Concept explainers

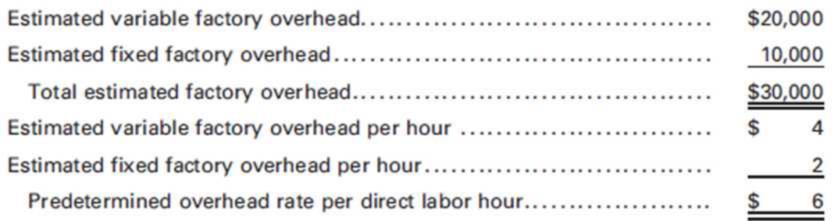

Luna Manufacturing Inc. completed Job 2525 on May 31, and there were no jobs in process in the plant. Prior to June 1, the predetermined

The factory has one production department and uses the direct labor hour method to apply factory overhead.

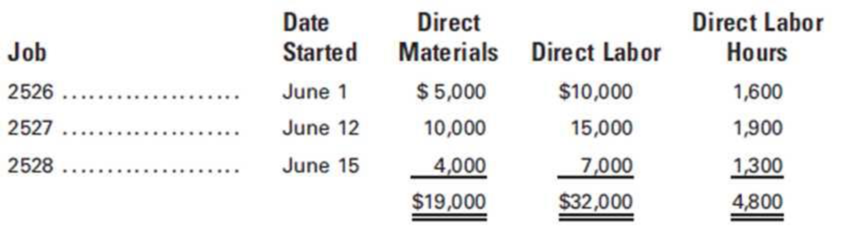

Three jobs are started during the month, and postings are made daily to the

The factory overhead control account was debited during the month for actual factory overhead expenses of $27,000. On June 11, Job 2526 was completed and delivered to the customer using a mark-on percentage of 50% on

Required:

- 1. Prepare job cost sheets for Jobs 2526, 2527, and 2528, including factory overhead applied when the job was completed or at the end of the month for partially completed jobs.

- 2. Prepare

journal entries as of June 30 for the following:- a. Applying factory overhead to production.

- b. Closing the applied factory overhead account.

- c. Closing the factory overhead account.

- d. Transferring the cost of the completed jobs to finished goods.

- e. Recording the cost of the sale and the sale of Job 2526.

Trending nowThis is a popular solution!

Chapter 4 Solutions

Principles of Cost Accounting

- Answer this general accounting questionarrow_forwardDJ Chase carries portfolios of both trading securities and available-for-sale securities. At the end of 2018 and 2017, the trading securities were valued at $468.4 billion and $595.6 billion, respectively; and the available-for-sale securities were valued at $205.9 billion and $85.4 billion, respectively. Together, the investments comprise about 25 percent of the company's total assets as of December 31, 2018. Unrealized gains reported on the 2018 income statement totaled $9.9 billion. Trading securities are carried on the balance sheet at market value. Compute the net decrease in the investment in trading securities during 2018.arrow_forwardPlease provide this question solution general accountingarrow_forward

- Provide answer general accountingarrow_forwardOn January 1, 2021, Nohara Inc, had cash and share capital of Yen 60,000,000. At that date, the company had no other asset, liability, or equity balances. On January 2, 2021, it purchased for cash Yen 20,000,000 of equity securities that it classified as non-trading. It received cash dividends of Yen 4,500,000 during the year on these securities. In addition, it has an unrealized holding gain on these securities of Yen 6,500,000 net of tax. Determine the following amounts for 2021: a) Net income. b) Comprehensive income. c) Other Comprehensive Income, and d) Accumulated other comprehensive income (end of 2021).arrow_forwardCORRECT ANSWER✅arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College