FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

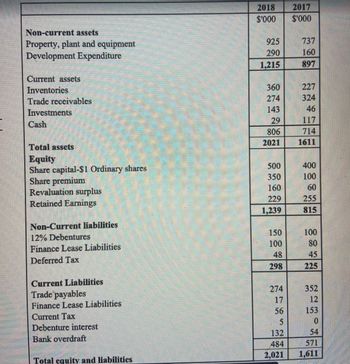

Transcribed Image Text:Non-current assets

Property, plant and equipment

Development Expenditure

Current assets

Inventories

Trade receivables

Investments

Cash

Total assets

Equity

Share capital-$1 Ordinary shares

Share premium

Revaluation surplus

Retained Earnings

Non-Current liabilities

12% Debentures

Finance Lease Liabilities

Deferred Tax

Current Liabilities

Trade payables

Finance Lease Liabilities

Current Tax

Debenture interest

Bank overdraft

Total equity and liabilities

2018

$'000

925

290

1,215

360

274

143

29

806

2021

500

350

160

229

1,239

150

100

48

298

274

17

56

132

484

2,021

2017

$'000

737

160

897

227

324

46

117

714

1611

400

100

60

255

815

100

80

45

225

352

12

153

54

571

1,611

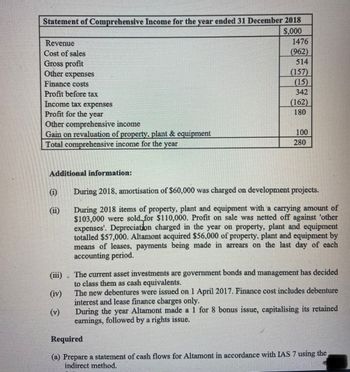

Transcribed Image Text:Statement of Comprehensive Income for the year ended 31 December 2018

$,000

Revenue

Cost of sales

Gross profit

Other expenses

Finance costs

Profit before tax

Income tax expenses

Profit for the

year

Other comprehensive income

Gain on revaluation of property, plant & equipment

Total comprehensive income for the year

(i)

(ii)

(iii)

(iv)

(v)

1476

(962)

514

•

(157)

(15)

342

(162)

180

Additional information:

During 2018, amortisation of $60,000 was charged on development projects.

During 2018 items of property, plant and equipment with a carrying amount of

$103,000 were sold for $110,000. Profit on sale was netted off against other

expenses'. Depreciation charged in the year on property, plant and equipment

totalled $57,000. Altamont acquired $56,000 of property, plant and equipment by

means of leases, payments being made in arrears on the last day of each

accounting period.

100

280

The current asset investments are government bonds and management has decided

to class them as cash equivalents.

The new debentures were issued on 1 April 2017. Finance cost includes debenture

interest and lease finance charges only.

During the year Altamont made a 1 for 8 bonus issue, capitalising its retained

earnings, followed by a rights issue.

Required

(a) Prepare a statement of cash flows for Altamont in accordance with IAS 7 using the

indirect method.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Current Attempt in Progress The following information is available for Bramble Corporation for 2024 (its first year of operations). 1. Excess of tax depreciation over book depreciation, $42,400. This $42,400 difference will reverse equally over the years 2025-2028. 2. Deferral, for book purposes, of $20,300 of rent received in advance. The rent will be recognized in 2025. 3. Pretax financial income, $272,300. 4. Tax rate for all years, 30%. (a) Your answer is correct. Compute taxable income for 2024. Taxable income $ 250200 Prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable for 2024. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Income Tax Expense Deferred Tax Asset Deferred Tax Liability Income Tax Payable Debit…arrow_forwardActuarial gain or loss - plan assets Fair value of plan assets (1 July 2013) Plus: Return on plan assets (6% x $94 356 000) Contributions Minus: Benefits paid Actuarial Fair value of plan assets (30 June 2014) Required: Select a correct answer for each blank. $94 356 000 5 661 360 8 640 000 (15 552 000) $95 832 000arrow_forwardDengararrow_forward

- Required information [The following information applies to the questions displayed below.] Arndt, Incorporated reported the following for 2024 and 2025 ($ in millions): Revenues Expenses Pretax accounting income (income statement) Taxable income (tax return) Tax rate: 25% 2024 $918 774 $144 $126 2025 $ 1,010 830 $ 180 $ 214 a. Expenses each year include $36 million from a two-year casualty insurance policy purchased in 2024 for $72 million. The cost is tax deductible in 2024. b. Expenses include $2 million insurance premiums each year for life insurance on key executives. c. Arndt sells one-year subscriptions to a weekly journal. Subscription sales collected and taxable in 2024 and 2025 were $37 million and $53 million, respectively. Subscriptions included in 2024 and 2025 financial reporting revenues were $31 million ($14 million collected in 2023 but not recognized as revenue until 2024) and $37 million, respectively. Hint. View this as two temporary differences-one reversing in…arrow_forwardBalance Sheet Presentation Thiel Company reports the following deferred tax items at the end of 2019: Deferred TaxItem # AccountBalance Related Asset or LiabilityCreating the Deferred Tax Item 1 $6,700 debit Current asset 2 7,200 credit Current liability 3 10,600 debit Noncurrent asset 4 15,500 credit Noncurrent liability Required: Show how the preceding deferred tax items are reported on Thiel's December 31, 2019, balance sheet. THIEL COMPANYBalance Sheet (Tax Items)December 31, 2019 Noncurrent Liabilities Deferred Tax asset or liability $arrow_forwardvi.8arrow_forward

- For each of the following cases, determine the amount of capital gain or loss to report in each year (after taking into account any applicable carrybacks) and the capital loss carryforward to 2019, if any. Capital gain or loss for year indicated Corporation 2013 2014 2015 2016 2017 2018 4,700 $11,600 $(14,550) $ 7,000 $ 4,950 $(1,450) 3,870 3,010 6,290 11,550 (61,490) 9,350 8,550 4,950 (3,040) 2,970 3,340 15,00е (26,810) (24,600) 8, 200 11,150 2,680 2,250 Assume that 2013 is the first year of operation for each corporation. (Do not leave cells blank, enter "0" if there is no effect.) Carried forward capital losses Reported capital gains Corporation 2013 2014 2015 2016 2017 2018 2019 A B Carrow_forwardHardevarrow_forwardvi.2arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education