Accounting For Governmental & Nonprofit Entities

18th Edition

ISBN: 9781259917059

Author: RECK, Jacqueline L., Lowensohn, Suzanne L., NEELY, Daniel G.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 24EP

The Town of Bedford Falls approved a General Fund operating budget for the fiscal year beginning on July 1. The budget provides for estimated revenues of $2,700,000 as follows: property taxes, $1,900,000; licenses and permits, $350,000; fines and forfeits, $250,000; and intergovernmental (state grants), $200,000. The budget approved appropriations of $2,650,000 as follows: General Government, $500,000; Public Safety, $1,600,000; Public Works, $350,000; Culture and Recreation, $150,000; and Miscellaneous, $50,000.

Required

- a. Prepare the

journal entry (or entries), including subsidiary ledger entries, to record the Town of Bedford Falls’s General Fund operating budget on July 1, the beginning of the Town’s fiscal year. - b. Prepare journal entries to record the following transactions that occurred during the month of July.

- 1. Revenues were collected in cash amounting to $31,000 for licenses and permits and $12,000 for fines and forfeits.

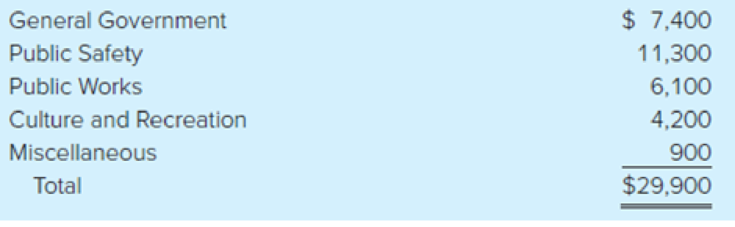

- 2. Supplies were ordered by the following functions in early July at the estimated costs shown:

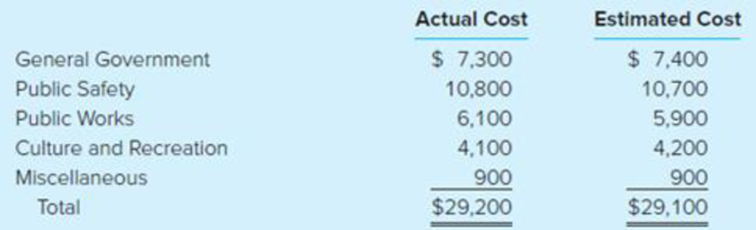

- 3. During July, supplies were received at the actual costs shown below and were paid in cash. General Government, Culture and Recreation, and Miscellaneous received all supplies ordered. Public Safety and Public Works received part of the supplies ordered earlier in the month at estimated costs of $10,700 and $5,900, respectively.

- c. Calculate and show in good form the amount of budgeted but unrealized revenues in total and from each source as of July 31.

- d. Calculate and show in good form the amount of available appropriation in total and for each function as of July 31.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Edwards City has the following information for its general fund for the upcoming

fiscal year. Which of the following would be the appropriate effect to budgetary fund

balance when the budget is recorded?

Estimated revenue

Appropriations

Property tax

3,500,000 Salaries

2,690,000

Sales tax

490,000 Capital items

1,320,000

Other

50,000 Other

15,000

None of these

Credit budgetary fund balance $30,000

Credit budgetary fund balance $15,000

Debit budgetary fund balance $30,000

The following transactions related to the General Fund of the City of Buffalo Falls for the year ended December 31, 2020:

1. Beginning balances were: Cash, $100,000: Taxes Receivable, $200,000: Accounts Payable, $57,500: and Fund Balance, $242,500.

2. The budget was passed. Estimated revenues amounted to $1, 300,000 and appropriations totaled1,296,000. All expenditures are classified as General Government.

3. Property taxes were levied in the amount of $950,000. All of the taxes are expected to be collected before February 2021.

4. Cash receipts totaled $920,000 for property taxes and $315,000 from other revenue.

5. Contracts were issued for contracted services in the amount of $107,500.

6. Contracted services were performed relating to $96,000 of the contracts with invoices amounting to $93,000.

7. Other expenditures amounted to $995,000.

8. Accounts payable were paid in the amount of $1,140,000.

9. The books were closed.

Required:

c. Prepare a Balance Sheet for the General Fund…

The following transactions relate to the General Fund of the City of Buffalo Falls for the year ended December 31, 2020:

Beginning balances were: Cash, $99,000; Taxes Receivable, $198,500; Accounts Payable, $56,750; and Fund Balance, $240,750.

The budget was passed. Estimated revenues amounted to $1,290,000 and appropriations totaled $1,286,200. All expenditures are classified as General Government.

Property taxes were levied in the amount of $945,000. All of the taxes are expected to be collected before February 2021.

Cash receipts totaled $915,000 for property taxes and $312,500 from other revenue.

Contracts were issued for contracted services in the amount of $105,750.

Contracted services were performed relating to $94,500 of the contracts with invoices amounting to $91,700.

Other expenditures amounted to $990,500.

Accounts payable were paid in the amount of $1,132,500.

The books were closed.

Required:a. Prepare journal entries for the above transactions.b. Prepare a Statement of…

Chapter 3 Solutions

Accounting For Governmental & Nonprofit Entities

Ch. 3 - Prob. 1QCh. 3 - Discuss the different ways in which depreciation...Ch. 3 - Prob. 3QCh. 3 - Prob. 4QCh. 3 - Explain the essential differences between revenues...Ch. 3 - Prob. 6QCh. 3 - How do Budgetary Fund Balance and Fund Balances...Ch. 3 - Prob. 8QCh. 3 - Prob. 9QCh. 3 - Prob. 10Q

Ch. 3 - The city manager of University City is finalizing...Ch. 3 - Prob. 16.1EPCh. 3 - Prob. 16.2EPCh. 3 - Which of the following accounts neither increases...Ch. 3 - Prob. 16.4EPCh. 3 - Which of the following statements is true for...Ch. 3 - An internal allocation of funds on a periodic...Ch. 3 - Prob. 16.7EPCh. 3 - Prob. 16.8EPCh. 3 - Before placing a purchase order, a department...Ch. 3 - Prob. 16.10EPCh. 3 - Which of the following is correct concerning the...Ch. 3 - Prob. 16.12EPCh. 3 - Prob. 16.13EPCh. 3 - Prob. 16.14EPCh. 3 - Supplies ordered by the Public Works function of...Ch. 3 - Prob. 17EPCh. 3 - Prob. 18EPCh. 3 - Prob. 19EPCh. 3 - The following information is provided about the...Ch. 3 - On February 15, the Town of Evergreen police...Ch. 3 - The Town of Willingdon adopted the following...Ch. 3 - During July, the first month of the fiscal year,...Ch. 3 - The Town of Bedford Falls approved a General Fund...Ch. 3 - The printout of the Revenues and Appropriations...Ch. 3 - Review the computer-generated budgetary comparison...Ch. 3 - Prob. 27EPCh. 3 - Greenville has provided the following information...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following transactions occurred during the 2020 fiscal year for the City of Evergreen. For budgetary purposes, the city reports encumbrances in the Expenditures section of its budgetary comparison schedule for the General Fund but excludes expenditures chargeable to a prior year’s appropriation. The budget prepared for the fiscal year 2020 was as follows: Estimated Revenues: Taxes $ 1,957,000 Licenses and permits 374,000 Intergovernmental revenue 399,000 Miscellaneous revenues 64,000 Total estimated revenues 2,794,000 Appropriations: General government 475,200 Public safety 890,200 Public works 654,200 Health and welfare 604,200 Miscellaneous 88,000 Total appropriations 2,711,800 Budgeted increase in fund balance $ 82,200 Encumbrances issued against the appropriations during the year were as follows: General government $ 60,000 Public safety 252,000 Public works 394,000 Health and…arrow_forwardThe following transactions relate to the general fund of the city of buffalo falls for the year ended december 31, 2020: 1. Begining Balances were: Cash, $80,000; Taxes receivable, $185,000; Accounts Payable, $50,000; and Fund Balance, $215,000. 2. The budget was passed. Estimated revenues amount to $1,200,000 and appropriations totaled $1,196,000. All expemditures are classifed as General Government. 3. property taxes were levied in the amount of $902,000. Alll of the taxes are expected to be collected before Febuary 2021. 4. Cash reciepts totaled $870,000 for property taxes and $275,000 from other revenue. 5. contracts were issued for contracted servies in the amount of $90,000. 6. Contracted services were preformed relating to $82,000 of the contracts with invoices ammounting to $80,000. 7. Other expenditures amounted to $950,000. 8. accounts payable were paid in the amount of $1,070,000. 9. The books were closed. Required: a. Prepare Jounal entries for the above tranactions. b.…arrow_forwardChesterfield County had the following transactions. Prepare the entries first for fund financial statements and then for government-wide financial statements.a. A budget is passed for all ongoing activities. Revenue is anticipated to be $834,000 with approved spending of $540,000 and operating transfers out of $242,000.b. A contract is signed with a construction company to build a new central office building for the government at a cost of $8 million. A budget for this project has previously been recorded.c. Bonds are sold for $8 million (face value) to finance construction of the new office building.d. The new building is completed. An invoice for $8 million is received and paid.e. Previously unrestricted cash of $1 million is set aside to begin paying the bonds issued in (c).f. A portion of the bonds comes due and $1 million is paid. Of this total, $100,000 represents interest. The interest had not been previously accrued.g. Citizens’ property tax levies are assessed. Total billing…arrow_forward

- Park City uses encumbrance accounting and formally integrates its budget into the general fund's accounting records. For the year ending July 31, Year 1, the following budget was adopted: Estimated revenues $30,000,000 Appropriations $27,000,000 Estimated transfer to debt service fund $900,000 Park's budgetary fund balance is a $3,000,000 credit balance $3,000,000 debit balance $2,100,000 credit balance O $2,1000,000 debit balancearrow_forwardThe following transactions relate to the General Fund of the City of Buffalo Falls for the year ended December 31, 2020: 1. Beginning balances were: Cash, $110,000; Taxes Receivable, $215,000; Accounts Payable, $65,000; and Fund Balance, $260,000. 2. The budget was passed. Estimated revenues amounted to $1,400,000 and appropriations totaled $1,394,000. All expenditures are classified as General Government. 3. Property taxes were levied in the amount of $1,000,000. All of the taxes are expected to be collected before February 2021. 4. Cash receipts totaled $970,000 for property taxes and $340,000 from other revenue. 5. Contracts were issued for contracted services in the amount of $125,000. 6. Contracted services were performed relating to $111,000 of the contracts with invoices amounting to $106,000. 7. Other expenditures amounted to $1,040,000. 8. Accounts payable were paid in the amount of $1,204,000. 9. The books were closed. Required: a. Prepare journal entries for the above…arrow_forwardThe City of Lynnwood was recently incorporated and had the following transactions for the fiscal year ended December 31. The city council adopted a General Fund budget for the fiscal year. Revenues were estimated at $2,000,000 and appropriations were $1,990,000. Property taxes in the amount of $1,940,000 were levied. It is estimated that $9,000 of the taxes levied will be uncollectible. A General Fund transfer of $25,000 in cash and $300,000 in equipment (with accumulated depreciation of $65,000) was made to establish a central duplicating internal service fund. A citizen of Lynnwood donated marketable securities with a fair value of $800,000. The donated resources are to be maintained in perpetuity with the city using the revenue generated by the donation to finance an after-school program for children, which is sponsored by the culture and recreation function. Revenue earned and received as of December 31 was $40,000. The city’s utility fund billed the city’s General Fund…arrow_forward

- The following information is provided about some of the Town of Truesdale’s General Fund operating statement and budgetary accounts for the fiscal year ended June 30. Estimated revenues $ 3,150,000 Revenues 3,190,000 Appropriations 3,185,000 Expenditures 3,175,000 Estimated other financing sources 400,000 Encumbrances 20,000 Encumbrances outstanding 20,000 Budgetary fund balance (calculate) The Town of Truesdale will honor all of its outstanding encumbrances in the next fiscal period. Prepare the journal entry(ies) to close budgetary accounts required to be closed at the fiscal year end using the information provided.arrow_forwardThe board of commissioners of the City of Hartmoore adopted a General Fund budget for the year ending June 30, 2017, that included revenues of $1,292,500, bond proceeds of $575,000, appropriations of $1,060,000, and operating transfers out of $420,000. a. If this budget is formally integrated into the accounting records, what journal entry is required at the beginning of the year? b. If this budget is formally integrated into the accounting records, what later entry is required?arrow_forward4. The board of commissioners of the city of Scranton adopted a general fund budget for the year ending June 30, 2024, which indicated tax levy revenues of $1,500,000, bond proceeds of $650,000, appropriations for government operations of $1,360,000, and operating transfers out of $425,000. Required: If this budget was formally integrated into the accounting records used to produce the governmental fund financial statements, what was the required journal entry at the beginning of the year? Governmental Fund Financial Statements - General Fund Estimated Revenues - Tax Levy Estimated Other Financing Sources - Bond Proceeds Appropriations - Government Operations Appropriations - Other Financing Uses - Operating Transfers Out Budgetary Fund Balance Debit 1,500,000 650,000 Credit 1,360,000 425,000 365,000arrow_forward

- The board of commissioners of the City of Hartmoore adopted a General Fund budget for the year ending June 30, 2017, that included revenues of $1,292,500, bond proceeds of $575,000, appropriations of $1,060,000, and operating transfers out of $420,000. If this budget is formally integrated into the accounting records, what journal entry is required at the beginning of the year? If this budget is formally integrated into the accounting records, what later entry is required?arrow_forwardhelp mearrow_forwardKM County approves the operating budget for the General Fund for 2021 (1/1/21 to 12/31/21), providing for $1,000,000 in revenue and $900,000 in expenditures. What is the appropriate journal entry in the General Fund to record the budget given any difference between the approved revenues and expenditures is unassigned?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

What is Budgeting? | Budgetary control | Advantages & Limitations of Budgeting; Author: Educationleaves;https://www.youtube.com/watch?v=INnPo0QPXf4;License: Standard youtube license