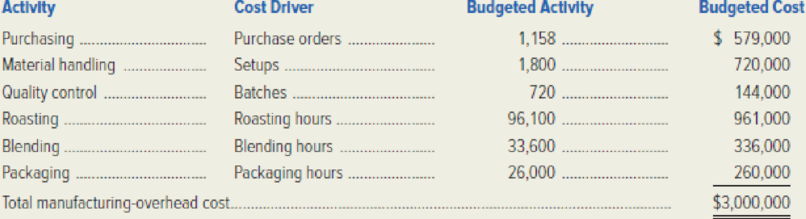

WGCC’s controller believes the traditional product-costing system may be providing misleading cost information. She has developed an analysis of the 20x1 budgeted

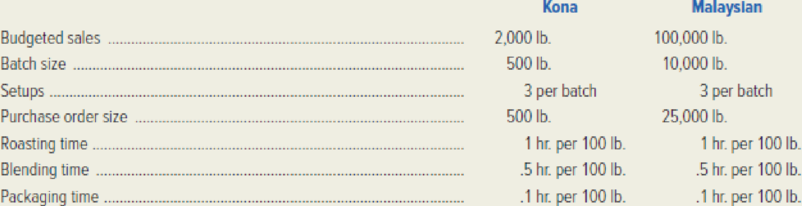

Data regarding the 20x1 production of Kona and Malaysian coffee are shown in the following table. There will be no raw-material inventory for either of these coffees at the beginning of the year.

Required:

- 1. Using WGCC’s current product-costing system:

- a. Determine the company’s predetermined overhead rate using direct-labor cost as the single cost driver.

- b. Determine the full product costs and selling prices of one pound of Kona coffee and one pound of Malaysian coffee.

- 2. Develop a new product cost, using an activity-based costing approach, for one pound of Kona coffee and one pound of Malaysian coffee.

- 3. What are the implications of the activity-based costing system with respect to

- a. The use of direct labor as a basis for applying overhead to products?

- b. The use of the existing product-costing system as the basis for pricing?

Want to see the full answer?

Check out a sample textbook solution

Chapter 5 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

- Muffin Factory (MF) bakes and sells muffins. MF buys materials from suppliers and bakes, frosts, and packages them for resale. Currently the firm offers 2 different types of muffins to gourmet bake shops in boxes, each containing a dozen muffins. The major cost is direct materials; however, a substantial amount of factory overhead is incurred in the baking, frosting, and packing process. MF prices its muffins at full product cost, including allocated overhead, plus a markup of 40%. Data for the current budget include factory overhead of $919,400, which has been allocated by its current costing system on the basis of each product’s direct labor cost. The budgeted direct labor cost for the current year totals $300,000. The budgeted direct costs for a one-dozen box of two of the company’s most popular muffins are as follows: Costs per one dozen Blueberry Cinnamon Activity Cost Driver Budgeted Activity Budgeted Cost Direct materials $…arrow_forwardSheffield’s Nut House is a processor and distributor of a variety of different nuts. The company buys nuts from around the world and roasts, seasons, and packages them for resale. Sheffield’s Nut House currently offers 15 different types of nuts in one-pound bags through catalogs and gourmet shops. The company’s major cost is that of the raw nuts; however, the predominantly automated roasting and packing processes consume a substantial amount of manufacturing overhead cost. The company uses relatively little direct labor.Some of Sheffield’s nuts are very popular and sell in large volumes, but some of the newer types sell in very low volumes. Sheffield’s prices its nuts at cost (including overhead) plus a markup of 50%. If the resulting prices of certain nuts are significantly higher than the market price, adjustments are made. Although the company competes primarily on the quality of its products, customers are price conscious.Data for the annual budget include manufacturing overhead…arrow_forwardCoffee Bean Incorporated (CBI) processes and distributes high-quality coffee. CBI buys coffee beans from around the world and roasts, blends, and packages them for resale. Currently, the firm offers 2 coffees to gourmet shops in 1-pound bags. The major cost is direct materials; however, a substantial amount of factory overhead is incurred in the predominantly automated roasting and packing process. The company uses relatively little direct labor. CBI prices its coffee at full product cost, including allocated overhead, plus a markup of 30%. If its prices are significantly higher than the market, CBI lowers its prices. The company competes primarily on the quality of its products, but customers are price conscious as well Data for the current budget include factory overhead of $3,028,000, which has been allocated on the basis of each product's direct labor cost. The budgeted direct labor cost for the current year totals $600,000. The firm budgeted $6,000,000 for purchase and use of…arrow_forward

- Coffee Bean Incorporated (CBI) processes and distributes high-quality coffee. CBI buys coffee beans from around the world and roasts, blends, and packages them for resale. Currently, the firm offers 2 coffees to gourmet shops in 1-pound bags. The major cost is direct materials; however, a substantial amount of factory overhead is incurred in the predominantly automated roasting and packing process. The company uses relatively little direct labor. CBI prices its coffee at full product cost, including allocated overhead, plus a markup of 30%. If its prices are significantly higher than the market, CBI lowers its prices. The company competes primarily on the quality of its products, but customers are price conscious as well. Data for the current budget include factory overhead of $3,168,000, which has been allocated on the basis of each product's direct labor cost. The budgeted direct labor cost for the current year totals $600,000. The firm budgeted $6,000,000 for purchase and use of…arrow_forwardMossfort, Inc., has a division in Canada that makes long-lasting exterior wood stain. Mossfort has another U.S. division, the Retail Division, that operates a chain of home improvement stores. The Retail Division would like to buy the unique, long-lasting wood stain from the Canadian division, since this type of stain is not currently available. The Exterior Stain Division incurs manufacturing costs of 13.45 for one gallon of stain. If the Retail Division purchases the stain from the Canadian division, the shipping costs will be 1.40 per gallon, but sales commissions of 0.75 per gallon will be avoided with an internal transfer. The Retail Division plans to sell the stain for 32.80 per gallon. Normally, the Retail Division earns a gross margin of 35 percent above cost of goods sold. Required: 1. Which Section 482 method should be used to calculate the allowable transfer price? 2. Calculate the appropriate transfer price per gallon. (Round to the nearest cent.)arrow_forwardAmazon Beverages produces and bottles a line of soft drinks using exotic fruits from Latin America and Asia. The manufacturing process entails mixing and adding juices and coloring ingredients at the bottling plant, which is a part of Mixing Division. The finished product is packaged in a company-produced glass bottle and packed in cases of 24 bottles each. Because the appearance of the bottle heavily influences sales volume, Amazon developed a unique bottle production process at the company’s container plant, which is a part of Container Division. Mixing Division uses all of the container plant’s production. Each division (Mixing and Container) is considered a separate profit center and evaluated as such. As the new corporate controller, you are responsible for determining the proper transfer price to use for the bottles produced for Mixing Division. At your request, Container Division’s general manager asked other bottle manufacturers to quote a price for the number and sizes…arrow_forward

- Zytel Corporation produces cleaning compounds and solutions for industrial and household use. While most of its products are processed independently, a few are related. Grit 337, a coarse cleaning powderwith many industrial uses, costs $1.60 a pound to make and sells for $2.00 a pound. A small portion of the annual production of this product is retained for further processing in the Mixing Department, where it is combined with several other ingredients to form a paste, which is marketed as a silver polish selling for $4.00 per jar. This further processing requires ¼ pound of Grit 337 per jar. Costs of other ingredients, labor, and variable overhead associated with this further processing amount to $2.50 per jar. Variableselling costs are $.30 per jar. If the decision were made to cease production of the silver polish, $5,600 of Mixing Department fixed costs could be avoided. Zytel has limited production capacity for Grit 337, but unlimited demand for the cleaning powder. Required:…arrow_forwardTeslum Inc. has a number of divisions, including the Machina Division, a producer of high-endespresso makers, and the Java Division, a chain of coffee shops.Machina Division produces the EXP-100 model espresso maker that can be used by JavaDivision to create various coffee drinks. The market price of the EXP-100 model is $950, andthe full cost of the EXP-100 model is $475.Required:1. If Teslum has a transfer pricing policy that requires transfer at full cost, what will thetransfer price be? Do you suppose that Machina and Java divisions will choose to transferat that price?2. If Teslum has a transfer pricing policy that requires transfer at market price, what wouldthe transfer price be? Do you suppose that Machina and Java divisions would choose totransfer at that price?3. Now suppose that Teslum allows negotiated transfer pricing and that Machina Divisioncan avoid $135 of selling expense by selling to Java Division. Which division sets theminimum transfer price, and what is it? Which…arrow_forwardCh Zytel Corporation produces cleaning compounds and solutions for industrial and household use. While most of its products are processed independently, a few are related. Grit 337, a coarse cleaning powder with many industrial uses, costs $2.20 a pound to make and sells for $3.40 a pound. A small portion of the annual production of this product is retained for further processing in the Mixing Department, where it is combined with several other ingredients to form a paste, which is marketed as a silver polish selling for $5.10 per jar. This further processing requires 1/4 pound of Grit 337 per jar. Costs of other ingredients, labor, and variable overhead associated with this further processing amount to $2.40 per jar. Variable selling costs are $0.30 per jar. If the decision were made to cease production,of the silver polish, $8,500 of Mixing Department fixed costs could be avoided. Zytel has limited production capacity for Grit 337, but unlimited demand for the cleaning powder.…arrow_forward

- Boney Corporation processes sugar beets that it purchases from farmers. Sugar beets are processed in batches. A batch of sugar beets costs $53 to buy from farmers and $18 to crush in the company's plant. Two intermediate products, beet fiber and beet juice, emerge from the crushing process. The beet fiber can be sold as is for $25 or processed further for $18 to make the end product industrial fiber that is sold for $39. The beet juice can be sold as is for $32 or processed further for $28 to make the end product refined sugar that is sold for $79. What is the financial advantage (disadvantage) for the company from processing the intermediate product beet juice into refined sugar rather than selling it as is?arrow_forwardCascade Containers is organized into two divisions-Manufacturing and Distribution. Manufacturing produces a product that can be sold immediately or transferred to Distribution for further processing and then sold. Distribution only buys from Manufacturing for quality control reasons. Manufacturing currently sells 2,400 units annually at a price of $600 per unit to outside customers. It sells an additional 1,200 units to Distribution. The unit variable cost in Manufacturing is $300 and annual fixed costs are $300,000. Manufacturing is located in a country with a 20 percent tax rate. Distribution can sell units that have had further processing for $1,200 each. In addition to what it pays Manufacturing, the variable costs in Distribution are $150 per unit. Annual fixed costs in Distribution are $360,000. Distribution is located in a country with a 10 percent tax rate. Required: a. Suppose Manufacturing would have excess capacity even with the demand from Distribution. Ignoring tax…arrow_forwardTourneSol Canada, Ltd. is a producer of high quality sunflower oil. The company buys raw sunflower seeds directly from large agricultural companies, and refines the seeds into sunflower oil that it sells in the wholesale market. As a by-product, the company also produces sunflower mash (a paste made from the remains of crushed sunflower seeds) that it sells into the market as base product for animal feed. The company has a maximum input capacity of 150 short tons of raw sunflower seeds every day (or 54,750 short tons per year). Of course the company cannot run at full capacity every day as it is required to shut down or reduce capacity for maintenance periods every year, and it experiences the occasional mechanical problem. The facility is expected to run at 90% capacity over the year (or on average 150 x 90% = 135 short tons per day). TourneSol is planning to purchase its supply of raw sunflower seeds from three primary growers, Supplier A, Supplier B, and Supplier C. Purchase prices…arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning