Corporate Finance

12th Edition

ISBN: 9781259918940

Author: Ross, Stephen A.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 3, Problem 21QAP

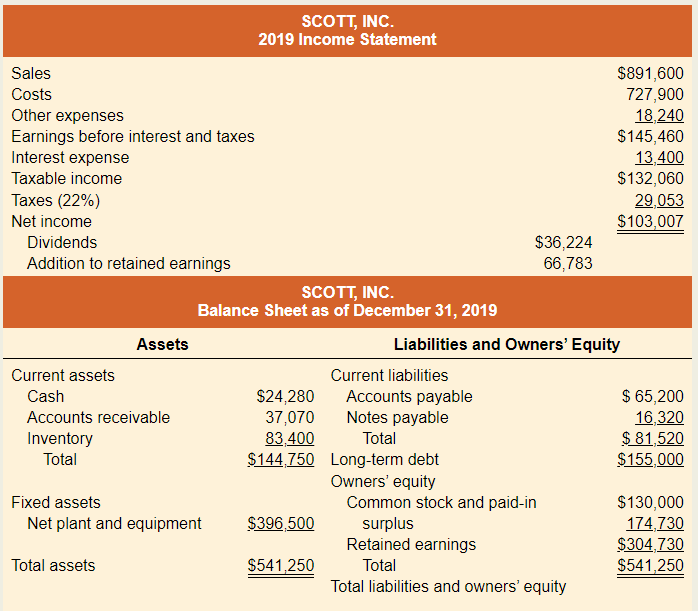

Calculating EFN The most recent financial statements for Scott, Inc., appear below. Sales for 2020 are projected to grow by 20 percent. Interest expense will remain constant; the tax rate and the

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

13. Using Percentage of Sales. The 2019 financial statements for Growth Industries are presented

below. Sales and costs are projected to grow at 20% a year for at least the next 4 years.

Both current assets and accounts payable are projected to rise in proportion to sales. The firm

is currently operating at full capacity, so it plans to increase fixed assets in proportion to sales.

Interest expense will equal 10% of long-term debt outstanding at the start of the year. The firm

will maintain a dividend payout ratio of 40. Construct a spreadsheet model for Growth

Industries similar to the one in Spreadsheet 18.1. (LO18-2)

INCOME STATEMENT, 2019

Sales

$200,000

Costs

150,000

$ 50,000

EBIT

Interest expense

10,000

Taxable income

$ 40,000

Taxes (at 21%)

8,400

Net income

$ 31,600

$12,640

$18,960

Dividends

Addition to retained earnings

BALANCE SHEET, YEAR-END, 2019

Assets

Liabilities

Current assets

Current liabilities

$ 3,000

$ 10,000

$ 10,000

Cash

Accounts payable

Accounts receivable

8,000…

The most recent financial statements for xyz inc. follow. Sales for 2019 are projected to grow by 22 percent. Interest expense will remain constant, the tax rate and dividend payout rate will also remain constant. Costs, other expenses, current assets, and accounts payable increase spontaneously with sales. If the firm is operating at full capacity and no new debt or equity is issued. How much external financing is needed to support the 16 percent growth rate in sales?

Income statement 2019

Net sales 17,300

Cost of Goods Sold 10,600

Depreciation 3,250

Earning before interest and taxes 3,450

Interest paid 680

Taxable income 2,770

Taxes 940

Net income…

which one is correct please suggest?

QUESTION 39

Getrag expects its sales to increase 20% next year from its current level of $4.7 million. Getrag has current assets of $660,000, net fixed assets of $1.5 million, and current liabilities of $462,000. All assets are expected to grow proportionately with sales. If Getrag has a net profit margin of 10%, what additional financing will be needed to support the increase in sales? Getrag does not pay dividends.

a.

$339,600

b.

No financing needed, surplus of $224,400

c.

No financing needed, surplus of $524,400

d.

$283,200

Chapter 3 Solutions

Corporate Finance

Ch. 3 - Financial Ratio Analysis A financial ratio by...Ch. 3 - Industry-Specific Ratios So-called same-store...Ch. 3 - Sales Forecast Why do you think most long-term...Ch. 3 - Sustainable Growth In the chapter, we used...Ch. 3 - EFN and Growth Rate Broslofski Co. maintains a...Ch. 3 - Common-Size Financials One tool of financial...Ch. 3 - Asset Utilization and EFN One of the implicit...Ch. 3 - Comparing ROE and ROA Both ROA and ROE measure...Ch. 3 - Ratio Analysis Consider the ratio EBITD/Assets....Ch. 3 - Return on Investment A ratio that is becoming more...

Ch. 3 - Use the following information to answer the next...Ch. 3 - Prob. 12CQCh. 3 - Use the following information to answer the next...Ch. 3 - Use the following information to answer the next...Ch. 3 - Use the following information to answer the next...Ch. 3 - DuPont Identity If Muenster, Inc., has an equity...Ch. 3 - Equity Multiplier and Return on Equity Synovec...Ch. 3 - Prob. 3QAPCh. 3 - EFN The most recent financial statements for...Ch. 3 - Prob. 5QAPCh. 3 - Sustainable Growth If the Moran Corp. has an ROE...Ch. 3 - Prob. 7QAPCh. 3 - Prob. 8QAPCh. 3 - Prob. 9QAPCh. 3 - Prob. 10QAPCh. 3 - Prob. 11QAPCh. 3 - Prob. 12QAPCh. 3 - External Funds Needed The Optical Scam Company has...Ch. 3 - Days' Sales in Receivables A company has net...Ch. 3 - Prob. 15QAPCh. 3 - Prob. 16QAPCh. 3 - Prob. 17QAPCh. 3 - Prob. 19QAPCh. 3 - Prob. 20QAPCh. 3 - Calculating EFN The most recent financial...Ch. 3 - Prob. 22QAPCh. 3 - Prob. 23QAPCh. 3 - Prob. 26QAPCh. 3 - Prob. 27QAPCh. 3 - Prob. 28QAPCh. 3 - Prob. 29QAPCh. 3 - Prob. 30QAPCh. 3 - Calculate all of the ratios listed in the industry...Ch. 3 - Prob. 2MCCh. 3 - Prob. 3MCCh. 3 - Prob. 4MCCh. 3 - Prob. 5MC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The most recent finical statements for Moose Tours, Inc., appear below. Sales for 2016 are projected to grow by 20 percent. Interest expense will remain constant; the tax rate and dividend payout rate will also remain constant. Costs, other expenses, current assets, fixed assets, and accounts payable increase spontaneously with sales. If the firm is operating at full capacity and no neb debt or equity issues, what external financing is needed to support the 20 percent growth rates in sales?arrow_forwardCould you please help with calculating the EFN for 10, 15, and 40 percent growth rates. The most recent financial statements for Crosby, Incorporated, follow. Interest expense and short-term debt will remain constant; the tax rate and the dividend payout rate will also remain constant. Costs, other expenses, current assets, fixed assets, and accounts payable increase spontaneously with sales. Assume the firm is operating at full capacity and the debt-equity ratio is held constant. CROSBY, INCORPORATED 2020 Income Statement Sales $ 754,000 Costs 610,000 Other expenses 24,500 Earnings before interest and taxes $ 119,500 Interest paid 10,400 Taxable income $ 109,100 Taxes (21%) 22,911 Net income $ 86,189 Dividends $ 42,540 Addition to retained earnings 43,649 CROSBY, INCORPORATED Balance Sheet as of December 31, 2020 Assets Liabilities and Owners’ Equity Current assets Current…arrow_forwardUse the percentage of sales forecasting method to compute the additional financing needed by Lambrechts Specialty Shops, Inc. (LSS), if sales are expected to increase from a current level of $20 million to a new level of $25 million over the coming year. LSS expects earnings after taxes to equal $1 million over the next year. LSS intends to pay a $300,000 dividend next year. The current year balance sheet for LSS is as follows: Lambrechts Specialty Shops, Inc. Balance Sheet as of December 31, 20X3 Cash $1,000,000 Accounts payable $3,000,000 Accounts receivable 1,500,000 Notes payable 3,000,000 inventories 6,000,000 Long-term debt 2,000,000 Net fixed assets 3,000,000 Stockholders’ equity 3,500,000 Total Assets $11,500,000 Total…arrow_forward

- Use the percentage of sales forecasting method to compute the additional financing needed by Lambrechts Specialty Shops, Inc. (LSS), if sales are expected to increase from a current level of $20 million to a new level of $25 million over the coming year. LSS expects earnings after taxes to equal $1 million over the next year. LSS intends to pay a $300,000 dividend next year. The current year balance sheet for LSS is as follows: Lambrechts Specialty Shops, Inc. Balance Sheet as of December 31, 20X3 Cash $1,000,000 Accounts Payable $3,000,000 Accounts Receivable 1,500,000 Notes Payable 3,000,000 Inventories 6,000,000 Long-Term Debt 2,000,000 Net Fixed Assets 3,000,000 Stockholders’ Equity 3,500,00 Total Assets $11,500,000 Total Liabilities and Equity $11,500,000arrow_forwardUse the AFN equation to estimate Hatfield’s required new external capital for 2020 if the sales growth rate is 11.1%. Assume that the firm’s 2019 ratios will remain the same in 2020. (Hint: Hatfield was operating at full capacity in 2019.)arrow_forwardWhich one is correct answer please confirm? QUESTION 39 Getrag expects its sales to increase 20% next year from its current level of $4.7 million. Getrag has current assets of $660,000, net fixed assets of $1.5 million, and current liabilities of $462,000. All assets are expected to grow proportionately with sales. If Getrag has a net profit margin of 10%, what additional financing will be needed to support the increase in sales? Getrag does not pay dividends. a. $339,600 b. No financing needed, surplus of $224,400 c. No financing needed, surplus of $524,400 d. $283,200arrow_forward

- Consider a company that is projected to generate revenues of $104 million next year. Analysts expect revenues to grow at a 4.6% annual rate for the following two years (until the end of year 3) and then at a stable rate of 2.5% in perpetuity. If the company is expected to have a gross margin of 75%, operating margin of 35%, net margin of 25%, tax rate of 16.4%, and reinvestment rate of 34%, what is its expected free cash in four years from today? Answer in millions, rounded to one decimal placearrow_forward(Forecasting financing needs) Beason Manufacturing forecasts its sales next year to be $5.4 million and expects to earn 4.9 percent of that amount after taxes. The firm is currently in the process of projecting its financing needs and has made the following assumptions (projections): • Current assets are equal to 19.8 percent of sales, and fixed assets remain at their current level of $0.8 million. • Common equity is currently $0.78 million, and the firm pays out half of its after-tax earnings in dividends. The firm has short-term payables and trade credit that normally equal 11.8 percent of sales, and it has no long-term debt outstanding. What are Beason's financing needs for the coming year? Beason's expected net income for next year is $ (Round to the nearest dollar.)arrow_forwardSuppose that TV Industries, Inc. currently has the balance sheet shown as follows, and that sales for the year just ended were $5 million. The firm also has a profit margin of 15 percent, a retention ratio of 25 percent, and expects sales of $5.5 million next year. If all assets and current liabilities are expected to increase with sales, what amount of additional funds will the company need from external sources to fund the expected growth? Assets Liabilities and Equity Current assets $ 1,000,000 Current liabilities $ 1,000,000 Fixed assets 2,000,000 Long-term debt 1,000,000 Equity 1,000,000 Total assets $ 3,000,000 Total liabilities and equity $ 3,000,000arrow_forward

- Sales and costs are projected to grow at 30% a year for at least the next 4 years. Both current assets and accounts payable are projected to rise in proportion to sales. The firm is currently operating at 75% capacity, so it plans to increase fixed assets in proportion to sales. Interest expense will equal 10% of long-term debt outstanding at the start of the year. The firm will maintain a dividend payout ratio of 0.40. What is the required external financing over the next year?arrow_forward(Forecasting financing needs) Beason Manufacturing forecasts its sales next year to be $5.6 million and expects to earn 4.3 percent of that amount after taxes. The firm is currently in the process of projecting its financing needs and has made the following assumptions (projections): • Current assets are equal to 19.3 percent of sales, and fixed assets remain at their current level of $1.1 million. • Common equity is currently $0.75 million, and the firm pays out half of its after-tax earnings in dividends. • The firm has short-term payables and trade credit that normally equal 12.1 percent of sales, and it has no long-term debt outstanding. What are Beason's financing needs for the coming year? Beason's expected net income for next year is $ 240,800 (Round to the nearest dollar.) Beason's expected common equity balance for next year is $ 870400. (Round to the nearest dollar.) Estimate Beason's financing needs by completing the pro forma balance sheet below: (Round to the nearest…arrow_forwardSupposing that the 2022 sales are projected to increase by 25% over the year 2021 sales and that there is proportional relationship between sales to operating costs, interest expenses, current assets and spontaneous liabilities. The company has been operating at full capacity and planned to maintain the dividend ratio and profit margin position of the previous year.Required i. Using the Percentage of Sales proforma method, compute the additional funds needed (AFN), assuming that the company was operating at full capacity in the year 2021. ii. Using the Formula method, compute the additional funds needed, assuming that the company was operating at full capacity in the year 2021.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

How To Analyze an Income Statement; Author: Daniel Pronk;https://www.youtube.com/watch?v=uVHGgSXtQmE;License: Standard Youtube License