Managerial Accounting

17th Edition

ISBN: 9781260247787

Author: Ray H. Garrison, Eric W. Noreen, Peter C. Brewer

Publisher: RENT MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 5, Problem 13E

EXERCISE 5-13 Changes in Selling Price, Sales Volume, Variable Cost per Unit, and Total Fixed Costs LOS-1, LO5-4

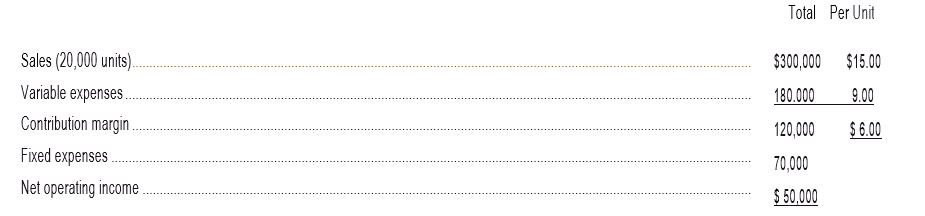

Miller Company’s contribution format income statement for the most recent month is shown below:

Total Per Unit

Required:

(Consider each case independently):

- What is the revised net operating income if unit sales increase by 15%?

- What is the revised net operating income if the setting price decreases by $1.50 per unit and the number of units sold increases by 25%?

- What is the revised net operating income if the selling price increases by $1.50 per unit, fixed expenses increase by $20,000, and the number of units sold decreases by 5%?

- What is the revised net operating income if the setting price per unit increases by 12%, variable expenses increase by 60 cents per unit, and the number of units sold decreases by 10%?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

PLS ANSWER AND SHOW SOLUTION

#10

The following monthly data are available for Tugg, Inc. which produces only one product: Selling price per unit, P42; Unit variable expenses, P14; Total fixed expenses, P70,000; Actual sales for the month of June, 4,000 units. How much is the margin of safety for the company for June?

Question 2

The following monthly data in contribution format are available for the Ross Company and its only product.

Product SD:

Sales

Variable expenses

Contribution margin

Fixed expenses

Net operating income

Total

$

$

$

$

$

381,600

304.800

76,800

34,500

42,300

Per Unit

$

5

159

127

32

The company produced and sold 2,400 units during the month and had no beginning or ending inventories.

a) What is the current operating leverage?

b) Projections indicate that the market will worsen by 15% next month. What is the projected net operating

income given this increase?

QUESTION 4

Exxarro Llimited is considering pricing and costing for the year ahead. The following data based on expected

production and sales of 15 000 units are provided for analysis:

Variable manufacturing cost

Fixed manufacturing cost

R1 185 000

R510 000

R5 per unit sold

R130 000

Sales commission

Fixed administration cost

Sales

R210 per unit

Study the information provided above and answer the following questions independently:

4.1 Calculate the break-even sales value.

4.2 Calculate the sales volume required to achieve a profit of R 800 000.

4.3 Suppose Exxaro Limited is considering a decrease of 10% per unit in the selling price of the product with the

expectation that it would increase sales volume by 10%. Is this a good idea? Motivate your answer with relevant

calculations.

Chapter 5 Solutions

Managerial Accounting

Ch. 5.A - EXERCISE 5A-1 High-Low Method LO5-10 The Cheyenne...Ch. 5.A - EXERCISE 5A-2 Least-Squares Regression LO5-11...Ch. 5.A - EXERCISE 5A-3 Cost Behavior; High-Low Method...Ch. 5.A - Prob. 4ECh. 5.A - EXERCISE 5A-5 Least-Squares Regression LO5-11...Ch. 5.A - Prob. 6PCh. 5.A - Problem 5A-7 Cost Behavior; High-Low Method;...Ch. 5.A - Problem 5A-8 High-Low Method; Predicting Cost...Ch. 5.A - Prob. 9PCh. 5.A - Prob. 10P

Ch. 5.A - Case 5A-11 Mixed Cost Analysis and the Relevant...Ch. 5.A - CASE 5A-12 Analysis of Mixed Costs in a Pricing...Ch. 5 - Prob. 1QCh. 5 - Often the most direct route to a business decision...Ch. 5 - Prob. 3QCh. 5 - What is the meaning of operating leverage?Ch. 5 - What is the meaning of break-even point?Ch. 5 - 5-6 In response to a request from your immediate...Ch. 5 - Prob. 7QCh. 5 - Prob. 8QCh. 5 - Prob. 9QCh. 5 - Prob. 1AECh. 5 - Prob. 2AECh. 5 - Prob. 3AECh. 5 - Prob. 4AECh. 5 - Prob. 5AECh. 5 - Prob. 1F15Ch. 5 - Prob. 2F15Ch. 5 - Prob. 3F15Ch. 5 - Prob. 4F15Ch. 5 - Prob. 5F15Ch. 5 - Prob. 6F15Ch. 5 - Prob. 7F15Ch. 5 - Prob. 8F15Ch. 5 - Prob. 9F15Ch. 5 - Prob. 10F15Ch. 5 - Prob. 11F15Ch. 5 - Prob. 12F15Ch. 5 - Prob. 13F15Ch. 5 - Prob. 14F15Ch. 5 - Prob. 15F15Ch. 5 - Prob. 1ECh. 5 - Prob. 2ECh. 5 - Prob. 3ECh. 5 - Prob. 4ECh. 5 - Prob. 5ECh. 5 - Prob. 6ECh. 5 - Prob. 7ECh. 5 - Prob. 8ECh. 5 - Prob. 9ECh. 5 - EXERCISE 5-10 Multiproduct Break-Even Analysis...Ch. 5 - Prob. 11ECh. 5 - EXERCISE 5-12 Multiproduct Break-Even Analysis...Ch. 5 - EXERCISE 5-13 Changes in Selling Price, Sales...Ch. 5 - Prob. 14ECh. 5 - Prob. 15ECh. 5 - Prob. 16ECh. 5 - Prob. 17ECh. 5 - Prob. 18ECh. 5 - Prob. 19PCh. 5 - PROBLEM 5-20 CVP Applications: Break-Even...Ch. 5 - PROBLEM 5-21 Sales Mix; Multiproduct Break-Even...Ch. 5 - Prob. 22PCh. 5 - Prob. 23PCh. 5 - Prob. 24PCh. 5 - Prob. 25PCh. 5 -

PROBLEM 5-26 CVP Applications; Break-Even...Ch. 5 - Prob. 27PCh. 5 - Prob. 28PCh. 5 - Prob. 29PCh. 5 - Prob. 30PCh. 5 -

PROBLEM 5-31 Interpretive Questions on the CVP...Ch. 5 - Prob. 32C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Refer to Cornerstone Exercise 7.10. (Round percentages to four significant digits and cost allocations to the nearest dollar.) Required: 1. Calculate the total revenue, total costs, and total gross profit the company will earn on the sale of L-Ten, Triol, and Pioze. 2. Allocate the joint cost to L-Ten, Triol, and Pioze using the constant gross margin percentage method. 3. What if it cost 2 to process each gallon of Triol beyond the split-off point? How would that affect the allocation of joint cost to these three products?arrow_forwardQuestion 3 The following monthly data in contribution format are available for the Timor Company and its only product. Product SD: Sales Variable expenses Contribution margin Fixed expenses Net operating income Total $ $ $ $ $ 227,500 162.500 65,000 45.000 20,000 Per Unit $ $ $ 91 65 26 The company produced and sold 2,500 units during the month and had no beginning or ending inventories. a) What is the current margin of safety? b) Management is concerned about having the funds to pay dividends next quarter. They believe net operating income of $35,000 will be sufficient. How much sales revenue is necessary to achieve this target profit?arrow_forwardExercise 18-21 (Algo) Predicting unit and dollar sales using contribution margin LO C2 Nombre Company management predicts $1,632,000 of variable costs, $2,213,000 of fixed costs, and income of $235,000 in the next period. Management also predicts that the contribution margin per unit will be $51. (1) Compute the total expected dollar sales for next period. Contribution margin Income (2) Compute the number of units expected to be sold and produced next period. Numerator: 1 Denominator: = = Units Unitsarrow_forward

- 254 EXERCISE 6-13 Changes in Selling Price, Sales Volume, Variable Cost per Unit, and Total Fixed Costs LO6-1, LO6-4 Miller Company's contribution format income statement for the most recent month is shown below: Sales (20,000 units) .. Variable expenses Contribution margin Fixed expenses. Net operating income Required: (Consider each case independently): Chapter 6 3. 4. Total $300,000 180,000 120,000 70,000 $ 50,000 Per Unit 1. What is the revised net operating income if unit sales increase by 15%? 2. What is the revised net operating income if the selling price decreases by $1.50 per unit and the number of units sold increases by 25%? What is the revised net operating income if the selling price increases by $1.50 per unit, fixed expenses increase by $20,000, and the number of units sold decreases by 5%? $15.00 9.00 $6.00 What is the revised net operating income if the selling price per unit increases by 12%, variable expenses increase by 60 cents per unit, and the number of units…arrow_forward15 Miller Company's contribution format Income statement for the most recent month is shown below: Total Per Unit $7.00 $ 259,000 148,000 4.00 $ 3.00 Sales (37,eee units) Variable expenses Contribution margin Fixed expenses Net operating income Required: (Consider each case independently): 111,000. 46,000 $ 65,000 1. What is the revised net operating income if unit sales increase by 18%? 2. What is the revised net operating income if the selling price decreases by $1.40 per unit and the number of units sold increases by 20%? 3. What is the revised net operating income if the selling price increases by $1.40 per unit, fixed expenses increase by $5,000, and the number of units sold decreases by 7%? 4. What is the revised net operating income if the selling price per unit increases by 10%, variable expenses increase by 20 cents per unit, and the number of units sold decreases by 14%? 1. Net operating income 2. Net operating income 3. Net operating income 4. Net operating incomearrow_forward3 Whirly Corporation's contribution format income statement for the most recent month is shown below: Per Unit $ 32.00 20.00 $ 12.00 Sales (7,800 units) Variable expenses Contribution margin Fixed expenses Net operating income Total $ 249,600 156,000 93,600 55,500 $ 38,100 Required: (Consider each case independently): 1. What would be the revised net operating income per month if the sales volume increases by 40 units? 2. What would be the revised net operating income per month if the sales volume decreases by 40 units? 3. What would be the revised net operating income per month if the sales volume is 6,800 units? 1. Revised net operating income 2. Revised net operating income 3. Revised net operating incomearrow_forward

- QUESTION 2 Sales salaries and commissions are N10,000 when 80,000 units are sold and N14,000 when 120,000 units are sold. Using high low point method. (a) What is the variable (b) what is the fixed portion? (c) portion of sales salaries and commission, when units sold is 95,000arrow_forwardQuestion 3 Study the information given below and answer: 3.3 Calculate the new total Marginal Income and Net Profit/Loss if an increase in advertising expense by R100 000 is expected to increase sales by 400 units. INFORMATION Samcor Limited manufactures tables. The following information was extracted from the budget for the year ended 30 June 2022: 1. 2. 3. 4. 5. Total production and sales Selling price per table Variable manufacturing costs per table: Direct material Direct labour Overheads Fixed manufacturing overheads Other costs: Fixed marketing and administrative costs Sales commission 2 400 units R1200 R288 R192 R96 R216 960 R144 000 5%arrow_forwardQuestion No.2 Menlo Company manufactures and sells a single product. The company’s sales and expenses for last quarter are as follows: Unit Cost $30 $12 $18 Total Cost $450,000 $180,000 $270,000 $216,000 $054,000 Sales. Less variable expenses.. Contribution margin. Less fixed expenses. Net operating income. Required: What is the B.E.P in units sold and in sales dollars? What is the total contribution at B.E.P? How many units must sold each quarter to earn a target profit of $90,000? Use the contribution margin method. Verify your answer by preparing a contribution format income statement at the target sales level. Refer to original data, compute the margin of safety in both dollars and %age terms. What is the company CM ratio? If sales increase by $50,000 per quarter by how much would you expect quarterly net operating income to increase?arrow_forward

- 3 Question 5 During August, Tyson Company sold 5,400 units and reported the following income statement: Sales revenue Variable costs Fixed costs Net income $216,000 $ 70,200 $ 86,400 $ 59,400 During September, Tyson Company sold 7,200 units. Calculate Tyson Company's degree of operating leverage for the month of September. 0.75arrow_forwardProblem 12-21 (Algo) Prepare a contribution margin format income statement; answer what-if questions LO 12-7, 12-8, 12-9 Shown here is an income statement in the traditional format for a firm with a sales volume of 7,500 units. Cost formulas also are shown: Revenues Cost of goods sold ($5,900 + $2.25/unit) Gross profit Operating expenses: Selling ($1,200 + $0.10/unit) Administrative ($3,500 + $0.20/unit) Operating income $34,400 22,775 $ 11,625 1,950 5,000 $ 4,675 Required: a. Prepare an income statement in the contribution margin format. b. Calculate the contribution margin per unit and the contribution margin ratio. c. Calculate the firm's operating income (or loss) if the volume changed from 7,500 units to 1. 11,250 units. 2. 3,750 units. d. Refer to your answer to part a for total revenues of $34,400. Calculate the firm's operating income (or loss) if unit selling price and variable expenses per unit do not change and total revenues 1. Increase by $14,500. 2. Decrease by $3,000.arrow_forwardQuestion 3 Study the information given below and answer: 3.2 Use the marginal income ratio to calculate the break-even value. INFORMATION Samcor Limited manufactures tables. The following information was extracted from the budget for the year ended 30 June 2022: 2. 3. 4. 5. Total production and sales Selling price per table Variable manufacturing costs per table: Direct material Direct labour Overheads Fixed manufacturing overheads Other costs: Fixed marketing and administrative costs Sales commission 2 400 units R1 200 R288 R192 R96 R216 960 R144 000 5%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Fixed Asset Replacement Decision 1235; Author: Accounting Instruction, Help, & How To;https://www.youtube.com/watch?v=LJRzn9K8Nwk;License: Standard Youtube License