Concept explainers

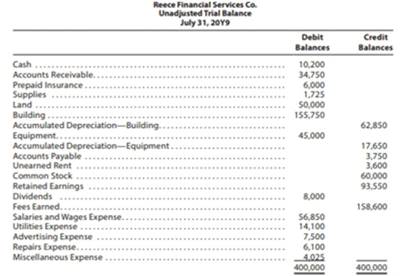

Reece Financial Services Co., which specializes in appliance repair services, it owned and operated by Joni Reece. Reece Financial Services’ accounting clerk prepared the following unadjusted

The data needed to determine year-end adjustment’ are as follows:

Depreciation of building for the year, $6,400.- Depreciation of equipment for the year, $2,800.

- Accrued salaries and wages at July 31, $900.

- Unexpired insurance at July 31, $1,500.

- Fees earned but unbilled on July 31, $10,200.

- Supplies on hand at July 31, $615.

- Rent unearned at July 31, $300.

Instructions

1. Journalize the adjusting entries using the following additional accounts: Salaries and Wages Payable; Rent Revenue; Insurance Expense; Depreciation Expense—Building; Depreciation Expense—Equipment; and Supplies Expense.

2. Determine the balances of tile accounts affected by the adjusting entries, and prepare an adjusted trial balance.

(1)

To journalize: The adjusting entries for RF Services as on July 31, 20Y9

Explanation of Solution

Journal entry: Journal entry is a set of economic events which can be measured in monetary terms. These are recorded chronologically and systematically.

Debit and credit rules:

- Debit an increase in asset account, increase in expense account, decrease in liability account, and decrease in stockholders’ equity accounts.

- Credit decrease in asset account, increase in revenue account, increase in liability account, and increase in stockholders’ equity accounts.

Adjusting entries: Adjusting entries are those entries which are recorded at the end of the year to update the income statement accounts (revenue and expenses) and balance sheet accounts (assets, liabilities, and stockholders’ equity) to maintain the records according to accrual basis principle.

Prepare adjusting entry for the depreciation expense as on July 31, 20Y9.

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20Y9 | 20Y9 | |||||

| July | 31 | Depreciation Expense | 6,400 | |||

| Accumulated Depreciation–Buildings | 6,400 | |||||

| (To record depreciation expense) | ||||||

Table (1)

Description:

- Depreciation Expense is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Accumulated Depreciation–Buildings is a contra-asset account, and contra-asset accounts would have a normal credit balance, hence, the account is credited.

Prepare adjusting entry for the depreciation expense as on July 31, 20Y9.

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20Y9 | ||||||

| July | 31 | Depreciation Expense | 2,800 | |||

| Accumulated Depreciation–Equipment | 2,800 | |||||

| (To record depreciation expense) | ||||||

Table (2)

Description:

- Depreciation Expense is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Accumulated Depreciation–Equipment is a contra-asset account, and contra-asset accounts would have a normal credit balance, hence, the account is credited.

Prepare adjusting entry for the salaries expense as on July 31, 20Y9.

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20Y9 | ||||||

| July | 31 | Salaries and Wages Expense | 900 | |||

| Salaries and Wages Payable | 900 | |||||

| (To record accrued expenses) | ||||||

Table (3)

Description:

- Salaries and Wages Expense is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Salaries and Wages Payable is a liability account. Since amount of payables has increased, liability decreased, and an increase in liability is credited.

Prepare adjusting entry for the prepaid insurance as on July 31, 20Y9.

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20Y9 | ||||||

| July | 31 | Insurance Expense | 4,500 | |||

| Prepaid Insurance | 4,500 | |||||

| (To record part of prepaid insurance expired) | ||||||

Table (4)

Description:

- Insurance Expense is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Prepaid Insurance is an asset account. Since amount of insurance is expired, asset account decreased, and a decrease in asset is credited.

Working Note:

Determine insurance expense as on July 31, 20Y9.

Prepare adjusting entry for the accounts receivable as on July 31, 20Y9.

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20Y9 | ||||||

| July | 31 | Accounts Receivable | 10,200 | |||

| Fees Earned | 10,200 | |||||

| (To record revenue earned on account for the services performed) | ||||||

Table (5)

Description:

- Accounts Receivable is an asset account. Since amount to be received has increased, asset account increased, and an increase in asset is debited.

- Fees Earned is a revenue account. Since revenues increase equity, equity value is increased. An increase in equity is credited.

Prepare adjusting entry for the supplies as on July 31, 20Y9.

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20Y9 | ||||||

| July | 31 | Supplies Expense | 1,110 | |||

| Supplies | 1,110 | |||||

| (To record part of supplies consumed) | ||||||

Table (2)

Description:

- Supplies Expense is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Supplies is an asset account. Since amount of supplies is used, asset account decreased, and a decrease in asset is credited.

Working Note:

Determine supplies expense as on July 31, 20Y9.

Prepare adjusting entry for the unearned rent revenue as on July 31, 20Y9.

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20Y9 | ||||||

| July | 31 | Unearned Rent | 3,300 | |||

| Rent Revenue | 3,300 | |||||

| (To record portion of advance earned till January) | ||||||

Table (5)

Description:

- Unearned Rent is a liability account. Since the unearned rent value is earned, liability is reduced, and a decrease in liability is debited.

- Rent Revenue is a revenue account. Since the unearned revenue has been earned, revenue value increased, and an increase in revenues increases stockholders’ equity. Hence, the account is credited.

Working Notes:

Determine rent revenue as on July 31, 20Y9.

(2)

To prepare: Trial balance of the RF Services as on July 31, 20Y9

Explanation of Solution

Adjusted trial balance: It is that statement which shows all the asset, liability, and equity account balances at the year-end, after recording of adjusting entries.

Prepare adjusted trial balance of RF Services as on July 31, 20Y9.

| RF Services | ||

| Adjusted Trial Balance | ||

| July 31, 20Y9 | ||

| Particulars | Debit $ | Credit $ |

| Cash | $10,200 | |

| Accounts Receivable | 44,950 | |

| Prepaid Insurance | 1,500 | |

| Supplies | 615 | |

| Land | 50,000 | |

| Building | 155,750 | |

| Accumulated Depreciation - Building | $69,250 | |

| Equipment | 45,000 | |

| Accumulated Depreciation - Equipment | 20,450 | |

| Accounts Payable | 3,750 | |

| Unearned Rent | 300 | |

| Salaries and Wages Payable | 900 | |

| Common Stock | 60,000 | |

| Retained Earnings | 93,550 | |

| Dividend | 8,000 | |

| Fees Earned | 168,800 | |

| Rent Revenue | 3,300 | |

| Salaries and Wages Expense | 57,750 | |

| Utilities Expense | 14,100 | |

| Advertising Expense | 7,500 | |

| Repairs Expense | 6,100 | |

| Depreciation Expense - Building | 6,400 | |

| Depreciation Expense - Equipment | 2,800 | |

| Insurance Expense | 4,500 | |

| Supplies Expense | 1,110 | |

| Miscellaneous Expense | 4,025 | |

| Total | $420,300 | $420,300 |

Table (8)

Working Notes:

Determine accounts receivable value as on July 31, 20Y9.

Determine accumulated depreciation-building value as on July 31, 20Y9.

Determine accumulated depreciation-equipment value as on July 31, 20Y9.

Determine salaries and wages payable value as on July 31, 20Y9.

Determine fees earned value as on July 31, 20Y9.

Determine rent revenue value as on July 31, 20Y9.

Determine salaries and wages expense value as on July 31, 20Y9.

Determine insurance expense as on July 31, 20Y9.

Determine supplies expense as on July 31, 20Y9.

Want to see more full solutions like this?

Chapter 3 Solutions

Cengagenowv2, 1 Term Printed Access Card For Warren/jones’ Corporate Financial Accounting, 15th

- On a particular date, FedEx has a stock price of $89.27 and an EPS of $7.11. Its competitor, UPS, had an EPS of $0.38. What would be the expected price of UPS stock on this date, if estimated using the method of comparables? A) $4.77 B) $7.16 C) $9.54 D) $10.50arrow_forwardHow much will you accumulated after 35 year? General accountingarrow_forwardGiven correct answer general Accountingarrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub  Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning