Concept explainers

Magness Delivery Service completed the f<blowing tranuttions during De< ;mbei 2016:

Dec. 1 Magness Dp!' i, >ei ' < "' 'lions by receiving $10,000 cash and a truck with a fair value of $20,000 horn Robert Mugness The business gave Magness capital in exchange for this contribution

1 Paid $ 1,000 cash for a tour-month insurance policy The policy begins December 1 4 Paid $500 cash for office supplies.

12 Performed delivery services for a customer and received $2,000 cash

15 Completed a large delivery job, billed the customer, $2,500, and received a promise to collect the $2,500 within one week.

18 Paid employee salary, $1,000,

20 Received $15,000 cash for performing delivery services.

22 Collected $800 in advance for delivery service to be performed later.

25 Collected $2,500 cash from customer on account.

27 Purchased fuel for the truck, paying $300 on account (Credit Accounts Payable)

28 Performed delivery services on account, $700.

29 Paid office rent, $1,600, for the month of December.

30 Paid $300 on account.

31 Magness withdrew cash of $3,000.

Requirements

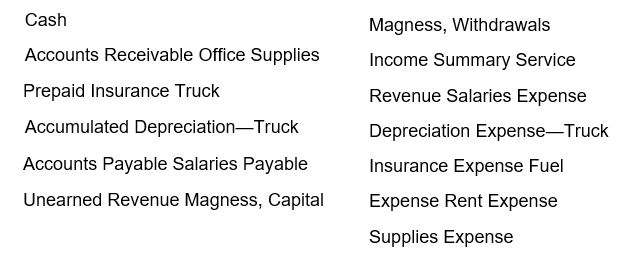

- jRecord each transaction in the journal using the following chart of accounts. Explanations are not required.

Adjustment data:

- Accrued Salaries Expense, $ 1,000.

- Depreciation was recorded on the truck using the straight-line me' ul. Asstn^ a useful life of five years and a salvage value ol $5,000.

- Prepaid Insurance for the month has expired.

- Office Supplies on hand, $100.

- Unearned Revenue earned during the month. $300.

- Accrued Service Revenue, $650.

Want to see the full answer?

Check out a sample textbook solution

Chapter 4 Solutions

Horngren's Accounting (11th Edition)

- Notes Receivable Metzler Communications designs and programs a website for a local business. Metzler charges $46,000 for the project, and the local business signs an 8% note January 1, 2019. Required: 1. Prepare the journal entry to record the sale on January 1, 2019. 2. Determine how much interest Metzler will receive if the note is repaid on October 1, 2019. 3. Prepare Metzlers journal entry to record the cash received to pay off the note and interest on October 1, 2019.arrow_forwardThe following information is provided to you by Amos 31st December 2014 31st December 2015 Shs. ShsWages in arrears 60,000 67,000Insurance paid in advance 21,000 25,500Rates in arrears 7,500 NILRates in advance NIL 9,000Payments made during 2015 were; Wages Kshs. 715,000 Insurance Kshs. 43,500 Rates Kshs. 46,000 Calculate the amounts Amos should transfer to the profit and loss account for wages, insurance and rates for the year 2015.Prepare the Balance sheet extract.arrow_forwardA ezto.mheducation.com mework Chapter 10 Saved Help Sa Thomton Industries began construction of a warehouse on July 1, 2021, The project was completed on March 31, 2022. No new loans were required to fund construction. Thornton does have the following two interest-bearing liabilities that were outstanding throughout the construction period: $3,000, 000, 10% note $7,000, 000, 6% bonds Construction expenditures incurred were as follows: July 1, 2021 September 3e, 2021 November 30, 2021 January 30, 2022 $ 460, 000 660, 000 660, 000 600, 000 Hint The company's fiscal year-end is December 31. Required: Calculate the amount of interest capitalized for 2021 and 2022. terences Complete this question by entering your answers in the tabs below. 2021 2022 Calculate the amount of interest capitalized for 2021. (Do not round the intermediate calculations. Round your percentage answers to 1 decimal place (i.e. 0.123 should be entered as 12.3%).) Date Expenditure Weight Average July 1, 2021 %24…arrow_forward

- 37-On 1st July 2020 Bashir purchase a machine for RO 15,000. The terms of purchase was 20% cash and the balance to be paid in monthly instalments of RO 500. What amount of the loan will be disclosed under current liabilities in the balance sheet on 31 Dec 2020? a. RO 7,000 b. RO 6,000 c. RO 5,000 d. RO 3,000arrow_forwardSaved Help Sa Required information (The following information applies to the questions displayed below.) On January 1, 2021, Gundy Enterprises purchases an office building for $206,000, paying $46,000 down and borrowing the remaining $160,000, signing a 9%, 10-year mortgage. Installment payments of $2,026.81 are due at the end of each month, with the first payment due on January 31, 2021. Required: 1. Record the purchase of the building on January 1, 2021. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet Record the purchase of the building. Noxtarrow_forwardProblem 16: The following disbursements were made in relation to the construction of CAN'T BE WITH YOU TONIGHT Co. building which started January 1, 2020 and the building was completed August 31, 2021. CAN'T BE WITH YOu TONIGHT Company have the following loans outstanding during 2020 and 2021: Interest Rate Amount Specific loan 15% 2,000,000 General loan 12% 15,000,000 The following expenditures were paid during 2020 and 2021 to KASI NANDITO ASAWA KO Construction. January 1, 2020 2,000,000 July 1, 2020 5,000,000 November 1, 2020 3,000,000 July 1, 2021 1,000,000 August 31, 2021 2,000,000 13,000,000 Answer the following questions In accordance with PAS 16 and PAS 23. 46. How much is the balance of the Building-in-progress at December 31, 2020? 47. How much interest incurred was capitalized in 2020? 48. How much interest incurred was recognized in the 2020 profit and loss statement? 49. How much interest incurred was recognized in the 2021 profit and loss statement assuming the all…arrow_forward

- 11 NANGUTANG started constructing a building for its own use on January 1, 2020. NANGUTANG provided the following information related to the construction: Outstanding loans of the Company at January 1, 2020: Interest Rate Amount of loan Interest Cost 5% P10,000,000 P 500,000 10% 20,000,000 2,000,000 Total P30,000,000 P2,500,000 Construction expenditures: July 1, 2020 7,000,000 November 31,2020 3,000,000 December 31, 2020 1,000,000 The amount of borrowing cost that should be charged to profit or loss for the period is? Group of answer choices 340,142 312,375 2,208,450 2,187,625arrow_forwardA company has the following loans in place throughout the year ended 31 December 20X8. $m 10% bank loan 140 8% bank loan 200 On 1 July 20X8 $50 million was drawn down for construction of a qualifying asset which was completed during 20X9. What amount should be capitalised as borrowing costs at 31 December 20X8 in respect of this asset? A $5.6 million B $2.8 million C $4.4 million D $2.2 millionarrow_forwardLUCAS BORROWED PHP 1,000 FROM WATER-ME-LOAN AAND PROMISES TO PAY THIS WITH LEVEL MONTHLY AMORTIZATION PAYMENTS FOR 10 MONTHS AT INTEREST RATE I PER MONTH YOU ARE GIVEN THE PARTIAL TABLE BELOW. t Pt B₂ 0 1 2 ४ন + t فی 4737.47 5 6 7 ४ q 10 1.000.00 249.36 F657.33arrow_forward

- Notes Receivable Link Communications programs voicemail systems for businesses. For a recent project, they charged $135 000. The customer secured this amount by signing a note bearing 9% interest on February 1, 2019. Required: 1. Prepare the journal entry to record the sale on February 1, 2019. 2. Determine how much interest Link will receive if the note is repaid on December 1, 2019. 3. Prepare Links journal entry to record the cash received to pay off the note and interest on December 1, 2019.arrow_forwardThe Problem 24-6 (IAA) Zephyr Company is provided a grant by a foreign governme for. the purpose of acquiring land for a building site grant is a zero-interest loan for 5 years evidenced hu promissory note. The loan was granted on January 1, 2020 for P8,000;000, The market rate of interest is 6%. The present value of 1 for fiv periods at 6% is .7473. Required: Prepare journal entries for 2020 and 2021.arrow_forward12 Review the details of transaction for the purchase of a new primary residence and determine if the loan satisfies Fannie Mae guidelines? And why? notes: Closing Costs Prepaid Expenses Sales Price $ 160,000.00 $ 3,198.00 $3,050.00 Total $ 166,248.00 Mortgage Amount $ 152,000.00 $ 1,000.00 EMD Seller Pd Costs $6.400.00 Cash needed to close $6,848.00 Answer:arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning