Horngren's Accounting (11th Edition)

11th Edition

ISBN: 9780133856781

Author: Tracie L. Miller-Nobles, Brenda L. Mattison, Ella Mae Matsumura

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

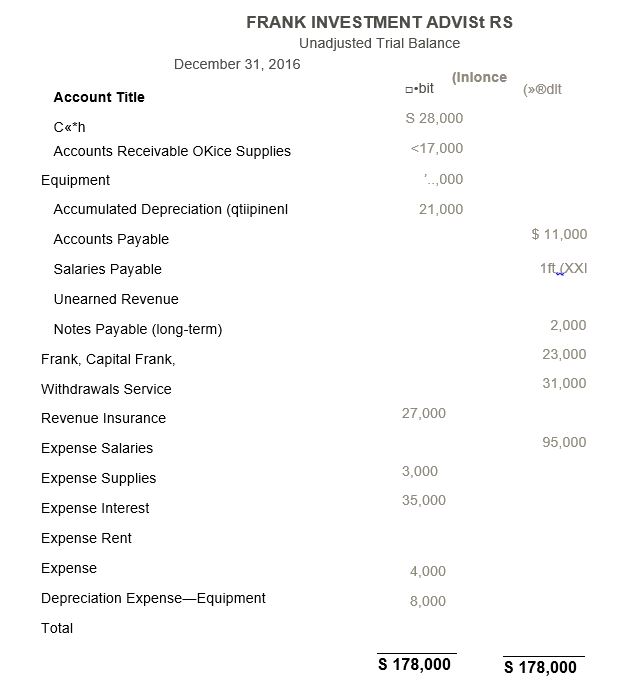

Chapter 4, Problem P4.30APGA

Preparing a worksheet, financial statements, and i losing <-ntrl< J he /nW/w/rt/

Adjustment data at December 31, 2016:

- Unearned Revenue earned during the year, $ 100.

- Office Supplies on hand, $4,000.

- Depreciation for the year, $7,000.

- Accrued Salaries Expense, $2,000.

- Accrued Service Revenue, $6,000.

Requirements

- Prepare a worksheet for Frank Investment Advisers at December 31, 2016.

- Prepare the income statement, the statement of owner’s equity, and the classified balance sheet in account loimat. Assume there were no contributions made by the owner during the year.

- Prepare closing entries.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Prepare the Statement of Comprehensive Income as at: 28 February 2021.Embassy TradersPre-adjustment Trial Balance as at: 28 February 2021Debit CreditBalance Sheet Accounts SectionCapital 1 651 100Drawings 132 900Land and buildings 1 254 800Vehicles at cost 925 000Equipment 662 000Accumulated depreciation on vehicles 528 000Accumulated depreciation on equipment 369 000Fixed deposit: Bob-bank (9% p.a.) 200 000Trading inventory 152 000Debtors control 174 800Provision for bad debts 10 000Bank 127 800Creditors control 184 800Mortgage loan: Bob-bank (18% p.a.) 330 000Nominal Accounts SectionSales 2 075 000Cost of sales 795 000Sales returns 15 000Salaries and wages 586 000Bad debts 18 000Stationary 30 000Rates and taxes 58 000Motor expenses 32 000Advertising 23 000Telephone 44 000Electricity and water 66 000Bank charges 8 000Insurance 5 000Interest on mortgage loan 26 000Interest on fixed deposit 15 000Rent income 171 6005 334 500 5 334 500Adjustments and additional information1.Trading…

Reconstruct an adjusted trial balance for the company, from the information presented in the specified financial statement.

(Amounts in millions)

2020

ASSETS

Current assets:

Cash and cash equivalents

$

9,465

$

Receivables, net

6,284

Inventories

44,435

Prepaid expenses and other

1,622

Total current assets

61,806

Property and equipment, net

105,208

Operating lease right-of-use assets

17,424

—

Finance lease right-of-use assets, net

4,417

—

Property under capital lease and financing obligations, net

—

Goodwill

31,073

Other long-term assets

16,567

Total assets

$

236,495

LIABILITIES AND EQUITY…

The Trial Balance TBA Limited contained the following accounts (alphabetically) at December 31, 2020, the end of company's fiscal year.

Accounts .. . .. .. . .. Balances ($).... ||| .... Accounts .. . . . Balances ($)

Accumulated Depreciation-Building. . 127000 .... ||| .

Accumulated Depreciation-Equipment. 35000.... ||| .... Merchandise Inventory . 227000

Additional Paid in Capital-Common Stock. 229000.... ||| . ... Mortgage Loan .. . . 104000

Loss on Sale of Property . .

7310

Auditors Fee .. .. ... . .... .... ..... ..... ..

204000.... I|I .... Rent Revenue . . . . 53000

Buildings. . 401000.... ||| .... Retained Earnings

51400

....... . u.

Cash

199660

- ||| . ... Salaries and Wages Expense . . 104000

.... .... .... ........ .... ..... ... ..... ..... ..... ...

Common Stock ($2 each)..

III .... Sales .. . .. ... . .. .. . 1755000

**** .... .... .... .. 119000

Cost of Goods Sold . . . . 1094000 .... ||| .... Sales Returns and Allowances .. 9030

Equipment . . ... .... ... .........…

Chapter 4 Solutions

Horngren's Accounting (11th Edition)

Ch. 4 - Assets are listed on the balance sheet in the...Ch. 4 - Which of the following accounts would be included...Ch. 4 - Which situation indicates a net loss within the...Ch. 4 - Which of the following accounts is not closed?...Ch. 4 - What do closing entries accomplish? Learning...Ch. 4 - Which of the following is not a closing entry?...Ch. 4 - Which of the following accounts may appear on a...Ch. 4 - 8. Which of the following steps of the accounting...Ch. 4 - Clean Water Softener Systems has Cash of $600,...Ch. 4 - Which of the following statements concerning...

Ch. 4 - What document are financial statements prepared...Ch. 4 - What does the income statement report?Ch. 4 - Prob. 3RQCh. 4 - Prob. 4RQCh. 4 - Why are financial statements prepared in a...Ch. 4 - Prob. 6RQCh. 4 - Prob. 7RQCh. 4 - Prob. 8RQCh. 4 - Prob. 9RQCh. 4 - How could a worksheet help in preparing financial...Ch. 4 - If a business had a net loss for the year, where...Ch. 4 - Prob. 12RQCh. 4 - What are temporary accounts? Are temporary...Ch. 4 - What are permanent accounts? Are permanent...Ch. 4 - How is the Income Summary account used? Is it a...Ch. 4 - Prob. 16RQCh. 4 - If a business had a net loss for the year, what...Ch. 4 - What types of accounts are listed on the...Ch. 4 - Prob. 19RQCh. 4 - What is the current ratio, and how is it...Ch. 4 - Prob. 21ARQCh. 4 - Prob. S4.1SECh. 4 - Prob. S4.2SECh. 4 - Prob. S4.3SECh. 4 - Preparing a balance sheet (classified, report...Ch. 4 - Classifying balance sheet accounts Learning...Ch. 4 - Prob. S4.6SECh. 4 - Prob. S4.7SECh. 4 - Prob. S4.8SECh. 4 - Prob. S4.9SECh. 4 - Prob. S4.10SECh. 4 - S412 Identifying accounts included on a...Ch. 4 - Identifying steps in the accounting cycle Learning...Ch. 4 - Prob. S4.13SECh. 4 - Prob. S4.14SECh. 4 - Prob. E4.15ECh. 4 - Classifying balance sheet accounts Learning...Ch. 4 - Prob. E4.17ECh. 4 - Prob. E4.18ECh. 4 - Prob. E4.19ECh. 4 - Prob. E4.20ECh. 4 - Prob. E4.21ECh. 4 - Prob. E4.22ECh. 4 - Preparing a worksheet and closing entries Jadence...Ch. 4 - I 2 I I’rcpai ing t losing end ics I rom an...Ch. 4 - a post-dosing trial balance rics* illic r. s ano a...Ch. 4 - Prob. E4.26ECh. 4 - Prob. E4A.27ECh. 4 - Prob. P4.28APGACh. 4 - 'v"-1 evaluate a company •""' UM"B tl,e r“" ratio...Ch. 4 - Preparing a worksheet, financial statements, and i...Ch. 4 - WIUIAMt Osy ANVILS UrMdjuMvd lr „ ik'Uno. l>cu...Ch. 4 - Completing the accounting cycle from journal...Ch. 4 - Prob. P4.33APGACh. 4 - Prob. P4.34BPGBCh. 4 - Prob. P4.35BPGBCh. 4 - Preparing a worksheet, financial statements, and...Ch. 4 - Prob. P4.37BPGBCh. 4 - Completing d««„„„u„g cycle 6mm inn.n.l cn.ric, .0...Ch. 4 - Prob. P4.39BPGBCh. 4 - Completing the accounting cycle from adjusted...Ch. 4 - Prob. P4.41PSCh. 4 - Prob. 1.1CPCh. 4 - Prob. 1.2CPCh. 4 - Prob. 1.3CPCh. 4 - Prob. 1.4CPCh. 4 - Magness Delivery Service completed the fblowing...Ch. 4 - Prob. 1.6CPCh. 4 - Prob. 1.7CPCh. 4 - Prob. 1.8CPCh. 4 - Prob. 1.9CPCh. 4 - Prob. 2.1CPCh. 4 - Prob. 2.2CPCh. 4 - Prob. 2.3CPCh. 4 - Prob. 2.4CPCh. 4 - Prob. 2.5CPCh. 4 - Prob. 2.6CPCh. 4 - Prob. 2.7CPCh. 4 - Prob. 2.8CPCh. 4 - Prob. 4.1EICh. 4 - Prob. 4.1FCCh. 4 - Prob. 4.1FSC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following information was extracted from the financial statements working papersfile for year ended 31 December 2020 for Dave Song’s Cleaning Services List of balances at 31 December 2020 Debits Credits Capital: D Song 660 000 Drawings 160 000 Land and buildings at cost 582 000 Vehicle at cost 224 000 Accumulated depreciation: Vehicle (1 January2020) 46 000 Bank 360 000 Inventories: Consumables 104 000 Trade receivables 261 200 Allowance for credit losses 13 060 10% Long term loan 320 000 Trade payables 260 000 Fees earned 1 036 600 Rent expense 160 000 Telephone 10 708 Other distribution expenses 454 752 Interest on long term loan 19 000 2 335 660 2 335 660 Additional information not yet taken into account:1. Included in rent expenses is an amount of R68 000 in respect of rent for 2021 whichwas paid and recorded in December 2020.2. The telephone account for December 2020 of R1 540 was received but not yet…arrow_forwardGiven the following account balances of MASK RIDER Co. for the year ended December 31, 2020, propare a Statomont of Financial Position using the report form. Mask Rider, capital Beg. Balance PO Contribution 30, 000 DUE ON MAY 15, 2021 Withdrawal 15, 000 Additional contribution 5, 000 Net Income Ending Balance 57, 450 Property, Plant and Equipment P 300, 000 Accumulated Depreciation 5, 000 Accounts payable 8, 110 Unearned income 1, 395 Cash 44, 535 Prepaid rent 5, 000 Salaries payable 1, 000 Long-term note payable 23, 000 Accounts receivable 575 Merchandise Inventory 15,345 Utlities payable 4, 000arrow_forwardFollowing are accounts and year-end adjusted balances of Cruz Company as of December 31. NumberAccount TitleDebitCredit101Cash$ 18,000 126Supplies 12,000 128 Prepaid insurance 2,000 167 Equipment23,000 168 Accumulated depreciation Equipment $ 6,500301A. Cruz, Capital 47, 343302A. Cruz, Withdrawals 6,000 403Services revenue 33,300612Depreciation expense Equipment2, 000 622Salaries expense19, 414 637 Insurance expense 1,399 640 Rent expense2, 231 652Supplies expense 1,099 Totals$ 87, 143$ 87,143 Prepare the December 31 closing entries. The account number for Income Summary is 901. Prepare the December 31 post - closing trial balance. Note: The A. Cruz, Capital account balance was $47,343 on December 31 of the prior year.arrow_forward

- Scanned with CamScanner Scanned with CamScanner Balance Sheets as at 31 December Non current asse Current assets ess depreciation Accounts reco Total assets Accounts pavable oan hotes Net awetse entory at 1 January 2018 was E50,000. Required: 2018 and 2019 Cn Net promt capons for and signi of any changes in the ratios shown by your calaton Scanned with CamScanner given below. Income Statements for the years ending 31 December 2018 2019 £00 £000 £000 E000 Sales Less Cost of sales Gross profit 200 (150) 50 280 (210) 70 Less Administration expenses 38 46 Loan note interest 4 (50) (38) 12 Net profit 20arrow_forwardUsing the following information, A. Make the December 31 adjusting journal entry for depreciation. B. Determine the net book value (NBV) of the asset on December 31. Cost of asset, $195,000 Accumulated depreciation, beginning of year, $26,000 Current year depreciation, $13,000arrow_forwardSpreadsheet The following 2019 information is available for Payne Company: Partial additional information: The net income for 2019 totaled 1,600. During 2019, the company sold, for 390, equipment that cost 390 and had a book value of 300. The company sold land for 200, resulting in a loss of 40. The remaining change in the Land account resulted from the purchase of land through the issuance of common stock. Required: Making whatever additional assumptions that are necessary, prepare a spreadsheet to support the 2019 statement of cash flows for Payne.arrow_forward

- Refer to the information for Cox Inc. above. What amount would Cox record as depreciation expense for 2019 if the units-of-production method were used ( Note: Round your answer to the nearest dollar)? a. $179,400 b. $184,000 c. $218,400 d. $224,000arrow_forwardPrepare the Statement of Comprehensive Income of Royal Traders for the year ended 28February 2021.INFORMATIONThe trial balance, adjustments and additional information given below were extracted from the accounting records ofRoyal Traders on 28 February 2021, the end of the financial year.ROYAL TRADERSPRE-ADJUSTMENT TRIAL BALANCE AS AT 28 FEBRUARY 2021Balance sheet accounts sectionCapital 301 000Drawings 134 720Vehicles at cost 360 000Equipment at cost 240 000Accumulated depreciation on vehicles 186 000Accumulated depreciation on equipment 62 000Trading inventory 140 000Debtors control 62 000Provision for bad debts 8 000Bank 42 800Cash float 1 000 Creditors control 82 800Mortgage loan: Leo Bank (18% p.a.) 160 000 Nominal accounts section Sales 1 000 000Cost of sales 480 000Sales returns 8 000Salaries and wages 178 000Bad debts 2 000Stationery 4 000Rent expense 42 880Motor expenses 34 000Bad debts recovered 2 000Telephone 14 000Electricity and water 24 000Bank charges 6 000Insurance 12…arrow_forwardNon-current assets Property, plant and equipment Development Expenditure Current assets Inventories Trade receivables Investments Cash Total assets Equity Share capital-$1 Ordinary shares Share premium Revaluation surplus Retained Earnings Non-Current liabilities 12% Debentures Finance Lease Liabilities Deferred Tax Current Liabilities Trade payables Finance Lease Liabilities Current Tax Debenture interest Bank overdraft Total equity and liabilities 2018 $'000 925 290 1,215 360 274 143 29 806 2021 500 350 160 229 1,239 150 100 48 298 274 17 56 132 484 2,021 2017 $'000 737 160 897 227 324 46 117 714 1611 400 100 60 255 815 100 80 45 225 352 12 153 54 571 1,611arrow_forward

- The following information was extracted from the records of Lodh Ltd for the year ended 30 June 2021. Lodh LTD Statement of financial position (extract) As at 30 June 2021 Relevant Assets Accounts Receivable $50,000 Allowance for doubtful debts (4,000) $46,000 Prepaid rent 42,000 Plant 200,000 Accumulated depreciation – Plant (25% on cost) (50,000) 150,000 DTA beginning balance 1,000 … Relevant Liabilities Interest Payable 2,000 Provision for long service leave 10,000 Unearned revenue 20,000 DTL beginning balance 5,000 … Additional information · The tax depreciation for plant is considered at 30% of $200,000 (original cost) at 30 June 2021. · Long service leave has not been taken by any employee during the year. · There…arrow_forwardThe following three accounts appear in the general ledger of Herrick Corp. during 2020. Equipment Date Debit Credit Balance Jan. 1 Balance 161,200 July 31 Purchase of equipment 68,100 229,300 Sept. 2 Cost of equipment constructed 54,600 283,900 Nov. 10 Cost of equipment sold 49,100 234,800 Accumulated Depreciation—Equipment Date Debit Credit Balance Jan. 1 Balance 70,700 Nov. 10 Accumulated depreciation on equipment sold 31,200 39,500 Dec. 31 Depreciation for year 24,200 63,700 Retained Earnings Date Debit Credit Balance Jan. 1 Balance 104,200 Aug. 23 Dividends (cash) 15,800 88,400 Dec. 31 Net income 66,700 155,100 From the postings in the accounts, indicate how the information is reported on a statement of cash flows using the indirect method. The…arrow_forwardLocate Gap Inc.’s 2020 Annual Report (for fiscal year 2/2/20-1/30/21) There are 10 sections of questions. You will find the information necessary to answer the questions in “Item 8. Financial Statements and Supplementary Data,” of the report. Read through the questions carefully and answer in the space provided. What are the following amounts at 1/30/21: Total Assets : Total Liabilities: Total Owner’s Equity : At 1/30/21: What is the percentage of debt used to finance Gap? What is the percentage of owner’s equity used to finance Gap? What is the significance of these two percentages?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

ACCOUNTING BASICS: Debits and Credits Explained; Author: Accounting Stuff;https://www.youtube.com/watch?v=VhwZ9t2b3Zk;License: Standard Youtube License