Corporate Finance

12th Edition

ISBN: 9781259918940

Author: Ross, Stephen A.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 3, Problem 4QAP

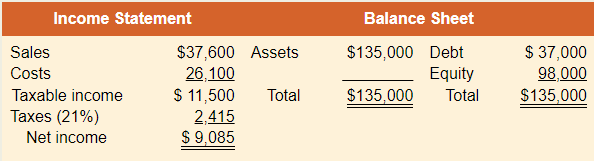

EFN The most recent financial statements for Bello, Inc., are shown here:

Assets and costs are proportional to sales; debt and equity are not. A dividend of $2,700 was paid, and the company wishes to maintain a constant payout ratio. Next year’s sales are projected to be $42,112. What external financing is needed?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

I need the answer as soon as possible

and the company wishes to maintain a constant payout ratio. Next year's sales are projected to

What is the external financing needed?

5. EFN [LO2] The most recent financial statements for Assouad, Inc., are shown here:

Income Statement

Balance Sheet

5 Q

Sales

$8,700

5,600

$3,100

Current assets

Fixed assets

$ 4,200

10,400

Costs

Taxable income

Current

liabilities

Long-term

debt

Equity

3,800

Q

Taxes (25%)

775

Total

$14,600

8,900

Net income

$2,325

Total

$14,600

Assets, costs, and current liabilities are proportional to sales. Long-term debt and equity are not. The company maintains a constant 40 percent dividend payout ratio. As with every other firm in

next year's sales are projected to increase by exactly 15 percent. What is the external financing needed?

Provide solution

Chapter 3 Solutions

Corporate Finance

Ch. 3 - Financial Ratio Analysis A financial ratio by...Ch. 3 - Industry-Specific Ratios So-called same-store...Ch. 3 - Sales Forecast Why do you think most long-term...Ch. 3 - Sustainable Growth In the chapter, we used...Ch. 3 - EFN and Growth Rate Broslofski Co. maintains a...Ch. 3 - Common-Size Financials One tool of financial...Ch. 3 - Asset Utilization and EFN One of the implicit...Ch. 3 - Comparing ROE and ROA Both ROA and ROE measure...Ch. 3 - Ratio Analysis Consider the ratio EBITD/Assets....Ch. 3 - Return on Investment A ratio that is becoming more...

Ch. 3 - Use the following information to answer the next...Ch. 3 - Prob. 12CQCh. 3 - Use the following information to answer the next...Ch. 3 - Use the following information to answer the next...Ch. 3 - Use the following information to answer the next...Ch. 3 - DuPont Identity If Muenster, Inc., has an equity...Ch. 3 - Equity Multiplier and Return on Equity Synovec...Ch. 3 - Prob. 3QAPCh. 3 - EFN The most recent financial statements for...Ch. 3 - Prob. 5QAPCh. 3 - Sustainable Growth If the Moran Corp. has an ROE...Ch. 3 - Prob. 7QAPCh. 3 - Prob. 8QAPCh. 3 - Prob. 9QAPCh. 3 - Prob. 10QAPCh. 3 - Prob. 11QAPCh. 3 - Prob. 12QAPCh. 3 - External Funds Needed The Optical Scam Company has...Ch. 3 - Days' Sales in Receivables A company has net...Ch. 3 - Prob. 15QAPCh. 3 - Prob. 16QAPCh. 3 - Prob. 17QAPCh. 3 - Prob. 19QAPCh. 3 - Prob. 20QAPCh. 3 - Calculating EFN The most recent financial...Ch. 3 - Prob. 22QAPCh. 3 - Prob. 23QAPCh. 3 - Prob. 26QAPCh. 3 - Prob. 27QAPCh. 3 - Prob. 28QAPCh. 3 - Prob. 29QAPCh. 3 - Prob. 30QAPCh. 3 - Calculate all of the ratios listed in the industry...Ch. 3 - Prob. 2MCCh. 3 - Prob. 3MCCh. 3 - Prob. 4MCCh. 3 - Prob. 5MC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Accounting Required: what profit margin must the firm achivearrow_forwardHello, Please answer questions and show workarrow_forwardLoreto Inc. has the following financial ratios: asset turnover = 1.60; net profit margin (i.e., net income/sales) = 6%; payout ratio = 30%; equity/assets = 0.50. a. What is Loreto's sustainable growth rate? b. What is its internal growth rate? (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) A. Sustainable growth rate _______% B. Internal growth rate ______%arrow_forward

- Loreto Inc. has the following financial ratios: asset turnover = 2.40; net profit margin (i.e., net income/sales) = 5%; payout ratio = 30%; equity/assets = 0.40. a. What is Loreto's sustainable growth rate? b. What is its internal growth rate?arrow_forwardUsing the DuPont method, evaluate the effects of the following relationships for the Butters Corporation. A.Butters Corporation has a profit margin of 5.5 percent and its return on assets (investment) is 8.75 percent. What is its assets turnover? Round your answer to 2 decimal places. ______ times B.If the Butters Corporation has a debt-to-total-assets ratio of 65.00 percent, what would the firm’s return on equity be? Note: Input your answer as a percent rounded to 2 decimal places. C.What would happen to return on equity if the debt-to-total-assets ratio decreased to 60.00 percent? Input your answer as a percent rounded to 2 decimal places.arrow_forwardYou've collected the following information about Hendrix Guitars, Incorporated: Profit margin Total asset turnover Total debt ratio Payout ratio 4.42% 3.30 .27 278 What is the sustainable growth rate for the company? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. Sustainable growth rate %arrow_forward

- Creative Analysis, Inc. is currently operating at maximum capacity. Assume that all costs and net working capital vary directly with sales. The dividend payout ratio will remain constant. How much is the External Financing needed (EFN) if sales are projected to increase by 10%? Income Statement end of last year: Sales $8,500 Costs $7,960 Net Income $540 Dividends paid = $324 Balance Sheet as of end of last year: Cash Accounts Receivables Inventory Net Fixed Assets Total assets -$25.1 $156.1 O $296.5 -$67.6 O $274.9 Assets $1,600 $975 $2,425 $2,200 $7,200 Accounts Payable Long-Term Debt Common Stock Retained Earnings Total Liabilities & Equity Liabilities & Equity $2,075 425 $3000 $1,700 $7,200arrow_forwardYou've collected the following information about Caccamisse, Incorporated: Sales Net income Dividends Total debt Total equity = a. Sustainable growth rate b. Additional borrowing c. Growth rate = = = = $ 330,000 $ 18,700 $ 7,500 $ 70,000 $ 101,000 a. What is the sustainable growth rate for the company? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. b. Assuming it grows at this rate, how much new borrowing will take place in the coming year, assuming a constant debt-equity ratio? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. c. What growth rate could be supported with no outside financing at all? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. % %arrow_forwardProvide this question solution general financearrow_forward

- Give typing answer with explanation and conclusion 27. EFN Define the following: S = Previous year’s sales A = Total assets E = Total equity g = Projected growth in sales PM = Profit margin b = Retention (plowback) ratio Assuming that all debt is constant, show that EFN can be written as EFN = −PM(S)b + [A − PM(S)b] × g Hint: Asset needs will equal A × g. The addition to retained earnings will equal PM(S)b × (1 + g).arrow_forwardWhat is the plug variable? arrow_forwardConsider the following simplified financial statements for the Wesney Corporation (assuming no income taxes) The company has predicted a sales increase of 20 percent. Assume the company pays out half of its net income in the form of a cash dividend. Costs and assets vary with sales, but debt and equity do not. What is the external financing needed? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations; round your answer to the nearest whole number, e.g., 32.) External financing neededarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...

Finance

ISBN:9781305635937

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

How To Analyze an Income Statement; Author: Daniel Pronk;https://www.youtube.com/watch?v=uVHGgSXtQmE;License: Standard Youtube License