Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

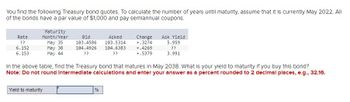

Transcribed Image Text:You find the following Treasury bond quotes. To calculate the number of years until maturity, assume that it is currently May 2022. All

of the bonds have a par value of $1,000 and pay semiannual coupons.

Rate

??

6.152

6.153

Maturity

Month/Year

May 35

May 38

May 44

Bid

103.4586

104.4926

??

Yield to maturity

Asked

103.5314

%

104.6383

??

Change Ask Yield

+.3274

5.959

??

3.991

In the above table, find the Treasury bond that matures in May 2038. What is your yield to maturity if you buy this bond?

Note: Do not round Intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.

+.4269

+.5379

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Please show step by solution. do not skip stepsarrow_forwardplease answer fast i give upvotearrow_forwardYou've just found a 10 percent coupon bond on the market that sells for par value. What is the maturity on this bond? (Warning: Possible trick question.) Use the following Treasury bond quotes to answer Questions 28-30: To calculate the number of years until maturity, assume that it is currently May 2022. All of the bonds have a $1,000 par value and pay semiannual coupons. RATE MATURITY BID ASKED Chg ASK Yld May 29 102.725 102.915 June 32 103.468 103.823 ?? 3.850 4.125 July 38 ?? ?? 0.3204 2.18 0.4513 ?? 0.6821 3.87arrow_forward

- You find the following Treasury bond quotes. To calculate the number of years until maturity, assume that it is currently May 2022. All of the bonds have a par value of $1,000 and pay semiannual coupons. Rate ?? 6.252 6.163 Maturity Month/Year May 37 May 40 May 46 Bid 103.4612 104.4952 Yield to maturity Asked 103.5340 % 104.6409 ?? Change +.3015 +.4293 +.5405 In the above table, find the Treasury bond that matures in May 2040. What is your yield to maturity if you buy this bond? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. Ask Yield 5.999 ?? 4.031arrow_forwardMasukharrow_forwardOn December 8, 2021, the yields on Treasury bonds with different maturities were as follows: Maturity 1 Month 1 Year 2 Years 5 Years 10 Years YTM 0.04% 0.29% 0.68% 1.27% 1.52% 30 Years 1.87% Which of the following statements is an appropriate interpretation of these data? The market is expecting future short-term rates to decrease. The market is expecting a recession in the near future. The market is not expecting future short-term rates to decrease. The risk of default is rising over time. The market demands a short-term risk premium.arrow_forward

- Please answer all questions what is the price of the bond using a semiannual convention if the maturity is 10 years, 30 years, 50 years and 80 years with explanations Thx .arrow_forwardAssume coupons are paid annually. Here are the prices of three bonds with 10-year maturities. Assume face value is $100. Bond Coupon (%) 2 4 8 a. What is the yield to maturity of each bond? b. What is the duration of each bond? Price (%) 80.22 96.79 135.42 Complete this question by entering your answers in the tabs below. Required A Bond Coupon (%) 2 4 8 Required B What is the yield to maturity of each bond? Note: Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places. YTM % % %arrow_forwardThe following is a list of prices for zero-coupon bonds of various maturities. Maturity (years) 1 2 3 4 Price of Bond $ 980.90 914.97 843.12 771.76 Required: a. Calculate the yield to maturity for a bond with a maturity of (i) one year; (ii) two years; (iii) three years; (iv) four years. Assume annual coupon payments. b. Calculate the forward rate for (i) the second year; (ii) the third year; (iii) the fourth year. Assume annual coupon payments. Complete this question by entering your answers in the tabs below. Required A Required B Calculate the yield to maturity for a bond with a maturity of (i) one year; (ii) two years; (iii) three years; (iv) four years. Assume annual coupon payments. Note: Do not round intermediate calculations. Round your answers to 2 decimal places. Maturity (Years) Price of Bond YTM 1 $ 980.90 % 2 $ 914.97 % 3 $ 843.12 %arrow_forward

- Raghubhaiarrow_forwardYou find the following Treasury bond quotes. To calculate the number of years until maturity, assume that it is currently May 2022. All of the bonds have a par value of $1,000 and pay semiannual coupons. Rate ?? 5.424 6.183 Maturity Month/Year May 32 May 35 May 41 Bid 103.4664 104.5004 ?? Asked Change 103.5392 +.3067 104.6461 ?? +.4341 +.5457 Ask Yield 6.079 ?? 4.111 In the above table, find the Treasury bond that matures In May 2035. What is your yield to maturity if you buy this bond? Note: Do not round Intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. Yield to maturity 96arrow_forwardToday is January 2, 2022, and investors expect the annual nominal risk-free interest rates in 2022 through 2024 to be: Year One-Year Rate (rRF) 2022 2.5 % 2023 2.3 2024 3.3 Assume the bonds have no risks. What is the yield to maturity for Treasury bonds that mature at the end of 2023 (a two-year bond)? Round your answer to one decimal place. % What is the yield to maturity for Treasury bonds that mature at the end of 2024 (a three-year bond)? Round your answer to one decimal place. %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education