Accounting For Governmental & Nonprofit Entities

18th Edition

ISBN: 9781259917059

Author: RECK, Jacqueline L., Lowensohn, Suzanne L., NEELY, Daniel G.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 23EP

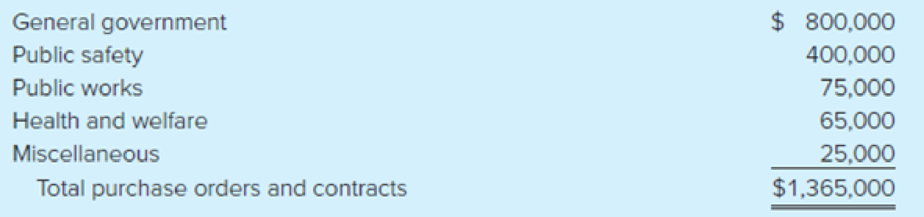

During July, the first month of the fiscal year, the Town of Willingdon issued the following purchase orders and contracts (see Problem 3–22):

Required

- a. Show the general

journal entry to record the issuance of the purchase orders and contracts. Show entries in subsidiary ledger accounts as well as general ledger accounts. - b. Explain why state and local governments generally record the estimated amounts of purchase orders and contracts in the accounts of budgeted governmental funds, whereas business entities generally do not prepare formal entries for purchase orders.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

To what extent do the unique features of government accounting make a difference on the financial statements?

The transactions that follow relate to the Danville County Comptroller’s Department over a two-year period.

Year 1• The county appropriated $12,000 for employee education and training.• The department signed contracts with outside consultants to conduct accounting and auditing workshops. The total cost was $10,000.• The consultants conducted the workshops and were paid $10,000.• The department ordered books and training materials, which it estimated would cost $1,800. As of year-end, the materials had not been received.

Year 2• The county appropriated $13,500 for employee education and training.• The department received and paid for the books and training materials that it ordered the previous year. Actual cost was only $1,700. The county’s accounting policies require that the books and training materials be charged as an expenditure when they are received (as opposed to being…

Assume that the City of Pasco maintains its books and records in a manner that facilitates preparation of the fund financial statements. The city engaged in the following transactions related to its general fund during the current fiscal year. The city formally integrates the budget into the accounting records. The city does not maintain an inventory of supplies. All amounts are in thousands. Prepare, in summary form, the appropriate journal entries.

(a) The city council approved a budget with revenues estimated to be $800 and expenditures of $785.

(b) The city ordered supplies at an estimated cost of $25 and equipment at an estimated cost of $20.

(c) The city incurred salaries and other operating expenses during the year totaling $730. The city paid for these items in cash.

(d) The city received the supplies at an actual cost of $23.

(e) The city collected revenues of $795.

Which of the following accounts of a government agency is closed out at the end of the fiscal

year?

Select the correct response:

Appropriations

Vouchers payable.

Reserve for encumbrance

Fund balance

Chapter 3 Solutions

Accounting For Governmental & Nonprofit Entities

Ch. 3 - Prob. 1QCh. 3 - Discuss the different ways in which depreciation...Ch. 3 - Prob. 3QCh. 3 - Prob. 4QCh. 3 - Explain the essential differences between revenues...Ch. 3 - Prob. 6QCh. 3 - How do Budgetary Fund Balance and Fund Balances...Ch. 3 - Prob. 8QCh. 3 - Prob. 9QCh. 3 - Prob. 10Q

Ch. 3 - The city manager of University City is finalizing...Ch. 3 - Prob. 16.1EPCh. 3 - Prob. 16.2EPCh. 3 - Which of the following accounts neither increases...Ch. 3 - Prob. 16.4EPCh. 3 - Which of the following statements is true for...Ch. 3 - An internal allocation of funds on a periodic...Ch. 3 - Prob. 16.7EPCh. 3 - Prob. 16.8EPCh. 3 - Before placing a purchase order, a department...Ch. 3 - Prob. 16.10EPCh. 3 - Which of the following is correct concerning the...Ch. 3 - Prob. 16.12EPCh. 3 - Prob. 16.13EPCh. 3 - Prob. 16.14EPCh. 3 - Supplies ordered by the Public Works function of...Ch. 3 - Prob. 17EPCh. 3 - Prob. 18EPCh. 3 - Prob. 19EPCh. 3 - The following information is provided about the...Ch. 3 - On February 15, the Town of Evergreen police...Ch. 3 - The Town of Willingdon adopted the following...Ch. 3 - During July, the first month of the fiscal year,...Ch. 3 - The Town of Bedford Falls approved a General Fund...Ch. 3 - The printout of the Revenues and Appropriations...Ch. 3 - Review the computer-generated budgetary comparison...Ch. 3 - Prob. 27EPCh. 3 - Greenville has provided the following information...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A local government has the following transactions during the current fiscal period. Prepare journal entries without dollar amounts, first for fund financial statements and then for government-wide financial statements.a. The budget for the police department, ambulance service, and other ongoing activities is passed. Funding is from property taxes, transfers, and bond proceeds. All monetary outflows will be for expenses and fixed assets. A deficit is projected.b. A bond is issued at face value to fund the construction of a new municipal building. c. A computer is ordered for the tax department.d. The computer is received.e. The invoice for the computer is paid.f. The city council agrees to transfer money from the general fund as partial payment for a special assessments project but has not yet done so. The city will be secondarily liable for any money borrowed for this work.g. The city council creates a motor pool to service all government vehicles.…arrow_forwardThe City of Jonesboro engaged in the following transactions during the fiscal year ended September 30, 2018. Record the following transactions related to interfund transfers. Be sure to indicate in which fund the entry is being made. a. The city transferred $400,000 from the general fund to a debt service fund to make the interest payments due during the fiscal year. The payments due during the fiscal year were paid. The city also transferred $200,000 from the general fund to a debt service fund to advance-fund the $200,000 interest payment due October 15, 2019. b. The city transferred $75,000 from the Air Operations Special Revenue Fund to the general fund to close out the operations of that fund. c. The city transferred $150,000 from the general fund to the city’s Electric Utility Enterprise Fund to pay for the utilities used by the general and administrative offices during the year. d. The city transferred the required pension contribution of $2 million from the general fund to the…arrow_forwardControl account is a summary account whose balance is equal to the total of the individual balances of its subsidiary accounts. a. True b. False In approving the budget of the City of Troy, the city council appropriated an amount less than expected revenues, what will be the result of this action a. An increase in outstanding encumbrances by the of the fiscal year b. A necessity for compensatory offsetting action in the debt service fund c. A debit to budgetary fund balance d. A credit to budgetary fund balancearrow_forward

- Prepare journal entries in general journal format to record the following transactions for the City of Dallas General Fund (subsidiary detail may be omitted) 1. The budget prepared for the fiscal year included total estimated revenues of $4,693,000, appropriations of $4,686,000 and estimated other financing uses of $225,000. 2. Purchase orders in the amount of $451,000 were mailed to vendors. 3. The current year’s tax levy of $4,005,000 was recorded; uncollectible taxes were estimated to be 2% of the tax levy. 4. Collections of delinquent taxes from prior years’ levies totaled $82,700; collections of the current year’s levy totaled $3,524,900. 5. Invoices were received and approved for payment for items ordered in documents recorded as encumbrances in transaction (#2) of this problem. The estimated liability for the related items was $351,200. Actual invoices were $353,500. 6. Revenue other than taxes collected during the year consisted of licenses and permits, $177,600;…arrow_forward1. Assume that the City of Juneau maintains its books and records to facilitate the preparation of its fund financial statements. The City pays its employees bi-weekly on Friday. The fiscal year ended on Wednesday, June 30. Employees had been paid on Friday, June 25. The employees paid from the General Fund had earned $120,000 on Monday, Tuesday, and Wednesday (June 28, 29, and 30). What entry, if any, should be made in the City s General Fund? a. Debit Expenditures; Credit Wages and Salaries Payable. b. Debit Expenses; Credit Wages and Salaries Payable. c. Debit Expenditures; Credit Encumbrances. d. No entry is required.arrow_forwardThe Budget Committee of the Department of Vehicles Licensing (DVL) put together the estimated revenues, the government subventions, the appropriations and the subsequent expenditures estimates of the department for the year to be presented to the Legislature for approval. The accrual, modified accrual and cash basis of accounting are used to recognize revenues of the department depending on the type of revenue. The accrual basis is applied on inspection fee for identified existing vehicles at the beginning of the year, unless there is any justification for the non-licensing of any such vehicle by the owner. Revenue is recognized for new vehicles as and when registered. Revenue is recognized for both new and old licenses as and when issued and renewed respectively. The following is a section of the transactions of the Department for the year 2012: Parliament approved an annual inspection fee of GH₵350 per existing vehicle, GH₵2650 for any new vehicle to be registered, GH ₵190 for…arrow_forward

- During the current year, the City of Hickory Hills issued purchase orders to various vendors in the amounts shown for the following functions of the city: General Government $ 171,200 Public Safety 309,000 Public Works 231,400 Culture and Recreation 188,700 Health and Welfare 175,100 Miscellaneous 25,300 Total $ 1,100,700 All goods ordered during the year were received at the following actual costs: General Government $ 166,800 Public Safety 308,700 Public Works 233,800 Culture and Recreation 188,700 Health and Welfare 178,300 Miscellaneous 27,000 Total $ 1,103,300 Required a.&b. Prepare journal entries in the General Fund general journal to record the issuance of purchase orders and to record the receipt of and payment for goods during the year. Also show subsidiary detail for the Encumbrances and Expenditures ledgers. (If no entry is required for a…arrow_forwardA government health care district incorporates its budget in its accounting system and encumbers all purchase orders and contracts. Prior to the start of the year, the governing board adopted a budget in which agency revenues were estimated at $5,600 and expenditures of $5,550 were appropriated. During the year, the following transactions incurred: the government health care district collected $5,500 in fees, grants, taxes, and other revenues It ordered goods and services for $3,000. it received and paid for $2,800 of goods and services that had been previously encumbered. It expects to receive the remaining $200 in the following year. It incurred $2500 in other expenditures for goods and services that had not been encumbered. What is total fund balance at year end? $500 $300 $200 None of abovearrow_forwardDuring the current year, the City of Hickory Hills issued purchase orders to various vendors in the amounts shown for the following functions of the city: General Government $ 172,200 Public Safety 310,000 Public Works 232,400 Culture and Recreation 189,700 Health and Welfare 176,100 Miscellaneous 25,400 Total $ 1,105,800 All goods ordered during the year were received at the following actual costs: General Government $ 167,800 Public Safety 309,700 Public Works 234,800 Culture and Recreation 189,700 Health and Welfare 179,300 Miscellaneous 27,200 Total $ 1,108,500 Required a.&b. Prepare journal entries in the General Fund general journal to record the issuance of purchase orders and to record the receipt of and payment for goods during the year. Also show subsidiary detail for the Encumbrances and Expenditures ledgers. (If noarrow_forward

- The following information has been provided for the City of Elizabeth for its fiscal year ended June 30. The information provided relates to financial information reported on the city's statement of net position and its total governmental funds balance. Deferred inflows of resources due to unavailability of resources to pay current expenditures Capital assets Accumulated depreciation on capital assets Accrued interest on bonds and long-term notes payable Bonds and long-term notes payable Unamortized premium on bonds payable Compensated absences Total governmental fund balances Total net position of governmental activities Required 5364,608 641,600 356,000 2,908 177,608 2,400 16,708 162,808 612,600 Prepare reconciliation of the governmental fund balances to the net position of governmental activities. (Decreases should be indicated with a minus sign.) CITY OF ELIZABETH Reconciliation of the Balance Sheet-Governmental Funds to the Statement of Net Position Total fund balances…arrow_forwardA city issues a 60-day tax anticipation note to fund operations until taxes have been collected. What recording should it make? Choose the correct.a. The liability should be reported in the government-wide financial statements; an other financing source should be shown in the fund financial statements.b. A liability should be reported in the government-wide financial statements and in the fund financial statements.c. An other financing source should be shown in the government-wide financial statements and in the fund financial statements.d. An other financing source should be shown in the government-wide financial statements; a liability is reported in the fund financial statements.arrow_forwardAssume that the County of Katerah maintains its books and records in a manner that facilitates preparation of the fund financial statements. The county formally integrates the budget into the accounting system and uses the encumbrance system. All appropriations lapse at year-end. At the beginning of the fiscal year, the county had the following balances in its accounts. All amounts are in thousands. Prepare the necessary entries for the current fiscal year. Cash $200 Fund balance unassigned 50 Reserve for encumbrances (committed or assigned) 150 (a) The county made the appropriate entry to restore the prior-year purchase commitments. (b) The county board approved a budget with revenues estimated to be $800 and expenditures of $750. (c) The county received the items that had been ordered in the prior year at an actual cost of $135. (d) The county ordered supplies at an estimated cost of $50 and equipment at an estimated cost of $70. (e) The county incurred salaries and other operating…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

Responsibility Accounting| Responsibility Centers and Segments| US CMA Part 1| US CMA course; Master Budget and Responsibility Accounting-Intro to Managerial Accounting- Su. 2013-Prof. Gershberg; Author: Mera Skill; Rutgers Accounting Web;https://www.youtube.com/watch?v=SYQ4u1BP24g;License: Standard YouTube License, CC-BY