Managerial Accounting

17th Edition

ISBN: 9781260247787

Author: Ray H. Garrison, Eric W. Noreen, Peter C. Brewer

Publisher: RENT MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 5, Problem 21P

PROBLEM 5-21 Sales Mix; Multiproduct Break-Even Analysis LO5-9

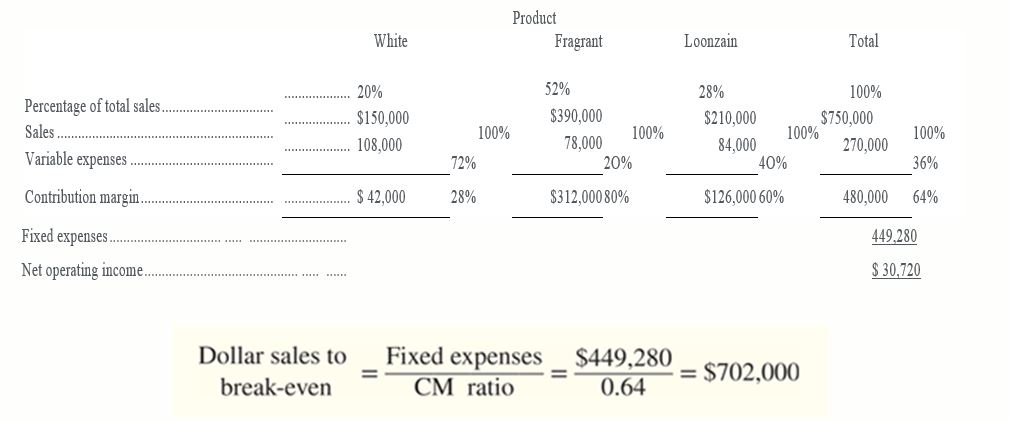

Gold Star Rice, Ltd., of Thailand exports Thai rice throughout Asia. The company grows three varieties of rice—White, Fragrant, and Loonzain. Budgeted sales by product and in total for the coming month are shown below:

As shown by these data, net operating income is budgeted at $30,720 for the month and the estimated break-even sales is $702,000.

Assume that actual sales for the month total $750,000 as planned. Actual sales by product are: White, $300,000: Fragrant, $180,000; and Loonzain, $270,000.

Required:

- Prepare a contribution format income statement for the month based on the actual sales data. Present the income statement in the format shown above.

- Compute the break-even point in dollar sales for the month based on your actual data.

- Considering the fact that the company met its $750,000 sales budget for the month, the president is shocked at the results shown on your income statement in (1) above. Prepare a brief memo for the president explaining why the net operating income (loss) and the break-even point in dollar sales are different from what was budgeted.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

02:06:01

Gold Star Rice, Limited, of Thailand exports Thai rice throughout Asia. The company grows three varieties of rice-White, Fragrant, and

Loonzain. Budgeted sales by product and in total for the coming month are shown below.

Produce

Percentage of total sales

Sales

Variable expenses

Contribution margin

White

40%

$.355,200

106,560

$ 246,640

Fragrant

20%

100%

30%

20% $29,600

140,000

118,400

Loonsain

32%

100%

80%

$236.000

130,240

20% $106,560

Complete this question by entering your answers in the tabs below.

Fixed expenses

Net operating income

Dollar sales to break-even - Fixed expenses/CM ratio-$232,440/0.52= $447,000

As shown by these data, net operating income is budgeted at $152,360 for the month and the estimated break-even sales is

$447,000.

Required:

1. Prepare a contribution format income statement for the month based on the actual sales data.

2. Compute the break-even point in dollar sales for the month based on your actual data.

Dutal

100%

100% $ 240,000

55%

45%

355,200…

PROBLEM 6-21 Sales Mix; Multiproduct Break-Even Analysis LO6-9

Gold Star Rice, Ltd., of Thailand exports Thai rice throughout Asia. The company grows three varieties

of rice-White, Fragrant, and Loonzain. Budgeted sales by product and in total for the coming month are

shown below:

Product

White

Fragrant

Loonzain

Total

Percentage of total sales.

20%

52%

28%

100%

Sales..

$150,000 100% $390,000 100% $210,000 100% $750,000 100%

Variable expenses

108,000 72%

78,000 20% 84,000

40%

270,000

36%

Contribution margin ..

42,000 28% $312,000 80% $126,000

60%

480,000

64%

Fixed expenses....

449,280

Net operating income

$ 30,720

............

Assignment

2.1 ABC Itd. Manufactures and sells four types of products under the band names of A,

B, C and D. the sales mix in value comprises 33 %, 41 2 %, 162% and 8 % of A,

3

3

3

B, C and D respectively. The total budgeted sales (100%) are birr 60,000 per month.

Operating costs are as follows:

Variable cost:

A 60% of selling price

B 68% of selling price

C 50% of selling price

D 40% of selling price

The fixed cost is birr 14,700 per month

Required

Compute the breakeven point for the products on an overall basis

Chapter 5 Solutions

Managerial Accounting

Ch. 5.A - EXERCISE 5A-1 High-Low Method LO5-10 The Cheyenne...Ch. 5.A - EXERCISE 5A-2 Least-Squares Regression LO5-11...Ch. 5.A - EXERCISE 5A-3 Cost Behavior; High-Low Method...Ch. 5.A - Prob. 4ECh. 5.A - EXERCISE 5A-5 Least-Squares Regression LO5-11...Ch. 5.A - Prob. 6PCh. 5.A - Problem 5A-7 Cost Behavior; High-Low Method;...Ch. 5.A - Problem 5A-8 High-Low Method; Predicting Cost...Ch. 5.A - Prob. 9PCh. 5.A - Prob. 10P

Ch. 5.A - Case 5A-11 Mixed Cost Analysis and the Relevant...Ch. 5.A - CASE 5A-12 Analysis of Mixed Costs in a Pricing...Ch. 5 - Prob. 1QCh. 5 - Often the most direct route to a business decision...Ch. 5 - Prob. 3QCh. 5 - What is the meaning of operating leverage?Ch. 5 - What is the meaning of break-even point?Ch. 5 - 5-6 In response to a request from your immediate...Ch. 5 - Prob. 7QCh. 5 - Prob. 8QCh. 5 - Prob. 9QCh. 5 - Prob. 1AECh. 5 - Prob. 2AECh. 5 - Prob. 3AECh. 5 - Prob. 4AECh. 5 - Prob. 5AECh. 5 - Prob. 1F15Ch. 5 - Prob. 2F15Ch. 5 - Prob. 3F15Ch. 5 - Prob. 4F15Ch. 5 - Prob. 5F15Ch. 5 - Prob. 6F15Ch. 5 - Prob. 7F15Ch. 5 - Prob. 8F15Ch. 5 - Prob. 9F15Ch. 5 - Prob. 10F15Ch. 5 - Prob. 11F15Ch. 5 - Prob. 12F15Ch. 5 - Prob. 13F15Ch. 5 - Prob. 14F15Ch. 5 - Prob. 15F15Ch. 5 - Prob. 1ECh. 5 - Prob. 2ECh. 5 - Prob. 3ECh. 5 - Prob. 4ECh. 5 - Prob. 5ECh. 5 - Prob. 6ECh. 5 - Prob. 7ECh. 5 - Prob. 8ECh. 5 - Prob. 9ECh. 5 - EXERCISE 5-10 Multiproduct Break-Even Analysis...Ch. 5 - Prob. 11ECh. 5 - EXERCISE 5-12 Multiproduct Break-Even Analysis...Ch. 5 - EXERCISE 5-13 Changes in Selling Price, Sales...Ch. 5 - Prob. 14ECh. 5 - Prob. 15ECh. 5 - Prob. 16ECh. 5 - Prob. 17ECh. 5 - Prob. 18ECh. 5 - Prob. 19PCh. 5 - PROBLEM 5-20 CVP Applications: Break-Even...Ch. 5 - PROBLEM 5-21 Sales Mix; Multiproduct Break-Even...Ch. 5 - Prob. 22PCh. 5 - Prob. 23PCh. 5 - Prob. 24PCh. 5 - Prob. 25PCh. 5 -

PROBLEM 5-26 CVP Applications; Break-Even...Ch. 5 - Prob. 27PCh. 5 - Prob. 28PCh. 5 - Prob. 29PCh. 5 - Prob. 30PCh. 5 -

PROBLEM 5-31 Interpretive Questions on the CVP...Ch. 5 - Prob. 32C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- CHAPTER 11 PRODUCT PRICING AND PROFIT ANALYSIS 558 41. Casablanca, Inc., has a practical production capacity of two million units, the current year's budget was based on the production and sales of 1.4 million units during the cur- rent year. Actual statistics came out to be: production of 1.44 million units and sales of 1.2 million.. Selling price is at P20 each and the contribution margin ratio is 30%. The peso value that best quantifies the marketing division's failure to achieve budgeted performance for the current year is P4,800,000 unfavorable b. P4,000,000 unfavorable а. P1,440,000 unfavorable d. P1,200,000 unfavorable С. (грера) 42. The differences between the master budget amounts and the amounts in the flexible budget are due to Activity level variances. b. Gaps in affectivity. a. с. Favorable variances. d. Unfavorable variances. (грсра)arrow_forwardQUESTION 8 Avery Company has compiled the following data for the upcoming year: Sales are expected to be 13300 units at $31 each. • Each unit requires 2.1 pounds of direct materials at $2.1 per pound. • Each unit requires 0.7 hours of direct labor at $14 per hour. Manufacturing overhead is $6 per unit. Selling and administrative costs are $6 per unit What is Avery's budgeted cost of goods sold? M Azarrow_forwardQUESTION 4 4.1 Study the information given below and answer the following questions independently INFORMATION: Banco Limited produces a single product. The following budgeted information for 2021 is made available: Variable manufacturing costs per unit R85.24 Selling price per unit R246 Fixed manufacturing costs R4 552 000 Marketing Costs R648 000 plus 6% of sales Administration costs R320 000 plus R8 per unit sold The number of units expected to be produced and sold during 2021 is 45 000. 4.1.1 Calculate the expected break- even quantity for 2021 4.1.2 Calculate the sales volume required to achieve an operating profit of R2 4848 000 4.1.3 Suppose Banco Limited is considering a decrease of R18 per unit in the selling price of the product, With the expectation that this would increase the sales volume by 10%. Is this a good idea? Motivate your answerarrow_forward

- Gold Star Rice, Limited, of Thailand exports Thai rice throughout Asia. The company grows three varieties of rice-White, Fragrant, and Loonzain. Budgeted sales by product and in total for the coming month are shown below: Percentage of total sales. Sales Variable expenses Contribution margin White 48% Required 11 $ 302,400 90,720 $ 211,680 Required 21 100% 30% 70% Fragrant 20% $ 126,000 100,800 $ 25,200 Product Loonzain 329 100% $ 201,600 80% 110,880 20% $ 90,720 Required: 1. Prepare a contribution format income statement for the month based on the actual sales data. 2. Compute the break-even point in dollar sales for the month based on your actual data. Complete this question by entering your answers in the tabs below. 100% 55% 45% Total 100% Fixed expenses Net operating income Dollar sales to break-even - Fixed expenses/CM ratio= $233,480/0.52-$449,000 As shown by these data, net operating income is budgeted at $94,120 for the month and the estimated break-even sales is $449,000.…arrow_forwardQ12 Gourmet Aroma Coffee House has an exclusive contract with Columbia exporters. Two brands of gourmet coffee are imported, Morning Thunder (MT) and Evening Tender (ET). The following data are provided for the current fiscal year: Budgeted Operating Results MT ET MT ET Price per pound $ 60 $ 90 $ 70 $ 85 Variable cost per pound 30 54 32 60 Sales (in pounds) 3,300 3,300 3,192 4,408 The total market was estimated to be 73,000 pounds at the time of budget. The actual total market for the year is 68,000 pounds. What is MT's contribution margin sales volume variance? Multiple Choice $3,240 unfavorable. $26,200 favorable. $3,480 unfavorable. $25,400 favorable. $26,440 favorable.arrow_forwardGold Star Rice, Limited, of Thailand exports Thai rice throughout Asia. The company grows three varieties of rice-White, Fragrant, and Loonzain. Budgeted sales by product and in total for the coming month are shown below: Percentage of total sales Sales Variable expenses Contribution margin White 48% $ 292,800 87,840 $ 204,960 100% 30% 70% Fragrant 20% $ 122,000 97,600 $ 24,400 Product 100% 80% 20% Loonzain 32% $ 195,200 107,360 $ 87,840 100% 55% 45% Required: 1. Prepare a contribution format income statement for the month based on the actual sales data. 2. Compute the break-even point in dollar sales for the month based on your actual data. Total 100% $ 610,000 292,800 317, 200 231,920 $ 85,280 100% 48% 52% Fixed expenses Net operating income Dollar sales to break-even Fixed expenses ÷ CM ratio = $231,920 ÷ 0.52 = $446,000 As shown by these data, net operating income is budgeted at $85,280 for the month and the estimated break-even sales is $446,000. Assume actual sales for the month…arrow_forward

- Gold Star Rice, Ltd., of Thailand exports Thai rice throughout Asia. The company grows three varieties of rice-White, Fragrant, and Loonzain. Budgeted sales by product and in total for the coming month are shown below: Percentage of total sales Sales Variable expenses Contribution margin Fixed expenses Net operating income Dollar sales to break-even = White 48 % $ 302,400 90,720 $ 211,680 Fixed expenses CM ratio = 100 % 30 % 70 % $ $ $232,440 0.52 Fragrant 20 % 126,000 100, 800 25, 200 Product 100 % 80 % 20 % = $447,000 Loonzain 32 % $ 201,600 110,880 90,720 100 % 55 % 45 % Required: 1. Prepare a contribution format income statement for the month based on the actual sales data. 2. Compute the break-even point in dollar sales for the month based on your actual data. Total 100 % $ 630,000 302,400 327,600 232,440 95,160 $ 100 % 48 % 52 % As shown by these data, net operating income is budgeted at $95,160 for the month and the estimated break-even sales is $447,000. Assume that actual…arrow_forwardQuestion 4 A company manufactures two products, SAMS and JAMS. Budgeted sales for next year are : Product SAMS 2400 units at Ghc 45 per unit Product JAMS 450units at Ghc 60 per unit. Standard cost data for the products for next year are as follows; Product SAMS per Unit Product JAMS per Unit Direct Materials U at GH 2 per Kg 24kg 30kg V at GH 5 per Kg 10kg 8kg W at GH 6 per Kg 5kg 10kg Direct Wages Unskilled at GH5 per hour 10 hours 5 hours Skilled at GH 10 per hour 6 hours 5 hours Budgeted stocks for next year are as follows: SAMS (Units) JAMS (Units) 01-Jan 400 800 31-Dec 500 1100 Material U Material V Material W 01-Jan 30000 25000 12000 31-Dec 35000 27000 12500 Prepare the following budgets for next year; a. Sales budget in cash b. Production budget, in units c. Material usage budget, in kg and in cash d. Direct labour budget, in hours and in casharrow_forwardQuestion 5 rame Limited makes three products: A, B and C. The budget for the following three months was as follows: Sales units Sales price per unit Variable cost per unit 10 A B C 1,000 1,500 2,000 €31 €20 €10 €10 €8 €4 However, the machine which is used in the production of all three products has malfunctioned. A temporary repair job has been done, but the total machine hours available for the next three months (until the replacement machine arrives) has been reduced to 4,800 hours. Each unit of product A requires 3 machine hours, each unit of Product B requires 1 machine hour and each unit of Product C requires 0.75 hours. On this basis, for the next three months, the product that Frame Limited will prioritise in relation to production is Product Under the revised plan, the production and sales of Product A will be units.arrow_forward

- 5 Question Content Area Sales and Production Budgets Berring Company produces two products: the deluxe and the standard. The deluxe sells for $40, and the standard sells for $10. Projected sales of the two models for the coming four quarters are given below. Deluxe Standard First quarter 12,000 90,000 Second quarter 14,200 88,600 Third quarter 16,800 92,000 Fourth quarter 20,000 91,800 The president of the company believes that the projected sales are realistic and can be achieved by the company. In the factory, the production supervisor has received the projected sales figures and gathered information needed to compile production budgets. He found that 1,300 deluxes and 1,170 standards were in inventory on January 1. Company policy dictates that ending inventory should equal 20 percent of the next quarter’s sales for deluxes and 10 percent of next quarter’s sales for standards. Required: Question Content Area 1. Prepare a sales…arrow_forwardGold Star Rice, Limited, of Thailand exports Thai rice throughout Asia. The company grows three varieties of rice-White, Fragrant, and Loonzain. Budgeted sales by product and in total for the coming month are shown below: Percentage of total sales Sales Variable expenses Contribution margin Fixed expenses Net operating income White 48% $ 374,400 112,320 $ 262,080 Fragrant 20% 100% $ 156,000 30% 124,800 70% $ 31,200 Product 100% 80% 20% Loonzain 32% $ 249,600 137, 280 $ 112,320 100% 55% 45% Total 100% $ 780,000 374,400 405, 600 228,800 $ 176,800 Dollar sales to break-even = Fixed expenses ÷ CM ratio = $228,800 ÷ 0.52 = $440,000 As shown by these data, net operating income is budgeted at $176,800 for the month and the estimated break-even sales is $440,000. Assume actual sales for the month total $780,000 as planned; however, actual sales by product are White, $249,600; Fragrant, $312,000; and Loonzain, $218,400. Required: 1. Prepare a contribution format income statement for the month…arrow_forwardQUESTION 1 B Limited produces and sells the following three products: Product X Y Z Selling price per unit (N$) 16 20 10 Variable cost per unit(N$) 5 15 7 Contribution per unit(N$) 11 5 3 Budgeted Sales Volume (units) 50,000 10,000 100,000 The company expects the fixed costs to be N$300000, for the coming year. Assume that sales arise throughout the year in a constant mix. Required: (a)Calculate the weighted average contribution sales ratio (C/S ratio) of the products? (b)Calculate the break-even sales revenue required AND Calculate the margin of safety. (c)Calculate the amount of sales revenue required to generate a profit of N$600000. (d)Draw a multiproduct profit volume chart assuming the budget is achieved.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

What is variance analysis?; Author: Corporate finance institute;https://www.youtube.com/watch?v=SMTa1lZu7Qw;License: Standard YouTube License, CC-BY