Accounting For Governmental & Nonprofit Entities

18th Edition

ISBN: 9781259917059

Author: RECK, Jacqueline L., Lowensohn, Suzanne L., NEELY, Daniel G.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 3, Problem 25EP

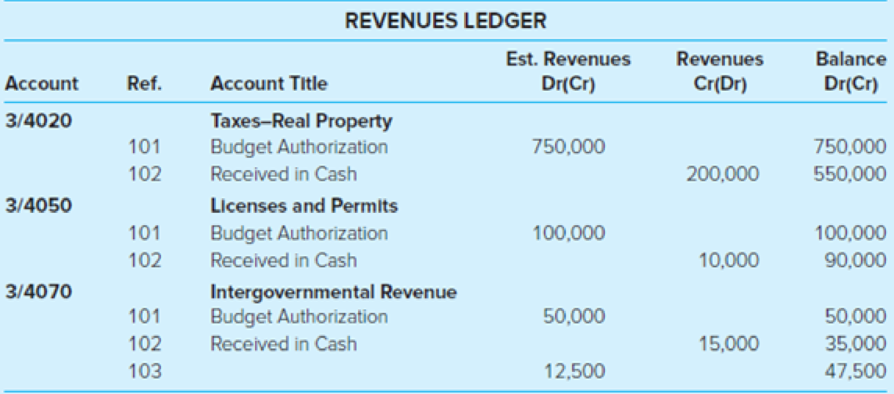

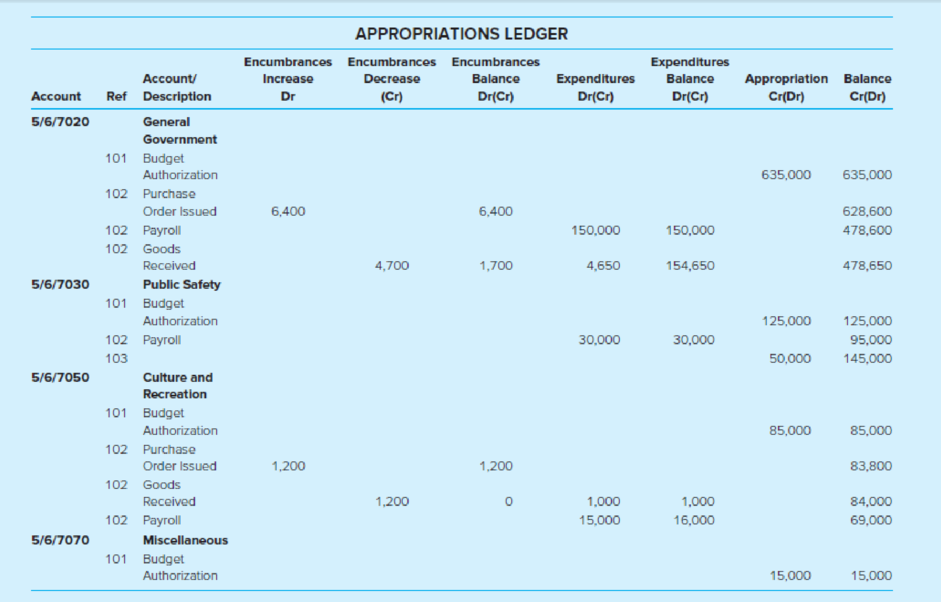

The printout of the Revenues and Appropriations subsidiary ledger accounts for the General Fund of the City of Augusta for the first quarter of the fiscal year appeared as follows:

Required

Assuming that this printout is correct in all details and that there are no other General Fund revenue or expenditure transactions, answer the following questions. Show all necessary computations in good form.

- a. What were the original approved budget amounts for Estimated Revenues and for Appropriations?

- b.

- (1) Was the budget adjusted during the year?

- (2) If so, which accounts if any were adjusted and by how much?

- (3) In total, has Budgetary Fund Balance increased, decreased, or remained the same during the first fiscal quarter?

- c.

- (1) What are the current balances of the Estimated Revenues and Appropriations control accounts?

- (2) What are the current balances of the Revenues, Encumbrances, and Expenditures control accounts?

- (3) What do these balances indicate?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Which of the following accounts of a government agency is closed out at the end of the fiscal

year?

Select the correct response:

Appropriations

Vouchers payable.

Reserve for encumbrance

Fund balance

Which of the following statements is true concerning the recording of a budget?

At the beginning of the year, debit Appropriations.

A debit to the Budgetary Fund Balance account indicates an expected surplus.

At the beginning of the year, debit Estimated Revenues.

At the end of the year, credit Appropriations.

Which of the following statements is true concerning the recording of a budget? Choose the correct.a. At the beginning of the year, debit Appropriations.b. A debit to the Budgetary Fund Balance account indicates an expected surplus.c. At the beginning of the year, debit Estimated Revenues.d. At the end of the year, credit Appropriations.

Chapter 3 Solutions

Accounting For Governmental & Nonprofit Entities

Ch. 3 - Prob. 1QCh. 3 - Discuss the different ways in which depreciation...Ch. 3 - Prob. 3QCh. 3 - Prob. 4QCh. 3 - Explain the essential differences between revenues...Ch. 3 - Prob. 6QCh. 3 - How do Budgetary Fund Balance and Fund Balances...Ch. 3 - Prob. 8QCh. 3 - Prob. 9QCh. 3 - Prob. 10Q

Ch. 3 - The city manager of University City is finalizing...Ch. 3 - Prob. 16.1EPCh. 3 - Prob. 16.2EPCh. 3 - Which of the following accounts neither increases...Ch. 3 - Prob. 16.4EPCh. 3 - Which of the following statements is true for...Ch. 3 - An internal allocation of funds on a periodic...Ch. 3 - Prob. 16.7EPCh. 3 - Prob. 16.8EPCh. 3 - Before placing a purchase order, a department...Ch. 3 - Prob. 16.10EPCh. 3 - Which of the following is correct concerning the...Ch. 3 - Prob. 16.12EPCh. 3 - Prob. 16.13EPCh. 3 - Prob. 16.14EPCh. 3 - Supplies ordered by the Public Works function of...Ch. 3 - Prob. 17EPCh. 3 - Prob. 18EPCh. 3 - Prob. 19EPCh. 3 - The following information is provided about the...Ch. 3 - On February 15, the Town of Evergreen police...Ch. 3 - The Town of Willingdon adopted the following...Ch. 3 - During July, the first month of the fiscal year,...Ch. 3 - The Town of Bedford Falls approved a General Fund...Ch. 3 - The printout of the Revenues and Appropriations...Ch. 3 - Review the computer-generated budgetary comparison...Ch. 3 - Prob. 27EPCh. 3 - Greenville has provided the following information...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- "The sum of fund balance in the beginning of the year and estimated revenues are less than the Appropriations". Does it amount to: O a. Compliance to state balance budget laws O b. Violation of state balance budget laws O c. Balanced budget d. None of the abovearrow_forwardThe Appropriations account of a governmental fund is credited when: a. The budgetary accounts are closed b. The budget is recorded c. Supplies are purchased d. Expenditures are recordedarrow_forwardGreenville has provided the following Information from its General Fund Revenues and Appropriations/Expenditure/Encumbrances subsidiary ledgers for the fiscal year ended. Assume the beginning fund balances are $149 (in thousands) and that the budget was not amended during the year. City of Greenville General Fund Subsidiary Ledger Account Balances (in thousands) Estimated Revenue Taxes For the Fiscal Year Fines & Forfeits Intergovernmental Revenue Charges for Services Revenues Debits 6,048 303 497 370 Credits Taxes Fines & Forfeits Intergovernmental Revenue Charges for Services Appropriations Public Safety General Government 6,080 308 497 368 1,636 3,375 Public Works Culture & Recreation Interfund Transfers Out Expenditures General Government 1,465 724 Estimated Other Financing Uses 48. 1,622 Public Safety 3,360 Public Works 1,443 Culture & Recreation 715 Encumbrances General Government 12 I Public Safety 13 Public Works 21 232 Culture & Recreation 0 Other Financing Uses Interfund…arrow_forward

- Assume that the City of Pasco maintains its books and records in a manner that facilitates preparation of the fund financial statements. The city engaged in the following transactions related to its general fund during the current fiscal year. The city formally integrates the budget into the accounting records. The city does not maintain an inventory of supplies. All amounts are in thousands. Prepare, in summary form, the appropriate journal entries. (a) The city council approved a budget with revenues estimated to be $800 and expenditures of $785. (b) The city ordered supplies at an estimated cost of $25 and equipment at an estimated cost of $20. (c) The city incurred salaries and other operating expenses during the year totaling $730. The city paid for these items in cash. (d) The city received the supplies at an actual cost of $23. (e) The city collected revenues of $795.arrow_forwardThe journal entry to re-establish an encumbrance from the prior year would include: Multiple Choice A debit to Budgetary Fund Balance – Reserve for Encumbrances. A credit to Appropriations Control. A credit to Budgetary Encumbrances. A debit to Encumbrances Control..arrow_forwardPrepare journal entries in general journal format to record the following transactions for the City of Dallas General Fund (subsidiary detail may be omitted) 1. The budget prepared for the fiscal year included total estimated revenues of $4,693,000, appropriations of $4,686,000 and estimated other financing uses of $225,000. 2. Purchase orders in the amount of $451,000 were mailed to vendors. 3. The current year’s tax levy of $4,005,000 was recorded; uncollectible taxes were estimated to be 2% of the tax levy. 4. Collections of delinquent taxes from prior years’ levies totaled $82,700; collections of the current year’s levy totaled $3,524,900. 5. Invoices were received and approved for payment for items ordered in documents recorded as encumbrances in transaction (#2) of this problem. The estimated liability for the related items was $351,200. Actual invoices were $353,500. 6. Revenue other than taxes collected during the year consisted of licenses and permits, $177,600;…arrow_forward

- The following adjusted trial balance is taken from the General Fund of Avon City for the year ended June 30. Prepare a (post-closing) Balance sheet. Allowance for uncollectible taxes Cash Due from capital projects fund Due to debt service fund Encumbrances Encumbrances outstanding Expenditures Fund Balance, nonspendable Fund Balance, unassigned Inventory of supplies Other financing sources -- bond proceeds Other financing uses -- transfers out Revenues Taxes receivable Unearned (unavailable) grant revenues Vouchers payable 5,000 121,000 32,000 19,000 23,000 23,000 57,000 9,000 14,000 9,000 18,000 12,000 130,000 25,000 38,000 23,000 DO NOT GIVE SOLUTION IN IMAGEarrow_forwardIn approving the budget of the City of Troy, the city council appropriated an amount less than expected revenues, what will be the result of this action .a An increase in outstanding encumbrances by the of the fiscal year .b A credit to budgetary fund balance .C A debit to budgetary fund balance .d A necessity for compensatory offsetting action in the debt service fundarrow_forwardThe City of South Pittsburgh maintains its books so as to prepare fund accounting statements and records worksheet adjustments in order to prepare government-wide statements. You are to prepare, in journal form, worksheet adjustments for each of the following situations: 1. Deferred inflows of resources-property taxes of $69,400 at the end of the previous fiscal year were recognized as property tax revenue in the current yearAc€?cs Statement of Revenues, Expenditures, and Changes in Fund Balance. 2. The City levied property taxes for the current fiscal year in the amount of $10,000,000. When making the entries, it was estimated that 2 percent of the taxes would not be collected. At year-end, $600,000 of the taxes had not been collected. It was estimated that $320,000 of that amount would be collected during the 60-day period after the end of the fiscal year and that $80,000 would be collected after that time. The City had recognized the maximum of property taxes allowable under…arrow_forward

- The City of South Pittsburgh maintains its books so as to prepare fund accounting statements and records worksheet adjustments in order to prepare government-wide statements. You are to prepare, in journal form, worksheet adjustments for each of the following situations: 1. Deferred inflows of resources-property taxes of $69,400 at the end of the previous fiscal year were recognized as property tax revenue in the current yearAc€?cs Statement of Revenues, Expenditures, and Changes in Fund Balance. 2. The City levied property taxes for the current fiscal year in the amount of $10,000,000. When making the entries, it was estimated that 2 percent of the taxes would not be collected. At year-end, $600,000 of the taxes had not been collected. It was estimated that $320,000 of that amount would be collected during the 60-day period after the end of the fiscal year and that $80,000 would be collected after that time. The City had recognized the maximum of property taxes allowable under…arrow_forwardsubsidiary ledgers for the fiscal year ended. Assume the beginning fund balances are $140 (in thousands) and that the budget was not amended during the year. Subsidiary Ledger Account Balances (in thousands) For the Fiscal Year Estimated Revenue Taxes Fines & Forfeits City of Greenville General Fund Intergovernmental Revenue Charges for Services Revenues Taxes Fines & Forfeits Intergovernmental Revenue Charges for Services Appropriations General Government Public Safety Public Works Culture & Recreation Estimated Other Financing Uses Interfund Transfers Out Expenditures General Government Public Safety Public Works Culture & Recreation Encumbrances General Government Public Safety Public Works D Culture & Recreation Other Financing Uses Interfund Transfers Out Debits 6,048 303 484 370 1,622 3,347 1,443 703 1 26 10 0 36 Credits 6,054 308 484 368 1,625 3,375 1,454 724 36 Required a. Prepare a General Fund statement of revenues, expenditures, and changes in fund balance. b. Prepare a…arrow_forwardThe general fund pays rent for two months. Which of the following is not correct? Choose the correct.a. Rent expense should be reported in the government-wide financial statements.b. Rent expense should be reported in the general fund.c. An expenditure should be reported in the fund financial statements.d. If one month of rent is in the first year with the other month in the next year, either the purchases method or the consumption method can be used in fund statements.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

What is Fund Accounting?; Author: Aplos;https://www.youtube.com/watch?v=W5D5Dr0j9j4;License: Standard Youtube License