Concept explainers

Journalizing and posting adjustments to the four-column accounts and preparing an adjusted

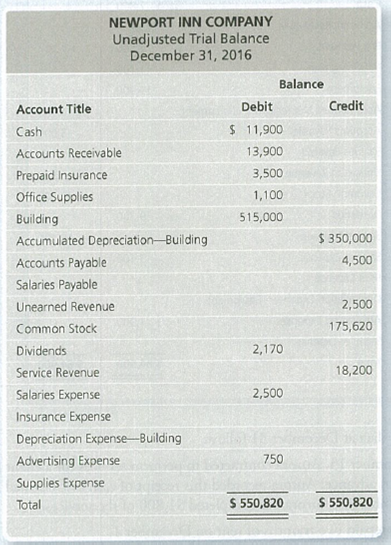

The unadjusted trial balance of Newport Inn Company at December 31, 2016, and the data needed for the adjustments follow.

Adjustment data at December 31 follow:

a. As of December 31, Newport had $600 of Prepaid Insurance remaining.

b. At the end of the month, Newport had $700 of office supplies remaining.

c. Depreciation on the building is $3,500.

d. Newport pays its employees weekly on Friday. Its employees earn $1,500 for a five-day workweek. December 31 falls on Wednesday this year.

e. On November 20, Newport contracted to perform services for a client receiving $2,500 in advance. Newport recorded this receipt of cash as Unearned Revenue.

As of December 31, Newport has $1,500 still unearned.

Requirements

1. Journalize the

2. Using the unadjusted trial balance, open the accounts (use a four-column ledger) with the unadjusted balances.

3. Prepare the adjusted trial balance.

4. Assuming the adjusted trial balance has total debits equal to total credits, does this mean that the adjusting entries have been recorded correctly? Explain.

Want to see the full answer?

Check out a sample textbook solution

Chapter 3 Solutions

Horngren's Financial & Managerial Accounting, The Financial Chapters (Book & Access Card)

- Prepare adjusting journal entries, as needed, considering the account balances excerpted from the unadjusted trial balance and the adjustment data. A. depreciation on buildings and equipment, $17,500 B. advertising still prepaid at year end, $2,200 C. interest due on notes payable, $4,300 D. unearned rental revenue, $6,900 E. interest receivable on notes receivable, $1,200arrow_forwardPrepare adjusting journal entries, as needed, considering the account balances excerpted from the unadjusted trial balance and the adjustment data. A. supplies actual count at year end, $6,500 B. remaining unexpired insurance, $6,000 C. remaining unearned service revenue, $1,200 D. salaries owed to employees, $2,400 E. depreciation on property plant and equipment, $18,000arrow_forwardAdjusting and Closing EntriesAccount balances taken from the ledger of Builders’ Supply Corporation on December31, 2013, before adjustment, follow information relating to adjustments on December31, 2013:(a) Allowance for Bad Debts is to be increased to a balance of $3,000.(b) Buildings are depreciated at the rate of 5% per year.(c) Accrued selling expenses are $3,840.(d) There are supplies of $780 on hand.(e) Prepaid insurance relating to 2014 totals $720.(f) Accrued interest on long-term investments is $240.(g) Accrued real estate and payroll taxes are $900.(h) Accrued interest on the mortgage is $480.(i) Income taxes are estimated to be 30% of the income before income taxes.Cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 24,000Accounts Receivable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 72,000Allowance for Bad…arrow_forward

- Adjusting and Closing EntriesAccount balances taken from the ledger of Builders’ Supply Corporation on December31, 2013, before adjustment, follow information relating to adjustments on December31, 2013:(a) Allowance for Bad Debts is to be increased to a balance of $3,000.(b) Buildings are depreciated at the rate of 5% per year.(c) Accrued selling expenses are $3,840.(d) There are supplies of $780 on hand.(e) Prepaid insurance relating to 2014 totals $720.(f) Accrued interest on long-term investments is $240.(g) Accrued real estate and payroll taxes are $900.(h) Accrued interest on the mortgage is $480.(i) Income taxes are estimated to be 30% of the income before income taxes.Cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 24,000Accounts Receivable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 72,000Allowance for Bad…arrow_forwardREQUIRED Record the adjustment journal entry in respect of rent income in the books of NT Stores as at 28 February 2022. INFORMATION The Rent Income account of NT Stores reflected a total of R276 000 on 28 February 2022, the end of the accounting period. This was in respect of rent for an office occupied by a tenant for the entire financial year. The monthly rental was increased by 10% with effect from 01 September 2021. The rent for February 2022 was due to be received on 01 March 2022.arrow_forwardPrepare adjusting journal entries, as needed, considering the account balances excerpted from the unadjusted trial balance and the adjustment data. A. amount due for employee salaries, $4,800 B. actual count of supplies inventory, $ 2,300 C. depreciation on equipment, $3,000arrow_forward

- The following accounts appear in the ledger of Celso and Company as of June 30, the end of this fiscal year. The data needed for the adjustments on June 30 are as follows: ab.Merchandise inventory, June 30, 54,600. c.Insurance expired for the year, 475. d.Depreciation for the year, 4,380. e.Accrued wages on June 30, 1,492. f.Supplies on hand at the end of the year, 100. Required 1. Prepare a work sheet for the fiscal year ended June 30. Ignore this step if using CLGL. 2. Prepare an income statement. 3. Prepare a statement of owners equity. No additional investments were made during the year. 4. Prepare a balance sheet. 5. Journalize the adjusting entries. 6. Journalize the closing entries. 7. Journalize the reversing entry as of July 1, for the wages that were accrued in the June adjusting entry. Check Figure Net income, 14,066arrow_forwardWorksheet Victoria Company has the following account balances on December 31, 2019, prior to any adjustments: Additional adjustment information: (a) depreciation on buildings, 1,100; on equipment, 600; (b) bad debts expense, 240; (c) interest accumulated but not paid: on note payable, 50; on mortgage payable, 530 (this interest is due during the next accounting period); (d) insurance expired, 175; (e) salaries accrued but not paid 370; (f) rent was collected in advance and the performance obligation is now satisfied, 800; (g) office supplies cm hand at year-end, 230 (expensed when originally purchased earlier in the year); and (h) the income tax rate is 30% on current income and is payable in the first quarter of 2020. Required: 1. Transfer the account balances to a 10-column worksheet and prepare a trial balance. 2. Prepare the adjusting entries in the general journal and complete the worksheet. 3. Prepare the companys income statement, retained earnings statement, and balance sheet. 4. Prepare closing entries in the general journal.arrow_forwardCALCULATING AND JOURNALIZING DEPRECIATION Equipment records for Byerly Construction Co. for the year follow. Byerly Construction uses the straight-line method of depreciation. In the case of assets acquired by the fifteenth day of the month, depreciation should be computed for the entire month. In the case of assets acquired after the fifteenth day of the month, no depreciation should be considered for the month in which the asset was acquired. REQUIRED 1. Calculate the depreciation expense for Byerly Construction as of December 31, 20--. 2. Prepare the entry for depreciation expense using a general journal.arrow_forward

- The trial balance of The New Decors for the month ended September 30 is as follows: Data for the adjustments are as follows: a. Expired or used-up insurance, 425. b. Depreciation expense on equipment, 2,750. c. Wages accrued or earned since the last payday, 475 (owed and to be paid on the next payday). d. Supplies remaining at end of month, 215. Required 1. Complete a work sheet. (Skip this step if using GL.) 2. Journalize the adjusting entries. If you are using CLGL, use the year 2020 when recording transactions.arrow_forwardAssume the following data for Oshkosh Company before its year-end adjustments: Journalize the adjusting entries for the following: a. Estimated customer refunds and allowances b. Estimated customer returnsarrow_forwardCALCULATING AND JOURNALIZING DEPRECIATION Equipment records for Johnson Machine Co. for the year follow. Johnson Machine uses the straight-line method of depreciation. In the case of assets acquired by the fifteenth day of the month, depreciation should be computed for the entire month. In the case of assets acquired after the fifteenth day of the month, no depreciation should be considered for the month in which the asset was acquired. REQUIRED 1. Calculate the depreciation expense for Johnson Machine as of December 31, 20--. 2. Prepare the entry for depreciation expense using a general journal.arrow_forward

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,