Concept explainers

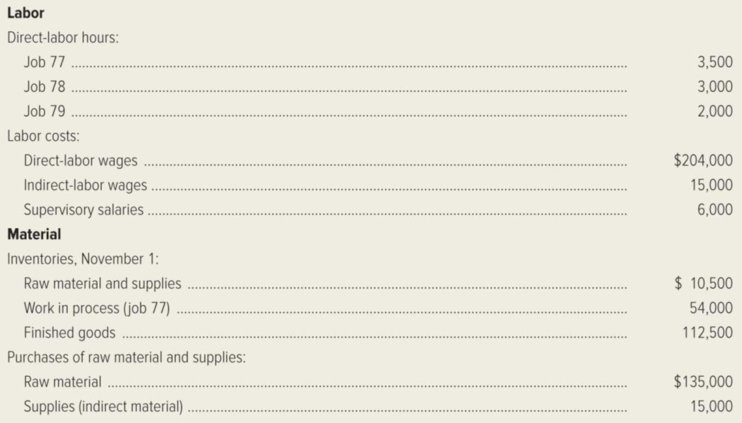

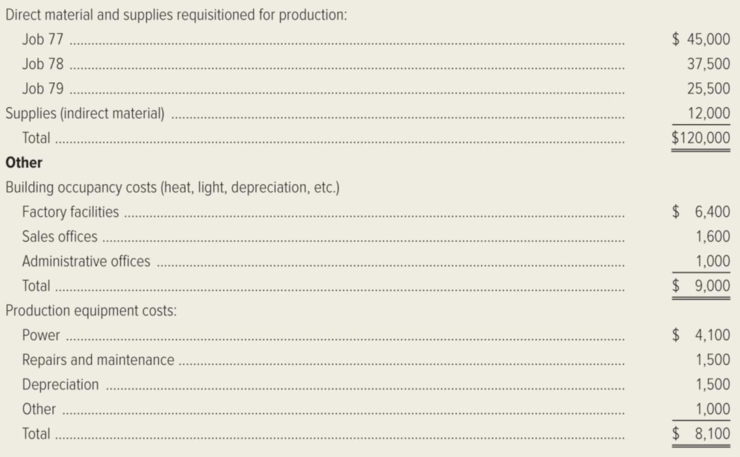

Tiana Shar, the controller for Bondi Furniture Company, is in the process of analyzing the

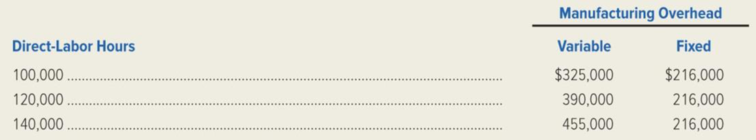

The firm’s job-order costing system uses direct-labor hours (measured at practical capacity) as the cost driver for overhead application. In December of the preceding year, Shar had prepared the following budget for direct-labor and

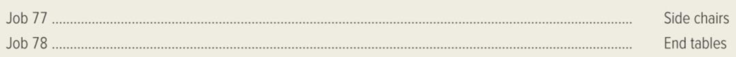

During November the following jobs were completed:

Required: Assist Shar by making the following calculations.

- 1. Calculate the predetermined overhead rate for the current year.

- 2. Calculate the total

cost of job 77. - 3. Compute the amount of manufacturing overhead applied to job 79 during November.

- 4. What was the total amount of manufacturing overhead applied during November?

- 5. Compute the actual manufacturing overhead incurred during November.

- 6. Calculate the over applied or under applied overhead for November.

Want to see the full answer?

Check out a sample textbook solution

Chapter 3 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

- Please use the information from this problem for these calculations. After grouping cost pools and estimating overhead and activities, Box Springs determined these rates: Box Springs estimates there will be four orders in the next year, and those jobs will involve: What is the total cost of the jobs?arrow_forwardThe cost accountant for River Rock Beverage Co. estimated that total factory overhead cost for the Blending Department for the coming fiscal year beginning February 1 would be 3,150,000, and total direct labor costs would be 1,800,000. During February, the actual direct labor cost totalled 160,000, and factory overhead cost incurred totaled 283,900. a. What is the predetermined factory overhead rate based on direct labor cost? b. Journalize the entry to apply factory overhead to production for February. c. What is the February 28 balance of the account Factory OverheadBlending Department? d. Does the balance in part (c) represent over- or underapplied factory overhead?arrow_forwardPlease use the information from this problem for these calculations. After grouping cost pools and estimating overhead and activities, Box Springs determined these rates: It estimates there will be five orders in the next year, and those jobs will involve: What is the total cost of the jobs?arrow_forward

- Firenza Company manufactures specialty tools to customer order. Budgeted overhead for the coming year is: Previously, Sanjay Bhatt, Firenza Companys controller, had applied overhead on the basis of machine hours. Expected machine hours for the coming year are 50,000. Sanjay has been reading about activity-based costing, and he wonders whether or not it might offer some advantages to his company. He decided that appropriate drivers for overhead activities are purchase orders for purchasing, number of setups for setup cost, engineering hours for engineering cost, and machine hours for other. Budgeted amounts for these drivers are 5,000 purchase orders, 500 setups, and 2,500 engineering hours. Sanjay has been asked to prepare bids for two jobs with the following information: The typical bid price includes a 40 percent markup over full manufacturing cost. Required: 1. Calculate a plantwide rate for Firenza Company based on machine hours. What is the bid price of each job using this rate? 2. Calculate activity rates for the four overhead activities. What is the bid price of each job using these rates? 3. Which bids are more accurate? Why?arrow_forwardGreiner Company makes and sells high-quality glare filters for microcomputer monitors. John Craven, controller, is responsible for preparing Greiners master budget and has assembled the following data for the coming year. The direct labor rate includes wages, all employee-related benefits, and the employers share of FICA. Labor saving machinery will be fully operational by March. Also, as of March 1, the companys union contract calls for an increase in direct labor wages that is included in the direct labor rate. Greiner expects to have 5,600 glare filters in inventory on December 31 of the current year, and has a policy of carrying 35 percent of the following month's projected sales in inventory. Information on the first four months of the coming year is as follows: Required: 1. Prepare the following monthly budgets for Greiner Company for the first quarter of the coming year. Be sure to show supporting calculations. a. Production budget in units b. Direct labor budget in hours c. Direct materials cost budget d. Sales budget 2. Calculate the total budgeted contribution margin for Greiner Company by month and in total for the first quarter of the coming year. Be sure to show supporting calculations. (CMA adapted)arrow_forwardThe controller for Muir Companys Salem plant is analyzing overhead in order to determine appropriate drivers for use in flexible budgeting. She decided to concentrate on the past 12 months since that time period was one in which there was little important change in technology, product lines, and so on. Data on overhead costs, number of machine hours, number of setups, and number of purchase orders are in the following table. Required: 1. Calculate an overhead rate based on machine hours using the total overhead cost and total machine hours. (Round the overhead rate to the nearest cent and predicted overhead to the nearest dollar.) Use this rate to predict overhead for each of the 12 months. 2. Run a regression equation using only machine hours as the independent variable. Prepare a flexible budget for overhead for the 12 months using the results of this regression equation. (Round the intercept and x-coefficient to the nearest cent and predicted overhead to the nearest dollar.) Is this flexible budget better than the budget in Requirement 1? Why or why not?arrow_forward

- Big Mikes, a large hardware store, has gathered data on its overhead activities and associated costs for the past 10 months. Nizam Sanjay, a member of the controllers department, believes that overhead activities and costs should be classified into groups that have the same driver. He has decided that unloading incoming goods, counting goods, and inspecting goods can be grouped together as a more general receiving activity, since these three activities are all driven by the number of receiving orders. The 10 months of data shown below have been gathered for the receiving activity. Required: 1. Prepare a scattergraph, plotting the receiving costs against the number of purchase orders. Use the vertical axis for costs and the horizontal axis for orders. 2. Select two points that make the best fit, and compute a cost formula for receiving costs. 3. Using the high-low method, prepare a cost formula for the receiving activity. 4. Using the method of least squares, prepare a cost formula for the receiving activity. What is the coefficient of determination?arrow_forwardRockford Company has four departmental accounts: Building Maintenance, General Factory Overhead, Machining, and Assembly. The direct labor hour method is used to apply factory overhead to the jobs being worked on in Machining and Assembly. The company expects each production department to use 30,000 direct labor hours during the year. The estimated overhead rates for the year include the following: During the year, both Machining and Assembly used 28,000 direct labor hours. Factory overhead costs incurred during the year follow: In determining application rates at the beginning of the year, cost allocations were made as follows, using the sequential distribution method: Building Maintenance to: General Factory Overhead, 10%; Machining, 50%; Assembly, 40%. General factory overhead was distributed according to direct labor hours. Required: Determine the under- or overapplied overhead for each production department. (Hint: First you must distribute the service department costs.)arrow_forwardFarnsworth Company has gathered data on its overhead activities and associated costs for the past 10 months. Tracy Heppler, a member of the controller's department, has convinced management that overhead costs can be better estimated and controlled if the fixed and variable components of each overhead activity are known. One such activity is receiving raw materials (unloading incoming goods, counting goods, and inspecting goods), which she believes is driven by the number of receiving orders. Ten months of data have been gathered for the receiving activity and are as follows: Month Receiving Orders Receiving Cost $ 1 1,000 18,000 2 700 15,000 3 1,500 28,000 4 1,200 17,000 5 1,300 25,000 6 1,100 21,000 7 1,600 29,000 8 1,400 24,000 9 1,700 27,000 10 900 16,000 Assume that Tracy has used the method of least squares on the receiving data and has gotten the following results: Intercept 3,212…arrow_forward

- Paul White has been studying his department’s profitability reports for the past six months. He has just completed a managerial accounting course and is beginning to question the company’s approach to allocating overhead to products based on machine hours. The current department overhead budget of $ 1,142,940 is based on 38,098 machine hours. In an initial analysis of overhead costs, Paul has identified the following activity cost pools.arrow_forwardTerri Ronsin had recently been transferred to the Home Security Systems Division of National Home Products. Shortly after taking over her new position as divisional controller, she was asked to develop the division’s predetermined overhead rate for the upcoming year. The accuracy of the rate is important because it is used throughout the year and any underapplied or overapplied overhead is closed out to Cost of Goods Sold at the end of the year. National Home Products uses direct labor-hours in all of its divisions as the allocation base for manufacturing overhead. To compute the predetermined overhead rate, Terri divided her estimate of the total manufacturing overhead for the coming year by the production manager’s estimate of the total direct labor-hours for the coming year. She took her computations to the division’s general manager for approval but was quite surprised when he suggested a modification in the allocation base. Her conversation with the general manager of the Home…arrow_forwardTerri Ronsin had recently been transferred to the Home Security Systems Division of National Home Products. Shortly after taking over her new position as divisional controller, she was asked to develop the division’s predetermined overhead rate for the upcoming year. The accuracy of the rate is important because it is used throughout the year and any overapplied or underapplied overhead is closed out to Cost of Goods Sold at the end of the year. National Home Products uses direct labor-hours in all of its divisions as the allocation base for manufacturing overhead. To compute the predetermined overhead rate, Terri divided her estimate of the total manufacturing overhead for the coming year by the production manager’s estimate of the total direct labor-hours for the coming year. She took her computations to the division’s general manager for approval but was quite surprised when he suggested a modification in the base. Her conversation with the general manager of the Home Security…arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College