Principles Of Taxation For Business And Investment Planning 2020 Edition

23rd Edition

ISBN: 9781259969546

Author: Sally Jones, Shelley C. Rhoades-Catanach, Sandra R Callaghan

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 14AP

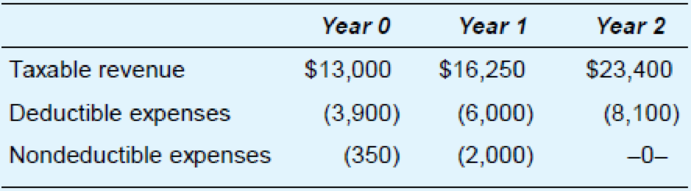

Firm Q is about to engage in a transaction with the following

If the firm’s marginal tax rate over the three-year period is 30 percent and its discount rate is 6 percent, compute the

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

What is the book value of this general accounting question?

Product O?

Need help with this accounting questions

Chapter 3 Solutions

Principles Of Taxation For Business And Investment Planning 2020 Edition

Ch. 3 - Does the NPV of future cash flows increase or...Ch. 3 - Explain the relationship between the degree of...Ch. 3 - Does the after-tax cost of a deductible expense...Ch. 3 - Prob. 4QPDCh. 3 - Prob. 5QPDCh. 3 - Prob. 6QPDCh. 3 - Prob. 7QPDCh. 3 - Which type of tax law provision should be more...Ch. 3 - In the U.S. system of criminal justice, a person...Ch. 3 - Identify two reasons why a firms actual marginal...

Ch. 3 - Prob. 11QPDCh. 3 - Prob. 12QPDCh. 3 - Prob. 1APCh. 3 - Prob. 2APCh. 3 - Prob. 3APCh. 3 - Use a 5 percent discount rate to compute the NPV...Ch. 3 - Consider the following opportunities: Opportunity...Ch. 3 - Prob. 6APCh. 3 - Refer to the income tax rate structure in the...Ch. 3 - Prob. 8APCh. 3 - Company N will receive 100,000 of taxable revenue...Ch. 3 - Prob. 10APCh. 3 - Investor B has 100,000 in an investment paying 9...Ch. 3 - Firm E must choose between two alternative...Ch. 3 - Company J must choose between two alternate...Ch. 3 - Firm Q is about to engage in a transaction with...Ch. 3 - Corporation ABC invested in a project that will...Ch. 3 - Prob. 16APCh. 3 - Investor W has the opportunity to invest 500,000...Ch. 3 - Prob. 18APCh. 3 - Prob. 19APCh. 3 - Prob. 20APCh. 3 - Prob. 21APCh. 3 - Prob. 1IRPCh. 3 - Firm V must choose between two alternative...Ch. 3 - Prob. 3IRPCh. 3 - Refer to the facts in problem 3. Company WB is...Ch. 3 - Prob. 5IRPCh. 3 - Prob. 6IRPCh. 3 - Prob. 7IRPCh. 3 - Prob. 8IRPCh. 3 - Prob. 9IRPCh. 3 - Prob. 1TPCCh. 3 - Firm D is considering investing 400,000 cash in a...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I won't to this question solution general Accountingarrow_forwardGeneral Accounting: Lian has $616,400 in sales. The profit margin is 8.75 percent and the firm has 14,000 shares of stock outstanding. The market price per share is $45.25. What is the price-earnings ratio?arrow_forwardTina Company uses the following formula for annual overhead: $360,000 + $1.20 for each machine hour used. For the upcoming month, Tina plans to manufacture 6,000 units. Each unit requires 2 machine hours. Tina's budgeted overhead for the month is _. Help me tutorarrow_forward

- Give correct solution for this following requirements on these general accounting questionarrow_forwardTina Company uses the following formula for annual overhead: $360,000 + $1.20 for each machine hour used. For the upcoming month, Tina plans to manufacture 6,000 units. Each unit requires 2 machine hours. Tina's budgeted overhead for the month is _. Help me tutor give me answer of this accounting questionarrow_forwardPlease answer the following requirements a. And b. On these financial accounting questionarrow_forward

- Tina Company uses the following formula for annual overhead: $360,000 + $1.20 for each machine hour used. For the upcoming month, Tina plans to manufacture 6,000 units. Each unit requires 2 machine hours. Tina's budgeted overhead for the month is _.arrow_forwardplease Not use ai solution financial accounting questionsarrow_forwardNeed Answer of this Accounting Questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License