Financial and Managerial Accounting - CengageNow

15th Edition

ISBN: 9781337911979

Author: WARREN

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 23, Problem 4MAD

Direct labor time variance

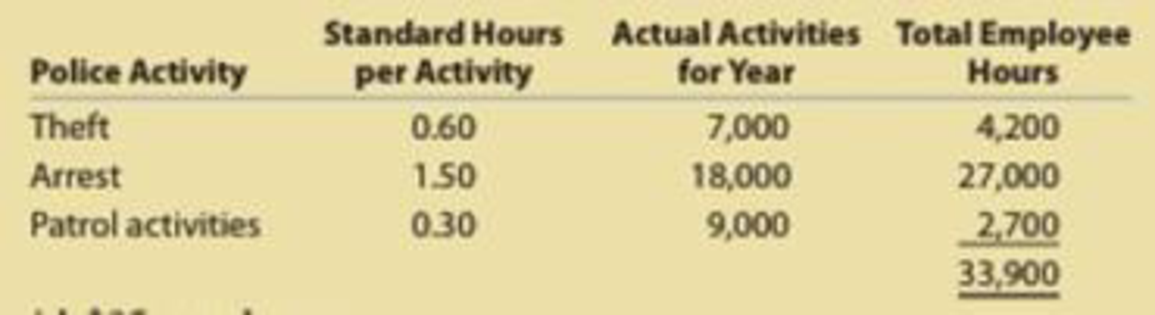

Maywood City Police uses

The police are paid $25 per hour.

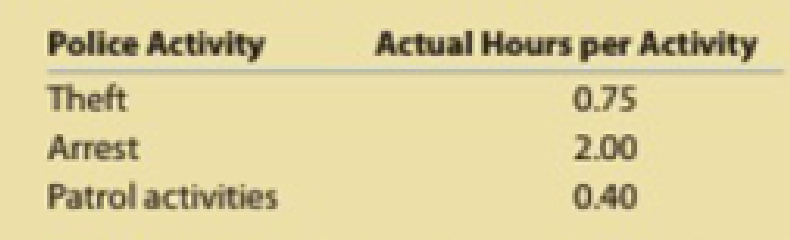

The actual amount of hours per activity for the year were as follows:

- A. Determine the total budgeted cost to perform the three police activities.

- B. Determine the total actual cost to perform the three police activities.

- C. Determine the direct labor time variance.

- D. What does the time variance suggest?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Pease Contractors is a local home remodeling company. In analyzing financial performance, the accountant compares actual results with a flexible budget. The standard direct labor rates used in the flexible budget are established each year at the time the annual plan is formulated and held constant for the entire year.

The standard direct labor rates in effect for the current fiscal year and the standard hours allowed for the actual output of work for August are shown in the following schedule.

Worker Classification

Standard Direct Labor Rate per Hour

Standard Direct Labor-Hours Allowed for Output

Supervisor

$ 50

1,800

Skilled

30

2,250

General

20

4,950

The actual direct labor-hours worked and the actual direct labor rates per hour experienced for the month of August were as follows.

Worker Classification

Actual Direct Labor Rate per Hour

Actual Direct Labor-Hours

Supervisor

$ 54

2,112

Skilled

32

2,112

General

18

5,376

Required:

Calculate the dollar…

Pease Contractors is a local home remodeling company. In analyzing financial performance, the accountant compares actual results with a flexible budget. The standard direct labor rates used in the flexible budget are established each year at the time the annual plan is formulated and held constant for the entire year.

The standard direct labor rates in effect for the current fiscal year and the standard hours allowed for the actual output of work for August are shown in the following schedule.

Worker Classification

Standard Direct Labor Rate per Hour

Standard Direct Labor-Hours Allowed for Output

Supervisor

$ 50

1,800

Skilled

30

2,250

General

20

4,950

The actual direct labor-hours worked and the actual direct labor rates per hour experienced for the month of August were as follows.

Worker Classification

Actual Direct Labor Rate per Hour

Actual Direct Labor-Hours

Supervisor

$ 54

2,112

Skilled

32

2,112

General

18

5,376

Required:

Calculate the dollar…

Snyders Kennel uses tenant-days as its measure of activity, an animal housed in the kennel for one day is counted as one tenant-day. During October, the kennel budgeted for 2,600 tenant.days, but its actual level of activity was 2,610 tenant-days. The kernel has provided the following data concerning the formulas to be used in its budgeting:

Fixed element per month

Variable element per tenant-day

Revenue

-

27.20

Wages and salaries

3300

5.20

Expendables

800

9.40

Facility expenses

8600

2.40

Adminstrative expenses

6600

0.30

Total Expenses

19300

17.30

The activity variance for wages and salaries in October would be closest to:

Select one:

a.

$52 U

b.

$652 F

c.

$52 F

d.

$652 U

Chapter 23 Solutions

Financial and Managerial Accounting - CengageNow

Ch. 23 - What are the basic objectives in the use of...Ch. 23 - What is meant by reporting by the principle of...Ch. 23 - Prob. 3DQCh. 23 - Prob. 4DQCh. 23 - A. What are the two variances between the actual...Ch. 23 - A new assistant controller recently was heard to...Ch. 23 - Would the use of standards be appropriate in a...Ch. 23 - Prob. 8DQCh. 23 - At the end of the period, the factory overhead...Ch. 23 - If variances are recorded in the accounts at the...

Ch. 23 - Direct materials variances Bellingham Company...Ch. 23 - Direct labor variances Bellingham Company produces...Ch. 23 - Factory overhead controllable variance Bellingham...Ch. 23 - Factory overhead volume variance Bellingham...Ch. 23 - Standard cost journal entries Bellingham Company...Ch. 23 - Income statement with variances Prepare an income...Ch. 23 - Crazy Delicious Inc. produces chocolate bars. The...Ch. 23 - Atlas Furniture Company manufactures designer home...Ch. 23 - Salisbury Bottle Company manufactures plastic...Ch. 23 - The following data relate to the direct materials...Ch. 23 - De Soto Inc. produces tablet computers. The...Ch. 23 - Standard direct materials cost per unit from...Ch. 23 - H.J. Heinz Company uses standards to control its...Ch. 23 - Direct labor variances The following data relate...Ch. 23 - Glacier Bicycle Company manufactures commuter...Ch. 23 - Ada Clothes Company produced 40,000 units during...Ch. 23 - Mexicali On the Go Inc. owns and operates food...Ch. 23 - Direct materials and direct labor variances At the...Ch. 23 - Flexible overhead budget Leno Manufacturing...Ch. 23 - Flexible overhead budget Wiki Wiki Company has...Ch. 23 - Factory overhead cost variances The following data...Ch. 23 - Thomas Textiles Corporation began November with a...Ch. 23 - Prob. 17ECh. 23 - Factory overhead cost variance report Tannin...Ch. 23 - Recording standards in accounts Cioffi...Ch. 23 - Prob. 20ECh. 23 - Income statement indicating standard cost...Ch. 23 - Rockport Industries Inc. gathered the following...Ch. 23 - Dickinsen Company gathered the following data for...Ch. 23 - Rosenberry Company computed the following revenue...Ch. 23 - Lowell Manufacturing Inc. has a normal selling...Ch. 23 - Shasta Fixture Company manufactures faucets in a...Ch. 23 - Flexible budgeting and variance analysis I Love My...Ch. 23 - Direct materials, direct labor, and factory...Ch. 23 - Factory overhead cost variance report Tiger...Ch. 23 - CodeHead Software Inc. does software development....Ch. 23 - Direct materials and direct labor variance...Ch. 23 - Flexible budgeting and variance analysis Im Really...Ch. 23 - Direct materials, direct labor, and factory...Ch. 23 - Factory overhead cost variance report Feeling...Ch. 23 - Prob. 5PBCh. 23 - Prob. 1COMPCh. 23 - Advent Software uses standards to manage the cost...Ch. 23 - Admissions time variance Valley Hospital began...Ch. 23 - United States Postal Service: Mail sorting time...Ch. 23 - Direct labor time variance Maywood City Police...Ch. 23 - Ethics in action Dash Riprock is a cost analyst...Ch. 23 - Variance interpretation Vanadium Audio Inc. is a...Ch. 23 - MinnOil performs oil changes and other minor...Ch. 23 - Prob. 2CMACh. 23 - Frisco Company recently purchased 108,000 units of...Ch. 23 - JoyT Company manufactures Maxi Dolls for sale in...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Georgia Gasket Co. budgets 8,000 direct labor hours for the year. The total overhead budget is expected to amount to 20,000. The standard cost for a unit of the companys product estimates the variable overhead as follows: The actual data for the period follow: Using the four-variance method, calculate the overhead variances. (Hint: First compute the budgeted fixed overhead rate.)arrow_forwardThe controller for Muir Companys Salem plant is analyzing overhead in order to determine appropriate drivers for use in flexible budgeting. She decided to concentrate on the past 12 months since that time period was one in which there was little important change in technology, product lines, and so on. Data on overhead costs, number of machine hours, number of setups, and number of purchase orders are in the following table. Required: 1. Calculate an overhead rate based on machine hours using the total overhead cost and total machine hours. (Round the overhead rate to the nearest cent and predicted overhead to the nearest dollar.) Use this rate to predict overhead for each of the 12 months. 2. Run a regression equation using only machine hours as the independent variable. Prepare a flexible budget for overhead for the 12 months using the results of this regression equation. (Round the intercept and x-coefficient to the nearest cent and predicted overhead to the nearest dollar.) Is this flexible budget better than the budget in Requirement 1? Why or why not?arrow_forwardUsing Regression to Calculate Fixed Cost, Calculate the Variable Rate, Construct a Cost Formula, and Determine Budgeted Cost Refer to the information for Pizza Vesuvio on the previous page. Coefficients shown by a regression program for Pizza Vesuvios data are: Required: Use the results of regression to make the following calculations: 1. Calculate the fixed cost of labor and the variable rate per employee hour. 2. Construct the cost formula for total labor cost. 3. Calculate the budgeted cost for next month, assuming that 675 employee hours are budgeted. (Note: Round answers to the nearest dollar.) Use the following information for Brief Exercises 3-17 through 3-20: Pizza Vesuvio makes specialty pizzas. Data for the past 8 months were collected:arrow_forward

- Preparing a performance report Use the flexible budget prepared in P7-6 for the 29,000-unit level of activity and the actual operating results listed below for the 29,000- unit level. Required: 1. Prepare a performance report. 2. List the major reasons why the actual operating income at 29,000 units differs from the master budget operating income at 30,000 units in Figure 7-12. 3. Given the level at which the company operated, how was its cost control? Item Direct materials: Direct labor:arrow_forwardFactory overhead cost variance report Tannin Products Inc. prepared the following factory overhead cost budget for the Trim Department for July of the current year, during which it expected to use 20,000 hours for production: Tannin has available 25,000 hours of monthly productive capacity in the Trim Department under normal business conditions. During July, the Trim Department actually used 22,000 hours for production. The actual fixed costs were as budgeted. The actual variable overhead for July was as follows: Construct a factory overhead cost variance report for the Trim Department for July.arrow_forwardPreparing a performance report Use the flexible budget prepared in P7-6 for the 31,000-unit level and the actual operating results listed below for the 31,000-unit level. Required: 1. Prepare a performance report. 2. List the major reasons why the actual operating income at 31,000 units differs from the master budget operating income at 30,000 units in Figure 7-12. 3. Given the level at which the company operated, how was its cost control? Item Direct materials: Direct labor:arrow_forward

- Rammazzotti, Inc., is looking for feedback on company performance. The company compares the budget for the year with the actual costs.Rammazzotti, Inc., had the following budgeted data: Unit sales for the year 26,000 Unit production for the year 26,000 Budgeted fixed overhead for the year: Supervision $ 800 Depreciation 2,000 Rent 100 Budgeted variable costs per unit: Direct materials $0.15 Direct labor 0.20 Supplies 0.02 Indirect labor 0.05 Power 0.02 The following actually occurred: Actual unit sales for the year 24,000 Actual unit production for the year 28,000 Actual fixed overhead for the year: Supervision $ 850 Depreciation 2,000 Rent 100 Actual variable costs: Direct materials $3,500 Direct labor 4,900 Supplies 530 Indirect labor 1,250 Power 470 The total budgeted costs for the year were a.$14,340. b.$11,440. c.$13,510. d.$13,460.arrow_forwardNeed answerarrow_forwardBuis Corporation, which makes landing gears, has provided the following data for a recent month: Budgeted production 1,200 gears Standard machine hours per gear Budgeted supplies cost 5.9 machine-hours $6.50 per machine-hour Actual production Actual machine hours Actual supplies cost (total) 1,300 gears 7,950 machine-hours $ 49,742 Determine the rate and efficiency variances for the variable overhead item supplies and indicate whether those variables are favorable or unfavorable. Yogi Company expects to produce 2,080 units in January which will require 10,400 hours of direct labor and 2,210 units in February which will require 11,050 hours of direct labor. Yogi budgets $9 per unit for variable manufacturing overhead; $1,900 per month for depreciation; and $75,320 per month for other fixed manufacturing overhead costs. Prepare Yogi's manufacturing overhead budget for January and February, including the predetermined overhead allocation rate using direct labor hours as the allocation…arrow_forward

- Varriano Corporation bases its budgets on the activity measure customers served. During October, the company planned to serve 46,000 customers, but actually served 47,000 customers. The company has provided the following data concerning the formulas it uses in its budgeting: Revenue Wages and salaries Supplies Insurance Miscellaneous expense Customers served Revenue Expenses: Wages and salaries Supplies Insurance Miscellaneous expense Total expense Net operating income Required: Prepare a report showing the company's activity variances for October. Indicate in each case whether the variance is favorable (F) or unfavorable (U). (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values.) Fixed element per month Flexible Budget $ 38,000 $0 $ 8,500 $ 8,000 Varriano Corporation Activity Variances For the Month Ended October 31 47,000 Planning Budget Variable element per…arrow_forwardGiven the following information, calculate the purchasing department's efficiency variance. Standard number of transaction per day Standard labor cost per day Actual number of days for processing transactions Actual number of transactions processed Actual labor cost per day Multiple choice question. $2,400 favorable $4,400 favorable $4,400 unfavorable $2,400 unfavorable 20 $200 120 1,960 $180arrow_forwardMiddler Corporation, a manufacturer of electronics and communications systems, uses a service department charge system to charge profit centers with Computing and Communications Services (CCS) service department costs. The following table identifies an abbreviated list of service categories and activity bases used by the CCS department. The table also includes some assumed cost and activity base quantity information for each service for October. CCS ServiceCategory Activity Base Budgeted Cost Budgeted ActivityBase Quantity Help desk Number of calls $55,660 2,200 Network center Number of devices monitored 668,100 10,200 Electronic mail Number of user accounts 57,500 5,750 Handheld technology support Number of handheld devices issued 153,600 9,600 One of the profit centers for Middler Corporation is the Communication Systems (COMM) sector. Assume the following information for the COMM sector: The sector has 1,000 employees, of whom 50% are office employees.…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

What is variance analysis?; Author: Corporate finance institute;https://www.youtube.com/watch?v=SMTa1lZu7Qw;License: Standard YouTube License, CC-BY