FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:15

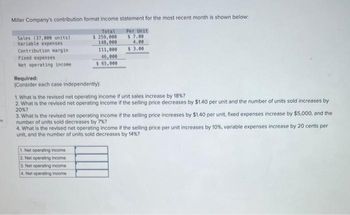

Miller Company's contribution format Income statement for the most recent month is shown below:

Total

Per Unit

$7.00

$ 259,000

148,000

4.00

$ 3.00

Sales (37,eee units)

Variable expenses

Contribution margin

Fixed expenses

Net operating income

Required:

(Consider each case independently):

111,000.

46,000

$ 65,000

1. What is the revised net operating income if unit sales increase by 18%?

2. What is the revised net operating income if the selling price decreases by $1.40 per unit and the number of units sold increases by

20%?

3. What is the revised net operating income if the selling price increases by $1.40 per unit, fixed expenses increase by $5,000, and the

number of units sold decreases by 7%?

4. What is the revised net operating income if the selling price per unit increases by 10%, variable expenses increase by 20 cents per

unit, and the number of units sold decreases by 14%?

1. Net operating income

2. Net operating income

3. Net operating income

4. Net operating income

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Miller Company's contribution format income statement for the most recent month is shown below: Per Unit $ 8.00 5.00 $ 3.00 Sales (34,000 units) Variable expenses Contribution margin Fixed expenses Net operating income Total $ 272,000 170,000 102,000 44,000 $ 58,000 Required: (Consider each case independently): 1. What is the revised net operating income if unit sales increase by 13%? 2. What is the revised net operating income if the selling price decreases by $1.20 per unit and the number of units sold increases by 22%? 3. What is the revised net operating income if the selling price increases by $1.20 per unit, fixed expenses increase by $10,000, and the number of units sold decreases by 7%? 4. What is the revised net operating income if the selling price per unit increases by 10%, variable expenses increase by 20 cents per unit, and the number of units sold decreases by 12%? 1. Net operating income 2. Net operating income 3. Net operating income 4. Net operating incomearrow_forwardMiller Company's contribution format income statement for the most recent month is shown below: Total $312,000 195,000 117,000 42,000 $ 75,000 Sales (39,000 units) Variable expenses Contribution margin Fixed expenses Net operating income Required: (Consider each case independently): 1. What is the revised net operating income if unit sales increase by 20%? 2. What is the revised net operating income if the selling price decreases by $1.50 per unit and the number of units sold increases by 16%? 1 3. What is the revised net operating income if the selling price increases by $1.50 per unit, fixed expenses increase by $5.000, and the number of units sold decreases by 6%? 4. What is the revised net operating income if the selling price per unit increases by 10%, variable expenses increase by 20 cents per unit, and the number of units sold decreases by 13% Per Unit Net operating income 2 Net operating income 3. Net operating income 4. 5.00 $ 3.00 Net operating incomearrow_forwardI need requiremetns 1-7 answered from this question Please. Thank youarrow_forward

- 7arrow_forwardThe contribution format income statement for Huerra Company for last year is given below: Total Unit Sales $ 992,000 $ 49.60 Variable expenses 595,200 29.76 Contribution margin 396,800 19.84 Fixed expenses 316,800 15.84 Net operating income 80,000 4.00 Income taxes @ 40% 32,000 1.60 Net income $ 48,000 $ 2.40 The company had average operating assets of $500,000 during the year. Required: 1. Compute the company’s margin, turnover, and return on investment (ROI) for the period. For each of the following questions, indicate whether the margin and turnover will increase, decrease, or remain unchanged as a result of the events described, and then compute the new ROI figure. Consider each question separately, starting in each case from the data used to compute the original ROI in (1) above. 2. Using Lean Production, the company is able to reduce the average level of inventory by $96,000. 3. The company achieves a cost savings of $6,000 per year by using less…arrow_forwardWhirly Corporation's contribution format income statement for the most recent month is shown below: Sales (8,000 units) Variable expenses Contribution margin Fixed expenses Net operating income Total $ 272,000 152, 000 120, 000 54,700 $ 65,300 Required: (Consider each case independently): Per Unit $34.00 19.00 $15.00 1. What would be the revised net operating income per month if the sales volume increases by 70 units? 2. What would be the revised net operating income per montii if the sales volume decreases by 70 units? 3. What would be the revised net operating income per month if the sales volume is 7.000 units?arrow_forward

- Miller Company's contribution format income statement for the most recent month is shown below: Per Unit $8.00 5.00 $1.00 Sales (39,000 units) Variable expenses Contribution margin Fixed expenses Net operating income Required: (Consider each case Independently) Total $312,000 195,000 117,000 41,000 $76,000 1. What is the revised net operating income if unit sales increase by 18%3 2. What is the revised net operating income if the selling price decreases by $110 per unit and the number of units sold increases by 19%7 3. What is the revised net operating income if the selling price increases by $1.10 per unit, fixed expenses increase by $7,000, and the number of units sold decreases by 2%7 4. What is the revised net operating income if the selling price per unit increases by 10%, variable expenses increase by 40 cents per unit, and the number of units sold decreases by 10%? 1. Net operating income 2. Net operating income 3. Net operating income 4. Net operating incomearrow_forwardThe contribution format income statement for Huerra Company for last year is given below: Total Unit Sales $ 1,006,000 $ 50.30 Variable expenses 603,600 30.18 Contribution margin 402,400 20.12 Fixed expenses 324,400 16.22 Net operating income 78,000 3.90 Income taxes @ 40% 31,200 1.56 Net income $ 46,800 $ 2.34 The company had average operating assets of $508,000 during the year. Required: 1. Compute the company’s margin, turnover, and return on investment (ROI) for the period. For each of the following questions, indicate whether the margin and turnover will increase, decrease, or remain unchanged as a result of the events described, and then compute the new ROI figure. Consider each question separately, starting in each case from the data used to compute the original ROI in (1) above. 2. Using Lean Production, the company is able to reduce the average level of inventory by $91,000. 3. The company achieves a cost savings of $6,000 per year by using less…arrow_forwardJust need 2,3,4 answeredarrow_forward

- only typed solutionarrow_forwardLast year’s contribution format income statement for Huerra Company is given below: Total Unit Sales $ 1,002,000 $ 50.10 Variable expenses 601,200 30.06 Contribution margin 400,800 20.04 Fixed expenses 316,800 15.84 Net operating income 84,000 4.20 Income taxes @ 40% 33,600 1.68 Net income $ 50,400 $ 2.52 The company had average operating assets of $491,000 during the year. Required: Compute last year’s margin, turnover, and return on investment (ROI). For each of the following questions, indicate whether last year’s margin and turnover will increase, decrease, or remain unchanged as a result of the events described, and then compute the new ROI. Consider each question separately. Using Lean Production, the company is able to reduce the average level of inventory by $100,000. The company achieves a cost savings of $10,000 per year by using less costly materials. The company purchases machinery and equipment that increase average operating assets by $125,000.…arrow_forwardThe GAAP income statement for Pace Company for the year ended December 31, 2022, shows sales $900,000, cost of goods sold $600,000, and operating expenses $200,000. Assuming all costs and expenses are 70% variable and 30% fixed, prepare a CVP income statement through contribution margin.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education