Concept explainers

The city manager of University City is finalizing the budget proposal that must be submitted to the city council 60 days prior to the July 1 start of the next fiscal year, FY 20X2. An economic recession has significantly reduced the city’s revenues over the past two years, particularly sales taxes and building permit fees. Despite strong political pressures on city council members to sustain current city services, the legal requirement to balance the budget has forced the council to cut certain services and staffing levels over the past two years. Federal financial assistance has prevented even deeper cuts, but will be sharply reduced at the end of FY 20X1. Even though the economy has gradually improved, reduced federal support will make achieving a balanced budget even more difficult in FY 20X2.

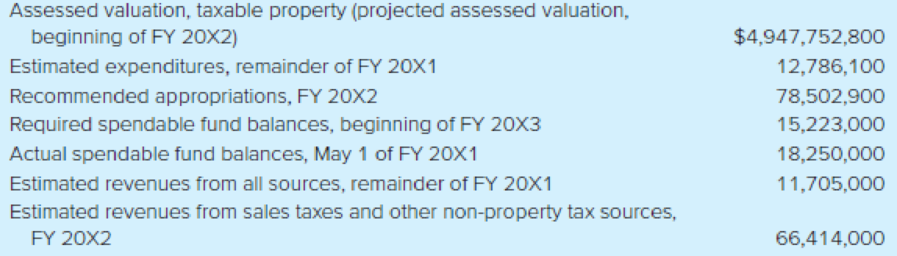

Constraints and planning factors: The city council has mandated that there be no increase in fees and taxes in FY 20X2. Although retail sales and housing starts are projected to increase modestly in FY 20X2, the assessed valuation of taxable property is projected to decrease an additional 5 percent in FY 20X2, reflecting the continuing decline in property values. Moreover, General Fund operating costs, particularly employee health insurance and energy, are expected to outpace revenue growth. Consequently, the city manager is recommending a third consecutive year of no salary and wage increases for city employees. The following financial information is provided as of May 1 of FY 20X1.

General Fund

Analysis and estimation of required property tax rate for FY 20X2: After analyzing the preceding information, constraints, and planning factors, respond to the following questions. (Keep in mind, however, that the city council may impose further changes to the budget as a result of the several budget hearings that will be held over the next two months.)

- a. What amount of estimated revenues is required from property taxes for FY 20X2? (Hint: Make your calculation using the format shown in Illustration 3–6.)

- b. What tax rate will be required in FY 20X2 to generate the amount of revenues from property taxes calculated in question a?

- c. Assuming the property tax rate for FY 20X1 was $0.20 per $100 of assessed valuation of taxable property, will the tax rate calculated in question b violate the city council mandate of no increase in taxes? If so, how would you justify the rate calculated in question b, since the city council will likely be sensitive to adverse public reaction to an increased tax rate?

Want to see the full answer?

Check out a sample textbook solution

Chapter 3 Solutions

Accounting For Governmental & Nonprofit Entities

- Fit & Slim (F&S) is a health club that offers members various gym services. Required: Assume F&S offers a deal whereby enrolling in a new membership for $950 provides a year of unlimited access to facilities and also entitles the member to receive a voucher redeemable for 20% off yoga classes for one year. The yoga classes are offered to gym members as well as to the general public. A new membership normally sells for $980, and a one-year enrollment in yoga classes sells for an additional $500. F&S estimates that approximately 40% of the vouchers will be redeemed. F&S offers a 10% discount on all one-year enrollments in classes as part of its normal promotion strategy. a. & b. Indicate below whether each item is a separate performance obligation. For each separate performance obligation you have indicated, allocate a portion of the contract price. c. Prepare the journal entry to recognize revenue for the sale of a new membership. Assume F&S offers a “Fit…arrow_forwardGeneral accountingarrow_forwardWhat is it's net income on these financial accounting question?arrow_forward

- Quick answer of this accounting questionsarrow_forwardA company provides services on account. Indicate how this transaction would affect (1) assets, (2) stockholders' equity, and (3) revenues. A. (1) Increase, (2) Increase, (3) Increase. B. (1) No effect, (2) Increase, (3) Increase. C. (1) No effect, (2) No effect, (3) No effect. D. (1) Increase, (2) No effect, (3) Increase.arrow_forwardHello tutor provide correct answer financial accounting questionarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education