Concept explainers

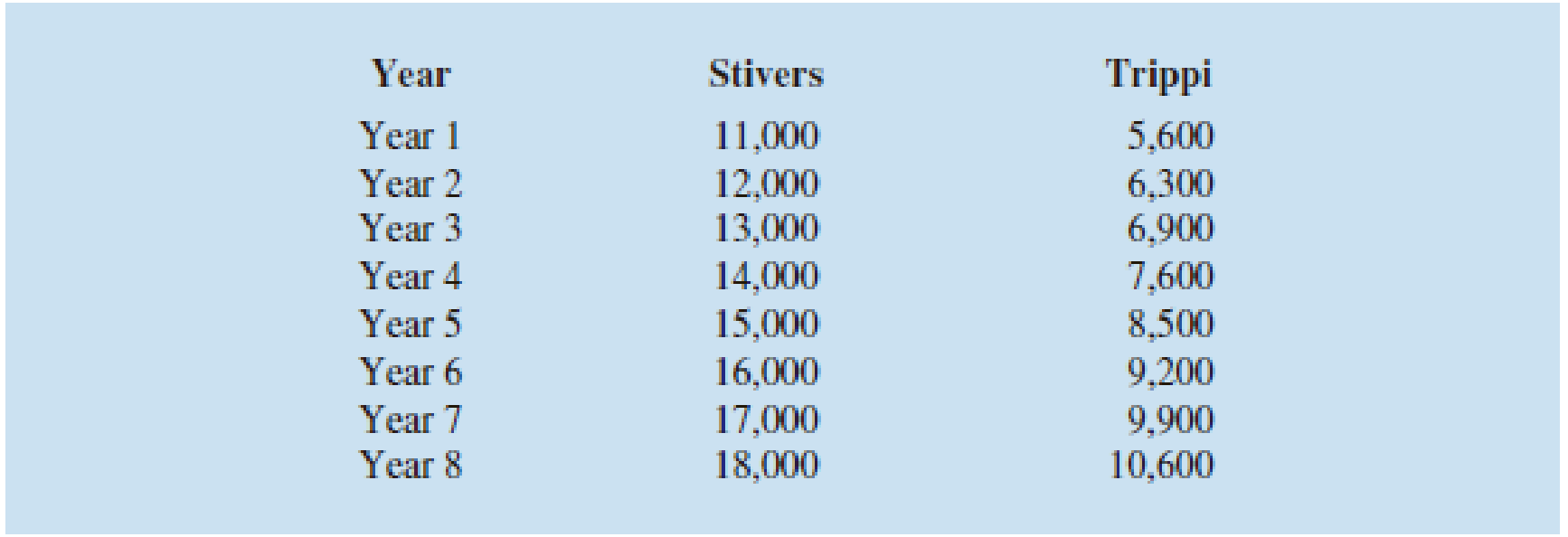

Suppose that at the beginning of Year 1 you invested $10,000 in the Stivers mutual fund and $5000 in the Trippi mutual fund. The value of each investment at the end of each subsequent year is provided in the table below. Which mutual fund performed better?

Identify the mutual fund that performed better.

Answer to Problem 20E

The Trippi mutual fund performed better than Stivers.

Explanation of Solution

Calculation:

In the Stivers mutual fund, $10,000 is invested at the beginning of Year 1 and in Trippi mutual fund, $5,000 is invested at the beginning of Year 1. The given table represents the value of each investment at the end of each subsequent year.

The geometric mean is often used for finding the mean growth rate.

The mean growth factor over these eight periods is:

Where,

The growing factor of each year can be obtained by dividing the value of end of year by the previous year value.

The growth factor of Stivers for the year 1 can be obtained as follows:

The growth factor of Trippi for the year 1 can be obtained as follows:

Similarly the growth actor for remaining years can be obtained as shown in the table given below:

| Year | Stivers | Trippi | ||

| End of Year Value | Growth Factor | End of Year Value | Growth Factor | |

| 1 | $11,000 | 1.100 | $5,600 | 1.120 |

| 2 | $12,000 | 1.091 | $6,300 | 1.125 |

| 3 | $13,000 | 1.083 | $6,900 | 1.095 |

| 4 | $14,000 | 1.077 | $7,600 | 1.101 |

| 5 | $15,000 | 1.071 | $8,500 | 1.118 |

| 6 | $16,000 | 1.067 | $9,200 | 1.082 |

| 7 | $17,000 | 1.063 | $9,900 | 1.076 |

| 8 | $18,000 | 1.059 | $10,600 | 1.071 |

For the Stivers mutual fund:

The balance at the end of the year 8 is the initial investment times the product of all 8 growth factors.

That is,

Substitute

Thus, the mean annual return for the Stivers mutual fund is

For the Trippi mutual fund:

The balance at the end of the year 8 is the initial investment times the product of all 8 growth factors.

That is,

Substitute

Thus, the mean annual return for the Trippi mutual fund is

The annual return earned by the Trippi mutual fund is 9.8% and by the Stivers mutual fund is 7.6%. Hence, the annual return earned by the Tripp mutual fund is more than that of Stivers mutual fund.

Thus, it can be concluded that the Trippi mutual fund performed better than Stivers.

Want to see more full solutions like this?

Chapter 3 Solutions

Modern Business Statistics with Microsoft Office Excel (with XLSTAT Education Edition Printed Access Card) (MindTap Course List)

- What interest rate would you need to get to double an investment of 200 in eight years?arrow_forwardWhat is the total effect on the economy of a government tax rebate of $500 to each household in order to stimulate the economy if each household will spend of the rebate in goods and services?arrow_forwardIn Example 11, during which year did the sales reach $180 billion?arrow_forward

Intermediate AlgebraAlgebraISBN:9781285195728Author:Jerome E. Kaufmann, Karen L. SchwittersPublisher:Cengage Learning

Intermediate AlgebraAlgebraISBN:9781285195728Author:Jerome E. Kaufmann, Karen L. SchwittersPublisher:Cengage Learning Algebra for College StudentsAlgebraISBN:9781285195780Author:Jerome E. Kaufmann, Karen L. SchwittersPublisher:Cengage Learning

Algebra for College StudentsAlgebraISBN:9781285195780Author:Jerome E. Kaufmann, Karen L. SchwittersPublisher:Cengage Learning

Holt Mcdougal Larson Pre-algebra: Student Edition...AlgebraISBN:9780547587776Author:HOLT MCDOUGALPublisher:HOLT MCDOUGAL

Holt Mcdougal Larson Pre-algebra: Student Edition...AlgebraISBN:9780547587776Author:HOLT MCDOUGALPublisher:HOLT MCDOUGAL

Trigonometry (MindTap Course List)TrigonometryISBN:9781337278461Author:Ron LarsonPublisher:Cengage Learning

Trigonometry (MindTap Course List)TrigonometryISBN:9781337278461Author:Ron LarsonPublisher:Cengage Learning