FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

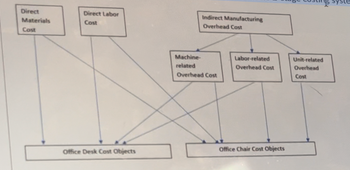

The following figure depicts the complete system that Office Inc. uses to estimate the total cost of each office desk and office

chair that it produces. How many cost pools does Office Inc.'s 2-stage costing system use for Office Chair objects?

A. 7

B. 0

C. 6

D. 5

E. 4

F. 2

G. 1

H. 3

I. 8

Transcribed Image Text:### Understanding Cost Allocation in Manufacturing

When it comes to manufacturing, accurately allocating costs to specific products is crucial for determining their profitability. The diagram provided illustrates the process of assigning various cost components to cost objects in a manufacturing environment, specifically focusing on office desks and office chairs as cost objects.

#### Key Components Explained:

1. **Direct Materials Cost**:

- The cost of raw materials that can be directly traced to the production of specific goods. In this case, direct materials costs are allocated to both office desk cost objects and office chair cost objects.

2. **Direct Labor Cost**:

- The wages paid to workers who can be directly involved in the manufacturing of specific products. These costs are also allocated to both office desk cost objects and office chair cost objects.

3. **Indirect Manufacturing Overhead Cost**:

- These are costs incurred in the manufacturing process that cannot be directly traced to specific products. These are further divided into different categories:

- **Machine-related Overhead Costs**

- **Labor-related Overhead Costs**

- **Unit-related Overhead Costs**

#### Allocation Process:

1. **Direct Materials and Direct Labor Cost Allocation**:

- Both direct materials cost and direct labor cost are directly allocated to both the office desks and office chairs. This is represented by arrows pointing from the boxes labeled "Direct Materials Cost" and "Direct Labor Cost" to the boxes labeled "Office Desk Cost Objects" and "Office Chair Cost Objects".

2. **Indirect Manufacturing Overhead Cost Allocation**:

- Indirect manufacturing overhead costs are first divided into more specific overhead categories: machine-related, labor-related, and unit-related.

- Each specialized overhead cost category is then allocated to both office desks and office chairs.

#### Detailed Diagram Explanation:

* **Direct Materials Cost** and **Direct Labor Cost**: Both cost categories have arrows leading directly to the cost objects for office desks and office chairs.

* **Indirect Manufacturing Overhead Cost**: This is divided into three sub-categories:

- **Machine-related Overhead Cost**: An arrow extends from this category to both office desk cost objects and office chair cost objects.

- **Labor-related Overhead Cost**: Similarly, an arrow from this category leads to both cost objects.

- **Unit-related Overhead Cost**: This category also has arrows leading to both office desk and office chair cost objects.

#### Conclusion:

Understanding how costs are allocated in a manufacturing setting enables better pricing, cost control, and

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Jay Give me correct answer with explanation..arrow_forwardimplementing an activity-based costing system that has four activity cost pools: Travel, Pickup and Delivery, Customer Service, and Other. The activity measures are miles for the Travel cost pool, number of pickups and deliveries for the Pickup and Delivery cost pool, and number of customers for the Customer Service cost pool. The Other cost pool has no activity measure because it is an organization-sustaining activity. The following costs will be assigned using the activity-based costing system Driver and guard wages Vehicle operating expense Vehicle depreciation. Customer representative salaries and i expenses office expenses Driver and guard wages Vehicle operating expense Vehicle depreciation Customer representative salaries and expenses office expenses Administrative expenses Administrative expenses Total cost The distribution of resource consumption across the activity cost pools is as follows. Pickup and Delivery 35% 5% $1,000,000 510,000 390,000 Driver and guard wages Vehicle…arrow_forwardClassic manufacturing costing system uses a three-part classification of direct materials, direct manufacturing labor, and manufacturing overhead costs. The following items (in millions) pertain to Classic Corporation. Requirement Prepare an income statement and a supporting schedule of cost of goods manufactured. Begin by preparing the supporting schedule of cost of goods manufactured (in millions). Start with the direct materials and direct labor costs, then indirect manufacturing costs, and complete the schedule by calculating cost of goods manufactured. For Specific Date Work-in-process inventory, January 1, 2020 $12 Direct materials inventory, December 31, 2020 8 Finished-goods inventory, December 31, 2020 11 Accounts payable, December 31, 2020 20 Accounts receivable, January 1, 2020 59 Work-in-process inventory, December 31, 2020 1 Finished-goods inventory, January 1, 2020 46 Accounts receivable, December 31,…arrow_forward

- Compute the indirect manufacturing costs allocated to each product using activity based costing.arrow_forwardPlease do not give solution in image format thankuarrow_forwardBelow is a list of costs. Please identify each cost as either a product or period cost. Dragged and dropped options on the right-hand side will be automatically saved. For keyboard navigation... SHOW MORE ✓ Depreciation on office copier Depreciation on office building Insurance on office building Metal used in building a car Salary of CEO Salary of production manager Salary of assembly line workers Utilities of office building = = Product Period = Period = Period = Product = Product = = Period Periodarrow_forward

- 3 2. An intern suggested that the company use activity-based costing to cost its products. A team was formed to investigate this idea, and it came back with the recommendation that four activity cost pools be used. These cost pools and their associated activities follow: 5 ints 00:40:40 Activity Cost Pool and Activity Measure Purchase orders (number of orders) Rework requests (number of requests) Product testing (number of tests) Machine related (machine-hours) Activity Cost Pool Purchase orders Rework requests Product testing Machine related Estimated Overhead Cost $ 170,000 374,400 350,000 1,150,000 $2,044,400 Compute the activity rate (i.e., predetermined overhead rate) for each of the activity cost pools. Activity Rate per order per request per test per MH Deluxe 1,000 600 5,000 18,000 Activity Regular 1,500 1,200 12,500 28,000 Total 2,500 1,800 17,500 46,000 3. Assume that actual activity is as expected for the year. Using activity-based costing, do the following: a. Determine the…arrow_forwardDo not give answer in imagearrow_forwardGarrell Corporation is conducting a time-driven activity-based costing study in its Customer Support Department. The company has provided the following data to aid in that study: Time-driven activity rate (cost per unit of activity) Activity cost pool: Receiving Calls Resolving Issues Settling Disputes Cost Object Data: Number of calls received Number of issues resolved Number of disputes settled Customer P 31 17 1 $5.46 $8.58 $13.26 Customer Q 21 10 Required: Using time-driven activity-based costing, determine the total Customer Support Department cost assigned to cach customer.arrow_forward

- Activity-based costing can be beneficial in allocating selling and administrative expenses to various products for managerial decision making. Which of the following would be the best allocation base for help desk costs? a. number of sales employees Ob. number of products sold c. number of calls Od. square footage of the help desk officearrow_forwardPlease do not give solution in image format thankuarrow_forwardMatch the costs for Oracle in producing computer servers to the appropriate cost types below.A. Raw MaterialsB. Direct LaborC. Overhead CostD. N/A1. Employee Wages for Soldering electronic pieces ________________Why? ________________________________________________________________________________________________________________________________________2. Sales Commissions for Salespersons ________Why? ________________________________________________________________________________________________________________________________________3. Soldering Materials purchased in bulk at the beginning of the year ________Why? ________________________________________________________________________________________________________________________________________4. Motherboards and Processors ________________Why? ________________________________________________________________________________________________________________________________________5. Salaries for the supervisor overseeing the…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education