Accounting For Governmental & Nonprofit Entities

18th Edition

ISBN: 9781259917059

Author: RECK, Jacqueline L., Lowensohn, Suzanne L., NEELY, Daniel G.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 5, Problem 24EP

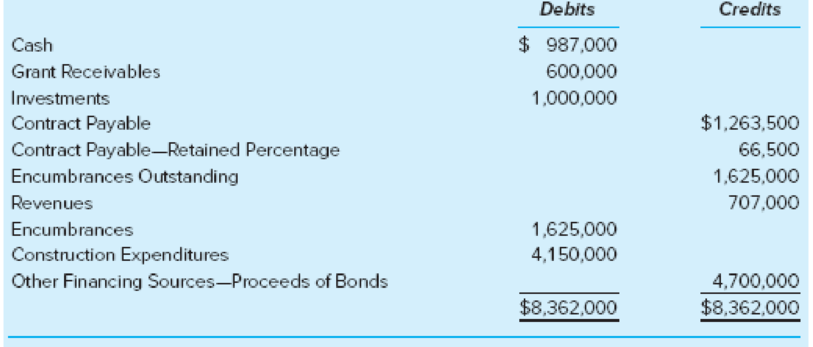

The year-end pre-closing

Required

- a. Prepare the year-end statement of revenues, expenditures, and changes in fund balances for the capital projects fund.

- b. Has the capital project been completed? Explain your answer.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Can you please give me correct answer this general accounting question?

Do fast answer of this general accounting question

I don't need ai answer accounting questions

Chapter 5 Solutions

Accounting For Governmental & Nonprofit Entities

Ch. 5 - What are general capital assets? How are they...Ch. 5 - Explain what disclosures the GASB requires for...Ch. 5 - Prob. 3QCh. 5 - Prob. 4QCh. 5 - Prob. 5QCh. 5 - What is the accounting difference between using...Ch. 5 - Prob. 7QCh. 5 - Prob. 8QCh. 5 - Prob. 9QCh. 5 - What is a service concession arrangement, and why...

Ch. 5 - Prob. 13CCh. 5 - Prob. 14CCh. 5 - Prob. 15CCh. 5 - Under GASB standards, which of the following would...Ch. 5 - Two new copiers were purchased for use by the city...Ch. 5 - Maxim County just completed construction of a new...Ch. 5 - A capital projects fund would probably not be used...Ch. 5 - Machinery and equipment depreciation expense for...Ch. 5 - Prob. 17.6EPCh. 5 - Prob. 17.7EPCh. 5 - Callaway County issued 10,000,000 in bonds at 101...Ch. 5 - Neighborville enters into a lease agreement for...Ch. 5 - Neighborville enters into a lease agreement for...Ch. 5 - Prob. 17.11EPCh. 5 - Prob. 17.12EPCh. 5 - Prob. 17.13EPCh. 5 - Arbitrage rules under the Internal Revenue Code a....Ch. 5 - Prob. 17.15EPCh. 5 - Make all necessary entries in the appropriate...Ch. 5 - Prob. 19EPCh. 5 - Prob. 20EPCh. 5 - In the current year, the building occupied by...Ch. 5 - Prob. 22EPCh. 5 - Make all necessary entries in a capital projects...Ch. 5 - The year-end pre-closing trial balance for the...Ch. 5 - Prob. 25EPCh. 5 - This year Riverside began work on an outdoor...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

What is Fund Accounting?; Author: Aplos;https://www.youtube.com/watch?v=W5D5Dr0j9j4;License: Standard Youtube License