Financial and Managerial Accounting - CengageNow

15th Edition

ISBN: 9781337911979

Author: WARREN

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 23, Problem 2E

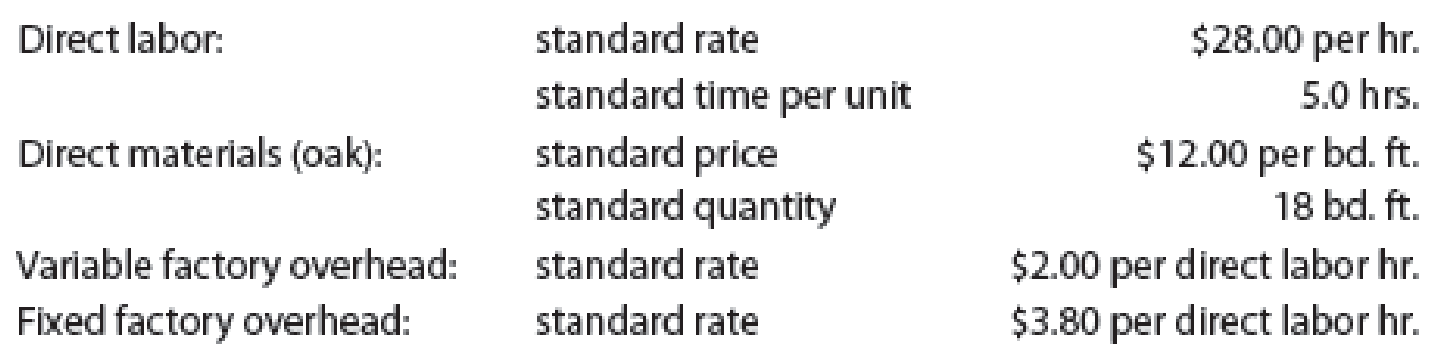

Atlas Furniture Company manufactures designer home furniture. Atlas uses a

- a. Determine the standard cost per dining room table.

- b. Why would Atlas Furniture Company use a standard cost system?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Choose the most likely used costing system for the industries listed below. choose either process costing or job order costing

A costing system used by a chemical manufacturer

Drag answer here

A costing system used by a tire manufacturer

Drag answer here

A costing system used by a food processing company

Drag answer here

A costing system used by an architectural firm

Drag answer here

A costing system used by a custom home builder

Drag answer here

A costing system used by a manufacturer of custom furniture

In a furniture company producing tables and chairs made of wood, which of the following would be considered fixed costs?

Group of answer choices

Wood materials

Nails and adhesives

Paints and thinners

Supervisor’s salaries

1. One of the products Al-Can Products, Inc. manufactures for their rest stops are benches. Perform the

following tasks to classify and record common manufacturing costs.

2. The production of the rest stop benches requires the following costs. For each cost, determine how the

cost should be classified by placing an X in the appropriate column.

Wages of factory supervisor

Rent of company headquarters

Lumber to manufacture benches

Factory property taxes

Bench inspector wages

Wages for the marketing manager

Cleaning supplies to maintain equipment

Wages of production employees

Stain for the benches

Direct

Materials

Direct Factory

Labor Overhead

None

Chapter 23 Solutions

Financial and Managerial Accounting - CengageNow

Ch. 23 - What are the basic objectives in the use of...Ch. 23 - What is meant by reporting by the principle of...Ch. 23 - Prob. 3DQCh. 23 - Prob. 4DQCh. 23 - A. What are the two variances between the actual...Ch. 23 - A new assistant controller recently was heard to...Ch. 23 - Would the use of standards be appropriate in a...Ch. 23 - Prob. 8DQCh. 23 - At the end of the period, the factory overhead...Ch. 23 - If variances are recorded in the accounts at the...

Ch. 23 - Direct materials variances Bellingham Company...Ch. 23 - Direct labor variances Bellingham Company produces...Ch. 23 - Factory overhead controllable variance Bellingham...Ch. 23 - Factory overhead volume variance Bellingham...Ch. 23 - Standard cost journal entries Bellingham Company...Ch. 23 - Income statement with variances Prepare an income...Ch. 23 - Crazy Delicious Inc. produces chocolate bars. The...Ch. 23 - Atlas Furniture Company manufactures designer home...Ch. 23 - Salisbury Bottle Company manufactures plastic...Ch. 23 - The following data relate to the direct materials...Ch. 23 - De Soto Inc. produces tablet computers. The...Ch. 23 - Standard direct materials cost per unit from...Ch. 23 - H.J. Heinz Company uses standards to control its...Ch. 23 - Direct labor variances The following data relate...Ch. 23 - Glacier Bicycle Company manufactures commuter...Ch. 23 - Ada Clothes Company produced 40,000 units during...Ch. 23 - Mexicali On the Go Inc. owns and operates food...Ch. 23 - Direct materials and direct labor variances At the...Ch. 23 - Flexible overhead budget Leno Manufacturing...Ch. 23 - Flexible overhead budget Wiki Wiki Company has...Ch. 23 - Factory overhead cost variances The following data...Ch. 23 - Thomas Textiles Corporation began November with a...Ch. 23 - Prob. 17ECh. 23 - Factory overhead cost variance report Tannin...Ch. 23 - Recording standards in accounts Cioffi...Ch. 23 - Prob. 20ECh. 23 - Income statement indicating standard cost...Ch. 23 - Rockport Industries Inc. gathered the following...Ch. 23 - Dickinsen Company gathered the following data for...Ch. 23 - Rosenberry Company computed the following revenue...Ch. 23 - Lowell Manufacturing Inc. has a normal selling...Ch. 23 - Shasta Fixture Company manufactures faucets in a...Ch. 23 - Flexible budgeting and variance analysis I Love My...Ch. 23 - Direct materials, direct labor, and factory...Ch. 23 - Factory overhead cost variance report Tiger...Ch. 23 - CodeHead Software Inc. does software development....Ch. 23 - Direct materials and direct labor variance...Ch. 23 - Flexible budgeting and variance analysis Im Really...Ch. 23 - Direct materials, direct labor, and factory...Ch. 23 - Factory overhead cost variance report Feeling...Ch. 23 - Prob. 5PBCh. 23 - Prob. 1COMPCh. 23 - Advent Software uses standards to manage the cost...Ch. 23 - Admissions time variance Valley Hospital began...Ch. 23 - United States Postal Service: Mail sorting time...Ch. 23 - Direct labor time variance Maywood City Police...Ch. 23 - Ethics in action Dash Riprock is a cost analyst...Ch. 23 - Variance interpretation Vanadium Audio Inc. is a...Ch. 23 - MinnOil performs oil changes and other minor...Ch. 23 - Prob. 2CMACh. 23 - Frisco Company recently purchased 108,000 units of...Ch. 23 - JoyT Company manufactures Maxi Dolls for sale in...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Stetson Manufacturing builds custom wooden cabinets. Classify the following items as a) what category of product costs and b) whether the item is a prime or conversion cost. Product Costs Prime\Conversion Cost Cost of Hardware (Slides, Handles, etc.) Cost of Wood Depreciation on Production Equipment Factory Property Taxes Factory Rent Glue Production Supervisor Salary Utilities for Factory Wages for Maintenance Workers Wages of Assembly Workers Wages of Finishing Workersarrow_forwardGreen Furniture (GF) manufactures a variety of furniture for household use and just two items for office use: desks and cabinets. The production process for desks and cabinets is similar, although machines must be retooled for each product. Both materials and labour costs are directly traceable to individual products; however, overhead is a common cost and allocated using direct labour-hours as the allocation base. GF's accountant is considering the use of activity-based costing (ABC) and has suggested evaluating the system by applying it to the two office use products (desks and cabinets). The following data are available for a typical quarter. Activity Cost Pool Parts receipts Machining Assembly Quality control Direct materials Direct labour Total manufacturing cost Cost per unit Activity Base Number of parts Machine-hours Units produced Units tested Total manufacturing cost Cost per unit $ $ Desks 26,735 $ 23.25 $ Cabinets Desks 28,275 17.67 Activity Rate $1.00 per part $11.00 per…arrow_forwardWhich of the following would be most likely to use process costing? Oa. lawn fertilizer manufacturer Ob. auto body repair shop Oc. law firm Od. custom furniture manufacturerarrow_forward

- Identify each of the following costs as either direct materials (DM), direct labor (DL), or factory overhead(FO). The company manufactures tennis balls. Cans to package the balls.arrow_forwardCape Cod Shirt Shop manufactures T-shirts and decorates them with custom designs for retail sale on the premises. Several costs incurred by the company are listed below. For each cost, indicate which of the following classifications best describe the cost. More than one classification may apply to the same cost item. Cost Classifications Variable Fixed Period Product Administrative Selling Manufacturing Research and Development Direct material Direct labor Manufacturing overhead Cost Items: Cost of fabric used in T-shirts Wages of shirtmakers Cost of new sign in front of retail T-shirt shop Wages of employee who repairs the firms sewing machines Cost of electricity used in the sewing department Wages of T-shirt designers and painters Wages of sales personnel Depreciation on sewing machines Rent on the building that is used to make and paint T-shirts Cost of daily advertisements in local media Wages of designers who experiment with new fabrics, paints and T-shirt designs Cost of…arrow_forwardA. How much overhead will be assigned to each product if these three cost drivers are used to allocate overhead? What is the total cost per unit produced for each product? B. How much overhead will be assigned to each product if direct labor cost is used to allocate overhead? What is the total cost per unit produced for each product?arrow_forward

- The following figure depicts the complete system that Office Inc. uses to estimate the total cost of each office desk and office chair that it produces. How many cost pools does Office Inc.'s 2-stage costing system use for Office Chair objects? A. 7 B. 0 C. 6 D. 5 E. 4 F. 2 G. 1 H. 3 I. 8arrow_forwardCape Cod Shirt Shop manufactures T-shirts and decorates them with custom designs for retail sale on the premises. Several costs incurred by the company are listed below. For each cost, indicate which of the following classifications best describe the cost. More than one classification may apply to the same cost item. For purposes of classifying costs as fixed or variable, assess cost behavior relative to the output quantity of finished T-shirts. (If your answer is "No" leave the cells blank.) Cost Items Variable or Fixed? Period or Product? Administrative? Selling? Manufacturing? Research and Development? Direct material, Direct labor, or Manufacturing overhead? 1. Cost of fabric used in T-shirts. 2. Wages of shirtmakers. 3. Cost of new sign in front of retail T-shirt shop. 4. Wages of the employee who repairs the firm’s sewing machines. 5.…arrow_forwardCape Cod Shirt Shop manufactures T-shirts and decorates them with custom designs for retail sale on the premises. Several costs incurred by the company are listed below. For each cost, indicate which of the following classifications best describe the cost. More than one classification may apply to the same cost item. For purposes of classifying costs as fixed or variable, assess cost behavior relative to the output quantity of finished T-shirts. (If your answer is "No" leave the cells blank.) Cost Items 1. Cost of fabric used in T-shirts. 2. Wages of shirtmakers. 3. Cost of new sign in front of retail T-shirt shop. 4. Wages of the employee who repairs the firm's sewing machines. 5. Cost of electricity used in the sewing department. 6. Wages of T-shirt designers and painters. 7. Wages of sales personnel. 8. Depreciation on sewing machines. 9. Rent on the building. Part of the building's first floor is used to make and paint T-shirts. Part of it is used for the retail sales shop. The…arrow_forward

- A furniture shop has enumerated the following cost determine the classification of the following according to Function (Manufacturing or Non Manufacturing), Traceability (Direct or Indirect ) and Timing Recognition( Product or Period). According to Function Traceability Timing of Recog Plywood Nails Taxes & Licenses Machine Operator Quality Controller Insurancearrow_forwardCentral Perk, LLC, a manufacturer of coffee beans, is considering switching its operations to an Activity Based Costing system. The following manufacturing overhead activities and cost drivers have been identified: Activity. Machine setup Machine assembly Product inspection Product movement General factory Cost Driver Number of machine setups Machine hours logged Inspection hours logged Number of moves Machine hours logged Based on the above descriptions, which of the following correctly pairs the activity with its appropriate cost level? O A. Product Inspection... batch level cost OB. Product Movement... facility level cost O C. Machine Assembly... unit level cost O D. General Factory... batch level cost O E. Machine Setup... unit level costarrow_forwardWheels, Inc. manufactures wheels for bicycles, tricycles, and scooters. For each cost given below, determine if the cost is a product cost or a period cost. If the cost is a product cost, further determine if the cost is direct materials (DM), direct labor (DL), or manufacturing overhead (MOH) and then determine if the product cost is a prime cost, conversion cost, or both. If the cost is a period cost, further determine if the cost is a selling expense or administrative expense (Admin). Cost (a) is answered as a guide. (If an answer does not apply, leave the box blank.) Product Product Period Cost DM DL MOH Prime Conversion Selling Admin. a. Metal used for rims X X b. Sales salaries c. Rent on factory d. Wages of assembly workers e. Salary…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cost control, Why cost control is necessary for a business?; Author: Educationleaves;https://www.youtube.com/watch?v=yMg3gJx48Fg;License: Standard youtube license