Concept explainers

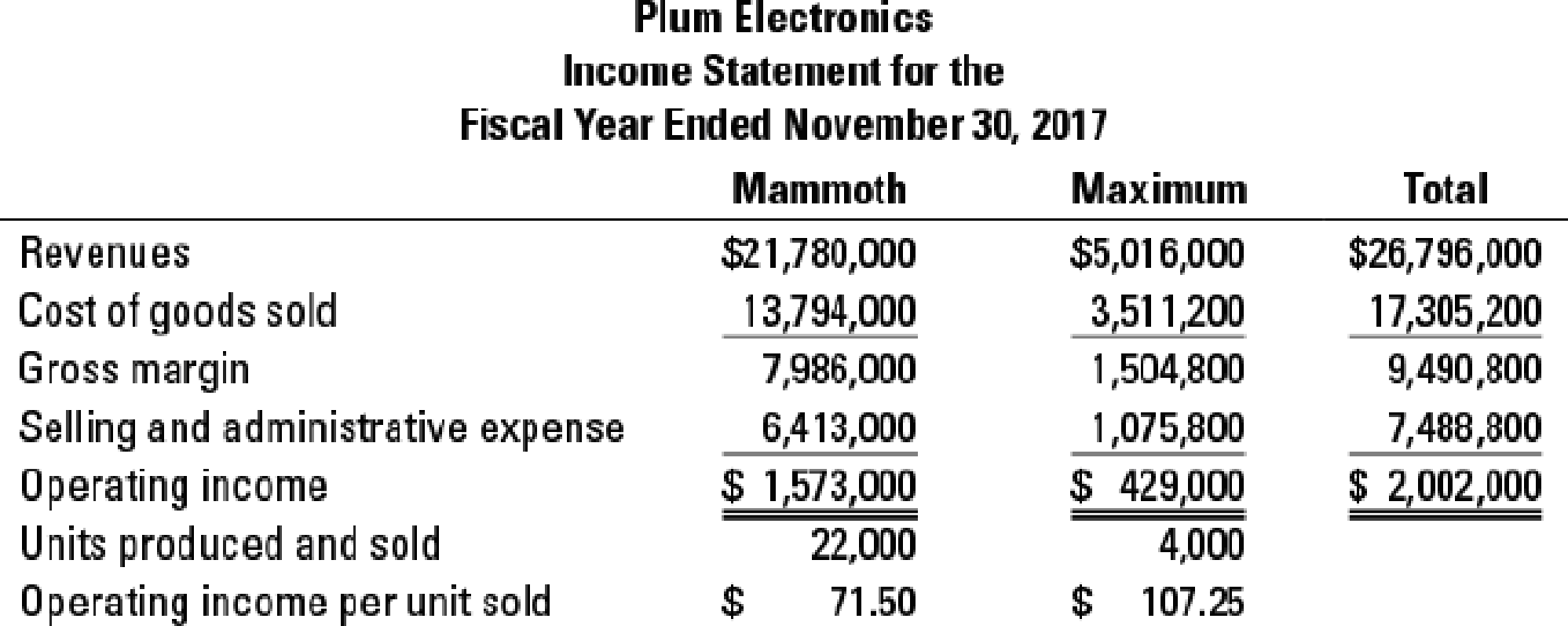

ABC, implementation, ethics. (CMA, adapted) Plum Electronics, a division of Berry Corporation, manufactures two large-screen television models: the Mammoth, which has been produced since 2013 and sells for $990, and the Maximum, a newer model introduced in early 2015 that sells for $1,254. Based on the following income statement for the year ended November 30, 2017, senior management at Berry have decided to concentrate Plum’s marketing resources on the Maximum model and to begin to phase out the Mammoth model because Maximum generates a much bigger operating income per unit.

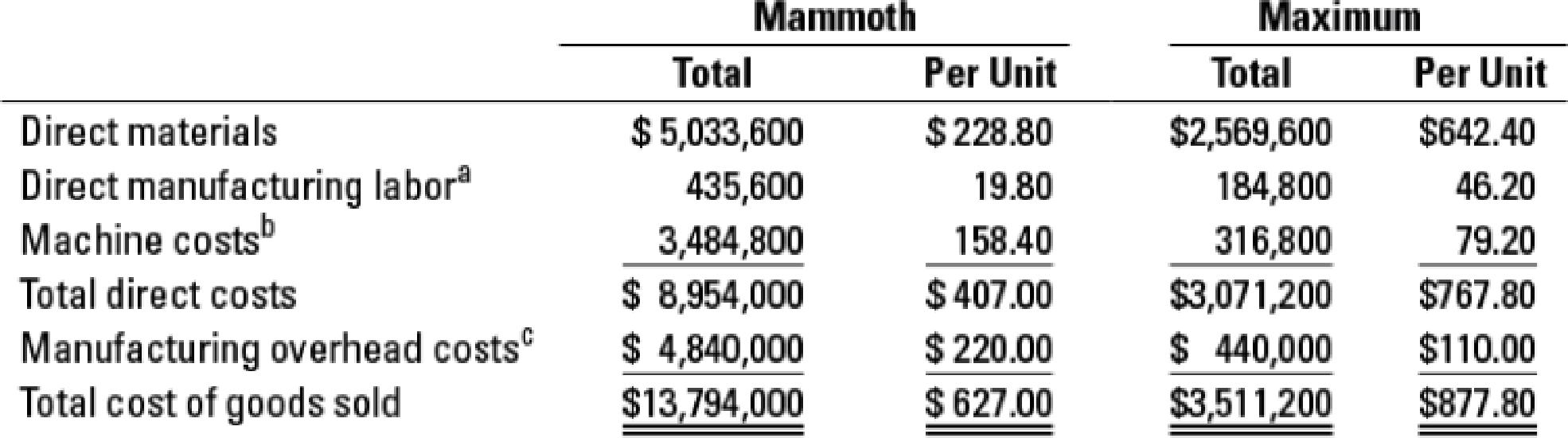

Details for cost of goods sold for Mammoth and Maximum are as follows:

a Mammoth requires 1.5 hours per unit and Maximum requires 3.5 hours per unit. The direct

b Machine costs include lease costs of the machine, repairs, and maintenance. Mammoth requires 8 machine-hours per unit and Maximum requires 4 machine-hours per unit. The machine-hour rate is $19.80 per hour.

c Manufacturing

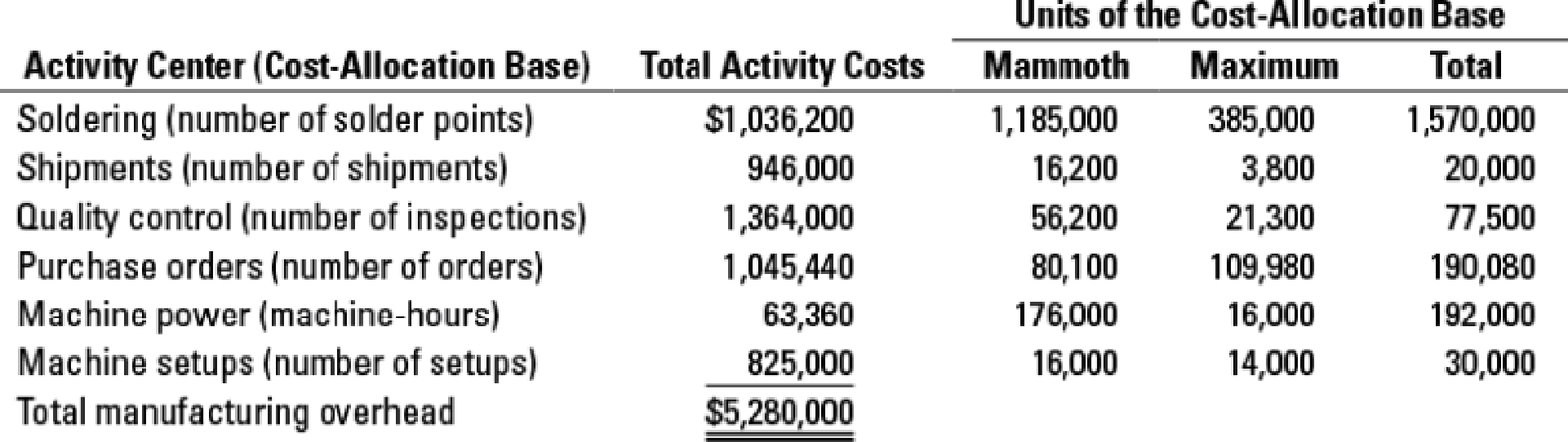

Plum’s controller, Steve Jacobs, is advocating the use of activity-based costing and activity-based management and has gathered the following information about the company’s manufacturing overhead costs for the year ended November 30, 2017.

After completing his analysis, Jacobs shows the results to Charles Clark, the Plum division president. Clark does not like what he sees. “If you show headquarters this analysis, they are going to ask us to phase out the Maximum line, which we have just introduced. This whole costing stuff has been a major problem for us. First Mammoth was not profitable and now Maximum.

“Looking at the ABC analysis, I see two problems. First, we do many more activities than the ones you have listed. If you had included all activities, maybe your conclusions would be different. Second, you used number of setups and number of inspections as allocation bases. The numbers would be different had you used setup-hours and inspection-hours instead. I know that measurement problems precluded you from using these other cost-allocation bases, but I believe you ought to make some adjustments to our current numbers to compensate for these issues. I know you can do better. We can’t afford to phase out either product.” Jacobs knows that his numbers are fairly accurate. As a quick check, he calculates the profitability of Maximum and Mammoth using more and different allocation bases. The set of activities and activity rates he had used results in numbers that closely approximate those based on more detailed analyses. He is confident that headquarters, knowing that Maximum was introduced only recently, will not ask Plum to phase it out. He is also aware that a sizable portion of Clark’s bonus is based on division revenues. Phasing out either product would adversely affect his bonus. Still, he feels some pressure from Clark to do something.

- 1. Using activity-based costing, calculate the gross margin per unit of the Maximum and Mammoth models.

Required

- 2. Explain briefly why these numbers differ from the gross margin per unit of the Maximum and Mammoth models calculated using Plum’s existing simple costing system.

- 3. Comment on Clark’s concerns about the accuracy and limitations of ABC.

- 4. How might Plum find the ABC information helpful in managing its business?

- 5. What should Steve Jacobs do in response to Clark’s comments?

Trending nowThis is a popular solution!

Chapter 5 Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

- CarniTrin is a manufacturer of Carnival costumes in a highly competitive market. The company's management team is seeking guidance on the use of financial performance measures to identify the key drivers of the company's financial performance and develop a strategy to improve it. The following data relate to the company for the year 2022: In its clothing division, the company has $6,000,000 invested in assets. After-tax operating income from sales of clothing in 2022 is $900,000. Income for the clothing division has grown steadily over the last few years. The cosmetics division has $14,000,000 invested in assets and an after-tax operating income in 2022 of $1,900,000. The weighted-average cost of capital for CarniTrin is 10% and the 2021’s after-tax return on investment for each division was 15%. The general manager of CarniTrin has asserted that in the future, managers should have their compensation structure aligned with their performance measures with no fixed salaries.…arrow_forwardCarniTrin is a manufacturer of Carnival costumes in a highly competitive market. Thecompany's management team is seeking guidance on the use of financial performancemeasures to identify the key drivers of the company's financial performance and develop astrategy to improve it.The following data relate to the company for the year 2022: In its clothing division, the company has $6,000,000 invested in assets. After-taxoperating income from sales of clothing in 2022 is $900,000. Income for the clothingdivision has grown steadily over the last few years. The cosmetics division has $14,000,000 invested in assets and an after-tax operatingincome in 2022 of $1,900,000. The weighted-average cost of capital for CarniTrin is 10% and the 2021’s after-taxreturn on investment for each division was 15%. The general manager of CarniTrin has asserted that in the future, managers shouldhave their compensation structure aligned with their performance measures with nofixed salaries. However, the…arrow_forwardCarniTrin is a manufacturer of Carnival costumes in a highly competitive market. The company's management team is seeking guidance on the use of financial performance measures to identify the key drivers of the company's financial performance and develop a strategy to improve it. The following data relate to the company for the year 2022: In its clothing division, the company has $6,000,000 invested in assets. After-tax operating income from sales of clothing in 2022 is $900,000. Income for the clothing division has grown steadily over the last few years. The cosmetics division has $14,000,000 invested in assets and an after-tax operating income in 2022 of $1,900,000. The weighted-average cost of capital for CarniTrin is 10% and the 2021’s after-tax return on investment for each division was 15%. The general manager of CarniTrin has asserted that in the future, managers should have their compensation structure aligned with their performance measures with no fixed salaries.…arrow_forward

- CarniTrin is a manufacturer of Carnival costumes in a highly competitive market. Thecompany's management team is seeking guidance on the use of financial performancemeasures to identify the key drivers of the company's financial performance and develop astrategy to improve it. The following data relate to the company for the year 2022: In its clothing division, the company has $6,000,000 invested in assets. After-taxoperating income from sales of clothing in 2022 is $900,000. Income for the clothingdivision has grown steadily over the last few years. The cosmetics division has $14,000,000 invested in assets and an after-tax operatingincome in 2022 of $1,900,000. The weighted-average cost of capital for CarniTrin is 10% and the 2021’s after-taxreturn on investment for each division was 15%. The general manager of CarniTrin has asserted that in the future, managers shouldhave their compensation structure aligned with their performance measures with nofixed salaries.…arrow_forwardCarniTrin is a manufacturer of Carnival costumes in a highly competitive market. Thecompany's management team is seeking guidance on the use of financial performancemeasures to identify the key drivers of the company's financial performance and develop astrategy to improve it. The following data relate to the company for the year 2022: In its clothing division, the company has $6,000,000 invested in assets. After-taxoperating income from sales of clothing in 2022 is $900,000. Income for the clothingdivision has grown steadily over the last few years. The cosmetics division has $14,000,000 invested in assets and an after-tax operatingincome in 2022 of $1,900,000. The weighted-average cost of capital for CarniTrin is 10% and the 2021’s after-taxreturn on investment for each division was 15%. The general manager of CarniTrin has asserted that in the future, managers shouldhave their compensation structure aligned with their performance measures with nofixed salaries. However, the…arrow_forwardMegaphone Corporation produces a molded plastic casing, M&M101, for many cell phones currently on the market. Summary data from its 2017 income statement are as follows:Revenues $5,000,000 Variable costs 3,250,000 Fixed costs 1,890,000 Operating income $ (140,000) Joshua Kirby, Megaphone’s president, is very concerned about Megaphone Corporation’s poor profitability. He asks Leroy Gibbs, production manager, and Tony DiNunzo, controller, to see if there are ways to reduce costs. After 2 weeks, Leroy returns with a proposal to reduce variable costs to 55% of revenues by reducing the costs Megaphone currently incurs for safe disposal of wasted plastic. Tony is concerned that this would expose the company to potential environmental liabilities. He tells Leroy, “We would need to estimate some of these potential environmental costs and include them in…arrow_forward

- Megaphone Corporation produces a molded plastic casing, M&M101, for many cell phones currently on the market. Summary data from its 2017 income statement are as follows:Revenues $5,000,000 Variable costs 3,250,000 Fixed costs 1,890,000 Operating income $ (140,000) Joshua Kirby, Megaphone’s president, is very concerned about Megaphone Corporation’s poor profitability. He asks Leroy Gibbs, production manager, and Tony DiNunzo, controller, to see if there are ways to reduce costs. After 2 weeks, Leroy returns with a proposal to reduce variable costs to 55% of revenues by reducing the costs Megaphone currently incurs for safe disposal of wasted plastic. Tony is concerned that this would expose the company to potential environmental liabilities. He tells Leroy, “We would need to estimate some of these potential environmental costs and include them in…arrow_forwardMegaphone Corporation produces a molded plastic casing, M&M101, for many cell phones currently on the market. Summary data from its 2017 income statement are as follows:Revenues $5,000,000 Variable costs 3,250,000 Fixed costs 1,890,000 Operating income $ (140,000) Joshua Kirby, Megaphone’s president, is very concerned about Megaphone Corporation’s poor profitability. He asks Leroy Gibbs, production manager, and Tony DiNunzo, controller, to see if there are ways to reduce costs. After 2 weeks, Leroy returns with a proposal to reduce variable costs to 55% of revenues by reducing the costs Megaphone currently incurs for safe disposal of wasted plastic. Tony is concerned that this would expose the company to potential environmental liabilities. He tells Leroy, “We would need to estimate some of these potential environmental costs and include them in…arrow_forwardEthics, CVP analysis. Megaphone Corporation produces a molded plastic casing, M&M101, formany cell phones currently on the market. Summary data from its 2017 income statement are as follows:Revenues $5,000,000Variable costs 3,250,000Fixed costs 1,890,000Operating income $ (140,000)Joshua Kirby, Megaphone’s president, is very concerned about Megaphone Corporation’s poor profitability.He asks Leroy Gibbs, production manager, and Tony DiNunzo, controller, to see if there are ways toreduce costs.After 2 weeks, Leroy returns with a proposal to reduce variable costs to 55% of revenues by reducingthe costs Megaphone currently incurs for safe disposal of wasted plastic. Tony is concerned that this wouldexpose the company to potential environmental liabilities. He tells Leroy, “We would need to estimate someof these potential environmental costs and include them in our analysis.” “You can’t do that,” Leroy replies.“We are not violating any laws. There is some possibility that we may have to…arrow_forward

- Nancy Tercek, the financial vice president, and Margaret Lilly, the controller, of Romine Manufacturing Company are reviewing the financial ratios of the company for the years 2020 and 2021. The financial vice president notes that the profit margin on sales ratio has increased from 6% to 12%, a hefty gain for the 2-year period. Tercek is in the process of issuing a media release that emphasizes the efficiency of Romine Manufacturing in controlling cost. Margaret Lilly knows that the difference in ratios is due primarily to an earlier company decision to reduce the estimates of warranty and bad debt expense for 2021. The controller, not sure of her supervisor's motives, hesitates to suggest to Tercek that the company's improvement is unrelated to efficiency in controlling cost. To complicate matters, the media release is scheduled in a few days. Instructions What, if any, is the ethical dilemma in this situation? Should Lilly, the controller, remain silent? Give reasons. What…arrow_forwardHorizon Corporation manufactures personal computers. The company began operations in 2013 and reportedprofits for the years 2013 through 2016. Due primarily to increased competition and price slashing in the industry,2017’s income statement reported a loss of $20 million. Just before the end of the 2018 fiscal year, a memo fromthe company’s chief financial officer to Jim Fielding, the company controller, included the following comments:If we don’t do something about the large amount of unsold computers already manufactured, our auditors willrequire us to write them off. The resulting loss for 2018 will cause a violation of our debt covenants and forcethe company into bankruptcy. I suggest that you ship half of our inventory to J.B. Sales, Inc., in Oklahoma City. Iknow the company’s president and he will accept the merchandise and acknowledge the shipment as a purchase.We can record the sale in 2018 which will boost profits to an acceptable level. Then J.B. Sales will simply returnthe…arrow_forwardEach year, Sunshine Motos surveys 7,500 former and prospective customers regarding satisfaction and brand awareness. For the current year, the company is considering outsourcing the survey to Global Associates, who have offered to conduct the survey and summarize results for $30,000.Craig Sunshine, the president of Sunshine Motors, believes that Global will do a higher-quality job than his company has been doing, but is unwilling to spend more than $10,000 above the current costs. The head of bookkeeping for Sunshine has prepared the following summary of costs related to the survey in the prior year. Mailing $16,000 Printing (done by Lester Print Shop) $4,500 Salary of Pat Fisher, part-time employee who stuffed envelopes and summarized data when surveys were returned (100 hours X $15) $1,500 Share of depreciation of computer and software used to track survey responses and summarized results. $1,100 Share…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education