Cengagenowv2, 1 Term Printed Access Card For Warren/jones’ Corporate Financial Accounting, 15th

15th Edition

ISBN: 9781337398244

Author: Carl Warren, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

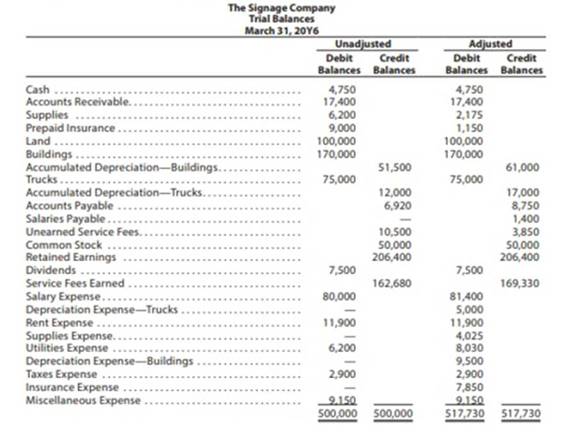

Chapter 3, Problem 3.4BPR

The Signage Company specializes in the maintenance and repair of signs, such as billboards. On March 31, 20Y6, the accountant for The Signage Company prepared the

Instructions

Journalize the seven entries that adjusted the accounts at March 31. None of the accounts were affected by more than one adjusting entry.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Accounting question

Not Ai Answer

Financial accounting question

Chapter 3 Solutions

Cengagenowv2, 1 Term Printed Access Card For Warren/jones’ Corporate Financial Accounting, 15th

Ch. 3 - How are revenues and expenses reported on the...Ch. 3 - Is the matching concept related to (A) the cash...Ch. 3 - Why are adjusting entries needed at the end of an...Ch. 3 - What is the difference between adjusting entries...Ch. 3 - Identify the four different categories of...Ch. 3 - If the effect of the debit portion of an adjusting...Ch. 3 - If the effect of the credit portion of an...Ch. 3 - Prob. 8DQCh. 3 - Prob. 9DQCh. 3 - (A) Explain the purpose of the two accounts:...

Ch. 3 - Account requiring adjustment Indicate with a Yes...Ch. 3 - Type of adjustment Classify the following items as...Ch. 3 - Adjustment for accrued revenues At the end of the...Ch. 3 - Adjustment for accrued expense Prospect Realty Co....Ch. 3 - Adjustment for unearned revenue On June 1, 20Y2,...Ch. 3 - Adjustment for prepaid expense The prepaid...Ch. 3 - Adjustment for depreciation The estimated amount...Ch. 3 - Effect of omitting adjustments For the year ending...Ch. 3 - Effect of errors on adjusted trial balance For...Ch. 3 - Vertical analysis Two income statements for Cornea...Ch. 3 - Prob. 3.1EXCh. 3 - Classifying adjusting entries The following...Ch. 3 - Adjusting entry for accrued fees At the end of the...Ch. 3 - Effect of omitting adjusting entry The adjusting...Ch. 3 - Adjusting entries for accrued salaries Paradise...Ch. 3 - Determining wages paid The wages payable and wages...Ch. 3 - Effect of omitting adjusting entry Accrued...Ch. 3 - Effect of omitting adjusting entry When preparing...Ch. 3 - Adjusting entries for unearned fees The balance in...Ch. 3 - Effect of omitting adjusting entry At the end of...Ch. 3 - Adjusting entry for supplies The balance in the...Ch. 3 - Determining supplies purchased The supplies and...Ch. 3 - Effect of omitting adjusting entry At March 31,...Ch. 3 - Adjusting entries for prepaid insurance The...Ch. 3 - Adjusting entries for prepaid insurance The...Ch. 3 - Adjusting entries for unearned and accrued fees...Ch. 3 - Prob. 3.17EXCh. 3 - Adjustment for depreciation The estimated amount...Ch. 3 - Determining fixed assets book value The balance in...Ch. 3 - Prob. 3.20EXCh. 3 - Effects of errors on financial statements For a...Ch. 3 - Effects of errors on financial statements For a...Ch. 3 - Effects of errors on financial statements The...Ch. 3 - Effects of errors on financial statements If the...Ch. 3 - Prob. 3.25EXCh. 3 - Adjusting entries from trial balances The...Ch. 3 - Corrected trial balance totals, 369,000 Adjusting...Ch. 3 - Adjusting entries On March 31, the following data...Ch. 3 - Prob. 3.2APRCh. 3 - Adjusting entries Trident Repairs Service, an...Ch. 3 - Adjusting entries Good Note Company specializes in...Ch. 3 - Adjusting entries and adjusted trial balances...Ch. 3 - Adjusting entries and errors At the end of April,...Ch. 3 - Adjusting entries On May 31, the following data...Ch. 3 - Adjusting entries Selected account balances before...Ch. 3 - Adjusting entries Crazy Mountain Outfitters Co.,...Ch. 3 - Adjusting entries The Signage Company specializes...Ch. 3 - Adjusting entries and adjusted trial balances...Ch. 3 - Adjusting entries and errors At the end of August,...Ch. 3 - Continuing Problem 3. Total of Debit column:...Ch. 3 - Prob. 3.1MADCh. 3 - Analyze Pandora Media Pandora Media, Inc. (P)...Ch. 3 - Analyze World Wrestling Entertainment World...Ch. 3 - Prob. 3.4MADCh. 3 - Prob. 3.5MADCh. 3 - Analyze and Compare ATT and Verizon Communications...Ch. 3 - Prob. 3.1TIFCh. 3 - Loan application Daryl Kirby opened Squid Realty...Ch. 3 - Prob. 3.4TIFCh. 3 - Prob. 3.5TIF

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The Willow Mills Company mills barley into flour. The equivalent units are measured in terms of tons of flour produced. At the beginning of the year, the mill contained 25 tons of barley that was 40 percent milled. During the year, another 600 tons of barley were completely milled. At the end of the year, the company has 50 tons of barley 70 percent milled. How many equivalent tons of barley has Willow Mills Company milled during the year?helparrow_forwardProvide general accounting questions.arrow_forwardGeneral accountingarrow_forward

- The Manana Corporation had annual sales of $60 million that occurred evenly throughout the 365 days of the year. Its accounts receivable balance averaged $2 million. How long, on average, does it take the firm to collect on its sales? a. 12.2 days. b. 19.1 days. c. 15.8 days. d. 25.2 days.arrow_forwardneed help this questionsarrow_forwardWhat are the equivalent units of production for materials?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY