Governmental and Nonprofit Accounting (11th Edition)

11th Edition

ISBN: 9780133799569

Author: Robert J. Freeman, Craig D. Shoulders, Dwayne N. McSwain, Robert B. Scott

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 4, Problem 5P

(GL and SL Entries) Prepare in proper form the

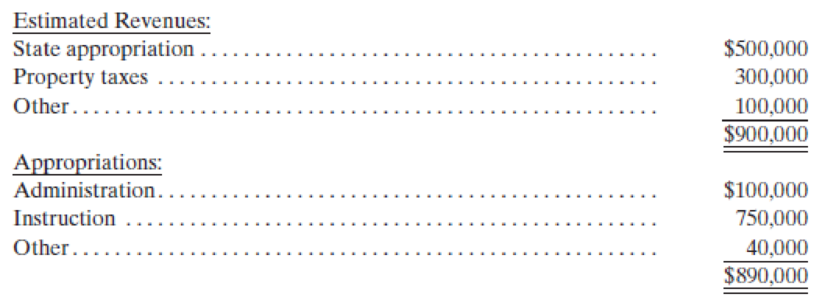

- 1. The annual operating budget (GAAP basis) provides for:

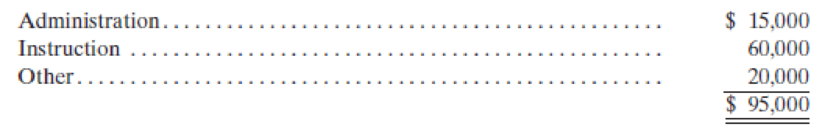

- 2. 2. Purchase orders and contracts for goods and services were approved at estimated costs of:

- 3. Property taxes were levied, $320,000, of which $15,000 are estimated to be uncollectible.

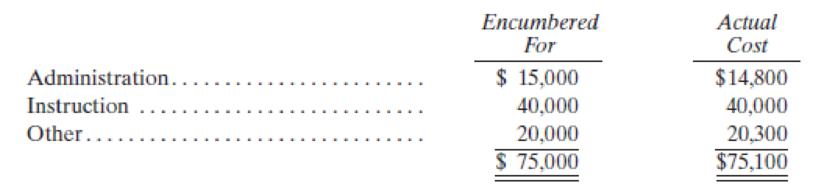

- 4. Most of the goods and services ordered in transaction 2 arrived and the invoices were approved and vouchered for payment:

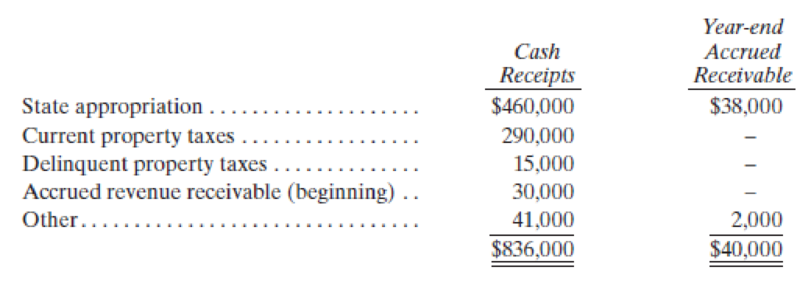

- 5. Cash receipts and year-end revenue accruals were:

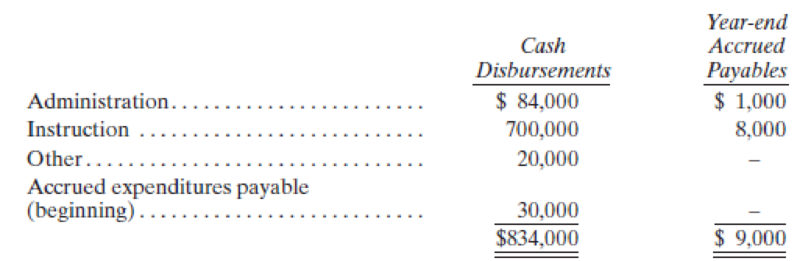

- 6. Cash disbursements, including payment of payroll and other unencumbered expenditures, and year-end expenditure accruals were:

- 7. Interfund transfers were ordered (not yet paid) as follows: (a) $25,000 to the Debt Service Fund to be used to pay general long-term debt principal and interest, and (b) $40,000 from an Internal Service Fund that is being discontinued.

- 8. It was discovered that $1,500 charged to Instruction (in transaction 6) should be charged to Transportation, which is financed through the General Fund.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

4.

The Village of Seaside Pines prepared the following enterprise fund Trial Balance as of December 31, 2020, the last day of its fiscal year. The enterprise fund was established this year

through a transfer from the General Fund.

Accounts payable

Accounts receivable

Accrued interest payable

Accumulated depreciation

Administrative and selling expenses

Allowance for uncollectible accounts

Capital assets

Cash

Charges for sales and services

Cost of sales and services

Depreciation expense

Due from General Fund

Interest expense

Interest revenue

Transfer in from General Fund

Bank note payable

Supplies inventory

Totals

Debits

$32,000

47,000

712,000

89,000

479,000

45,000

17,000

40,000

18,000

$1,479,000

Credits

$ 96,000

28,000

45,000

12,000

550,000

4,000

119,000

625,000

$1,479,000

Required:

a. Prepare the closing entries for December 31.

b. Prepare the Statement of Revenues, Expenses, and Changes in Fund Net Position for the year ended December 31.

c. Prepare the Net Position section of the…

Prepare journal entries in general journal format to record the following transactions for the City of Dallas General Fund (subsidiary detail may be omitted)

1. The budget prepared for the fiscal year included total estimated revenues of $4,693,000, appropriations of $4,686,000 and estimated other financing uses of $225,000.

2. Purchase orders in the amount of $451,000 were mailed to vendors.

3. The current year’s tax levy of $4,005,000 was recorded; uncollectible taxes were estimated to be 2% of the tax levy.

4. Collections of delinquent taxes from prior years’ levies totaled $82,700; collections of the current year’s levy totaled $3,524,900.

5. Invoices were received and approved for payment for items ordered in documents recorded as encumbrances in transaction (#2) of this problem. The estimated liability for the related items was $351,200. Actual invoices were $353,500.

6. Revenue other than taxes collected during the year consisted of licenses and permits, $177,600;…

The Bellflower City school district formally adopted a budget wi

revenues of $800 and approved expenditures of $780. Which of

is the appropriate entry to record the budget?

MATER

OLARA

O Debit Estimated revenues $800; Credit Appropriations $780; Credit F

$20.

EFERE

Debit Appropriations $780: Debit Fund balance $20: Credit Estimated

$800.

Debit Encumbrances $780: Debit Fund balance $20; Credit Estimated

$800.

Memorandum entry only.

Chapter 4 Solutions

Governmental and Nonprofit Accounting (11th Edition)

Ch. 4 - Prob. 1QCh. 4 - What characteristics of expenditures distinguish...Ch. 4 - How does the purchase of a capital asset affect...Ch. 4 - Prob. 4QCh. 4 - Explain what is meant by General Ledger control...Ch. 4 - List and explain the five fund balance reporting...Ch. 4 - Prob. 7QCh. 4 - Prob. 8QCh. 4 - Prob. 9QCh. 4 - Prob. 11Q

Ch. 4 - Prob. 12QCh. 4 - Define the following interfund transaction terms...Ch. 4 - What are the most likely circumstances to cause...Ch. 4 - Explain the purpose, nature, and effect of the...Ch. 4 - Which of the following is a characteristic of a...Ch. 4 - Prob. 1.2ECh. 4 - Assume that Nathan County has levied its...Ch. 4 - Refer to the previous question. What amount of tax...Ch. 4 - Assume the following transactions that affected...Ch. 4 - Prob. 1.6ECh. 4 - The GAAP-based statements that are required to be...Ch. 4 - A city levies property taxes of 500,000 for its...Ch. 4 - At year end a school district purchases...Ch. 4 - A state borrowed 10,000,000 on a 9-month, 9% note...Ch. 4 - Charges for services rendered by a countys General...Ch. 4 - Prob. 2.5ECh. 4 - In the Statement of Revenues, Expenditures, and...Ch. 4 - The minimum expenditure classifications required...Ch. 4 - Which fund balance category is affected by having...Ch. 4 - Prob. 3.2ECh. 4 - Prob. 3.3ECh. 4 - The GAAP fund balance classifications are...Ch. 4 - The fund balance category that can have either a...Ch. 4 - The fund balance category used to reflect a...Ch. 4 - The fund balance category that must be zero if...Ch. 4 - Enabling legislation requiring that resources be...Ch. 4 - Prob. 4.3ECh. 4 - Prob. 4.4ECh. 4 - Prob. 4.5ECh. 4 - Prob. 5ECh. 4 - (Expenditure Accounting Entries) Record the...Ch. 4 - (Statement of Revenues, Expenditures, and Changes...Ch. 4 - (Fund Balance Classification) Your firm is...Ch. 4 - (Interfund Transactions and Errors) (a) Prepare...Ch. 4 - (General FundTypical Transactions) Prepare all...Ch. 4 - Prob. 3PCh. 4 - Prob. 4PCh. 4 - (GL and SL Entries) Prepare in proper form the...Ch. 4 - (Debt-Related Transactions) Prepare the general...Ch. 4 - (Closing Entries and Financial Statements) The...Ch. 4 - (Statement of Revenues, Expenditures, and Changes...Ch. 4 - Statement of Revenues, Expenditures, and Changes...Ch. 4 - Fund Balance Reporting (Fund Balance Reporting)...Ch. 4 - Prob. 1CCh. 4 - (Financial Statement PreparationCity of Savannah,...

Additional Business Textbook Solutions

Find more solutions based on key concepts

What are assets limited as to use and how do they differ from restricted assets?

Accounting for Governmental & Nonprofit Entities

Interest-bearing notes payable with year-end adjustments P1 Keesha Co. borrows $200,000 cash on November 1, 201...

Financial Accounting: Information for Decisions

The amount that should be recorded by Company R for building under historical cost principle.

Financial Accounting (11th Edition)

List five asset accounts, three liability accounts, and five expense accounts included in the acquisition and p...

Auditing and Assurance Services (16th Edition)

Assume you are a CFO of a company that is attempting to race additional capital to finance an expansion of its ...

Financial Accounting, Student Value Edition (4th Edition)

Adjusting Journal Entries; Adjusted Trial Balance. Magic Cleaning Services (MCS) has a fiscal year-end of Decem...

Intermediate Accounting (2nd Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The budget officer of the Department of Social Welfare and Development (DSWD) was granted a cash advance in the amount of P15,000. He is to attend a seminar in the Department of Budget and Management (DBM) head office. Accordingly, the obligation incurred for this purpose was appropriately recorded in the Registry of Allocation, Obligation, and Disbursement – Maintenance and Other Operating Expenses (RAOD-MOOE) in the amount of P15,000. After that seminar, the budget officer liquidated his cash advance by preparing the Liquidation Report form and reported total expenses related to that official travel in the amount of 12,300.Required: Give the necessary entries to be made by the DSWD for the above scenario.arrow_forwardRequired information Exercise 6-4 and Exercise 6-5 (Algo) [The following information applies to the questions displayed below.] The Village of Seaside Pines prepared the following enterprise fund Trial Balance as of December 31, 2020, the last day of its fiscal year. The enterprise fund was established this year through a transfer from the General Fund. Accounts payable Accounts receivable Accrued interest payable Accumulated depreciation Administrative and selling expenses Allowance for uncollectible accounts Capital assets Cash Charges for sales and services Cost of sales and services Depreciation expense Due from General Fund Interest expense Interest revenue Transfer in from General Fund Bank note payable Supplies inventory Totals Exercise 6-4 (Algo) $ Debits 31,900 55,500 732,000 99,500 509,000 53,500 18, 200 41,400 Credits $ 117,000 35,100 53,500 13,900 579,000 6,200 128,500 628,500 20,700 $1,561,700 $1,561,700 Required: a. Prepare the closing entries for December 31. b. Prepare…arrow_forwardPreparation of financial statements and interpretation of operating results Below is the December 31, 2022 trial balance for Radnor City's General Fund. Trial Balance Account Debit Credit Estimated revenues-property taxes $500,000 Estimated revenues-intergovernmental 150,000 Estimated revenues-licenses and fees 100,000 Estimated revenues-fines 50,000 Budgetary fund balance Appropriations-general government 10,000 $159,000 Appropriations-parks and recreation 175,000 Appropriations-public safety 446,000 Appropriations-social services 30,000 Expenditures-public safety 441,000 Expenditures-general government 150,500 Expenditures-parks and recreation 170,500 Expenditures-social services 27,000 Cash 35,600 Property taxes receivable 67,200 Tax anticipation notes payable 10,000 Interest payable 800 Revenues-property taxes 497,000 Revenues-intergovernmental 154,000 Revenues-licenses and fees 99,000 Revenues-fines 48,000 Fund balance 62,000 Vouchers payable 21,000 Total $1,701,800 $1,701,800arrow_forward

- The General Fund for Nisland has the following budget for the current year: Estimated Revenues Appropriations Estimated other financing sources Estimated other financing uses During the year, the actual results were: Revenues Expenditures Other financing sources Other financing uses Required: Prepare the Closing Entries for Nisland. $4,500,000 $5,200,000 $800,000 $75,000 $4,300,000 $5,150,000 $850,000 $70,000arrow_forwardThe general ledger of the County of Konstantin contains the following selected account balances: $91400 $35600 $16500 $5700 Appropriations Outstanding Encumbrances Expenditures Vouchers Payable Konstantin wants to order additional goods and services before the fiscal year end. What is the unencumbered balance (i.e., the remaining authority) of the budget that may be expended by Konstantin? BE SURE TO TYPE A SIMPLE NUMBER WITH NO COMMAS OR DOLLAR SIGNS. FOR EXAMPLE, TYPE 1000 INSTEAD OF $1,000.arrow_forwardRequired: For each of the summarized transactions for the Village of Sycamore General Fund, prepare the general ledger journal entries. The budget was formally adopted, providing for estimated revenues of $1,076,000 and appropriations of $1,006,000. Revenues were received, all in cash, in the amount of $1,019,000. Purchase orders were issued in the amount of $486,000. Of the $486,000 in (c), purchase orders were filled in the amount of $479,500; the invoice amount was $478,000 (not yet paid). Expenditures for payroll not encumbered amounted to $518,000 (not yet paid). Amounts from (d) and (e) are paid in cash. Note: If no entry is required for a transaction or event, select "No Journal Entry Required" in the first account field.arrow_forward

- The budget officer of the Department of Social Welfare and Development (DSWD) was granted a cashadvance in the amount of P15,000. He is to attend a seminar in the Department of Budget andManagement (DBM) head office. Accordingly, the obligation incurred for this purpose was appropriatelyrecorded in the Registry of Allocation, Obligation, and Disbursement – Maintenance and OtherOperating Expenses (RAOD-MOOE) in the amount of P15,000. After that seminar, the budget officerliquidated his cash advance by preparing the Liquidation Report form and reported total expensesrelated to that official travel in the amount of 12,300.Required: Give the necessary entries to be made by the DSWD for the above scenario. The Department of Foreign Affairs (DFA) collected P10,000,000 revenue from passport and visaapplications for March 20X2. The said amount was then deposited in an authorized servicing bank.Moreover, in the same month, the DFA received a P5,000,000 cash disbursement ceiling (CDC) andpaid…arrow_forwardA government health care district incorporates its budget in its accounting system and encumbers all purchase orders and contracts. Prior to the start of the year, the governing board adopted a budget in which agency revenues were estimated at $5,600 and expenditures of $5,550 were appropriated. During the year, the following transactions incurred: the government health care district collected $5,500 in fees, grants, taxes, and other revenues It ordered goods and services for $3,000. it received and paid for $2,800 of goods and services that had been previously encumbered. It expects to receive the remaining $200 in the following year. It incurred $2500 in other expenditures for goods and services that had not been encumbered. What is total fund balance at year end? $500 $300 $200 None of abovearrow_forward4. City of Atwater wants to prepare closing entries at the end of a fiscal year for budgetary and operating statement control accounts in the general ledger of the General Fund. Following balance are belong to the City. Appropriations, $7,824,000%3; Financing Uses, $2,766,000; Estimated Revenues, $7,798,000; Encumbrances,$0; Expenditures, $5,900,0003; Uses, $2,770,000; Revenues, $8,980,000. Required Show in general journal form the entry needed to close all of the preceding accounts that should be closed as of the end of the fiscal year. Estimated Other Other Financingarrow_forward

- Accounting Cycle Project Following is the trial balance of City of Kendall Green’s General Fund at December 31, 2019. Using MS-Excel, prepare well-formatted worksheets as follows: (a) closing entries (b) a post-closing trial balance. (c) a statement of revenues, expenditures, and changes in fund balance for the year ended December 31, 2019 (d) a balance sheet at December 31, 2019.arrow_forward1. What items are typically submitted as part of the budget or annual plan? Marketing plan Capital plan Employee plan Both A & Barrow_forward1.Prepare a tuition revenue budget for the upcoming academic year. 2. Determine the number of faculty members needed to cover classes.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

What is Budgeting? | Budgetary control | Advantages & Limitations of Budgeting; Author: Educationleaves;https://www.youtube.com/watch?v=INnPo0QPXf4;License: Standard youtube license