Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

I won't to this question solution general Accounting

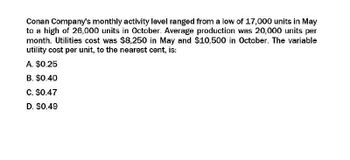

Transcribed Image Text:Conan Company's monthly activity level ranged from a low of 17,000 units in May

to a high of 26,000 units in October. Average production was 20,000 units per

month. Utilities cost was $8,250 in May and $10,500 in October. The variable

utility cost per unit, to the nearest cent, is:

A. $0.25

B. $0.40

C. $0.47

D. $0.49

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- 4. The following monthly data are available for Salalah Company which produces only one product: Selling price per unit, RO 30; Unit variable expenses, RO 15; Total fixed expenses, RO 50,000; Actual sales for the month of July, 10,000 units. How much is the margin of safety for the company for July?arrow_forwardThe following monthly data are available for Sunland Company. which produces only one product: Selling price per unit, $49; Unit variable expenses, $14; Total fixed expenses, $42000; Actual sales for the month of June, 5000 units. How much is the margin of safety for the company for June? A. $84000 B. $1200 C. $186200 D. $42000arrow_forwardPluto Company sold 2,000 units in October at a price of $35 per unit. The variable cost is $20 per unit. The monthly fixed costs are $10,000. Calculate the total contribution margin. What is the operating income earned in October?arrow_forward

- A company sells one of its products for $13.60 per unit. Its fixed costs are $1,056.00 per month, and the variable cost per unit is $4.00. (a) The contribution margin per unit is $ (rounded to the nearest cent). (b) The break-even volume, i.e., the level of output at break-even, is units per month. (c) The profit at a monthly output level of 205 units is $ nearest cent). (rounded to thearrow_forwardThe following monthly data are available for Seasons Company, which produces only one product: Unit selling price, $42; Unit variable expenses, $14; Total fixed expenses, $42,000; Actual sales for the month of June, 4,000 units. What is the company's margin of safety in dollars for June? OA) $105,000 B) $63,000 O C) $70,000 OD) $2,500arrow_forwardThe following monthly data are available for Swifty Corporation. which produces only one product: Selling price per unit, $44; Unit variable expenses, $14; Total fixed expenses, $42000; Actual sales for the month of June, 4000 units. How much is the margin of safety for the company for June? $1400 $42000 $114400 $84000arrow_forward

- Which answer is correct?arrow_forwardA company sells one of the items in its product line for $8.50 each. The variable costs per unit is $4.80, and the associated fixed costs per week are $2,100. If the total revenue is $8,075 per week, then determine each of the following quantities: (1) The weekly level of output, that is the number of items produced and sold, is units. (2) The total variable costs per week are $ (3) The net income per week is $arrow_forwardHamby Company expects to incurarrow_forward

- For a single product being manufactured, the fixed cost F is $9,877 per month and the required profit Pr is $1,832 per month. The selling price P and the variable cost V are constant, and P > V. If the profit increases by 13%, the sales revenue in dollars per month will: A. increase by 2.03% B. decrease by 18.55% C. Increase by 1.30% D. decreease by 87.00%arrow_forwardWhat is the fixed cost per month of these general accounting question?arrow_forwardThe following monthly data are available for Lumberyard Company. which produces only one product: Selling price per unit, $42; Unit variable expenses, $14; Total fixed expenses, $42,000; Actual sales for the month of June, 3,000 units. How much is the margin of safety for the company for June? Group of answer choices $1,500 $42,000 $84,000 $63,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning