Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

please Not use ai solution financial accounting questions

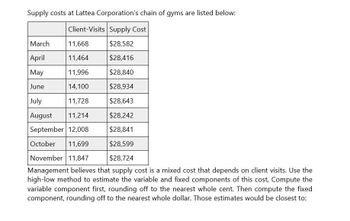

Transcribed Image Text:Supply costs at Lattea Corporation's chain of gyms are listed below:

Client-Visits Supply Cost

March

11,668

$28,582

April

11,464

$28,416

May

11,996

$28,840

June

14,100

$28,934

July

11,728

$28,643

August

11,214

$28,242

September 12,008

$28,841

October 11,699

$28,599

November 11,847

$28,724

Management believes that supply cost is a mixed cost that depends on client visits. Use the

high-low method to estimate the variable and fixed components of this cost, Compute the

variable component first, rounding off to the nearest whole cent. Then compute the fixed

component, rounding off to the nearest whole dollar. Those estimates would be closest to:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Supply costs at Coulthard Corporation's chain of gyms are listed below: Client-Visits Supply Cost March 12,855 $ 23,598 April 12,283 $ 23,278 May 13,104 $ 23,742 June 12,850 $ 23,607 July 12,493 $ 23,415 August 12,794 $ 23,562 September 12,686 $ 23,496 October 12,765 $ 23,541 November 13,018 $ 23,687 Management believes that supply cost is a mixed cost that depends on client-visits. Use the high-low method to estimate the variable and fixed components of this cost. Compute the variable component first, rounding off to the nearest whole cent. Then compute the fixed component, rounding off to the nearest whole dollar. Those estimates are closest to: (Round your intermediate calculations to 2 decimal places.) Multiple Choice $1.85 per client-visit; $23,547 per month $1.77 per client-visit; $557 per month $0.57 per client-visit; $16,273 per month $0.55 per client-visit; $16,579 per montharrow_forwardIvanhoe Company makes three models of tasers. Information on the three products is given below. Tingler Shocker Stunner Sales $296,000 $504,000 $200,000 Variable expenses 151,100 203,300 138,600 Contribution margin 144,900 300,700 61,400 Fixed expenses 116,616 228,184 93,900 Net income $28,284 $72,516 $(32,500) Fixed expenses consist of $296,000 of common costs allocated to the three products based on relative sales, as well as direct fixed expenses unique to each model of $29,000 (Tingler), $79,000 (Shocker), and $34,700 (Stunner). The common costs will be incurred regardless of how many models are produced. The direct fixed expenses would be eliminated if that model is phased out.James Watt, an executive with the company, feels the Stunner line should be discontinued to increase the company’s net income.(a)Compute current net income for Ivanhoe Company. Net income $ (b)Compute net income by product line…arrow_forwardHaresharrow_forward

- Sviarrow_forwardCullumber Company makes three models of tasers. Information on the three products is given below. Sales Variable expenses Contribution margin Fixed expenses Net income (a) Net income $ (b) Shocker Net Income Tingler $300,000 $500,000 Tingler Net Income $ Total Net Income (c) Why or why not? Compute current net income for Cullumber Company. ta Net income would 151,400 148,600 $ 119,400 S $29,200 Fixed expenses consist of $298,000 of common costs allocated to the three products based on relative sales, as well as direct fixed expenses unique to each model of $30,000 (Tingler), $80,800 (Shocker), and $34,300 (Stunner). The common costs will be incurred regardless of how many models are produced. The direct fixed expenses would be eliminated if that model is phased out. James Watt, an executive with the company, feels the Stunner line should be discontinued to increase the company's net income. Shocker 197,000 303,000 229,800 $73,200 Compute net income by product line and in total for…arrow_forwardQuestion 2: Bed and Bath, a retailing company has two departments, Hardware and Linens. The company's most recent monthly contribution format income statement is given below: Department Total Hardware Linens Sales $40,00,000 $30,00,000 $10,00,000 Variable expenses 13,00,000 9,00,000 4,00,000 Contribution Margin Fixed expenses 21,00,000 14,00,000 $700,000 600,000 27,00,000 22,00,000 $5,00,000 800,000 ($200,000) Net Operating Income A study indicates that, $340,000 of the fixed expenses charged to Lines are sunk costs or allocated cost that will continue to incur even if the Linens department is dropped. In addition, the elimination of the Lines department will result in a 10% increase in the sales of the Hardware department. Required : If the Linens Department is dropped, what will be the effect on the net operating income of the company as a whole?[arrow_forward

- Lucido Products markets two computer games: Clalmjumper and Makeover. A contribution format Income statement for a recent month for the two games appears below: Claimjumper $ 116,000 35,800 $ 8e, 200 Makeover $ 58,000 7,700 $ 50, 300 Total $ 174,809 43,5ee 130, see Sales Variable expenses Contribution margin 88,425 $ 42,075 Fixed expenses Net operating income Required: 1. What is the overall contribution margin (CM) ratio for the company? 2 What Is the company's overall break-even polnt in dollar sales? 3. Prepare a contribution format Income statement at the company's break-even polnt that shows the appropriate levels of sales for the two products. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 What is the company's overall break-even point in dollar sales? (Do not round intermediate calculations.) Overall break-even pointarrow_forwardABC Company has an ABC system with three pools: Total cost in cost pool Total $13,000 Activity Product X Machine setups Customer service Maintenance Cost Driver Product Y #setups #orders machine- hours $6,000 $10,000 Compute total capacity costs allocated to product X. Group of answer choices $29,000 $9,000 $18,500 $5,000 not enough information Activity volume (#cost driver units) 45 15 25 20 65 5 20 25 50arrow_forwardes Lucido Products markets two computer games: Claimjumper and Makeover. A contribution format income statement for a recent month for the two games appears below: Sales Variable expenses Contribution margin Fixed expenses Net operating income Claimjumper $ 76,500 51,000 $ 25,500 Makeover $ 178,500 127,500 $ 51,000 Total $ 255,000 178,500 76,500 61,200 $ 15,300 Required: 1. What is the overall contribution margin (CM) ratio for the company? 2. What is the company's overall break-even point in dollar sales? 3. Prepare a contribution format income statement at the company's break-even point that shows the appropriate levels of sales for the two products.arrow_forward

- Cawley Company makes three models of tasers. Information on the three products is given below.arrow_forwardLucido Products markets two computer games: Claimjumper and Makeover. A contribution format income statement for a recent month for the two games appears below: Sales Variable expenses Contribution margin Fixed expenses Net operating income Claimjumper $ 106,000 26,440 $ 79,560 Makeover $ 53,000 5,360 $ 47,640 Total $ 159,000 31,800 127,200 94,080 $ 33,120 Required: 1. What is the overall contribution margin (CM) ratio for the company? 2. What is the company's overall break-even point in dollar sales? 3. Prepare a contribution format income statement at the company's break-even point that shows the appropriate levels of sales for the two products.arrow_forwardH1 . Accountarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub