FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

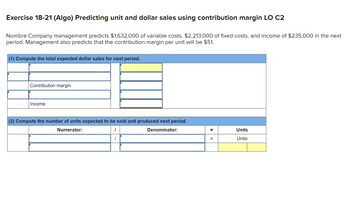

Transcribed Image Text:Exercise 18-21 (Algo) Predicting unit and dollar sales using contribution margin LO C2

Nombre Company management predicts $1,632,000 of variable costs, $2,213,000 of fixed costs, and income of $235,000 in the next

period. Management also predicts that the contribution margin per unit will be $51.

(1) Compute the total expected dollar sales for next period.

Contribution margin

Income

(2) Compute the number of units expected to be sold and produced next period.

Numerator:

1

Denominator:

=

=

Units

Units

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- Current Attempt in Progress Pharoah Company estimates that variable costs will be 55% of sales, and fixed costs will total $1,401,750. The selling price of the product is $7. Calculate the break-even point in units and dollars. Break-even point Break-even point unitsarrow_forwardQuestion 3 The following monthly data in contribution format are available for the Timor Company and its only product. Product SD: Sales Variable expenses Contribution margin Fixed expenses Net operating income Total $ $ $ $ $ 227,500 162.500 65,000 45.000 20,000 Per Unit $ $ $ 91 65 26 The company produced and sold 2,500 units during the month and had no beginning or ending inventories. a) What is the current margin of safety? b) Management is concerned about having the funds to pay dividends next quarter. They believe net operating income of $35,000 will be sufficient. How much sales revenue is necessary to achieve this target profit?arrow_forwardProblem 12-21 (Algo) Prepare a contribution margin format income statement; answer what-if questions LO 12-7, 12-8, 12-9 Shown here is an income statement in the traditional format for a firm with a sales volume of 7,500 units. Cost formulas also are shown: Revenues Cost of goods sold ($5,900 + $2.25/unit) Gross profit Operating expenses: Selling ($1,200 + $0.10/unit) Administrative ($3,500 + $0.20/unit) Operating income $34,400 22,775 $ 11,625 1,950 5,000 $ 4,675 Required: a. Prepare an income statement in the contribution margin format. b. Calculate the contribution margin per unit and the contribution margin ratio. c. Calculate the firm's operating income (or loss) if the volume changed from 7,500 units to 1. 11,250 units. 2. 3,750 units. d. Refer to your answer to part a for total revenues of $34,400. Calculate the firm's operating income (or loss) if unit selling price and variable expenses per unit do not change and total revenues 1. Increase by $14,500. 2. Decrease by $3,000.arrow_forward

- Question 2 The following monthly data in contribution format are available for the Ross Company and its only product. Product SD: Sales Variable expenses Contribution margin Fixed expenses Net operating income Total $ $ $ $ $ 381,600 304.800 76,800 34,500 42,300 Per Unit $ 5 159 127 32 The company produced and sold 2,400 units during the month and had no beginning or ending inventories. a) What is the current operating leverage? b) Projections indicate that the market will worsen by 15% next month. What is the projected net operating income given this increase?arrow_forwardExercise 18-13 (Algo) Computing sales to achieve target income LO C2 Sunn Company manufactures a single product that sells for $145 per unit and whose variable costs are $87 per unit. The company's annual fixed costs are $916,400. Management targets an annual income of $1,450,000. (1) Compute the unit sales to earn the target income. Numerator: 1 1 Denominator: (2) Compute the dollar sales to earn the target income. Numerator: 1 1 Denominator: = || = = || Units to Achieve Target Units to achieve target 0 Dollars to Achieve Target Dollars to achieve target 0arrow_forwardExercise 20.3 (Algo) Computing Required Sales Volume (LO20-4, LO20-5) The following is information concerning a product manufactured by Ames Brothers. Sales price per unit Variable cost per unit Total fixed manufacturing and operating costs (per month) 78 43 430,000 ces a. Determine the unit contribution margin. b. Determine the number of units that must be sold each month to break even. (Round your answer to the nearest whole number.) c. Determine the number of units that must be sold to earn an operating income of $234,000 per month. (Round your answer to the nearest whole number.) a. Unit contribution margin b. Break-even units C. Target sales in units 23 NOV 11 itv li 1 W %24 ...arrow_forward

- Exercise 18-22 (Algo) CVP analysis with two products LO P3 Handy Home sells windows (80% of sales) and doors (20% of sales). The selling price of each window is $330 and of each door is $760. The variable cost of each window is $190 and of each door is $480. Fixed costs are $940,800. (1) Compute the weighted-average contribution margin (2) Compute the break-even point in units using the weighted-average contribution margin (3) Compute the number of units of each rpoduct that will be sold at the break-even pointarrow_forwardpre.3arrow_forwardPLEASE ANSWER QUESTIONS D, E & Farrow_forward

- QS 18-18 (Algo) Zhao Company has fixed costs of $342,200. Its single product sells for $173 per unit, and variable costs are $115 per unit. If the company expects sales of 10,000 units, compute its margin of safety (a) in dollars and (b) as a percent of expected sales. X Answer is complete but not entirely correct. a. Margin of safety (in dollar) $ 5,900 x b. Margin of safety (%) 41%arrow_forwardBreak-even sales and sales to realize operating income For the current year ended March 31, Kadel Company expects fixed costs of $550,000, a unit variable cost of $50, and a unit selling price of $75. a. Compute the anticipated break-even sales (units). units b. Compute the sales (units) required to realize operating income of $127,500. units 220000arrow_forwardsaarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education