PRIN.OF CORPORATE FINANCE

13th Edition

ISBN: 9781260013900

Author: BREALEY

Publisher: RENT MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 3, Problem 26PS

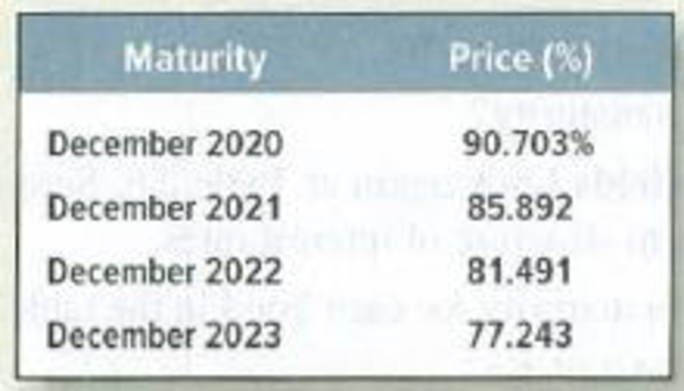

Measuring term structure* The following table shows the prices of a sample of Narnian Treasury strips in December 2018. Each strip makes a single payment of $1,000 at maturity.

- a. Calculate the annually

compounded, spot interest rate for each year. - b. Is the term structure upward- or downward-sloping or flat?

- c. Would you expect the yield on a coupon bond maturing in December 2023 to be higher or lower than the yield on the 2020 strip?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Find the duration of a bond with a settlement date of May 27, 2025, and

maturity date November 15, 2036. The coupon rate of the bond is 8.0%,

and the bond pays coupons semiannually. The bond is selling at a bond-

equivalent yield to maturity of 8.0%. Use Spreadsheet 16.3

Note: Do not round intermediate calculations. Round your answers to

2 decimal places.

Macaulay duration

Modified duration

Consider a government bond that pays coupon semi-annually on 15 February and 15 August each year, where the annual

coupon rate is 7%. The face value of the bond is $100 and the bond is redeemable at par on 15 August 2030. If the current

date is 27 March 2021 and the bond yield is quoted as 7.5% per annum compounded semi-annually, calculate the market

price (which is also known as the clean price) with the help of the RBA formula.

Yields: On April 1, 2022, the prices of 1-year, 2-year, and 3-year zero coupon US

Treasury bonds with face value 100 were, respectively, 98.2318, 95. 1814, and 92.5887.

(a) Calculate the yields, in percent terms, of the three bonds.

(b) Using the expectations theory of the yield curve, find the expected one-year in-

terest rates between years 1 and 2 and between years 2 and 3.

(c) According to the expectations theory (as of April 1), what is the Fed's plan for

interest rates over the next 3 years?

Chapter 3 Solutions

PRIN.OF CORPORATE FINANCE

Ch. 3 - (PRICE) In February 2009, Treasury 8.5s of 2020...Ch. 3 - (YLD) On the same day, Treasury 3.5s of 2018 were...Ch. 3 - (DURATION) What was the duration of the Treasury...Ch. 3 - (MDURATION) What was the modified duration of the...Ch. 3 - Bond prices and yields A 10-year bond is issued...Ch. 3 - Bond prices and yields The following statements...Ch. 3 - Bond prices and yields Construct some simple...Ch. 3 - Bond prices and yields A 10-year German government...Ch. 3 - Bond prices and yields A 10-year German government...Ch. 3 - Bond prices and yields A 10-year U.S. Treasury...

Ch. 3 - Bond returns If a bonds yield to maturity does not...Ch. 3 - Bond returns a. An 8%, five-year bond yields 6%....Ch. 3 - Prob. 10PSCh. 3 - Duration True or false? Explain. a....Ch. 3 - Duration Here are the prices of three bonds with...Ch. 3 - Duration Calculate the durations and volatilities...Ch. 3 - Prob. 14PSCh. 3 - Duration Find the spreadsheet for Table 3.4 in...Ch. 3 - Prob. 16PSCh. 3 - Spot interest rates and yields Which comes first...Ch. 3 - Prob. 18PSCh. 3 - Spot interest rates and yields Look again at Table...Ch. 3 - Prob. 20PSCh. 3 - Spot interest rates and yields Assume annual...Ch. 3 - Spot interest rates and yields A 6% six-year bond...Ch. 3 - Spot interest rates and yields Is the yield on...Ch. 3 - Prob. 24PSCh. 3 - Measuring term structure The following table shows...Ch. 3 - Term-structure theories The one-year spot interest...Ch. 3 - Term-structure theories Look again at the spot...Ch. 3 - Real interest rates The two-year interest rate is...Ch. 3 - Prob. 30PSCh. 3 - Bond ratings A bonds credit rating provides a...Ch. 3 - Prob. 32PSCh. 3 - Price and spot interest rates Find the arbitrage...Ch. 3 - Prob. 34PSCh. 3 - Prices and spot interest rates What spot interest...Ch. 3 - Prices and spot interest rates Look one more time...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- As of November 14, 2023, Treasury yields were as follows: 1-year 5.24% 2-year 4.80% 3-year 4.56% 5-year 4.42% 10-year 4.44% 30-year 4.61% Use these yields to answer the questions below. a. What do the rates above imply about the shape of the yield curve? Explain. b. Using the pure expectations theory of the term structure of interest rates, carefully explain how the general shape of the yield curve described in (a) could come about.arrow_forwardOn January 1, 2020 you bought the Superset bond at $1118.07 and sold it on March 15 of the same year. On the day of the sale, you read the following information from the financial pages of a local newspaper: Coupon Maturity Price Yield SuperSet 8. Septembre 15/2025 8 What then is the effective annual return realized on this investment? a) -29.35% b) -6.98% c) -41.47% d) -10.56%arrow_forwardA Treasury bond that settles on October 18, 2019, matures on March 30, 2038. The coupon rate is 6.20 percent, and the bond has a yield to maturity of 5.71 percent. What are the Macaulay duration and modified duration? (Use the duration functions in Excel to solve the problem. Do not round intermediate calculations. Round your answers to 4 decimal places.) Macaulay duration Modified durationarrow_forward

- Refer to this chart and look at the Treasury bond maturing in March 2022. Required: How much would you have to pay to purchase one of these bonds? Note: Do not round intermediate calculations. Round your answer to 3 decimal places. What is its coupon rate? Note: Round your answer to 3 decimal places. What is the yield to maturity of the bond? Note: Do not round intermediate calculations. Round your answer to 3 decimal places.arrow_forwardAt the end of March 2019, a Zambian corporate bond had a coupon rate of 6%, a par (face) value of K1,000 and will mature in March 2022. Market rates of interest are currently 4.5%.Required:A. Using the data given above and assuming semi-annual coupons and a semi-annual discount rate equal to 2.25%, calculate the value of the corporate bond.B. Calculate the Macaulay duration of the Zambian corporate bond described above assuming annual coupons and discount rate.C. Explain Macaulay duration and describe the main characteristics of Macaulay duration in relation to bonds.D. Explain modified duration and explain the limitations of using this measurearrow_forwardFind the duration of a bond with settlement date June 9, 2018, and maturity date December 11, 2027. The coupon rate of the bond is 8%, and the bond pays coupons semiannually. The bond is selling at a yield to maturity of 9%. (Do not round intermediate calculations. Round your answers to 4 decimal places.) What is the modified duration?arrow_forward

- You find the following Treasury bond quotes. To calculate the number of years until maturity, assume that it is currently May 2022. All of the bonds have a par value of $1,000 and pay semiannual coupons. Rate ?? 5.674 6.208 Maturity Month/Year May 35 May 40 May 50 a. Asked price b. Bid price Asked 103.5457 104.5069 104.6526 ?? ?? Bid 103.5579 Change +.3132 +.4401 +.5522 Ask Yield 6.179 ?? 4.211 a. In the above table, find the Treasury bond that matures in May 2050. What is the asked price of this bond in dollars? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. b. If the bid-ask spread for this bond is .0588, what is the bid price in dollars? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.arrow_forwardFind the duration of a bond with a settlement date of May 27, 2025, and maturity date November 15, 2036. The coupon rate of the bond is 6.0%, and the bond pays coupons semiannually. The bond is selling at a bond-equivalent yield to maturity of 8.0%. Use Spreadsheet 16.3. Note: Do not round intermediate calculations. Round your answers to 2 decimal places. X Answer is complete but not entirely correct. Macaulay duration Modified duration 11.98 X 11.52 Xarrow_forwardA bond that has a face value of $1,500 and coupon rate of 3.10% payable semi- annually was redeemable on July 1, 2035. Calculate the purchase price of the bond on February 10, 2029 when the yield was 3.60% compounded semi-annually. Please include a well-labelled timeline diagram. Full solutions should be shown on separate sheets of paper. Submit your solutions. a. What was the purchase price of the bond? Round to the nearest cent b. What was the amount of discount or premium on the bond? (click to select) v amount is Round to the nearest centarrow_forward

- You find the following Treasury bond quotes. To calculate the number of years until maturity, assume that it is currently May 2022. All of the bonds have a par value of $1,000 and pay semiannual coupons. Rate ?? 6.052 6.143 Maturity Month/Year Bid Asked Change May 33 May 36 May 42 103.4560 103.5288 104.4900 104.6357 ?? ?? +.3248 Ask Yield 5.919 +.4245 +.5353 ?? 3.951 In the above table, find the Treasury bond that matures in May 2036. What is your yield to maturity if you buy this bond? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. Yield to maturity %arrow_forwardYou find the following Treasury bond quotes. To calculate the number of years until maturity, assume that it is currently May 2022. All of the bonds have a par value of $1,000 and pay semiannual coupons. Rate ?? 6.302 6.168 Maturity Month/Year May 29 May 32 May 38 Yield to maturity Asked Bid 103.4625 103.5353 104.4965 104.6422 ?? ?? In the above table, find the Treasury bond that matures in May 2032. What is your yield to maturity if you buy this bond? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. = Change Ask Yield +.3028 6.019 ?? +.4305 +.5418 4.051 %arrow_forwardYou find the following Treasury bond quotes. To calculate the number of years until maturity, assume that it is currently May 2022. All of the bonds have a par value of $1,000 and pay semiannual coupons. Rate ?? 6.152 6.153 Maturity Month/Year May 35 May 38 May 44 Bid 103.4586 104.4926 ?? Yield to maturity Asked 103.5314 % 104.6383 ?? Change Ask Yield +.3274 5.959 ?? 3.991 In the above table, find the Treasury bond that matures in May 2038. What is your yield to maturity if you buy this bond? Note: Do not round Intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. +.4269 +.5379arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education

Journalizing Bonds Payable/Amortization of a Premium; Author: TLC Tutoring;https://www.youtube.com/watch?v=5gEpAFFnIE8;License: Standard YouTube License, CC-BY

Investing Basics: Bonds; Author: TD Ameritrade;https://www.youtube.com/watch?v=IuyejHOGCro;License: Standard YouTube License, CC-BY