Concept explainers

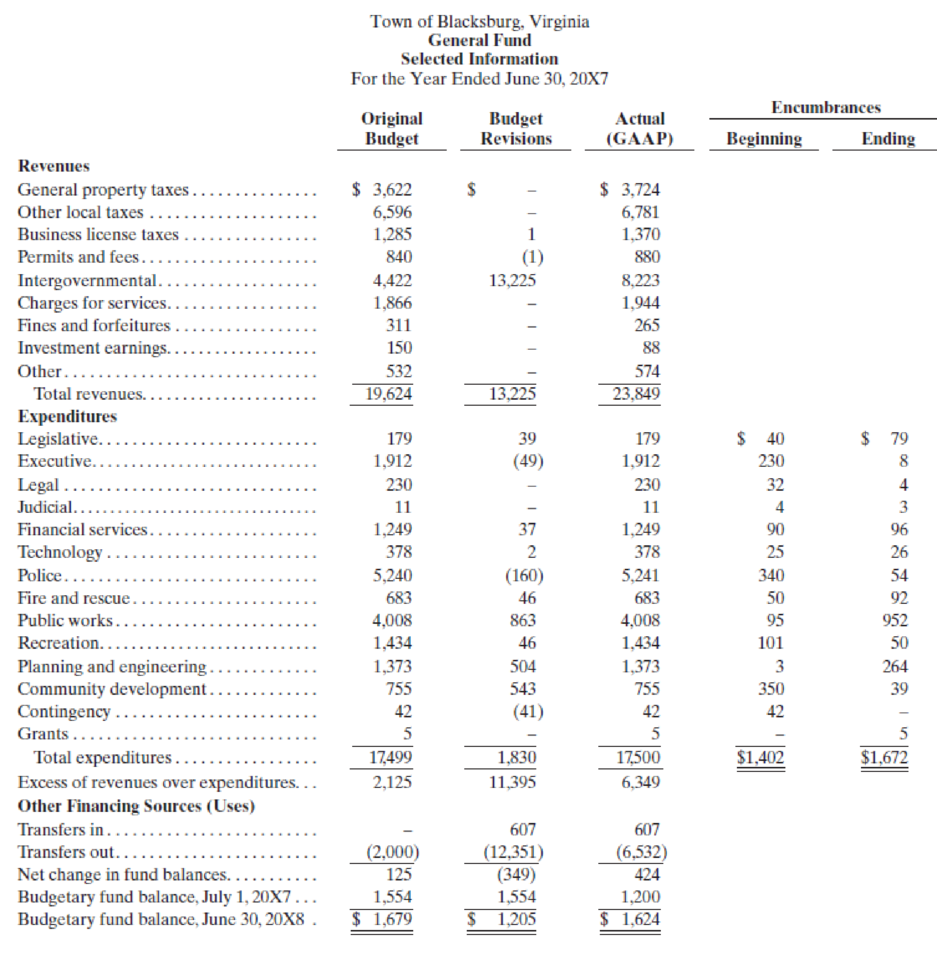

(Budgetary Comparison Statement—Budgetary Basis Differs from GAAP—Town of Blacksburg, Virginia) Selected data for the Town of Blacksburg, Virginia, General Fund for the fiscal year ended June 30, 20X7, are presented here. The town's budgetary basis is the modified accrual basis except that encumbrances are treated as budgetary expenditures when the encumbrance is established, not when the goods or services are received.

Prepare the Statement of Revenues, Expenditures, and Changes in Fund Balance—Budget and Actual for the General Fund of the Town of Blacksburg, Virginia, for the year ended June 30, 20X7. (Note: This case is based on a recent Comprehensive Annual Financial Report of the Town of Blacksburg, Virginia.)

Want to see the full answer?

Check out a sample textbook solution

Chapter 3 Solutions

Governmental and Nonprofit Accounting (11th Edition)

Additional Business Textbook Solutions

Auditing And Assurance Services

Intermediate Accounting

Managerial Accounting: Tools for Business Decision Making

Financial Accounting (11th Edition)

Horngren's Accounting (11th Edition)

Accounting For Governmental & Nonprofit Entities

- In approving the budget of the City of Troy, the city council appropriated an amount less than expected revenues, what will be the result of this action .a An increase in outstanding encumbrances by the of the fiscal year .b A credit to budgetary fund balance .C A debit to budgetary fund balance .d A necessity for compensatory offsetting action in the debt service fundarrow_forwardThe City of South Pittsburgh maintains its books so as to prepare fund accounting statements and records worksheet adjustments in order to prepare government-wide statements. You are to prepare, in journal form, worksheet adjustments for each of the following situations: 1. Deferred inflows of resources-property taxes of $69,400 at the end of the previous fiscal year were recognized as property tax revenue in the current yearAc€?cs Statement of Revenues, Expenditures, and Changes in Fund Balance. 2. The City levied property taxes for the current fiscal year in the amount of $10,000,000. When making the entries, it was estimated that 2 percent of the taxes would not be collected. At year-end, $600,000 of the taxes had not been collected. It was estimated that $320,000 of that amount would be collected during the 60-day period after the end of the fiscal year and that $80,000 would be collected after that time. The City had recognized the maximum of property taxes allowable under…arrow_forwardThe City of South Pittsburgh maintains its books so as to prepare fund accounting statements and records worksheet adjustments in order to prepare government-wide statements. You are to prepare, in journal form, worksheet adjustments for each of the following situations: 1. Deferred inflows of resources-property taxes of $69,400 at the end of the previous fiscal year were recognized as property tax revenue in the current yearAc€?cs Statement of Revenues, Expenditures, and Changes in Fund Balance. 2. The City levied property taxes for the current fiscal year in the amount of $10,000,000. When making the entries, it was estimated that 2 percent of the taxes would not be collected. At year-end, $600,000 of the taxes had not been collected. It was estimated that $320,000 of that amount would be collected during the 60-day period after the end of the fiscal year and that $80,000 would be collected after that time. The City had recognized the maximum of property taxes allowable under…arrow_forward

- Greenville has provided the following Information from its General Fund Revenues and Appropriations/Expenditure/Encumbrances subsidiary ledgers for the fiscal year ended. Assume the beginning fund balances are $149 (in thousands) and that the budget was not amended during the year. City of Greenville General Fund Subsidiary Ledger Account Balances (in thousands) Estimated Revenue Taxes For the Fiscal Year Fines & Forfeits Intergovernmental Revenue Charges for Services Revenues Debits 6,048 303 497 370 Credits Taxes Fines & Forfeits Intergovernmental Revenue Charges for Services Appropriations Public Safety General Government 6,080 308 497 368 1,636 3,375 Public Works Culture & Recreation Interfund Transfers Out Expenditures General Government 1,465 724 Estimated Other Financing Uses 48. 1,622 Public Safety 3,360 Public Works 1,443 Culture & Recreation 715 Encumbrances General Government 12 I Public Safety 13 Public Works 21 232 Culture & Recreation 0 Other Financing Uses Interfund…arrow_forwardPrepare journal entries in general journal format to record the following transactions for the City of Dallas General Fund (subsidiary detail may be omitted) 1. The budget prepared for the fiscal year included total estimated revenues of $4,693,000, appropriations of $4,686,000 and estimated other financing uses of $225,000. 2. Purchase orders in the amount of $451,000 were mailed to vendors. 3. The current year’s tax levy of $4,005,000 was recorded; uncollectible taxes were estimated to be 2% of the tax levy. 4. Collections of delinquent taxes from prior years’ levies totaled $82,700; collections of the current year’s levy totaled $3,524,900. 5. Invoices were received and approved for payment for items ordered in documents recorded as encumbrances in transaction (#2) of this problem. The estimated liability for the related items was $351,200. Actual invoices were $353,500. 6. Revenue other than taxes collected during the year consisted of licenses and permits, $177,600;…arrow_forwardAssume that the City of Pasco maintains its books and records in a manner that facilitates preparation of the fund financial statements. The city engaged in the following transactions related to its general fund during the current fiscal year. The city formally integrates the budget into the accounting records. The city does not maintain an inventory of supplies. All amounts are in thousands. Prepare, in summary form, the appropriate journal entries. (a) The city council approved a budget with revenues estimated to be $800 and expenditures of $785. (b) The city ordered supplies at an estimated cost of $25 and equipment at an estimated cost of $20. (c) The city incurred salaries and other operating expenses during the year totaling $730. The city paid for these items in cash. (d) The city received the supplies at an actual cost of $23. (e) The city collected revenues of $795.arrow_forward

- The following information is provided about some of the Town of Truesdale’s General Fund operating statement and budgetary accounts for the fiscal year ended June 30. Estimated revenues $ 3,150,000 Revenues 3,190,000 Appropriations 3,185,000 Expenditures 3,175,000 Estimated other financing sources 400,000 Encumbrances 20,000 Encumbrances outstanding 20,000 Budgetary fund balance (calculate) The Town of Truesdale will honor all of its outstanding encumbrances in the next fiscal period. Prepare the journal entry(ies) to close budgetary accounts required to be closed at the fiscal year end using the information provided.arrow_forwardThe following information has been provided for the City of Elizabeth for its fiscal year ended June 30. The information provided relates to financial information reported on the city's statement of net position and its total governmental funds balance. Deferred inflows of resources due to unavailability of resources to pay current expenditures Capital assets Accumulated depreciation on capital assets Accrued interest on bonds and long-term notes payable Bonds and long-term notes payable Unamortized premium on bonds payable Compensated absences Total governmental fund balances Total net position of governmental activities Required 5364,608 641,600 356,000 2,908 177,608 2,400 16,708 162,808 612,600 Prepare reconciliation of the governmental fund balances to the net position of governmental activities. (Decreases should be indicated with a minus sign.) CITY OF ELIZABETH Reconciliation of the Balance Sheet-Governmental Funds to the Statement of Net Position Total fund balances…arrow_forwardsubsidiary ledgers for the fiscal year ended. Assume the beginning fund balances are $140 (in thousands) and that the budget was not amended during the year. Subsidiary Ledger Account Balances (in thousands) For the Fiscal Year Estimated Revenue Taxes Fines & Forfeits City of Greenville General Fund Intergovernmental Revenue Charges for Services Revenues Taxes Fines & Forfeits Intergovernmental Revenue Charges for Services Appropriations General Government Public Safety Public Works Culture & Recreation Estimated Other Financing Uses Interfund Transfers Out Expenditures General Government Public Safety Public Works Culture & Recreation Encumbrances General Government Public Safety Public Works D Culture & Recreation Other Financing Uses Interfund Transfers Out Debits 6,048 303 484 370 1,622 3,347 1,443 703 1 26 10 0 36 Credits 6,054 308 484 368 1,625 3,375 1,454 724 36 Required a. Prepare a General Fund statement of revenues, expenditures, and changes in fund balance. b. Prepare a…arrow_forward

- The following transactions occurred during the 2020 fiscal year for the City of Evergreen. For budgetary purposes, the city reports encumbrances in the Expenditures section of its budgetary comparison schedule for the General Fund but excludes expenditures chargeable to a prior year’s appropriation. The budget prepared for the fiscal year 2020 was as follows: Estimated Revenues: Taxes $ 1,957,000 Licenses and permits 374,000 Intergovernmental revenue 399,000 Miscellaneous revenues 64,000 Total estimated revenues 2,794,000 Appropriations: General government 475,200 Public safety 890,200 Public works 654,200 Health and welfare 604,200 Miscellaneous 88,000 Total appropriations 2,711,800 Budgeted increase in fund balance $ 82,200 Encumbrances issued against the appropriations during the year were as follows: General government $ 60,000 Public safety 252,000 Public works 394,000 Health and…arrow_forwardThe following transactions relate to the general fund of the city of Lost Angels for the year ending December 31, 2020. Prepare a statement of revenues, expenditures, and other changes in fund balance for the general fund for the period to be included in the fund financial statements. Assume that the fund balance at the beginning of the year was $180,000. Assume also that the city applies the purchases method to supplies. Receipt within 60 days serves as the definition of available resources. Collects property tax revenue of $700,000. A remaining assessment of $100,000 will be collected in the subsequent period. Half of that amount should be received within 30 days, and the remainder approximately five months after the end of the year. Spends $200,000 on three new police cars with 10-year lives. The anticipated price was $207,000 when the cars were ordered. The city calculates all depreciation using the straight-line method with no expected residual value. The city applies the…arrow_forwardThe following transactions relate to the general fund of the city of Lost Angels for the year ending December 31, 2020. Prepare a statement of revenues, expenditures, and other changes in fund balance for the general fund for the period to be included in the fund financial statements. Assume that the fund balance at the beginning of the year was $180,000. Assume also that the city applies the purchases method to supplies. Receipt within 60 days serves as the definition of available resources. Collects property tax revenue of $700,000. A remaining assessment of $100,000 will be collected in the subsequent period. Half of that amount should be received within 30 days, and the remainder approximately five months after the end of the year. Spends $200,000 on three new police cars with 10-year lives. The anticipated price was $207,000 when the cars were ordered. The city calculates all depreciation using the straight-line method with no expected residual value. The city applies the…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education