Horngren's Financial & Managerial Accounting, The Financial Chapters (Book & Access Card)

5th Edition

ISBN: 9780134078939

Author: Tracie L. Miller-Nobles, Brenda L. Mattison, Ella Mae Matsumura

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 3.34AP

Journalizing

Wright Fishing Charters has collected the following data for the December 31 adjusting entries:

- a. The company received its electric bill on December 20 for $225 but will not pay it until January 5. (Use the Utilities Payable account.)

- b. Wright purchased a nine-month boat insurance policy on November 1 for $9,000. Wright recorded a debit to Prepaid Insurance.

- c. As of December 31, Wright had earned $2,000 of charter revenue that has not been recorded or received.

- d. Wright’s fishing boat was purchased on January 1 at a cost of $44,500. Wright expects to use the boat for five years and that it will have a residual value of $4,500. Determine annual depredation assuming the

straight-line depredation method is used. - e. On October 1, Wright received $8,000 prepayment for a deep-sea fishing charter to take place in December. As of December 31, Wright has completed the charter.

Requirements

- 1. Journalize the adjusting entries needed on December 31 for Wright Fishing Charters. Assume Wright records adjusting entries only at the end of the year.

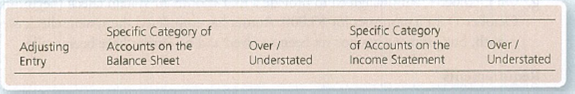

- 2. If Wright had not recorded the adjusting entries, indicate which specific category of accounts on the financial statements would be misstated and if the misstatement is overstated or understated. Use the following table as a guide.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Reviewing insurance policies revealed that a single policy was purchased on March 1, for one year's coverage, in the amount of $9,000. There was no previous balance in the Prepaid Insurance account at that time. Based on the information provided,

Make the December 31 adjusting journal entry to bring the balances to correct.

Show the impact that these transactions had.

Reviewing insurance policies revealed that a single policy was purchased on August 1, for one year’s coverage, in the amount of $6,000. There was no previous balance in the Prepaid Insurance account at that time. Based on the information provided:

A. Make the December 31 adjusting journal entry to bring the balances to correct. If an amount box does not require an entry, leave it blank.

B. Show the impact that these transactions had. If an amount box does not require an entry, leave it blank.

Reviewing insurance policies revealed that a single policy was purchased on August 1, for one year’s coverage, in the amount of $6,000. There was no previous balance I n the Prepaid Insurance account at that time. Based on the information provided:-

Make the December 31 adjusting journal entry to bring the balances to correct.

Show the impact that these transactions had.

Chapter 3 Solutions

Horngren's Financial & Managerial Accounting, The Financial Chapters (Book & Access Card)

Ch. 3 - Which of the following is true of accrual basis...Ch. 3 - Get Fit Now gains a client who prepays 540 for a...Ch. 3 - The revenue recognition principle requires a. time...Ch. 3 - Adjusting the accounts is the process of a....Ch. 3 - Which of the following is an example of a deferral...Ch. 3 - Assume that the weekly payroll of In the Woods...Ch. 3 - The adjusted trial balance shows a. amounts that...Ch. 3 - A D Window Cleaning performed 450 of services but...Ch. 3 - A worksheet a. is a journal used to record...Ch. 3 - On February 1, Clovis Wilson Law Firm contracted...

Ch. 3 - What is the difference between cash basis...Ch. 3 - Which method of accounting (cash or accrual basis)...Ch. 3 - Which accounting concept or principle requires...Ch. 3 - What is a fiscal year? Why might companies choose...Ch. 3 - Under the revenue recognition principle, when is...Ch. 3 - Prob. 6RQCh. 3 - When are adjusting entries completed, and what is...Ch. 3 - Prob. 8RQCh. 3 - Prob. 9RQCh. 3 - Prob. 10RQCh. 3 - Prob. 11RQCh. 3 - Prob. 12RQCh. 3 - Prob. 13RQCh. 3 - Prob. 14RQCh. 3 - Prob. 15RQCh. 3 - What is an accrued expense? Provide an example.Ch. 3 - What is an accrued revenue? Provide an example.Ch. 3 - Prob. 18RQCh. 3 - When is an adjusted trial balance prepared, and...Ch. 3 - If an accrued expense is not recorded at the end...Ch. 3 - What is a worksheet, and how is it used to help...Ch. 3 - If a payment of a deferred expense was recorded...Ch. 3 - If a payment of a deferred expense was recorded...Ch. 3 - Comparing cash and accrual basis accounting for...Ch. 3 - Comparing cash and accrual basis accounting for...Ch. 3 - Applying the revenue recognition principle South...Ch. 3 - Applying the matching principle Suppose on January...Ch. 3 - Identifying types of adjusting entries A select...Ch. 3 - Journalizing and posting adjusting entries for...Ch. 3 - Journalizing and posting an adjusting entry for...Ch. 3 - Journalizing and posting an adjusting entry for...Ch. 3 - Prob. 3.9SECh. 3 - Prob. 3.10SECh. 3 - Prob. 3.11SECh. 3 - Journalizing an adjusting entry for accrued...Ch. 3 - Prob. 3.13SECh. 3 - Determining the effects on financial statements In...Ch. 3 - Prob. 3.15SECh. 3 - Prob. 3.16SECh. 3 - Prob. 3.17SECh. 3 - Prob. 3.18ECh. 3 - Prob. 3.19ECh. 3 - Prob. 3.20ECh. 3 - Prob. 3.21ECh. 3 - Prob. 3.22ECh. 3 - Prob. 3.23ECh. 3 - Prob. 3.24ECh. 3 - Prob. 3.25ECh. 3 - Prob. 3.26ECh. 3 - Identifying the impact of adjusting entries on the...Ch. 3 - Journalizing adjusting entries and analyzing their...Ch. 3 - Prob. 3.29ECh. 3 - Prob. 3.30ECh. 3 - Understanding the alternative treatment of prepaid...Ch. 3 - Understanding the alternative treatment of...Ch. 3 - Journalizing adjusting entries and subsequent...Ch. 3 - Journalizing adjusting entries and identifying the...Ch. 3 - Journalizing and posting adjustments to the...Ch. 3 - Journalizing and posting adjustments to the...Ch. 3 - A Using the worksheet to record the adjusting...Ch. 3 - Understanding the alternative treatment of prepaid...Ch. 3 - Journalizing adjusting entries and subsequent...Ch. 3 - Journalizing adjusting entries and identifying the...Ch. 3 - Journalizing and posting adjustments to the...Ch. 3 - Journalizing and posting adjustments to the...Ch. 3 - Prob. 3.43BPCh. 3 - Understanding the alternative treatment of prepaid...Ch. 3 - Prob. 3.45CPCh. 3 - Prob. 3.46PSCh. 3 - One year ago, Tyler Stasney founded Swift...Ch. 3 - Prob. 3.1CTEICh. 3 - XM, Ltd. was a small engineering firm that built...Ch. 3 - Prob. 3.1CTFSCCh. 3 - In 75 words or fewer, explain adjusting journal...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I. The senior accountant for Koo Graphics discovered that the company'e accounting clerk had a different method of recording the purchase cf automobile insurance. Specifically, when one-year policies were purchased on July 1, the clerk debited Insurance Expense $7200 and credited Bank $7200, A. Has the clerk done anything seriously wrong? Explain. B. Use the T-accounts in your Workbook to calculate the year-end adjustment for insurance for December 31. Journalize the adjusting entry.arrow_forwardMarcellus Purse conduct cleaning business on the credit basis. He provides the collects the sccount receivable in 60 days. The Allowance October 2019 is $3,993. The following information is available Douchd D 1. The business uses aging of account receivable method to count the bad de 2. The accountant is required to update the balance of allowance of dosud des OURE at the end of each month 3. On 5 October 2019 a total of $1.997 ewed by Lucy Frone has been deemed w uncollectable and therefore written off 4. The total sales recorded during 1 October 2019 to 31 October 2019 is $812577 The balance in the Account receivable on 31 October 2019 is $198.300 5. 6. On 31 October 2019 the accountant estimates that 3% of the account receivable is estimated as doubtful. Q3 Required (a) Prepare the Accounting Entries for the transactions or events relating to bad debt for the month ended 31 October 2019, ignore GST ( (b) Prepare and balance the T-account for Allowance for Doubtful Debts accounts as…arrow_forwardTaylor Fishing Charters has collected the following data for the December 31 adjusting entries: View the data. Read the requirements. Requirement 1. Journalize the adjusting entries needed on December 31 for Taylor Fishing Charters. Assume Taylor Fishing Charters records adjusting entries only at the end of the year. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) a. The company received its electric bill on December 20 for $350 but will not pay it until January 5. (Use the Utilities Payable account.) Accounts and Explanation Credit Date (a) Dec. 31 Utilities Expense b. Taylor Fishing Charters purchased a three-month boat insurance policy on November 1 for $2,100. Taylor Fishing Charters recorded a debit to Prepaid Insurance. Accounts and Explanation Debit Date (b) Dec. 31 Date Debit c. As of December 31, Taylor Fishing Charters had earned $1,500 of charter revenue that has not been recorded or received. Accounts and Explanation…arrow_forward

- Present entries to record the following (a,b,c) for a business that uses the Allowance Method: a: Record the adjusting entry at 12/31/19, the end of the fiscal year to provide for doubtful accounts. The accounts receivable account has a balance of $100,000 and the contra asset account, before adjustment has a debit balance of $700. Analysis of receivables indicates doubtful accounts of $4,500. b: In March of the following fiscal year $610 owed by the Filthy Disgusting Yankees Inc was written off. c: Six months later the $610 is reinstated and payment of that amount received What is the estimated realizable value of the accounts receivable as reported on the Balance Sheet prepared as of 12/31/19 Assuming that the business had been following the direct write off method for accounting for uncollectibles, present the entry to record the write-off in (1b) Record the entry for the reinstatement of the account written off in (3) under the direct write-off method Assignment: Record the…arrow_forwardYou are given the following selected transactions of Bobby merchandising for the year ended December 31, 2020. You are required to prepare the adjusting journal entries without explanations.a. Supplies on hand account is shown in the books with a balance of P450. An actual count shows only P150 worth of supplies are still on hand.b. Interest of P60 was debited to Prepaid Interest account for interest paid in advance on a 60-day-6% note dated December 16.c. Salaries of P850 remain unpaid as at the end of the year.d. Office equipment was bought for P50,000 on May 31 of the current year. It is expected to be useful for only 7 years and have a salvage value of P8,000.e. Commission Income account which is shown in the books at P1,000 is only ¾ earned.f. A bill for P2,000 for services rendered to a client has not been collected.g. It is expected that only 95% of outstanding accounts receivable of P20,000 will be collectible.h. Unearned Rental Income account which is shown in the books at…arrow_forwardReviewing insurance policies revealed that a single policy was purchased on August 1, for one year's coverage, in the amount of $6,000. There was no previous balance in the Prepaid Insurance account at that time. Based on the information provided: A) Make the December 31 adjusting journal entry to bring the balances to correct.arrow_forward

- On December 31, the end of the accounting period, Maricall Center has an outstanding Accounts Receivable of Php 72,000 and an Allowance for Impairment Loss balance of Php 600 prior to the year-end adjustments. Bad debts are estimated at 2% of the accounts receivable. How much are the bad debts expense to be charged to the Impairment Loss account? Prepare the adjusting journal entry.arrow_forwardOn December 31, journalize the write-offs and the year-end adjusting entry under the allowance method, assuming that the allowance account had a beginning balance of $89,000 and the company uses the analysis of receivables method. If no entry is required, simply skip to the next transaction. Refer to the Chart of Accounts for exact wording of account titles.arrow_forwardPrepare journal entries to adjust the books of Raymond Corp. at December 31, 2020 based on the following information: " just 2. savir Interest earned during the month on a savings account totaled $300. a. b. Received the utility bill for December of $3,200, which will be paid on January 4th. C. The office supplies account at the beginning of 2020 was $800. During the year, Raymond Corp. made two purchases of office supplies for $3,000 and $4,000. Office supplies on hand at the end of the year totaled $400. Prepare the AJE (adjusting journal entry) to adjust the supplies account. d. On July 1, 2020, Raymond Corp. paid a two-year insurance premium in the amount of $6,000. This amount was debited to insurance expense when the premium was paid. Prepare the end-of-year adjusting entry. e. On October 1, 2020, Raymond Corp. received cash of $7,500 from a customer for work to be performed over the next few months. As of the end of the year, one-third of the work had been completed. Prepare the…arrow_forward

- At the end of the first year of operations, Mayberry Advertising had accounts receivable of $21,000. Management of the company estimates that 12% of the accounts will not be collected. What adjusting entry would Mayberry Advertising record to establish Allowance for Uncollectible Accounts? (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet Record the adjusting entry for Allowance for Uncollectible Accounts. Note: Enter debits before credits. Transaction Record entry General Journal Clear entry Debit Credit View general journalarrow_forwardPrepare Adjusting Journal Entries on the general journal using the following information. Please make sure the interest is up to date and the depreciation is recorded. On 3/1/21, the company purchased a large fishing boat for $20,000 of which had a down payment of $5,000 and the rest of borrowed from First Hawaiian Bank. The Note Payable’s principle has a 4% annual interest rate due every 8-months while the principle is due at maturity date in 5 years. The boat has a useful life of 10 years and salvage of $4,000. Straight-line depreciation method is used. Liability insurance was purchased on 5/1/21. The 18 month policy cost $4,600 and was paid in full. Shark Bait purchased $12,000 of office supplies and lures from Huge Minnows Company on 4/1/21 on account. Also, on 11/5/21, Shark Bait received $3,400 cash for the sale of some unused lures that were bought on 4/1/21 for $2,900. On 12/31/21, due to the use of office supplies, the Office Supplies and lures only added up to $2,000. On…arrow_forwardSmokey Company purchases a one-year insurance policy on July 1 for $11,568. The adjusting entry on December 31 is a.debit Insurance Expense, $11,568 and credit Prepaid Insurance, $11,568 b.debit Insurance Expense, $5,784 and credit Prepaid Insurance, $5,784 c.debit Prepaid Insurance, $10,604 and credit Cash, $10,604 d.debit Insurance Expense, $964 and credit Prepaid Insurance, $11,568arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY