Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

16th Edition

ISBN: 9780134475585

Author: Srikant M. Datar, Madhav V. Rajan

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 5, Problem 5.27E

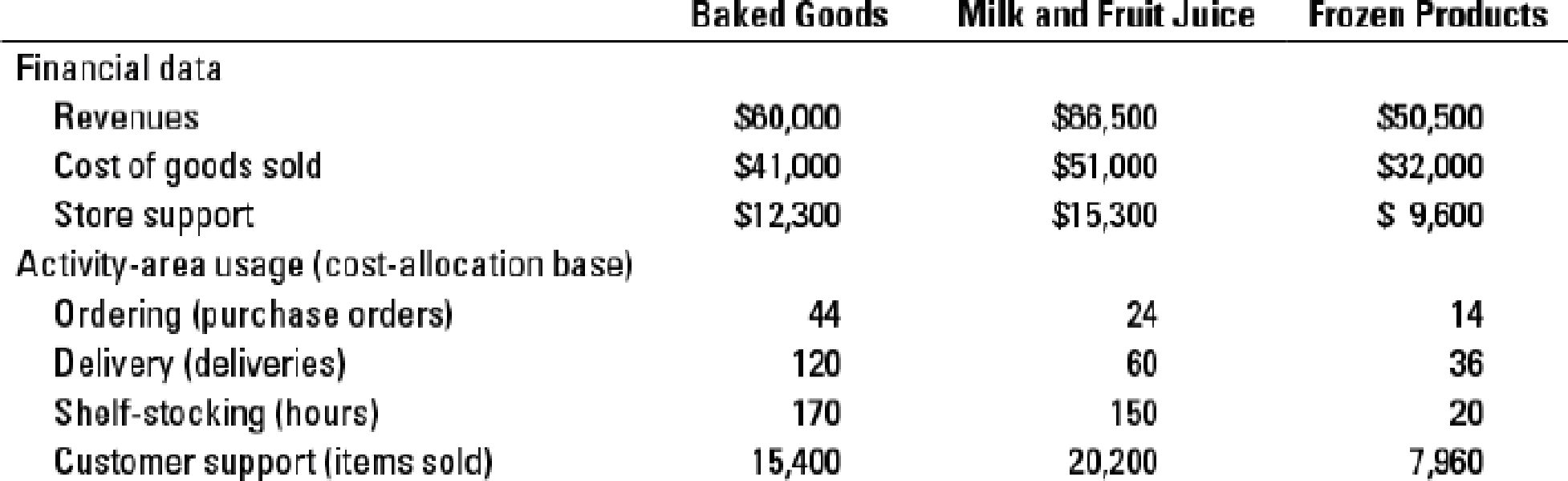

ABC, retail product-line profitability. Fitzgerald Supermarkets (FS) operates at capacity and decides to apply ABC analysis to three product lines: baked goods, milk and fruit juice, and frozen foods. It identifies four activities and their activity cost rates as follows:

| Ordering | $95 per purchase order |

| Delivery and receipt of merchandise | $76 per delivery |

| Shelf-stocking | $19 per hour |

| Customer support and assistance | $ 0.15 per item sold |

The revenues, cost of goods sold, store support costs, activities that account for the store support costs, and activity-area usage of the three product lines are as follows:

Under its simple costing system, FS allocated support costs to products at the rate of 30% of cost of goods sold.

- 1. Use the simple costing system to prepare a product-line profitability report for FS.

Required

- 2. Use the ABC system to prepare a product-line profitability report for FS.

- 3. What new insights does the ABC system in requirement 2 provide to FS managers?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Kindly help me with this accounting questions

Need help with this accounting questions

Hello tutor please provide this question solution general accounting

Chapter 5 Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Ch. 5 - What is broad averaging, and what consequences can...Ch. 5 - Why should managers worry about product...Ch. 5 - What is costing system refinement? Describe three...Ch. 5 - What is an activity-based approach to designing a...Ch. 5 - Describe four levels of a cost hierarchy.Ch. 5 - Why is it important to classify costs into a cost...Ch. 5 - What are the key reasons for product cost...Ch. 5 - Prob. 5.8QCh. 5 - Department indirect-cost rates are never...Ch. 5 - Prob. 5.10Q

Ch. 5 - Prob. 5.11QCh. 5 - Prob. 5.12QCh. 5 - Activity-based costing is the wave of the present...Ch. 5 - Increasing the number of indirect-cost pools is...Ch. 5 - The controller of a retail company has just had a...Ch. 5 - Conroe Company is reviewing the data provided by...Ch. 5 - Prob. 5.17MCQCh. 5 - Cost hierarchy. Roberta, Inc., manufactures...Ch. 5 - ABC, cost hierarchy, service. (CMA, adapted)...Ch. 5 - Alternative allocation bases for a professional...Ch. 5 - Plant-wide, department, and ABC Indirect cost...Ch. 5 - Plant-wide, department, and activity-cost rates....Ch. 5 - ABC, process costing. Sander Company produces...Ch. 5 - Department costing, service company. DLN is an...Ch. 5 - Activity-based costing, service company....Ch. 5 - Activity-based costing, manufacturing. Decorative...Ch. 5 - ABC, retail product-line profitability. Fitzgerald...Ch. 5 - Prob. 5.28ECh. 5 - Activity-based costing. The job-costing system at...Ch. 5 - ABC, product costing at banks,...Ch. 5 - Problems 5-31 Job costing with single direct-cost...Ch. 5 - Job costing with multiple direct-cost categories,...Ch. 5 - Job costing with multiple direct-cost categories,...Ch. 5 - First-stage allocation, time-driven activity-based...Ch. 5 - First-stage allocation, time-driven activity-based...Ch. 5 - Department and activity-cost rates, service...Ch. 5 - Activity-based costing, merchandising. Pharmahelp,...Ch. 5 - Choosing cost drivers, activity-based costing,...Ch. 5 - ABC, health care. Crosstown Health Center runs two...Ch. 5 - Unused capacity, activity-based costing,...Ch. 5 - Unused capacity, activity-based costing,...Ch. 5 - ABC, implementation, ethics. (CMA, adapted) Plum...Ch. 5 - Activity-based costing, activity-based management,...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What is the return on assets on these financial accounting question?arrow_forwardCalifornia Industries, Inc. borrowed $300,000 at 12% interest on January 1, 2025, for the construction or their new headquarters. Construction began on January 1, 2025, and concluded on December 31, 2025. In addition to the construction loan, California Industries provided the following data: Expenditures: June 1 $500,000 (7 months: 0.58) July 1 $500,000 (6 months:0.50) December 1 $1,000,000 (1 month: 0.08) Other Debt: 10-year, 13% Bond for $4,000,000, dated December 31, 2018 6-year, 10% Note for $1,600,000, dated December 31, 2022 HOW MUCH INTEREST SHOULD BE CAPITALIZED? Avoidable Interest Actual Interestarrow_forwardThe following information was taken from charu company's balance sheet:arrow_forward

- California Industries, Inc. borrowed $300,000 at 12% interest on January 1, 2025, for the construction of their new headquarters. Construction began on January 1, 2025, and concluded on December 31, 2025. In addition to the construction loan, California Industries provided the following data: Expenditures: June 1 $500,000 (7 months: 0.58) July 1 $500,000 (6 months:0.50) December 1 $1,000,000 (1 month: 0.08) Other Debt: 10-year, 13% Bond for $4,000,000, dated December 31, 2018* ó-year, 10% Note for $1,600,000, dated December 31, 2022 WHAT IS THEIR AVOIDABLE INTEREST? $24,000 $74,400 $36,000 $30,250arrow_forwardPlease provide solution these financial Accounting Questionarrow_forwardCalifornia Industries, Inc. borrowed $300,000 at 12% interest on January 1, 2025, for the construction of their new headguarters. Construction began on January 1, 2025, and concluded on December 31, 2025. In addition to the construction loan, California Industries provided the following data: Expenditures: June 1 $500,000 (7 months: 0.58) July 1 $500,000 (6 months: 0.50) December 1 $1,000,000 (1 month: 0.08) Other Debt: 10-year, 13% Bond for $4,000,000, dated December 31, 2018 6-year, 10% Note for $1,600,000, dated December 31, 2022 WHAT IS THE WEIGHTED AVERAGE EXPENSES? $540,000 $80,000 $620,000 $250,000arrow_forward

- Non-cash related transactions ARE required to be disclosed on the face of the financials and/or in the footnotes to those statements. Which financial statement shows the non-cash transactions and/or directs financial statement users to see the related footnote for additional details? Income Statement Balance Sheet Statement of Cash Flows Statement of Retained Earningsarrow_forwardGeneral Accountingarrow_forwardI won't to this question answer general Accounting not use aiarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub  Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning

How to Estimate Project Costs: A Method for Cost Estimation; Author: Online PM Courses - Mike Clayton;https://www.youtube.com/watch?v=YQ2Wi3Jh3X0;License: Standard Youtube License