Concept explainers

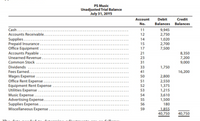

The unadjusted

The data needed to determine adjustments are as follows:

• During July, PS Music provided guest disc jockeys for KXMD for a total of 115 hours. For information on the amount of the accrued revenue to be billed to KXMD, see the contract described in the July 3 transaction at the end of Chapter 2

. Supplies on hand at July 31, $275-

. The balance of the prepaid insurance account relates to the July 1 transaction at the end of Chapter 2.

.

.The balance of the unearned revenue account relates to the contract between PS Music and KXMD, described in the July 3 transaction at the end of Chapter 2.

• Accrued wages as of July 31 were $140.

Instructions

1. Prepare adjusting

18

57 Insurance Expense

58 Depreciation Expense

2.

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

- Answer each of the questions below submitting your response in the reply section. Some answer will require a sentence or two while others may require you to calculate a numerical response. On January 1, a flower shop contracts with customers to provide flowers for their wedding on June 2. The total contract price is $3,000, payable in equal installments for the next six months on the first of each month (with the first payment due January 1). How much will be recorded as revenue during the month of April? American Signs allows customers to pay with their Jones credit card and cash. Jones charges American Signs a 3.5% service fee for each credit sale using its card. Credit sales for the month of June total $328,430, where 40% of those sales were made using the Jones credit card. Based on this information, what will be the total in Credit Card Expense at the end of June? Which account type is used to record bad debt estimation and is a contra account to Accounts Receivable? Racing…arrow_forwardINSTRUCTIONS: (1) Complete the adjustments section of the worksheet [WS]. Use the following information regarding unadjusted items. (a) On September 30, the firm received its utilities bill for the month of September amounting to P14,300. This remains to be unpaid at month-end. Record an adjustment for the utilities for the month of September. Accrued Expense (b) On September 21, the firm received a 6% 90-day note for money lent to Ling Ying Wei amounting to P400,000. The remainder of the amount pertains to a 12-month 9% promissory note received on May 1, 2021. Record an adjustment for the accrued interest from both notes for the month of September. Accrued Income (c) On September 30, an inventory of Warehouse Supplies and Office Supplies showed that items costing P127,000 and P12,000 were on hand respectively. Record an adjustment for the supplies used in September. Prepaid Expense (d) On July 1, 2021, the firm purchased a six-month insurance policy for P232,000. Record an…arrow_forwardIncluded in Blossom’s December 31 trial balance is unearned revenue of $12,600. Management reviewed the company’s progress on the underlying contracts and determined that $4,000 of revenue should be recognized. Prepare Blossom’s December 31 adjusting entryarrow_forward

- How to track the following revenue recognitions as a journal entry: A firm rents psace in its store to a travel agency for $9,000/mo effective March 1. Receives $18,000 cash on March 1 for two months rent. Same as above except; firm receives teh check for the March and April rent on April 1.arrow_forwardSheffield Corp. received a check for $19080 on July 1, which represents a 6-month advance payment of rent on a building it rents to a client. Unearned Rent Revenue was credited for the full $19080. Financial statements will be prepared on July 31. Sheffield's should make the following adjusting entry on July 31: debit Unearned Rent Revenue, $19080; credit Rent Revenue, $19080. debit Cash, $19080; credit Rent Revenue, $19080. debit Rent Revenue, $3180; credit Unearned Rent Revenue, $3180. debit Unearned Rent Revenue, $3180; credit Rent Revenue, $3180.arrow_forwardOn June 30 of the current year, Rosemount Copy Center has completed the Trial Balance columns of the work sheet. Analyze the adjustment information given here into debit and credit parts. Record the adjustments on the work sheet. Total the Adjustments columns. Adjustment Information June 30 Supplies on hand $188.00 Value of prepaid insurance 540.00 WORK SHEET For Month Ended June 30, 20-- ACCOUNT TITLE TRIAL BALANCE ADJUSTMENTS INCOME STATEMENT BALANCE SHEET DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT 1 Cash 8,715.00 1 2 Petty Cash 75.00 2 3 Accounts Receivable-Raymond O’Neil 642.00 3 4 Supplies 518.00 4 5 Prepaid Insurance 675.00 5 6 Accounts Payable-Western Supply 268.00 6 7 Akbar…arrow_forward

- On June 1, one company collected total subscriptions of $22,800 in which they promise to deliver of their products to his customers. They would earn the sales revenue equally for each month. As of December 31, what would be the balance of Unearned Revenue for one company?arrow_forwardOn March 15, a customer pays $3,133 for ten 4-day passes to Disney World for avacation that will take place June 1–4. Did Disney earn the revenue on March 15?arrow_forwardOn July 1, a client paid an advance payment (retainer) of $10,000, to cover future legal services. During the period, the company completed $6,200 of the agreed-on services for the client. There was no beginning balance in the Unearned Revenue account for the period. Based on the information provided, make the journal entries needed to bring the balances to correct for: original transaction December 31 adjustmentarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education