Managerial Accounting: Creating Value in a Dynamic Business Environment

12th Edition

ISBN: 9781260417074

Author: HILTON, Ronald

Publisher: MCGRAW-HILL HIGHER EDUCATION

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 60P

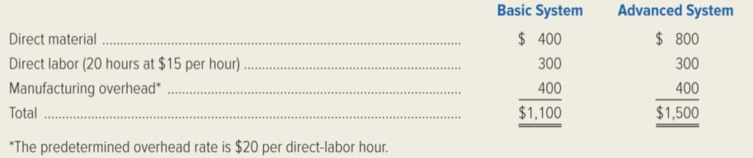

TeleTech Corporation manufactures two different color printers for the business market. Cost estimates for the two models for the current year are as follows:

Each model of printer requires 20 hours of direct labor. The basic system requires 5 hours in department A and 15 hours in department B. The advanced system requires 15 hours in department A and 5 hours in department B. The

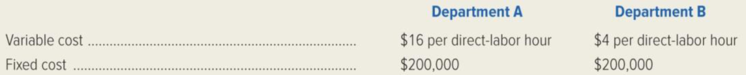

The firm’s management expects to operate at a level of 20,000 direct-labor hours in each production department during the current year. (This estimate is based on the practical capacity of each department.)

Required:

- 1. Show how the company’s predetermined overhead rate was determined.

- 2. If the firm prices each model of color printer at 10 percent over its cost, what will be the price of each model?

- 3. Suppose the company were to use departmental predetermined overhead rates. Calculate the rate for each of the two production departments.

- 4. Compute the product cost of each model using the departmental overhead rates calculated in requirement (3).

- 5. Compute the price to be charged for each model, assuming the company continues to price each product at 10 percent above cost. Use the revised product costs calculated in requirement (4).

- 6. Write a memo to the president of TeleTech Corporation making a recommendation as to whether the firm should use a plant wide overhead rate or departmental rates. Consider the potential implications of the overhead rates and the firm’s pricing policy. How might these considerations affect the firm’s ability to compete in the marketplace?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Catalytic Chemical Corporation has a significant level of manufacturing overhead. After preparing their budget for the next year, management expects the following overhead costs (the cost driver for each overhead cost pool is also shown):

Activity

Total Cost

Cost Driver

Maintenance

$20,000

Machine hours

Materials receiving

80,000

Shipments received

Machine setups

50,000

# of setups

Inspection

30,000

# of inspections

The expected activity for the year for various cost drivers is:

Direct Labor Hours

40,000

Machine Hours

20,000

Shipments Received

4,000

Setups

200

Quality Inspections

8,000

The company is considering accepting a significant production contract. Estimates for the contract are as follows:

Direct materials

$100,000

Direct labor (7,500 hours)

$150,000

Number of material shipments received

290

Number of inspections

50

Number of setups

35

Number of machine houre

3,000…

Blue Devil Inc. has a significant level of manufacturing overhead. After preparing their budget for the next year, management expects the following overhead costs (the cost driver for each overhead cost pool is also shown):

Activity

Total Cost

Cost Driver

Maintenance

$20,000

Machine hours

Materials receiving

80,000

Shipments received

Machine setups

50,000

Number of setups

Inspection

40,000

Number of inspections

The expected activity for the year for various cost drivers is:

Direct Labor Hours

40,000

Machine Hours

20,000

Shipments Received

4,000

Setups

200

Quality Inspections

8,000

The company is considering accepting a significant production contract. Estimates for the contract are as follows:

Direct materials

$100,000

Direct labor (7,500 hours)

$150,000

Number of material shipments received

290

Number of inspections

50

Number of setups

35

Number of machine hour

3,000…

Tioga company manufactures sophisticated lenses and mirrors used in large optical telescopes. The company is now

preparing its annual profit plan. As part of its analysis of the profitability of individual products, the controller estimates the

amount of overhead that should be allocated to the individual product lines from the following information.

Lenses

Mirrors

Units produced

Material moves per product line 5

Direct-labor hours per unit

The total budgeted material-handling cost is 50,000

Required:

1. Under a costing system that allocates overhead on the basis of direct-labor hours, the material-handling costs

allocated to one lens would be what amount?

2. Answer the same question as in requirement 1), but for mirrors

3. Under activity-based costing(ABC), the material-handling costs allocated to one lens would be what amount? The

cost driver for the material-handling activity is the number of material moves

4. Answer the same question as in requirement 3, but for mirrors.

25

25

15…

Chapter 3 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

Ch. 3 - List and explain four purposes of product costing.Ch. 3 - Explain the difference between job-order and...Ch. 3 - How is the concept of product costing applied in...Ch. 3 - What are the purposes of the following documents:...Ch. 3 - Why is manufacturing overhead applied to products...Ch. 3 - Explain the benefits of using a predetermined...Ch. 3 - Describe one advantage and one disadvantage of...Ch. 3 - Describe an important cost-benefit issue involving...Ch. 3 - Explain the difference between actual and normal...Ch. 3 - When a single, volume-based cost driver (or...

Ch. 3 - Prob. 11RQCh. 3 - Describe the process of two-stage cost allocation...Ch. 3 - Define each of the following terms, and explain...Ch. 3 - Describe how job-order costing concepts are used...Ch. 3 - What is meant by the term cost driver? What is a...Ch. 3 - Describe the flow of costs through a...Ch. 3 - Give an example of how a hospital, such as the...Ch. 3 - Why are some manufacturing firms switching from...Ch. 3 - What is the cause of over applied or under applied...Ch. 3 - Briefly describe two ways of closing out over...Ch. 3 - Describe how a large retailer such as Lowes would...Ch. 3 - Prob. 22RQCh. 3 - For each of the following companies, indicate...Ch. 3 - The controller for Tender Bird Poultry, Inc....Ch. 3 - Finley Educational Products started and finished...Ch. 3 - Bodin Company manufactures finger splints for kids...Ch. 3 - McAllister, Inc. employs a normal costing system....Ch. 3 - Garrett Toy Company incurred the following costs...Ch. 3 - Crunchem Cereal Company incurred the following...Ch. 3 - Prob. 31ECh. 3 - Selected data concerning the past years operations...Ch. 3 - Sweet Tooth Confectionary incurred 157,000 of...Ch. 3 - The following information pertains to Trenton...Ch. 3 - The following data pertain to the Oneida...Ch. 3 - Refer to the data for the preceding exercise for...Ch. 3 - Design Arts Associates is an interior decorating...Ch. 3 - Suppose you are the controller for a company that...Ch. 3 - Laramie Leatherworks, which manufactures saddles...Ch. 3 - Refer to Exhibit 312, which portrays the three...Ch. 3 - Refer to the illustration of overhead application...Ch. 3 - The following data refer to Twisto Pretzel Company...Ch. 3 - Burlington Clock Works manufactures fine,...Ch. 3 - Perfecto Pizza Company produces microwavable...Ch. 3 - Stellar Sound, Inc. which uses a job-order costing...Ch. 3 - Finlon Upholstery, Inc. uses a job-order costing...Ch. 3 - JLR Enterprises provides consulting services...Ch. 3 - Garcia, Inc. uses a job-order costing system for...Ch. 3 - MarineCo, Inc. manufactures outboard motors and an...Ch. 3 - The following data refers to Huron Corporation for...Ch. 3 - Refer to the schedule of cost of goods...Ch. 3 - Marco Polo Map Companys cost of goods sold for...Ch. 3 - Midnight Sun Apparel Company uses normal costing,...Ch. 3 - Marc Jackson has recently been hired as a cost...Ch. 3 - Troy Electronics Company calculates its...Ch. 3 - Tiana Shar, the controller for Bondi Furniture...Ch. 3 - Scholastic Brass Corporation manufactures brass...Ch. 3 - Refer to the preceding problem regarding...Ch. 3 - Prob. 59PCh. 3 - TeleTech Corporation manufactures two different...Ch. 3 - CompuFurn, Inc. manufactures furniture for...Ch. 3 - FiberCom, Inc., a manufacturer of fiber optic...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Adam Corporation manufactures computer tables and has the following budgeted indirect manufacturing cost information for the next year: If Adam uses the step-down (sequential) method, beginning with the Maintenance Department, to allocate support department costs to production departments, the total overhead (rounded to the nearest dollar) for the Machining Department to allocate to its products would be: a. 407,500. b. 422,750. c. 442,053. d. 445,000.arrow_forwardHatch Manufacturing produces multiple machine parts. The theoretical cycle time for one of its products is 65 minutes per unit. The budgeted conversion costs for the manufacturing cell dedicated to the product are 12,960,000 per year. The total labor minutes available are 1,440,000. During the year, the cell was able to produce 0.6 units of the product per hour. Suppose also that production incentives exist to minimize unit product costs. Required: 1. Compute the theoretical conversion cost per unit. 2. Compute the applied conversion cost per minute (the amount of conversion cost actually assigned to the product). 3. Discuss how this approach to assigning conversion cost can improve delivery time performance. Explain how conversion cost acts as a performance driver for on-time deliveries.arrow_forwardCloud Shoes manufactures recovery sandals and is planning on producing 12.000 units in March and 11,500 in April. Each sandal requires 1.2 yards if material, which costs $3.00 per yard. The companys policy is to have enough material on hand to equal 15% of next months production needs and to maintain a finished goods inventory equal to 20% of the next months production needs. What is the budgeted cost of purchases for March?arrow_forward

- Foy Company has a welding activity and wants to develop a flexible budget formula for the activity. The following resources are used by the activity: Four welding units, with a lease cost of 12,000 per year per unit Six welding employees each paid a salary of 50,000 per year (A total of 9,000 welding hours are supplied by the six workers.) Welding supplies: 300 per job Welding hours: Three hours used per job During the year, the activity operated at 90 percent of capacity and incurred the actual activity and resource costs, shown on page 676. Lease cost: 48,000 Salaries: 315,000 Parts and supplies: 805,000 Required: 1. Prepare a flexible budget formula for the welding activity using welding hours as the driver. 2. Prepare a performance report for the welding activity. 3. What if welders were hired through outsourcing and paid 30 per hour (the welding equipment is provided by Foy)? Repeat Requirement 1 for the outsourcing case.arrow_forwardNovo, Inc., wants to develop an activity flexible budget for the activity of moving materials. Novo uses eight forklifts to move materials from receiving to stores. The forklifts are also used to move materials from stores to the production area. The forklifts are obtained through an operating lease that costs 18,000 per year per forklift. Novo employs 25 forklift operators who receive an average salary of 50,000 per year, including benefits. Each move requires the use of a crate. The crates are used to store the parts and are emptied only when used in production. Crates are disposed of after one cycle (two moves), where a cycle is defined as a move from receiving to stores to production. Each crate costs 1.80. Fuel for a forklift costs 3.60 per gallon. A gallon of gas is used every 20 moves. Forklifts can make three moves per hour and are available for 280 days per year, 24 hours per day (the remaining time is downtime for various reasons). Each operator works 40 hours per week and 50 weeks per year. Required: 1. Prepare a flexible budget for the activity of moving materials, using the number of cycles as the activity driver. 2. Calculate the activity capacity for moving materials. Suppose Novo works at 80 percent of activity capacity and incurs the following costs: Prepare the budget for the 80 percent level and then prepare a performance report for the moving materials activity. 3. Calculate and interpret the volume variance for moving materials. 4. Suppose that a redesign of the plant layout reduces the demand for moving materials to one-third of the original capacity. What would be the budget formula for this new activity level? What is the budgeted cost for this new activity level? Has activity performance improved? How does this activity performance evaluation differ from that described in Requirement 2? Explain.arrow_forwardSunrise Poles manufactures hiking poles and is planning on producing 4,000 units in March and 3,700 in April. Each pole requires a half pound of material, which costs $1.20 per pound. The companys policy is to have enough material on hand to equal 10% of the next months production needs and to maintain a finished goods inventory equal to 25% of the next months production needs. What is the budgeted cost of purchases for March?arrow_forward

- Nashler Company has the following budgeted variable costs per unit produced: Budgeted fixed overhead costs per month include supervision of 98,000, depreciation of 76,000, and other overhead of 245,000. Required: 1. Prepare a flexible budget for all costs of production for the following levels of production: 160,000 units, 170,000 units, and 175,000 units. 2. What is the per-unit total product cost for each of the production levels from Requirement 1? (Round each unit cost to the nearest cent.) 3. What if Nashler Companys cost of maintenance rose to 0.22 per unit? How would that affect the unit product costs calculated in Requirement 2?arrow_forwardFirenza Company manufactures specialty tools to customer order. Budgeted overhead for the coming year is: Previously, Sanjay Bhatt, Firenza Companys controller, had applied overhead on the basis of machine hours. Expected machine hours for the coming year are 50,000. Sanjay has been reading about activity-based costing, and he wonders whether or not it might offer some advantages to his company. He decided that appropriate drivers for overhead activities are purchase orders for purchasing, number of setups for setup cost, engineering hours for engineering cost, and machine hours for other. Budgeted amounts for these drivers are 5,000 purchase orders, 500 setups, and 2,500 engineering hours. Sanjay has been asked to prepare bids for two jobs with the following information: The typical bid price includes a 40 percent markup over full manufacturing cost. Required: 1. Calculate a plantwide rate for Firenza Company based on machine hours. What is the bid price of each job using this rate? 2. Calculate activity rates for the four overhead activities. What is the bid price of each job using these rates? 3. Which bids are more accurate? Why?arrow_forwardCold X, Inc. uses this information when preparing their flexible budget: direct materials of $2 per unit, direct labor of $3 per unit, and manufacturing overhead of $1 per unit. Fixed costs are $35,000. What would be the budgeted amounts for 20,000 and 25,000 units?arrow_forward

- Douglas Davis, controller for Marston, Inc., prepared the following budget for manufacturing costs at two different levels of activity for 20X1: During 20X1, Marston worked a total of 80,000 direct labor hours, used 250,000 machine hours, made 32,000 moves, and performed 120 batch inspections. The following actual costs were incurred: Marston applies overhead using rates based on direct labor hours, machine hours, number of moves, and number of batches. The second level of activity (the right column in the preceding table) is the practical level of activity (the available activity for resources acquired in advance of usage) and is used to compute predetermined overhead pool rates. Required: 1. Prepare a performance report for Marstons manufacturing costs in the current year. 2. Assume that one of the products produced by Marston is budgeted to use 10,000 direct labor hours, 15,000 machine hours, and 500 moves and will be produced in five batches. A total of 10,000 units will be produced during the year. Calculate the budgeted unit manufacturing cost. 3. One of Marstons managers said the following: Budgeting at the activity level makes a lot of sense. It really helps us manage costs better. But the previous budget really needs to provide more detailed information. For example, I know that the moving materials activity involves the use of forklifts and operators, and this information is lost when only the total cost of the activity for various levels of output is reported. We have four forklifts, each capable of providing 10,000 moves per year. We lease these forklifts for five years, at 10,000 per year. Furthermore, for our two shifts, we need up to eight operators if we run all four forklifts. Each operator is paid a salary of 30,000 per year. Also, I know that fuel costs about 0.25 per move. Assuming that these are the only three items, expand the detail of the flexible budget for moving materials to reveal the cost of these three resource items for 20,000 moves and 40,000 moves, respectively. Based on these comments, explain how this additional information can help Marston better manage its costs. (Especially consider how activity-based budgeting may provide useful information for non-value-added activities.)arrow_forwardNozama.com Inc. sells consumer electronics over the Internet. For the next period, the budgeted cost of the sales order processing activity is 250,000 and 50,000 sales orders are estimated to be processed. a. Determine the activity rate of the sales order processing activity. b. Determine the amount of sales order processing cost associated with 30,000 sales orders.arrow_forwardSalisbury Bottle Company manufactures plastic two-liter bottles for the beverage industry. The cost standards per 100 two-liter bottles are as follows: At the beginning of March, Salisburys management planned to produce 500,000 bottles. The actual number of bottles produced for March was 525,000 bottles. The actual costs for March of the current year were as follows: a. Prepare the March manufacturing standard cost budget (direct labor, direct materials, and factory overhead) for Salisbury, assuming planned production. b. Prepare a budget performance report for manufacturing costs, showing the total cost variances for direct materials, direct labor, and factory overhead for March. c. Interpret the budget performance report.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Responsibility Accounting| Responsibility Centers and Segments| US CMA Part 1| US CMA course; Master Budget and Responsibility Accounting-Intro to Managerial Accounting- Su. 2013-Prof. Gershberg; Author: Mera Skill; Rutgers Accounting Web;https://www.youtube.com/watch?v=SYQ4u1BP24g;License: Standard YouTube License, CC-BY