Accounting: What the Numbers Mean

11th Edition

ISBN: 9781259535314

Author: David Marshall, Wayne William McManus, Daniel Viele

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 4, Problem 4.27P

Problem 4.27

LO 6. 7

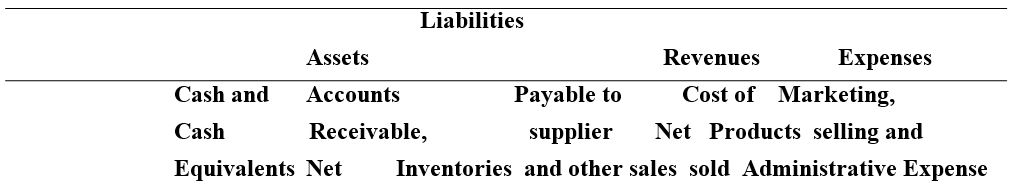

Analyze several accounts using Campbell Soup Company annual report data Set up a horizontal model in the following format:

Beginning balance

Net sales

Cost of products sold

Marketing, selling, and administrative expanses

Purchases on account

Collection of accounts receivable

Payments to suppliers and other

Ending balance

Required:

- Enter the beginning (July 23, 2013) and ending (August 3, 2014) account balances for Accounts Receivable, Inventories, and Payable to Suppliers and Others. Find these amounts on the balance sheet for Campbell Soup Company in the appendix.

- From the income statement for Campbell Soup Company for the year ended August 3, 2014, in the appendix, record the following transactions in the model:

- Net Sales, assuming that all sales were made on account.

- Cost of Products Sold, assuming that all costs were transferred from inventories.

- Marketing, Selling, and Administrative Expenses, assuming all of these expenses were accrued in the Payable to Suppliers and Others liability category as they were incurred.

(Hint: Campbell's General, Selling, and Administrative Expenses are contained m two separate captions. Note that Payable to Suppliers and Others is another term for Accounts Payable.)

- Purchases of inventories on account.

- Collections of accounts receivable.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Question Content Area

Based on the following data, what is the accounts receivable turnover?

Sales on account during year

$700,000

Cost of merchandise sold during year

270,000

Accounts receivable, beginning of year

45,000

Accounts receivable, end of year

35,000

Merchandise inventory, beginning of year

90,000

Merchandise inventory, end of year

110,000

a.20.0

b.15.5

c.2.6

d.17.5

Problem 1

The following summarizes the transactions recorded in the Accounts receivable – trade account of Pratt Corporation:

Accounts Receivable – Trade

Balance forwarded, net of

P9,000 credit balance

Charge sales ....

Charge for consignment sales

Shareholders' subscriptions

Receipts from customers,

including overpayment of P10,000

106,000

1,250,000 | Write offs ...

25,000 Merchandise returns

1,240,000

7,000

5,500

60,000 Allowance to customers for

Recovery of previous write-offs

Refunds to customers with credit balances ...

5,000

5,000 | Collection on subscription

50,000

shipping damages

Collections on carrier claims

3,000

2,000

45,000

Deposit on contract

Claim against common carrier for

shipping damages

IOUS from employees

Cash advances to affiliate

Advances to supplier

5,000

1,000

50,000

10,000

Audit notes:

a) It was ascertained that half of the adjusted outstanding accounts receivable – trade balance are still currently collectible.

The term of sale is 5/30, n/60. Based on past…

Question 28

The sum of customers' unpaid balances that is compared to the general ledger comes from:

the total of sales invoices

a total of shipping orders

the sales journal

the accounts receivable trial balance

Chapter 4 Solutions

Accounting: What the Numbers Mean

Ch. 4 - Prob. 4.1MECh. 4 - Mini-Exercise 4.2 LO 2, 6, 7 Record transactions...Ch. 4 - Prob. 4.3MECh. 4 - Prob. 4.4MECh. 4 - Exercise 4.5 LO 2. 6, 7 Record transactions and...Ch. 4 - Exercise 4.6 LO 2. 6, 7 Record transactions and...Ch. 4 - Exercise 4.7 LO 6 Write journal entries Write the...Ch. 4 - Exercise 4.8 LQ 6 Write journal entries Write the...Ch. 4 - Exercise 4.9 LO 2, 6, 7 Record transactions and...Ch. 4 - Exercise 4.10 LO 2. 6, 7 Record transactions and...

Ch. 4 - Exercise 4.11 LO 2. 6, 7 Record transactions and...Ch. 4 - Exercise 4.12 LO 2, 6, 7 Record transactions and...Ch. 4 - Exercise 4.13 LO 3 Calculate retained earnings On...Ch. 4 - Prob. 4.14ECh. 4 - Exercise 4.15 LO 6 . 7 Notes receivable-interest...Ch. 4 - Exercise 4.16 LO 6, 7 Notes payable-interest...Ch. 4 - Exercise 4.17 LO 6, 7 Effect of adjustments on net...Ch. 4 - Exercise 4.18 LO 6, 7 Effects of adjustments A...Ch. 4 - Exercise 4.19 LO 6 , 7 T-account analysis Answer...Ch. 4 - Exercise 4.20 LO 6, 7 Transaction analysis using...Ch. 4 - Problem 4.21 LO 2, 6, 7 Record transactions and...Ch. 4 - Prob. 4.22PCh. 4 - Prob. 4.23PCh. 4 - Problem 4.24 LO 6. 7 Calculate income from...Ch. 4 - Prob. 4.25PCh. 4 - Prob. 4.26PCh. 4 - Problem 4.27 LO 6. 7 Analyze several accounts...Ch. 4 - Prob. 4.28PCh. 4 - Case 4.29LO 6, 7Capstone analytical review of...Ch. 4 - Prob. 4.30C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- JOURNALIZING SALES RETURNS AND ALLOWANCES Enter the following transactions starting on page 60 of a general journal and post them to the appropriate general ledger and accounts receivable ledger accounts. Use account numbers as shown in the chapter. Beginning balance in Accounts Receivable is 3,900. Beginning balances in selected customer accounts are Adams, 850; Greene, 428; and Phillips, 1,018.arrow_forwardFINANCIAL RATIOS Use the work sheet and financial statements prepared in Problem 15-8A. All sales are credit sales. The Accounts Receivable balance on January 1,20--, was 3,800. REQUIRED Prepare the following financial ratios: (a) Working capital (b) Current ratio (c) Quick ratio (d) Return on owners equity (e) Accounts receivable turnover and average number of days required to collect receivables (f) Inventory turnover and average number of days required to sell inventoryarrow_forwardFINANCIAL RATIOS Use the spreadsheet and financial statements prepared in Problem 15-8A. All sales are credit sales. The Accounts Receivable balance on January 1, 20--, was 10,200. REQUIRED Prepare the following financial ratios: (a) Current ratio (b) Quick ratio (c) Working capital (d) Return on owners equity (e) Accounts receivable turnover and average number of days required to collect receivables (f) Inventory turnover and average number of days required to sell inventoryarrow_forward

- Accounts Receivable Turnover and Number of Days Sales in Receivables Analyze and compare Amazon.com to Best Buy Amazon.com, Inc. (AMZN) is one of the largest Internet retailers in the world. Best Buy, Inc. (BBY) is a leading retailer of consumer electronics and media products in the United States. Amazon and Best Buy compete in similar markets; however, Best Buy sells through both traditional retail stores and the Internet, while Amazon sells only through the Internet. Sales and accounts receivable information for both companies for a recent period follows (in millions): Amazon Best Buy Sales 135,987 39,528 Accounts receivable: Beginning of year 5,654 1,280 End of year 8,339 1,162 a.Determine the accounts receivable turnover for each company. Round all calculations to one decimal place. b.Determine the number of days sales in receivables for each company. Round all calculations to one decimal place. c. Evaluate the relative efficiency in collecting accounts receivables between the two companies. d. What might explain this difference?arrow_forward27. The average payment period of an organization is calculated by __________. a. Average payables / Daily credit purchases b. Average payables / Net purchases c. Accounts payables / Total purchases d. Opening account payable + Closing account payable /2arrow_forwardGLO402 - Based on Problem 4-2A Lowe's Company LO P1, P2 Prepare journal entries to record the following merchandising transactions of Lowe's, which uses the perpetual inventory system. (Hint: It will help to identify each receivable and payable; for example, record the purchase on August 1 in Accounts Payable-Aron.) 1 Purchased merchandise from Aron Company for $7,500 under credit terms of 1/10, n/30, FOB destination, invoice dated August 1. 5 Sold merchandise to Baird Corp. for $5,200 under credit terms of 2/10, n/60, FOB destination, invoice dated August 5. The merchandise had cost $4,000. 8 Purchased merchandise from Waters Corporation for $5,400 under credit terms of 1/10, n/45, FOB shipping point, invoice dated August 8. 9 Paid $125 cash for shipping charges related to the August 5 sale to Baird Corp. Aug. Aug. Aug. Aug. Aug. 10 Baird returned merchandise from the August 5 sale that had cost Lowe's $400 and was sold for $600. The merchandise was restored to inventory. Aug. 12…arrow_forward

- Accounts Receivable Calculations The following amounts were reported for Cotton, Newton, and Miller Companies: Required: Next Level Compute the missing amounts.arrow_forwardContinuing Company AnalysisAmazon: Accounts receivable turnover and number of days sales in receivables Amazon.com, Inc. is one of the largest Internet retailers in the world. Best Buy, Inc. is a leading retailer of consumer electronics and media products in the United States. Amazon and Best Buy compete in similar markets; however, Best Buy sells through both traditional retail stores and the Internet, while Amazon sells only through the Internet. Sales and accounts receivable information for both companies for a recent period follows (in millions): Amazon Best Buy Sales 88,988 40,339 Accounts receivable: Beginning of year 4,767 1,308 End of year 5,612 1,280 A. Determine the accounts receivable turnover for each company. (Round all calculations to one decimal place.) B. Determine the number of days sales in receivables for each company. (Round all calculations to one decimal place.) C. Evaluate the relative efficiency in collecting accounts receivables between the two companies. D. What might explain this difference?arrow_forwardCodification Situation You are conducting an accounting research project for your boss. Your boss has asked you to determine the appropriate U.S. GAAP that specifies how your company should recognize revenues from the sales of products in a retail store. Your boss is confused because most customers pay cash, but some customers purchase on credit terms, and pay in cash 30 days later. Your manager also wants you to determine the GAAP guidance for how revenue should be recognized in income. Your manager has a lot of knowledge and experience in accounting and has heard about, but has never used, the FASB Accounting Standards Codification system. Directions Use the FASB Accounting Standards Codification system to conduct the research your manager has assigned to you. Use the Codification to determine how to recognize revenue from retail sales, including the right to return. Be prepared to show your manager the specific FASB ASC references that provide the appropriate guidance. Also prepare a brief memo explaining to your manager the different levels of the Codification and how to use the Codification system.arrow_forward

- explain the result of ACCOUNTS RECEIVABLE TURNOVER RATIO DAYS TO COLLECT INVENTORY TURNOVER DAYS TO SELL ACCOUNTS PAYABLE TURNOVERarrow_forward12.1 Match the term in the left column with its definition in the right column. 1. CRM system a. Document used to authorize reducing the balance in a customer account 2. Open-invoice method b. Process of dividing customer account master file into subsets and preparing invoices for one subset at a time 3. Credit memo C. System that integrates EFT and EDI information 4. Credit limit d. System that contains customer-related data organized in a manner to facilitate customer service, sales, and retention 5. Cycle billing e. Electronic transfer of funds 6. FEDI f. Method of maintaining accounts receivable that generates one payment for all sales made the previous montharrow_forwardQuestion 14 Revenue and accounts receivable in a company that sells product should be recorded when: only when items have been paid for The customer's order is received all supporting documentation of shipping is in complete and in order All of the answers provided would result in revenue recognition and accounts receivable being recorded.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Corporate Financial AccountingAccountingISBN:9781337398169Author:Carl Warren, Jeff JonesPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781337398169Author:Carl Warren, Jeff JonesPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:9781337398169

Author:Carl Warren, Jeff Jones

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Financial & Managerial Accounting

Accounting

ISBN:9781337119207

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

How To Analyze an Income Statement; Author: Daniel Pronk;https://www.youtube.com/watch?v=uVHGgSXtQmE;License: Standard Youtube License