Managerial Accounting: Creating Value in a Dynamic Business Environment

12th Edition

ISBN: 9781260417074

Author: HILTON, Ronald

Publisher: MCGRAW-HILL HIGHER EDUCATION

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 53P

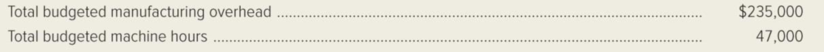

Midnight Sun Apparel Company uses normal costing, and manufacturing

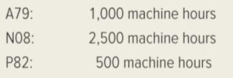

During January, the firm began the following production jobs:

During January, job numbers A79 and N08 were completed, and job number A79 was sold. The actual manufacturing overhead incurred during January was $26,000.

Required:

- 1. Compute the company’s predetermined overhead rate for the current year.

- 2. How much manufacturing overhead was applied to production during January?

- 3. Calculate the over applied or under applied overhead for January.

- 4. Prepare a

journal entry to close the balance calculated in requirement (3) into Cost of Goods Sold. - 5. Prepare a journal entry to prorate the balance calculated in requirement (3) among the Work-in-Process Inventory, Finished-Goods Inventory, and Cost of Goods Sold accounts.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Luxury Goods Pty Ltd allocates manufacturing overhead to work in process on the basis of machine hours. On 1 January of the current year, there were no balances in work in process or finished goods inventories. The following estimates were included in the budget for the current year:Total estimated manufacturing overhead$300 000Total estimated machine hours40 000During January, the firm worked on the following production jobs:B81:1 600 machine hoursJ76:2 400 machine hoursM49:1 000 machine hoursDuring January, job numbers B81 and J76 were completed, and job number B81 was sold. The actual manufacturing overhead incurred during January was $30 000.Required:a) Calculate the company’s predetermined overhead rate for the year.b) How much manufacturing overhead was applied to production during January?c) Calculate the overapplied or underapplied overhead for January.SHOW YOUR WORKINGQuestion 3-Week 4(9b) (7 marks)Kool Inc. uses a weighted-average process costing system and has one production…

Luxury Goods Pty Ltd allocates manufacturing overhead to work in process on the basis of machine hours. On 1 January of the current year, there were no balances in work in process or finished goods inventories. The following estimates were included in the budget for the current year:Total estimated manufacturing overhead$300 000Total estimated machine hours40 000During January, the firm worked on the following production jobs:B81:1 600 machine hoursJ76:2 400 machine hoursM49:1 000 machine hoursDuring January, job numbers B81 and J76 were completed, and job number B81 was sold. The actual manufacturing overhead incurred during January was $30 000.Required:a) Calculate the company’s predetermined overhead rate for the year.b) How much manufacturing overhead was applied to production during January?c) Calculate the overapplied or underapplied overhead for January

Avery Company uses a predetermined overhead rate based on direct labor hours. For the month of October, Avery’s budgeted overhead was P300,000 based on a budgeted volume of 100,000 direct labor hours. Actual overhead amounted to P325,000 with actual direct labor hours totaling 110,000.

Compute for the following:

__________1. Factory overhead charged to Work in Process account

Chapter 3 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

Ch. 3 - List and explain four purposes of product costing.Ch. 3 - Explain the difference between job-order and...Ch. 3 - How is the concept of product costing applied in...Ch. 3 - What are the purposes of the following documents:...Ch. 3 - Why is manufacturing overhead applied to products...Ch. 3 - Explain the benefits of using a predetermined...Ch. 3 - Describe one advantage and one disadvantage of...Ch. 3 - Describe an important cost-benefit issue involving...Ch. 3 - Explain the difference between actual and normal...Ch. 3 - When a single, volume-based cost driver (or...

Ch. 3 - Prob. 11RQCh. 3 - Describe the process of two-stage cost allocation...Ch. 3 - Define each of the following terms, and explain...Ch. 3 - Describe how job-order costing concepts are used...Ch. 3 - What is meant by the term cost driver? What is a...Ch. 3 - Describe the flow of costs through a...Ch. 3 - Give an example of how a hospital, such as the...Ch. 3 - Why are some manufacturing firms switching from...Ch. 3 - What is the cause of over applied or under applied...Ch. 3 - Briefly describe two ways of closing out over...Ch. 3 - Describe how a large retailer such as Lowes would...Ch. 3 - Prob. 22RQCh. 3 - For each of the following companies, indicate...Ch. 3 - The controller for Tender Bird Poultry, Inc....Ch. 3 - Finley Educational Products started and finished...Ch. 3 - Bodin Company manufactures finger splints for kids...Ch. 3 - McAllister, Inc. employs a normal costing system....Ch. 3 - Garrett Toy Company incurred the following costs...Ch. 3 - Crunchem Cereal Company incurred the following...Ch. 3 - Prob. 31ECh. 3 - Selected data concerning the past years operations...Ch. 3 - Sweet Tooth Confectionary incurred 157,000 of...Ch. 3 - The following information pertains to Trenton...Ch. 3 - The following data pertain to the Oneida...Ch. 3 - Refer to the data for the preceding exercise for...Ch. 3 - Design Arts Associates is an interior decorating...Ch. 3 - Suppose you are the controller for a company that...Ch. 3 - Laramie Leatherworks, which manufactures saddles...Ch. 3 - Refer to Exhibit 312, which portrays the three...Ch. 3 - Refer to the illustration of overhead application...Ch. 3 - The following data refer to Twisto Pretzel Company...Ch. 3 - Burlington Clock Works manufactures fine,...Ch. 3 - Perfecto Pizza Company produces microwavable...Ch. 3 - Stellar Sound, Inc. which uses a job-order costing...Ch. 3 - Finlon Upholstery, Inc. uses a job-order costing...Ch. 3 - JLR Enterprises provides consulting services...Ch. 3 - Garcia, Inc. uses a job-order costing system for...Ch. 3 - MarineCo, Inc. manufactures outboard motors and an...Ch. 3 - The following data refers to Huron Corporation for...Ch. 3 - Refer to the schedule of cost of goods...Ch. 3 - Marco Polo Map Companys cost of goods sold for...Ch. 3 - Midnight Sun Apparel Company uses normal costing,...Ch. 3 - Marc Jackson has recently been hired as a cost...Ch. 3 - Troy Electronics Company calculates its...Ch. 3 - Tiana Shar, the controller for Bondi Furniture...Ch. 3 - Scholastic Brass Corporation manufactures brass...Ch. 3 - Refer to the preceding problem regarding...Ch. 3 - Prob. 59PCh. 3 - TeleTech Corporation manufactures two different...Ch. 3 - CompuFurn, Inc. manufactures furniture for...Ch. 3 - FiberCom, Inc., a manufacturer of fiber optic...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Abbey Products Company is studying the results of applying factory overhead to production. The following data have been used: estimated factory overhead, 60,000; estimated materials costs, 50,000; estimated direct labor costs, 60,000; estimated direct labor hours, 10,000; estimated machine hours, 20,000; work in process at the beginning of the month, none. The actual factory overhead incurred for November was 80,000, and the production statistics on November 30 are as follows: Required: 1. Compute the predetermined rate, based on the following: a. Direct labor cost b. Direct labor hours c. Machine hours 2. Using each of the methods, compute the estimated total cost of each job at the end of the month. 3. Determine the under-or overapplied factory overhead, in total, at the end of the month under each of the methods. 4. Which method would you recommend? Why?arrow_forwardLuna Manufacturing Inc. completed Job 2525 on May 31, and there were no jobs in process in the plant. Prior to June 1, the predetermined overhead application rate for June was computed from the following data, based on an estimate of 5,000 direct labor hours: The factory has one production department and uses the direct labor hour method to apply factory overhead. Three jobs are started during the month, and postings are made daily to the job cost sheets from the materials requisitions and labor-time records. The following schedule shows the jobs and amounts posted to the job cost sheets: The factory overhead control account was debited during the month for actual factory overhead expenses of 27,000. On June 11, Job 2526 was completed and delivered to the customer using a mark-on percentage of 50% on manufacturing cost. On June 24, Job 2527 was completed and transferred to Finished Goods. On June 30, Job 2528 was still in process. Required: 1. Prepare job cost sheets for Jobs 2526, 2527, and 2528, including factory overhead applied when the job was completed or at the end of the month for partially completed jobs. 2. Prepare journal entries as of June 30 for the following: a. Applying factory overhead to production. b. Closing the applied factory overhead account. c. Closing the factory overhead account. d. Transferring the cost of the completed jobs to finished goods. e. Recording the cost of the sale and the sale of Job 2526.arrow_forwardBaldwin Printing Company uses a job order cost system and applies overhead based on machine hours. A total of 150,000 machine hours have been budgeted for the year. During the year, an order for 1,000 units was completed and incurred the following: The accountant computed the inventory cost of this order to be 4.30 per unit. The annual budgeted overhead in dollars was: a. 577,500. b. 600,000. c. 645,000. d. 660,000.arrow_forward

- On August 1, Cairle Companys work-in-process inventory consisted of three jobs with the following costs: During August, four more jobs were started. Information on costs added to the seven jobs during the month is as follows: Before the end of August, Jobs 70, 72, 73, and 75 were completed. On August 31, Jobs 72 and 75 were sold. Required: 1. Calculate the predetermined overhead rate based on direct labor cost. 2. Calculate the ending balance for each job as of August 31. 3. Calculate the ending balance of Work in Process as of August 31. 4. Calculate the cost of goods sold for August. 5. Assuming that Cairle prices its jobs at cost plus 20 percent, calculate Cairles sales revenue for August.arrow_forwardThe following information, taken from the books of Herman Brothers Manufacturing represents the operations for January: The job cost system is used, and the February cost sheet for Job M45 shows the following: The following actual information was accumulated during February: Required: 1. Using the January data, ascertain the predetermined factory overhead rates to be used during February, based on the following: a. Direct labor cost b. Direct labor hours c. Machine hours 2. Prepare a schedule showing the total production cost of Job M45 under each method of applying factory overhead. 3. Prepare the entries to record the following for February operations: a. The liability for total factory overhead. b. Distribution of factory overhead to the departments. c. Application of factory overhead to the work in process in each department, using direct labor hours. (Use the predetermined rate calculated in Requirement 1.) d. Closing of the applied factory overhead accounts. e. Recording under- and overapplied factory overhead and closing the actual factory overhead accounts.arrow_forwardChannel Products Inc. uses the job order cost system of accounting. The following is a list of the jobs completed during March, showing the charges for materials issued to production and for direct labor. Assume that factory overhead is applied on the basis of direct labor costs and that the predetermined rate is 200%. Required: Compute the amount of overhead to be added to the cost of each job completed during the month. Compute the total cost of each job completed during the month. Compute the total cost of producing all the jobs finished during the month.arrow_forward

- Rockford Company has four departmental accounts: Building Maintenance, General Factory Overhead, Machining, and Assembly. The direct labor hour method is used to apply factory overhead to the jobs being worked on in Machining and Assembly. The company expects each production department to use 30,000 direct labor hours during the year. The estimated overhead rates for the year include the following: During the year, both Machining and Assembly used 28,000 direct labor hours. Factory overhead costs incurred during the year follow: In determining application rates at the beginning of the year, cost allocations were made as follows, using the sequential distribution method: Building Maintenance to: General Factory Overhead, 10%; Machining, 50%; Assembly, 40%. General factory overhead was distributed according to direct labor hours. Required: Determine the under- or overapplied overhead for each production department. (Hint: First you must distribute the service department costs.)arrow_forwardPotomac Automotive Co. manufactures engines that are made only on customers orders and to their specifications. During January, the company worked on Jobs 007, 008, 009, and 010. The following figures summarize the cost records for the month: Jobs 007 and 008 have been completed and delivered to the customer at a total selling price of 426,000, on account. Job 009 is finished but has not yet been delivered. Job 010 is still in process. There were no materials or work in process inventories at the beginning of the month. Material purchases were 115,000, and there were no indirect materials used during the month. Required: 1. Prepare a summary showing the total cost of each job completed during the month or in process at the end of the month. 2. Prepare the summary journal entries for the month to record the distribution of materials, labor, and overhead costs. 3. Determine the cost of the inventories of completed engines and engines in process at the end of the month. 4. Prepare the journal entries to record the completion of the jobs and the sale of the jobs. 5. Prepare a statement of cost of goods manufactured.arrow_forwardCycle Specialists manufactures goods on a job order basis. During the month of June, three jobs were started in process. (There was no work in process at the beginning of the month.) Jobs Sprinters and Trekkers were completed and sold, on account, during the month (selling prices: Sprinters, 22,000; Trekkers, 27,000); Job Roadsters was still in process at the end of June. The following data came from the job cost sheets for each job. The factory overhead includes a total of 1,200 of indirect materials and 900 of indirect labor. Prepare journal entries to record the following: a. Materials used. b. Factory wages and salaries earned. c. Factory Overhead transferred to Work in Process d. Jobs completed. e. Jobs sold.arrow_forward

- LeMans Company produces specialty papers at its Fox Run plant. At the beginning of June, the following information was supplied by its accountant: During June, direct labor cost was 143,000, direct materials purchases were 346,000, and the total overhead cost was 375,800. The inventories at the end of June were: Required: 1. Prepare a cost of goods manufactured statement for June. 2. Prepare a cost of goods sold schedule for June.arrow_forwardSpokane Production Co. obtained the following information from its records for July: Required: 1. Prepare, in summary form, the journal entries that would have been made during the month to record issuing materials to production, the distribution of labor, and overhead costs; the completion of the jobs; and the sale of the jobs. 2. Prepare schedules computing the following for July: a. The gross profit or loss for each job completed and sold, and for the business as a whole. b. For each job, the gross profit or loss per unit. (Round to the nearest cent.)arrow_forwardDuring the month, a company with no departmentalization incurred costs of 45,000 for materials, 36,000 for labor, and 22,500 for factory overhead. There were no units in process at the beginning or at the end of the month, and 20,000 units were completed. Determine the unit cost for the month for materials, labor, factory overhead, and the total unit cost. (Round unit costs to three decimal places.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY